Online accommodations platform Airbnb (NASDAQ:ABNB) reported Q4 FY2023 results beating Wall Street analysts' expectations, with revenue up 16.6% year on year to $2.22 billion. It made a GAAP loss of $0.55 per share, down from its profit of $0.47 per share in the same quarter last year.

Airbnb (ABNB) Q4 FY2023 Highlights:

- Revenue: $2.22 billion vs analyst estimates of $2.16 billion (2.5% beat)

- Adjusted EBITDA: $738 million vs analyst estimates of $646 million (14.2% beat)

- EPS: -$0.55 vs analyst estimates of $0.55 (-$1.10 miss due to a one-time "lodging tax reserves and reserves for host withholding taxes" charge)

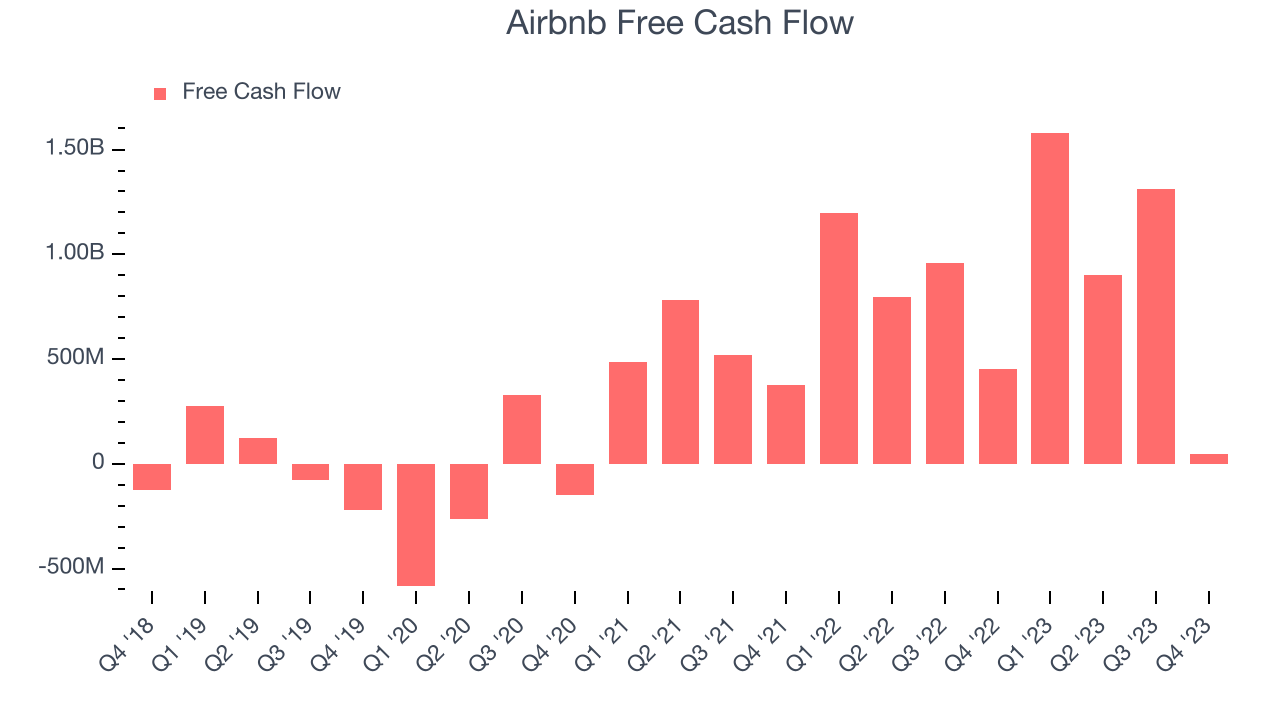

- Free Cash Flow of $46 million, down 96.5% from the previous quarter

- Gross Margin (GAAP): 82.7%, up from 81.9% in the same quarter last year

- Nights and Experiences Booked: 98.8 million, up 10.6 million year on year (0.7% beat vs. expectations of 98.1 million)

- Market Capitalization: $98.57 billion

Founded by Joe Gebbia and Brian Chesky by renting out a blowup bed on the floor of their San Francisco apartment, Airbnb (NASDAQ:ABNB) is the world’s largest online marketplace for lodging, primarily homestays.

Airbnb was founded on the premise that the travel industry had become commoditized into offering standardized accommodations in crowded hotel districts around landmarks and attractions. Their view was that a one-size-fits-all approach limited how much of the world a person could access, leaving guests feeling like outsiders in the places they visit. Airbnb enabled home sharing at a global scale and created a new category of travel.

Their innovation was instead of traveling like tourists and feeling like outsiders, guests on Airbnb can stay in neighborhoods where people live, have authentic experiences and live like locals in over 100,000 cities around the world. Airbnb’s platform also opened up a whole new revenue stream to thousands of people around the world; earning money on spare rooms. For hosts, Airbnb provided them an aggregation platform that brought global demand to individual’s doorsteps, while providing for pricing, scheduling, liability protection, and merchandising functionality to remove the friction from bringing their inventory online.

Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

Airbnb (NASDAQ:ABNB) competes with a range of online travel companies such as Booking Holdings (NASDAQ:BKNG), Expedia (NASDAQ:EXPE), TripAdvisor (NASDAQ:TRIP), Trivago (NASDAQ:TRIV) and Alphabet (NASDAQ:GOOG.L).

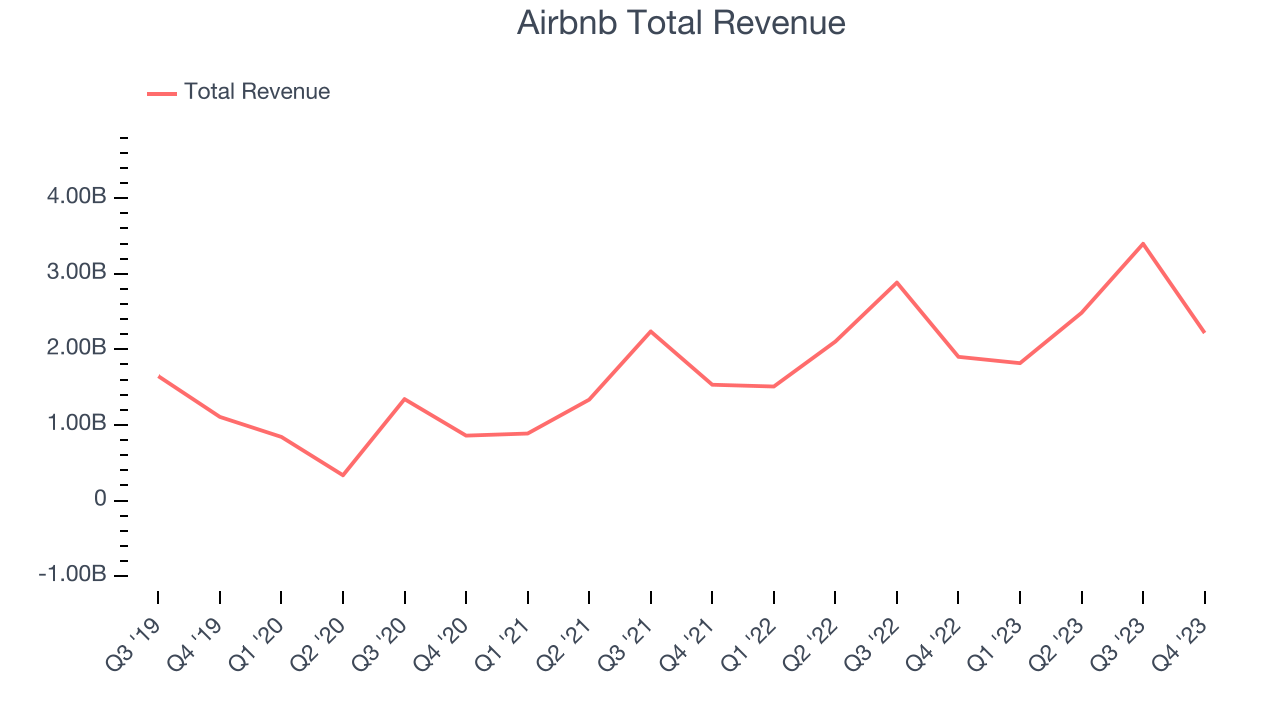

Sales Growth

Airbnb's revenue growth over the last three years has been exceptional, averaging 58.6% annually. This quarter, Airbnb beat analysts' estimates and reported 16.6% year-on-year revenue growth.

Usage Growth

As an online marketplace, Airbnb generates revenue growth by increasing both the number of bookings on its platform and the average order size in dollars.

Over the last two years, Airbnb's nights booked, a key performance metric for the company, grew 23% annually to 98.8 million. This is strong growth for a consumer internet company.

In Q4, Airbnb added 10.6 million nights booked, translating into 12% year-on-year growth.

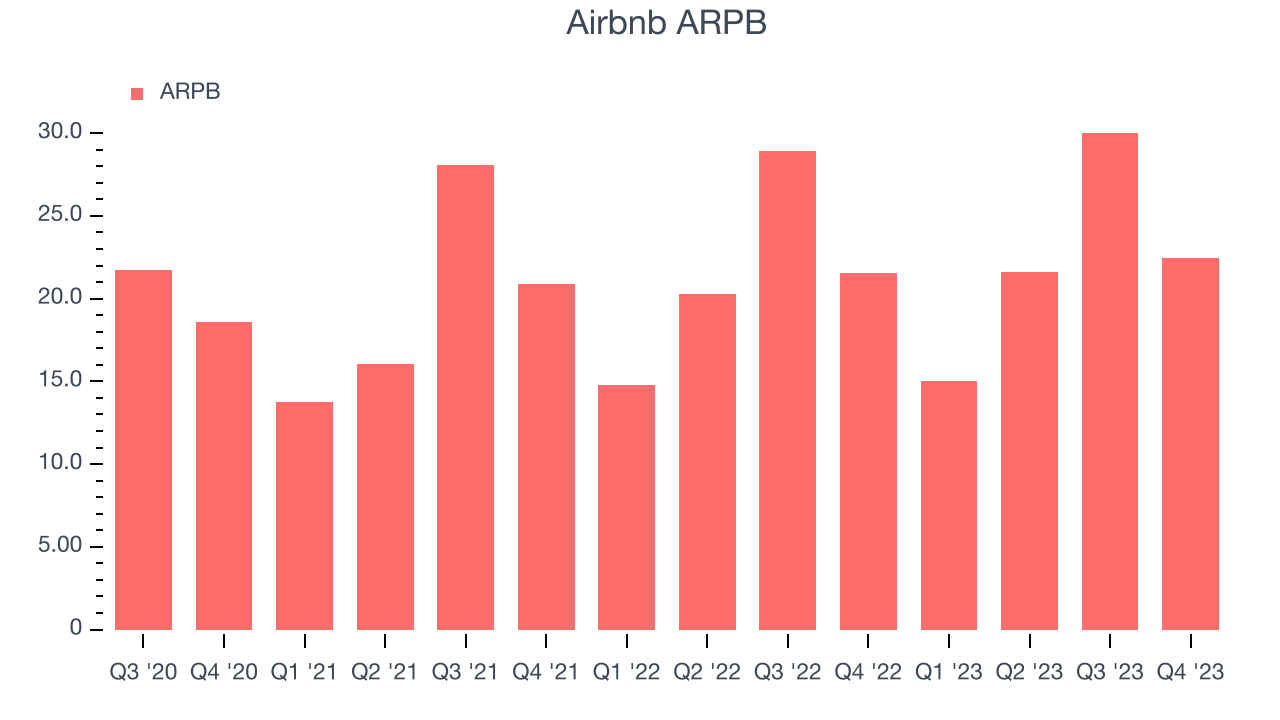

Revenue Per Booking

Average revenue per booking (ARPB) is a critical metric to track for consumer internet businesses like Airbnb because it measures how much the company earns in transaction fees from each booking. Furthermore, ARPB gives us unique insights as it's a function of a user's average order size and Airbnb's take rate, or "cut", on each order.

Airbnb's ARPB growth has been decent over the last two years, averaging 7%. The company's ability to increase prices while constantly growing its nights booked demonstrates the value of its platform. This quarter, ARPB grew 4.1% year on year to $22.45 per booking.

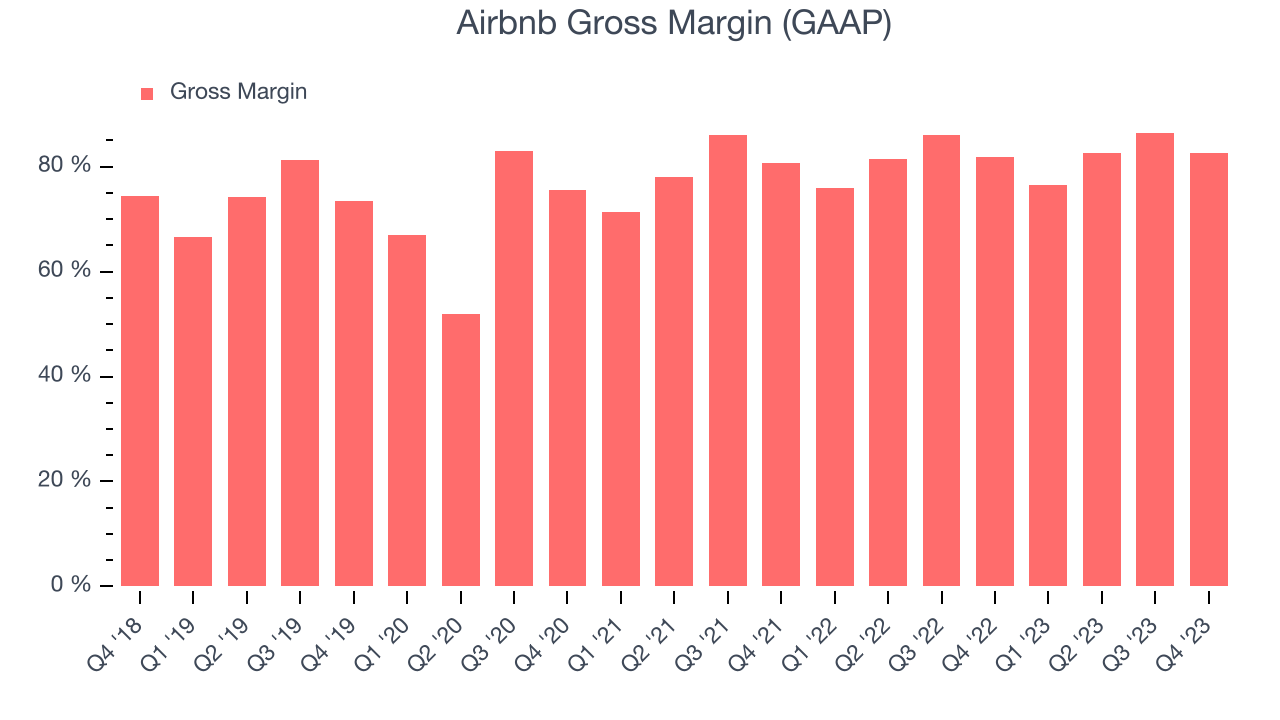

Pricing Power

A company's gross profit margin has a major impact on its ability to exert pricing power, develop new products, and invest in marketing. These factors may ultimately determine the winner in a competitive market, making it a critical metric to track for the long-term investor. Airbnb's gross profit margin, which tells us how much money the company gets to keep after covering the base cost of its products and services, came in at 82.7% this quarter, up 0.8 percentage points year on year.

For online marketplaces like Airbnb, these aforementioned costs typically include payment processing, hosting, and bandwidth fees in addition to the costs necessary to onboard buyers and sellers, such as identity verification. After paying for these expenses, Airbnb had $0.83 for every $1 in revenue to invest in marketing, talent, and the development of new products and services.

Gross margins have been relatively stable over the last year, averaging 82.1%. Airbnb's margins are some of the highest in the consumer internet sector, enabling it to fund large investments in product and marketing during periods of rapid growth to stay one step ahead of the competition.

User Acquisition Efficiency

Consumer internet businesses like Airbnb grow from a combination of product virality, paid advertisement, and incentives (unlike enterprise software products, which are often sold by dedicated sales teams).

Airbnb is very efficient at acquiring new users, spending only 23.2% of its gross profit on sales and marketing expenses over the last year. This efficiency indicates that it has a strong brand reputation and customer acquisition advantages from scale, giving Airbnb the freedom to invest its resources into new growth initiatives while maintaining optionality.

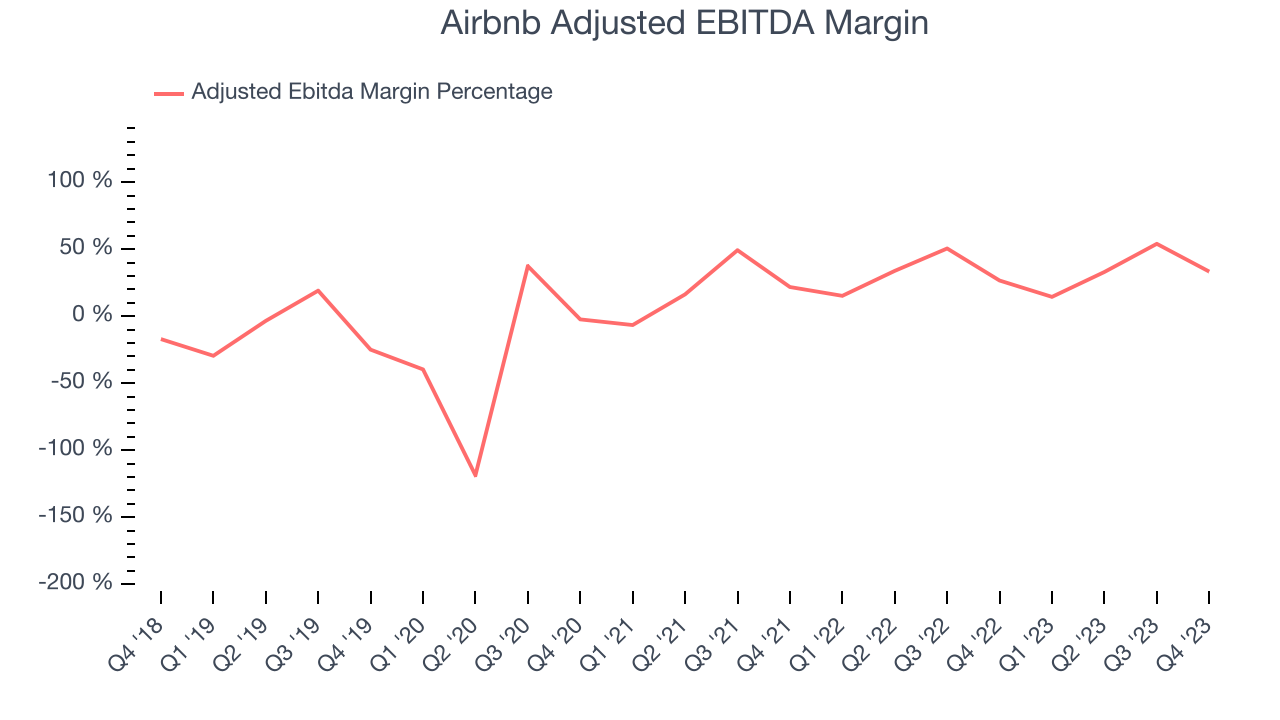

Profitability & Free Cash Flow

Investors frequently analyze operating income to understand a business's core profitability. Similar to operating income, adjusted EBITDA is the most common profitability metric for consumer internet companies because it removes various one-time or non-cash expenses, offering a more normalized view of a company's profit potential.

Airbnb reported EBITDA of $738 million this quarter, resulting in a 33.3% margin. Additionally, Airbnb has demonstrated extremely high profitability over the last four quarters, with average EBITDA margins of 33.7%.

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Airbnb's free cash flow came in at $46 million in Q4, down 89.9% year on year.

Airbnb has generated $3.84 billion in free cash flow over the last 12 months, an eye-popping 41% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Key Takeaways from Airbnb's Q4 Results

It was great to see Airbnb beat analysts' revenue expectations this quarter on better-than-expected 'Nights & Experiences Booked' (a key volume metric). On the other hand, its revenue growth slowed. Additionally, the company guided to adjusted EBITDA margins of "at least 35%" due to investments in "incremental growth opportunities", below expectations of a margin slightly over 36%. Zooming out, we think this was a decent, albeit mixed, quarter. The guidance may be weighing on shares. Investors were likely expecting more, and the stock is down 4.1% after reporting, trading at $144.68 per share.

Is Now The Time?

When considering an investment in Airbnb, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

There are numerous reasons why we think Airbnb is one of the best consumer internet companies out there. While we'd expect growth rates to moderate from here, its revenue growth has been exceptional over the last three years. Additionally, its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits and its impressive gross margins are a wonderful starting point for the overall profitability of the business.

At the moment Airbnb trades at 23.8x next 12 months EV-to-EBITDA. Looking at the consumer internet landscape today, Airbnb's qualities really stand out, and we really like it at this price.

Wall Street analysts covering the company had a one-year price target of $140.96 per share right before these results (compared to the current share price of $144.68).

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.