Online accommodations platform Airbnb (NASDAQ:ABNB) reported Q4 FY2023 results topping analysts' expectations, with revenue up 16.6% year on year to $2.22 billion. It made a GAAP loss of $0.55 per share, down from its profit of $0.47 per share in the same quarter last year.

Is now the time to buy Airbnb? Find out by accessing our full research report, it's free.

Airbnb (ABNB) Q4 FY2023 Highlights:

- Revenue: $2.22 billion vs analyst estimates of $2.16 billion (2.5% beat)

- Adjusted EBITDA: $738 million vs analyst estimates of $646 million (14.2% beat)

- EPS: -$0.55 vs analyst estimates of $0.55 (-$1.10 miss due to a one-time "lodging tax reserves and reserves for host withholding taxes" charge)

- Free Cash Flow of $46 million, down 96.5% from the previous quarter

- Gross Margin (GAAP): 82.7%, up from 81.9% in the same quarter last year

- Nights and Experiences Booked: 98.8 million, up 10.6 million year on year (0.7% beat vs. expectations of 98.1 million)

- Market Capitalization: $98.57 billion

Founded by Joe Gebbia and Brian Chesky by renting out a blowup bed on the floor of their San Francisco apartment, Airbnb (NASDAQ:ABNB) is the world’s largest online marketplace for lodging, primarily homestays.

Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

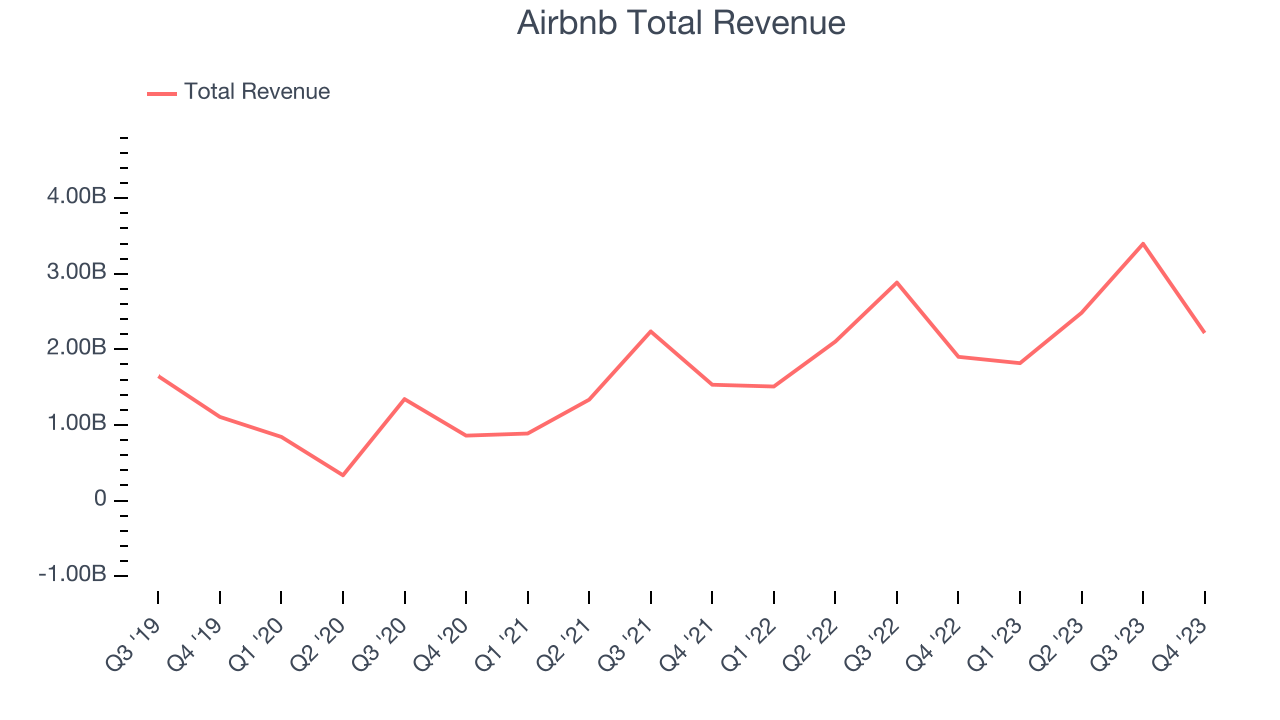

Sales Growth

Airbnb's revenue growth over the last three years has been exceptional, averaging 58.6% annually. This quarter, Airbnb beat analysts' estimates and reported 16.6% year-on-year revenue growth.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

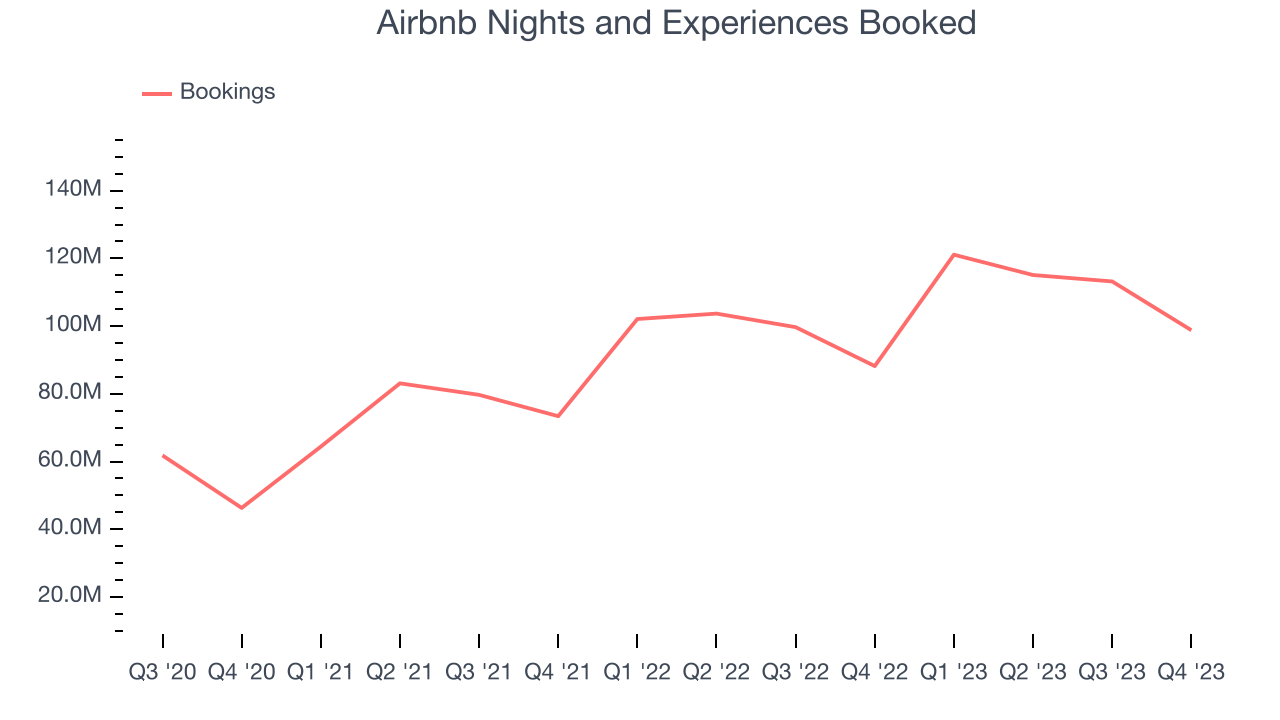

Usage Growth

As an online marketplace, Airbnb generates revenue growth by increasing both the number of bookings on its platform and the average order size in dollars.

Over the last two years, Airbnb's nights booked, a key performance metric for the company, grew 23% annually to 98.8 million. This is strong growth for a consumer internet company.

In Q4, Airbnb added 10.6 million nights booked, translating into 12% year-on-year growth.

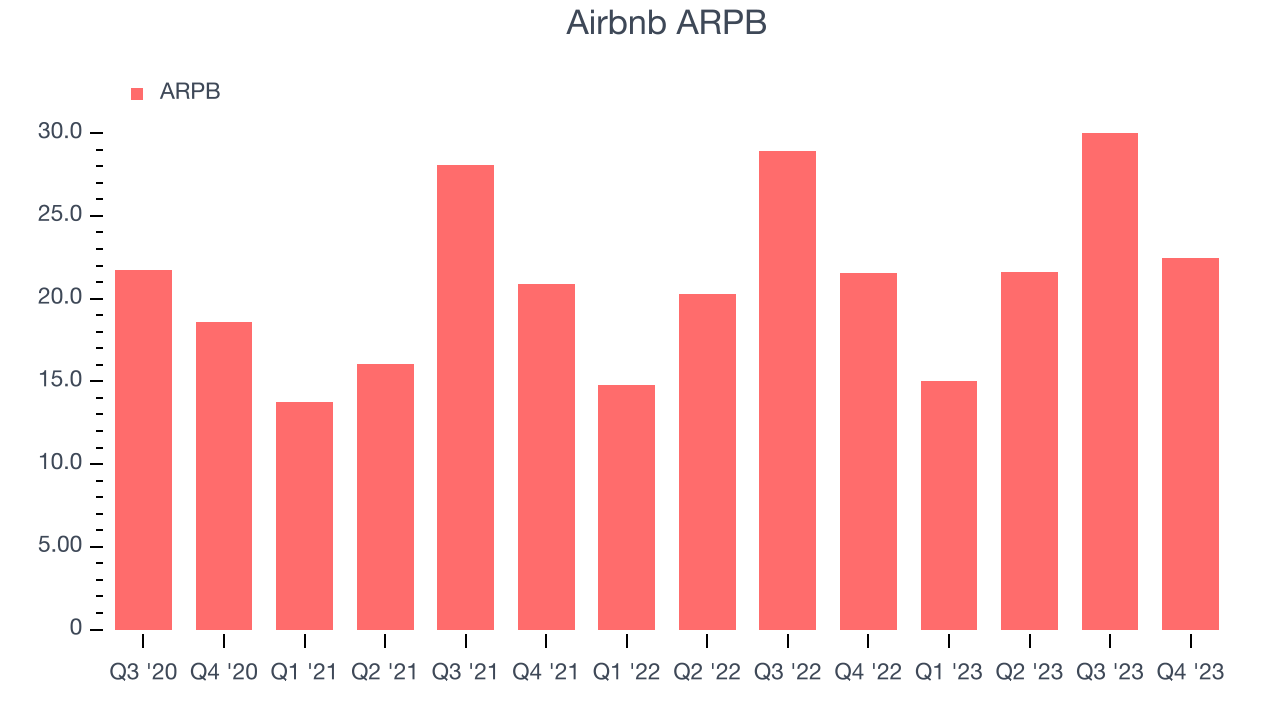

Revenue Per Booking

Average revenue per booking (ARPB) is a critical metric to track for consumer internet businesses like Airbnb because it measures how much the company earns in transaction fees from each booking. Furthermore, ARPB gives us unique insights as it's a function of a user's average order size and Airbnb's take rate, or "cut", on each order.

Airbnb's ARPB growth has been decent over the last two years, averaging 7%. The company's ability to increase prices while constantly growing its nights booked demonstrates the value of its platform. This quarter, ARPB grew 4.1% year on year to $22.45 per booking.

Key Takeaways from Airbnb's Q4 Results

It was great to see Airbnb beat analysts' revenue expectations this quarter on better-than-expected 'Nights & Experiences Booked' (a key volume metric). On the other hand, its revenue growth slowed. Additionally, the company guided to adjusted EBITDA margins of "at least 35%" due to investments in "incremental growth opportunities", below expectations of a margin slightly over 36%. Zooming out, we think this was a decent, albeit mixed, quarter. The guidance may be weighing on shares. Investors were likely expecting more, and the stock is down 4.1% after reporting, trading at $144.68 per share.

So should you invest in Airbnb right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.