iPhone and iPad maker Apple (NASDAQ:AAPL) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 6.1% year on year to $94.93 billion. Its EPS of $0.97 per share was 2.5% above analysts’ consensus estimates.

Is now the time to buy Apple? Find out by accessing our full research report, it’s free.

Apple (AAPL) Q3 CY2024 Highlights:

- Revenue: $94.93 billion vs analyst estimates of $94.42 billion (in line)

- Operating Profit (GAAP): $29.59 billion vs analyst estimates of $29.16 billion (1.5% beat)

- EPS (GAAP): $0.97 vs analyst estimates of $0.95 (2.5% beat)

- Products Revenue: $69.96 billion vs analyst estimates of $69.35 billion (small beat)

- Services Revenue: $24.97 billion vs analyst estimates of $25.26 billion (1.1% miss)

- Gross Margin: 46.2%, up from 45.2% in the same quarter last year

- Operating Margin: 31.2%, up from 30.1% in the same quarter last year

- Free Cash Flow Margin: 25.2%, up from 21.7% in the same quarter last year

- Market Capitalization: $3.50 trillion

“Today Apple is reporting a new September quarter revenue record of $94.9 billion, up 6 percent from a year ago,” said Tim Cook, Apple’s CEO.

Key Topics & Areas Of Debate

On June 10, 2024, Apple held its Worldwide Developers Conference. The splashy announcement was Apple Intelligence, which combines GenAI with user-specific data to enhance the personalization of its devices. This feature will be powered by a combination of internally developed large-language models (LLMs) and GPT-4.0 from OpenAI.

Since backward compatibility is limited, the market is waiting to see if this integration will spur a large, multi-year device upgrade cycle. An upgrade cycle will come with spikes in shipment volumes, but Apple could also drive higher selling prices and Services revenue as well.

Before the Apple Intelligence announcement, some investors were bemoaning Apple’s seeming lack of participation in the AI wave. How did a company that introduced Siri in 2011 fail to introduce a ChatGPT-like platform before OpenAI? This is a critical juncture where that misstep could be forgotten if the company can re-establish itself as a major AI player.

Samsung (KOSE:A005930) is Apple’s main competitor in the worldwide smartphone market while its operating system competes with Alphabet's (NASDAQ:GOOGL) Android. Regarding other devices and services, competitors include Microsoft (NASDAQ:MSFT), Netflix (NASDAQ:NFLX), and Spotify (NYSE:SPOT).

Revenue Growth

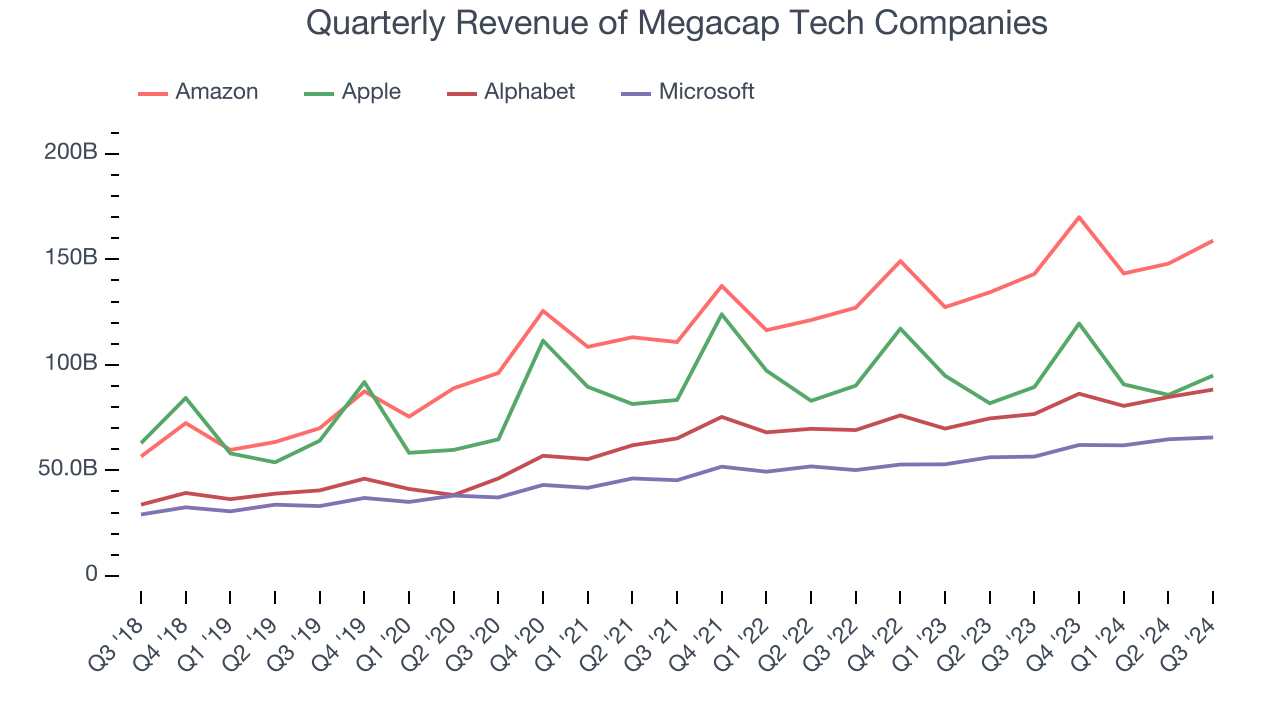

Apple (with its installed base of roughly 2 billion devices) shows that growth and massive scale can coexist despite the conventional wisdom about the law of large numbers. The company’s revenue base of $260.2 billion five years ago has increased to $391 billion in the last year, translating into a decent 8.5% annualized growth rate.

In light of its megacap peers, however, Apple’s growth trailed Amazon (18.5%), Alphabet (17%), and Microsoft (14.4%) over the same period. Comparing the four is relevant because investors often pit them against each other to derive their valuations. When adjusting for these benchmarks, we think Apple is a bit on the expensive side.

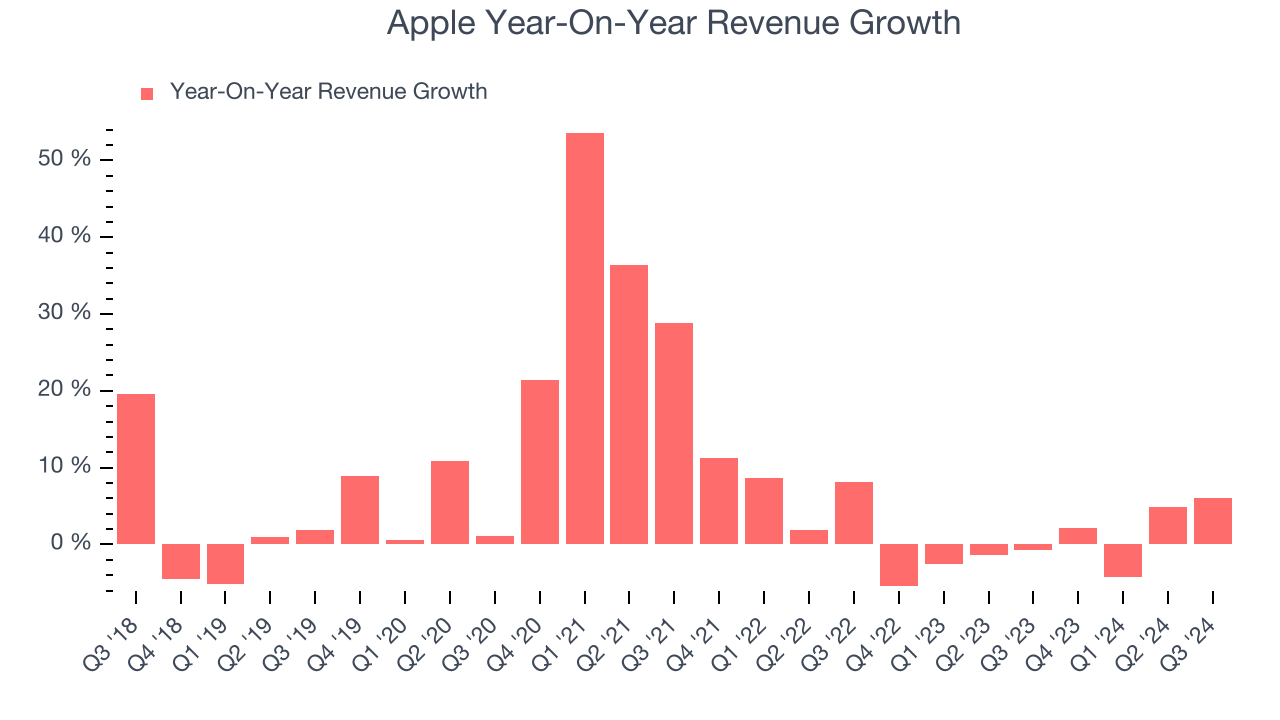

We at StockStory emphasize long-term growth, but for megacap tech companies, a half-decade historical view may miss the impact of emerging trends like AI. Apple’s recent history shows its demand slowed as its revenue was flat over the last two years.

This quarter, Apple grew its revenue by 6.1% year on year, and its $94.93 billion of revenue was in line with Wall Street’s estimates. Looking ahead, sell-side analysts expect revenue to grow 7.1% over the next 12 months, an improvement versus the last two years. This projection is healthy for a company of its scale and illustrates the market thinks that AI, in the form of Apple Intelligence, could catalyze higher growth rates.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Products: Steve Jobs’s Legacy

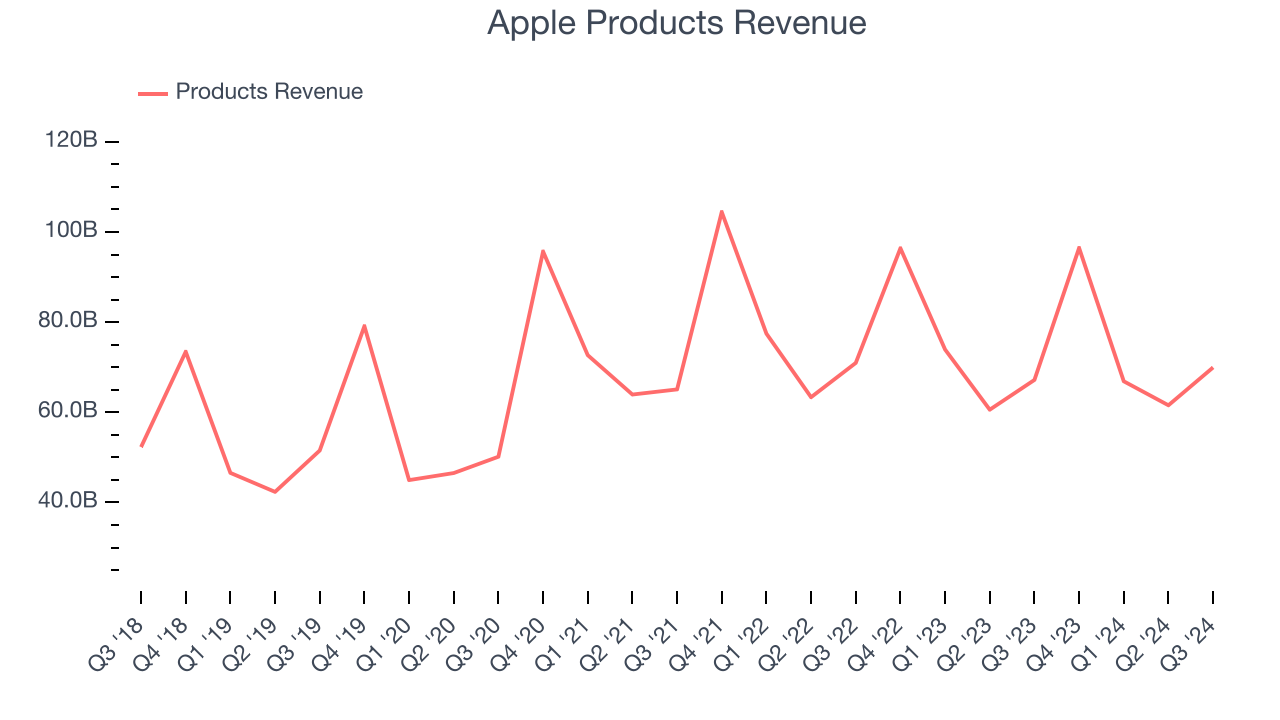

Apple’s Products segment includes everything from its flagship iPhone, iPad, and Mac computers to AirPods and Apple Watch. We are closely monitoring whether the GenAI-powered Apple Intelligence, which was released in September 2024 but has limited interoperability with older devices, can spur an upgrade cycle for the company.

Products sales are by far the biggest chunk of Apple’s revenue at 75.4%. They grew by 6.6% annually over the last five years, slower than total revenue. The narrative has flipped recently, as sales dropped at an annual clip of 3.4% over the last two years. Apple could really use that upgrade cycle right about now.

This quarter, Products sales were up 4.1% year on year, in line with Wall Street’s estimates. Holding aside expectations, the recently improved rate of change shows that more customers are upgrading their devices than before. We’ll be watching to see if Apple Intelligence and iOS 18 can accelerate this trend. Wall Street is pricing the stock like it will.

Key Takeaways from Apple’s Q3 Results

Despite roughly in line revenue, it was encouraging to see Apple top analysts’ operating income expectations this quarter. On the other hand, the all-important Services segment missed on the revenue line. Overall, this quarter was mixed. The stock traded down 1.1% to $223 immediately after reporting.

Is Apple an attractive investment opportunity at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.