Quarterly earnings results are a good time to check in on a company’s progress, especially compared to other peers in the same sector. Today we are looking at Airbnb (NASDAQ:ABNB), and the best and worst performers in the online marketplace group.

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission paying sellers, generating flywheel scale effects which feed back into further customer acquisition.

The 4 online marketplace stocks we track reported a mixed Q2; on average, revenues beat analyst consensus estimates by 1.89%, while on average next quarter revenue guidance was 2.89% under consensus. There has been a stampede out of high valuation technology stocks, but online marketplace stocks held their ground better than others, with the share price up 1.21% since earnings, on average.

Best Q2: Airbnb (NASDAQ:ABNB)

Founded by Joe Gebbia and Brian Chesky by renting out a blowup bed on the floor of their San Francisco apartment, Airbnb (NASDAQ: ABNB) is the world’s largest online marketplace for lodging, primarily homestays.

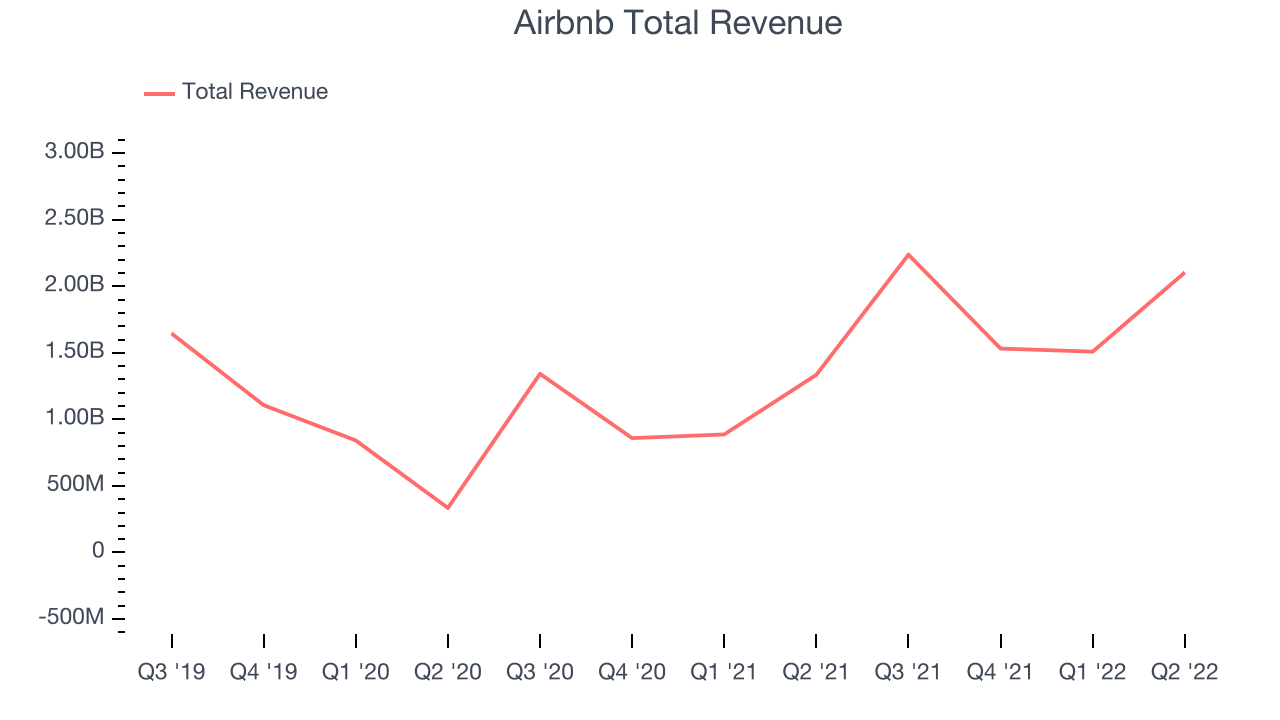

Airbnb reported revenues of $2.1 billion, up 57.5% year on year, missing analyst expectations by 0.04%. Despite the stock dropping on the results, it was a very strong quarter for the company, with an exceptional revenue growth and growing number of users.

Airbnb achieved the fastest revenue growth but had the weakest performance against analyst estimates of the whole group. The company reported 103.7 million nights booked, up 24.7% year on year. The stock is up 4.73% since the results and currently trades at $122.02.

Read why we think that Airbnb is one of the best online marketplace stocks, our full report is free.

Farfetch (NYSE:FTCH)

Inspired by the idea of allowing anyone to buy clothes from landmark boutiques of cities like Paris or Milan without having to leave their couch, Farfetch (NYSE: FTCH) is a global marketplace for luxury fashion, connecting boutiques, brands and consumers.

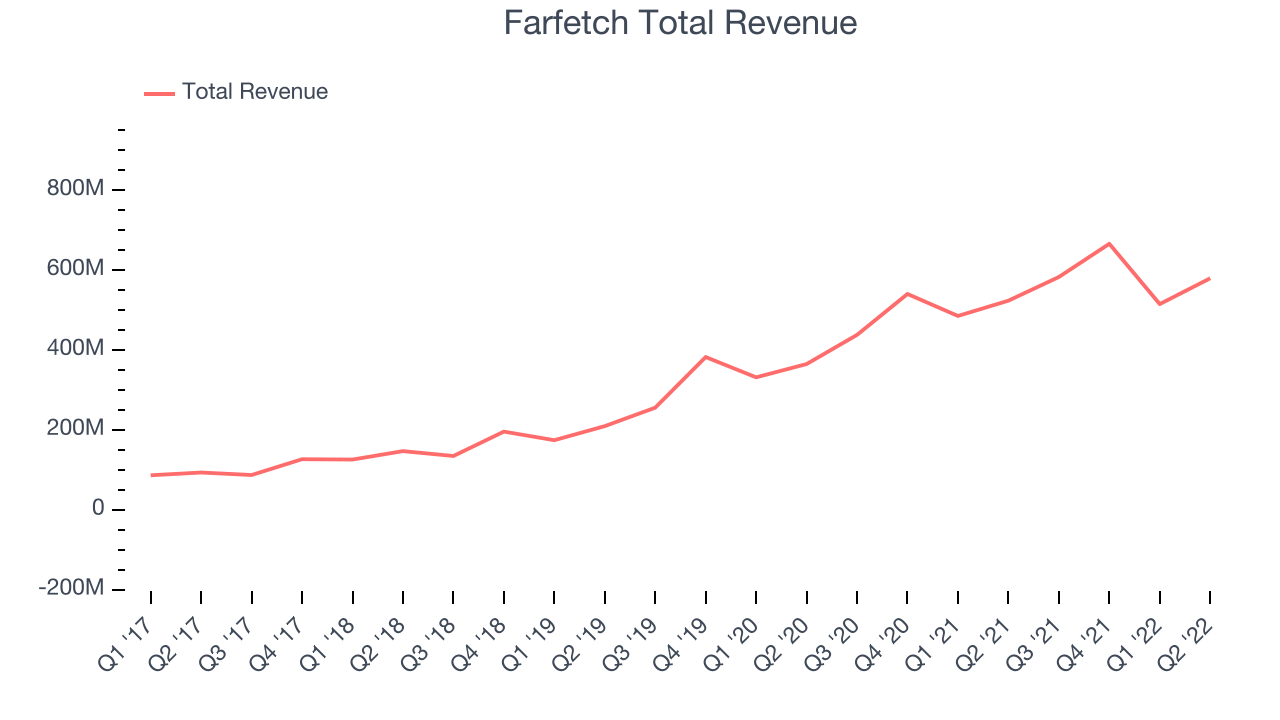

Farfetch reported revenues of $579.3 million, up 10.7% year on year, beating analyst expectations by 2.26%. It was a mixed quarter for the company, with a growing number of users but a slow revenue growth.

The company reported 3.84 million active buyers, up 13.2% year on year. The stock is up 13.1% since the results and currently trades at $10.78.

Is now the time to buy Farfetch? Access our full analysis of the earnings results here, it's free.

Slowest Q2: Etsy (NASDAQ:ETSY)

Founded by a struggling amateur furniture maker Robert Kalin and his two friends, Etsy (NASDAQ: ETSY) is one of the world’s largest online marketplaces, focusing on handmade or vintage items.

Etsy reported revenues of $585.1 million, up 10.6% year on year, beating analyst expectations by 5.06%. It was a weaker quarter for the company, with an underwhelming revenue guidance for the next quarter and a slow revenue growth.

Etsy delivered the strongest analyst estimates beat but had the slowest revenue growth in the group. The company reported 93.9 million active buyers, up 3.82% year on year. The stock is up 12.5% since the results and currently trades at $107.49.

Read our full analysis of Etsy's results here.

The RealReal (NASDAQ:REAL)

Founded by consignment store aficionado Julie Wainwright, The RealReal (NASDAQ: REAL) is an online marketplace for buying and selling secondhand luxury goods.

The RealReal reported revenues of $154.4 million, up 47.2% year on year, in line with analyst expectations. Despite the solid topline growth, it was a slower quarter for the company, with revenue guidance for both the next quarter and the full year missing analysts' estimates.

The company reported 889 thousand paying users, up 21.7% year on year. The stock is down 25.5% since the results and currently trades at $2.27.

Read our full, actionable report on The RealReal here, it's free.

The author has no position in any of the stocks mentioned