Looking back on online marketplace stocks' Q2 earnings, we examine this quarter's best and worst performers, including Airbnb (NASDAQ:ABNB) and its peers.

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission paying sellers, generating flywheel scale effects which feed back into further customer acquisition.

The 11 online marketplace stocks we track reported a weaker Q2; on average, revenues missed analyst consensus estimates by 0.54%, while on average next quarter revenue guidance was 1.72% under consensus. Tech multiples have reverted to the historical mean after reaching all time levels in early 2021 and online marketplace stocks have not been spared, with share prices down 15.7% since the previous earnings results, on average.

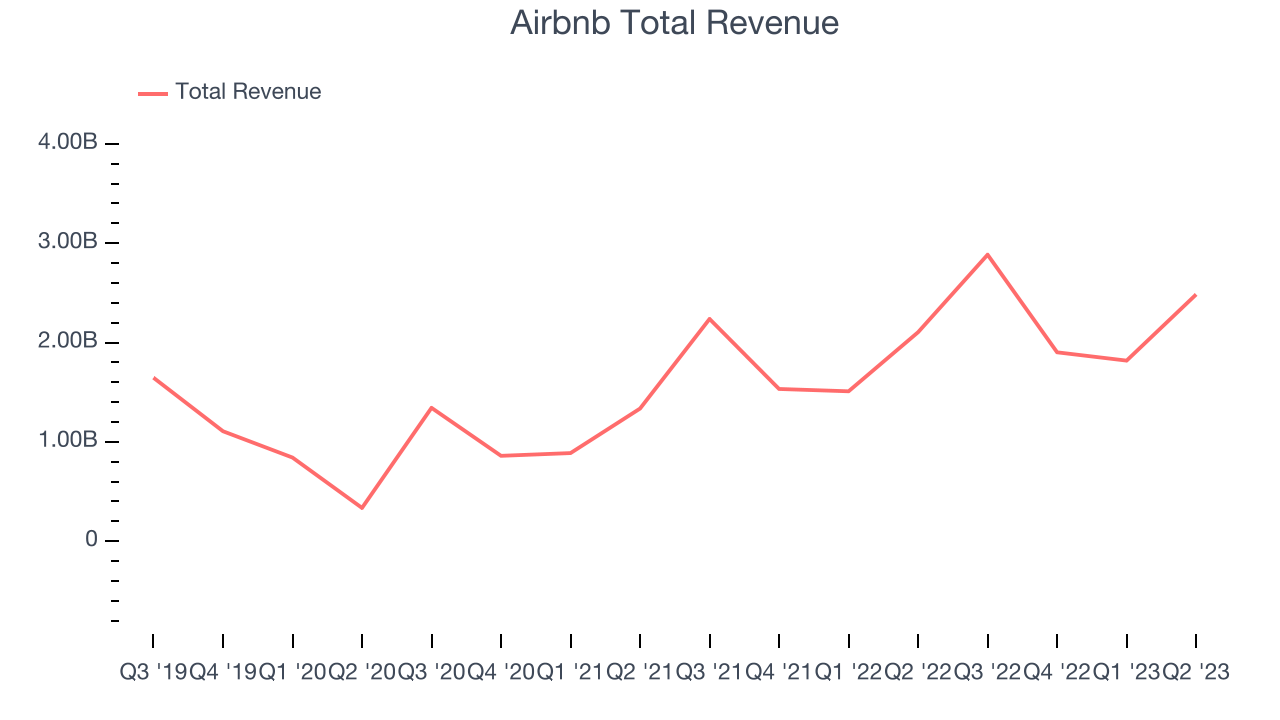

Airbnb (NASDAQ:ABNB)

Founded by Joe Gebbia and Brian Chesky by renting out a blowup bed on the floor of their San Francisco apartment, Airbnb (NASDAQ: ABNB) is the world’s largest online marketplace for lodging, primarily homestays.

Airbnb reported revenues of $2.48 billion, up 18.1% year on year, beating analyst expectations by 2.69%. It was a mixed quarter for the company, with Nights and Experiences Booked, a key volume measure for Airbnb, missing expectations, although Gross Bookings was in line with expectations. However, revenue came in ahead of expectations, as did revenue guidance for the next quarter.

The stock is up 1.04% since the results and currently trades at $142.34.

Read why we think that Airbnb is one of the best online marketplace stocks, our full report is free.

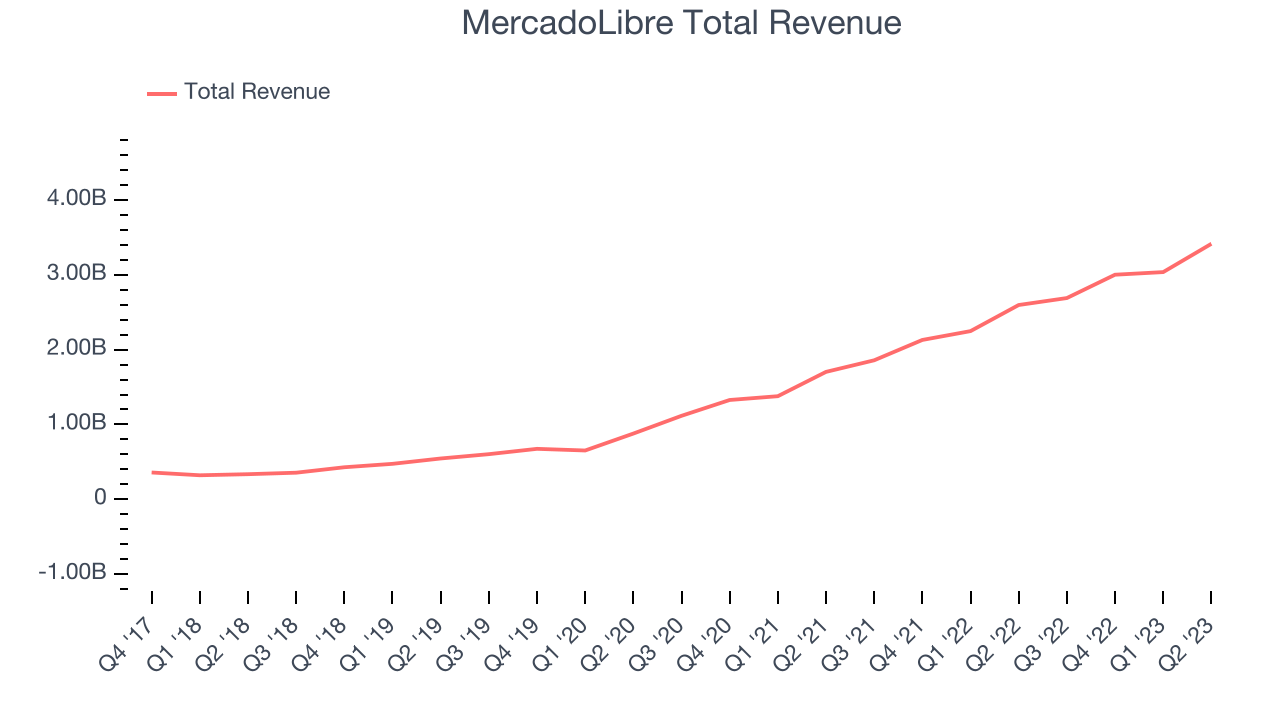

Best Q2: MercadoLibre (NASDAQ:MELI)

Originally started as an online auction platform, MercadoLibre (NASDAQ:MELI) today is a one-stop e-commerce marketplace in Latin America.

MercadoLibre reported revenues of $3.42 billion, up 31.5% year on year, beating analyst expectations by 4.4%. It was a very strong quarter for the company, with impressive growth in its user base and a decent beat of analysts' revenue estimates.

MercadoLibre achieved the strongest analyst estimates beat and fastest revenue growth among its peers. The company reported 109 million daily active users, up 29.8% year on year. The stock is up 19.7% since the results and currently trades at $1,394.51.

Is now the time to buy MercadoLibre? Access our full analysis of the earnings results here, it's free.

Weakest Q2: Sea (NYSE:SE)

Founded in 2009 and a publicly-traded company since 2017, Sea Limited (NYSE:SE) started as a gaming platform and has since expanded to offer a variety of services such as e-commerce, digital payments, and financial services across Southeast Asia.

Sea reported revenues of $3.1 billion, up 5.2% year on year, missing analyst expectations by 4.68%. It was a weak quarter for the company, with a decline in its user base and a miss of analysts' revenue estimates.

The stock is down 30.6% since the results and currently trades at $39.38.

Read our full analysis of Sea's results here.

Farfetch (NYSE:FTCH)

Inspired by the idea of allowing anyone to buy clothes from landmark boutiques of cities like Paris or Milan without having to leave their couch, Farfetch (NYSE: FTCH) is a global marketplace for luxury fashion, connecting boutiques, brands and consumers.

Farfetch reported revenues of $572.1 million, down 1.25% year on year, missing analyst expectations by 12.1%. It was a weak quarter for the company, with slow revenue growth and a miss on key metrics such as gross merchandise value (GMV), active consumers, revenue, and adjusted EBITDA. Looking ahead, the company lowered its full year GMV guidance meaningfully and also cut adjusted EBITDA guidance for the same period.

Farfetch had the weakest performance against analyst estimates among the peers. The company reported 4.13 million active buyers, up 7.49% year on year. The stock is down 51.4% since the results and currently trades at $2.32.

Read our full, actionable report on Farfetch here, it's free.

Cars.com (NYSE:CARS)

Originally started as a joint venture between several media companies including The Washington Post and The New York Times, Cars.com (NYSE:CARS) is a digital marketplace that connects new and used car buyers and sellers.

Cars.com reported revenues of $168.2 million, up 3.26% year on year, missing analyst expectations by 0.53%. It was a weak quarter for the company, with slow revenue growth and a decline in its user base.

The company reported 18.8 thousand active buyers, down 3.75% year on year. The stock is down 22.7% since the results and currently trades at $17.32.

Read our full, actionable report on Cars.com here, it's free.

The author has no position in any of the stocks mentioned