Creative software maker Adobe (NASDAQ:ADBE) reported results in line with analysts’ expectations in Q3 CY2024, with revenue up 10.6% year on year to $5.41 billion. On the other hand, next quarter’s revenue guidance of $5.53 billion was less impressive, coming in 1.4% below analysts’ estimates. It made a non-GAAP profit of $4.65 per share, improving from its profit of $4.09 per share in the same quarter last year.

Is now the time to buy Adobe? Find out by accessing our full research report, it’s free.

Adobe (ADBE) Q3 CY2024 Highlights:

- Revenue: $5.41 billion vs analyst estimates of $5.37 billion (small beat)

- Net New Digital Media ARR: $504 million vs analyst estimates of $462 million (9.1% beat)

- Adjusted Operating Income: $2.52 billion vs analyst estimates of $2.46 billion (2.3% beat)

- EPS (non-GAAP): $4.65 vs analyst estimates of $4.54 (2.5% beat)

- Revenue Guidance for Q4 CY2024 is $5.53 billion at the midpoint, below analyst estimates of $5.60 billion

- Net New Digital Media ARR Guidance for Q4 CY2024 is $550 million at the midpoint, below analyst estimates of $561 million

- EPS (non-GAAP) guidance for Q4 CY2024 is $4.65 at the midpoint, roughly in line with what analysts were expecting

- Gross Margin (GAAP): 89.8%, up from 88.1% in the same quarter last year

- Free Cash Flow Margin: 36.3%, similar to the previous quarter

- Billings: $5.63 billion at quarter end, up 12.7% year on year

- Market Capitalization: $257.3 billion

One of the most well-known Silicon Valley software companies around, Adobe (NASDAQ:ADBE) is a leading provider of software as service in the digital design and document management space.

Design Software

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

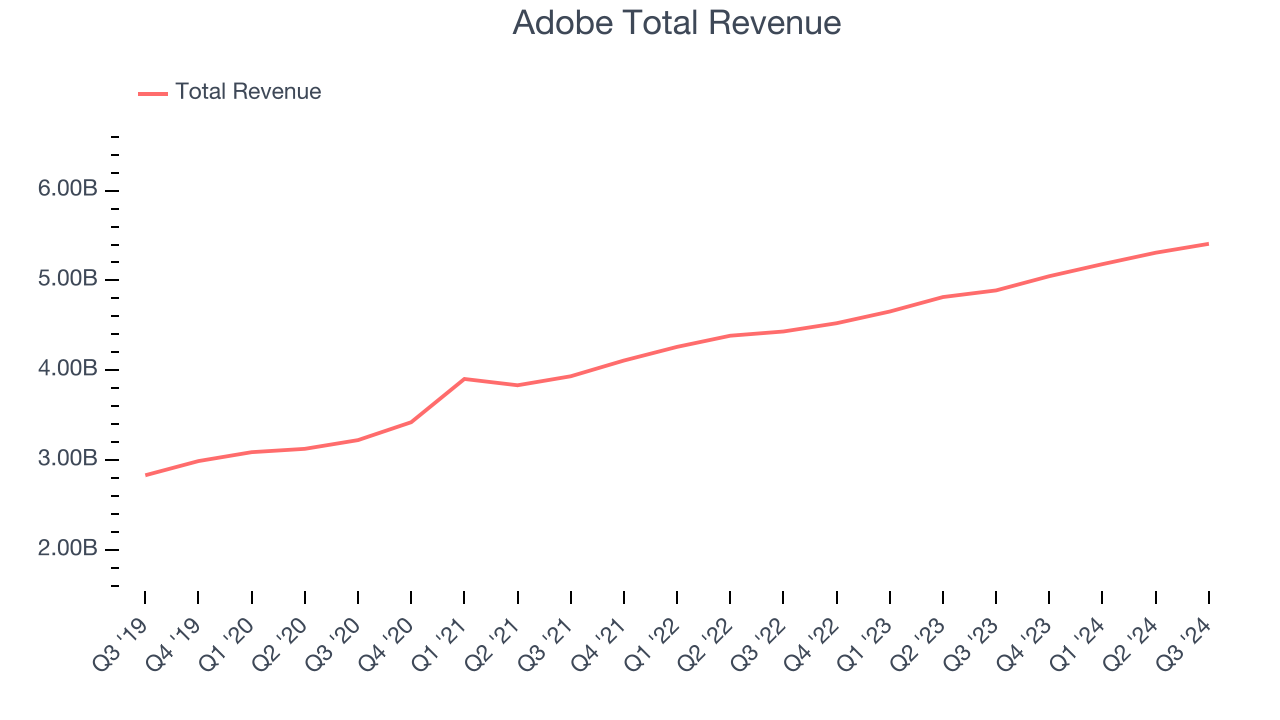

Sales Growth

As you can see below, Adobe’s 11.5% annualized revenue growth over the last three years has been sluggish, and its sales came in at $5.41 billion this quarter.

This quarter, Adobe’s quarterly revenue was once again up 10.6% year on year. However, its growth did slow down compared to last quarter as the company’s revenue increased by just $99 million in Q3 compared to $127 million in Q2 CY2024. While we’d like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter’s guidance suggests that Adobe is expecting revenue to grow 9.4% year on year to $5.53 billion, slowing down from the 11.6% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 11.2% over the next 12 months before the earnings results announcement.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

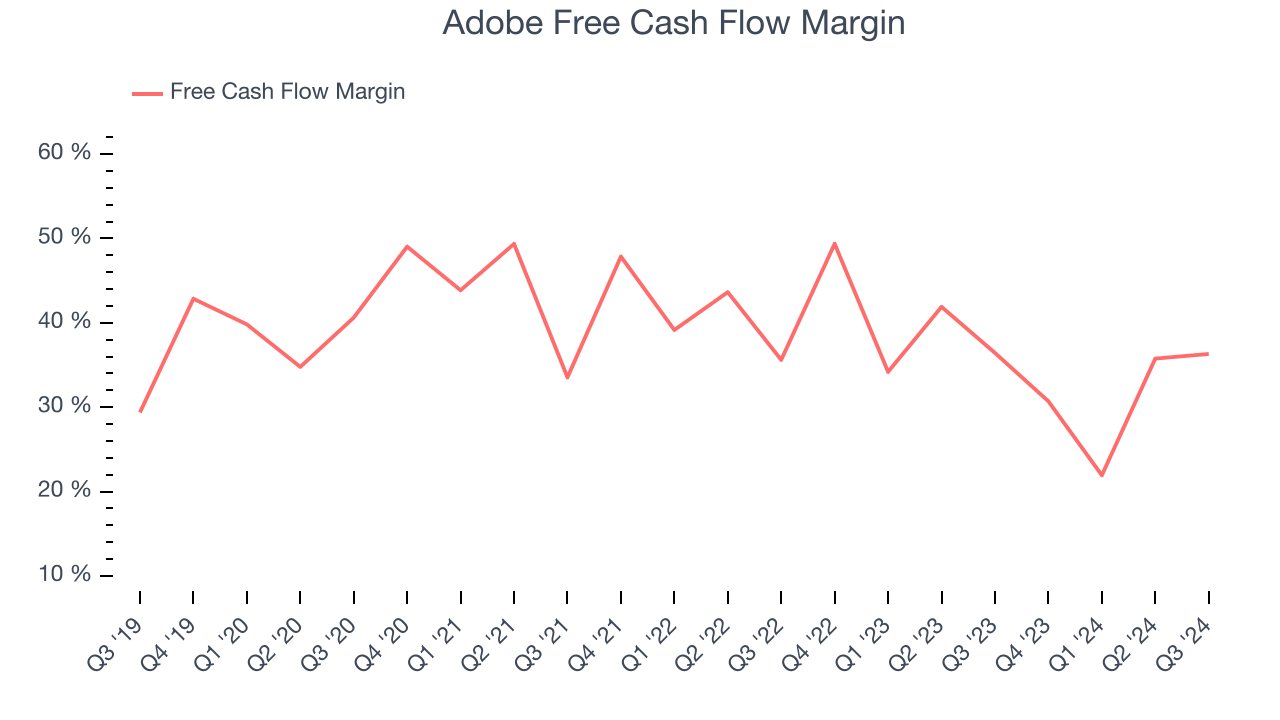

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Adobe has shown terrific cash profitability, driven by its lucrative business model and cost-effective customer acquisition strategy that enable it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the software sector, averaging an eye-popping 31.3% over the last year.

Adobe’s free cash flow clocked in at $1.96 billion in Q3, equivalent to a 36.3% margin. This quarter’s cash profitability was in line with the comparable period last year and above its one-year average.

Over the next year, analysts predict Adobe’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 31.3% for the last 12 months will increase to 39.5%, giving it more money to invest.

Key Takeaways from Adobe’s Q3 Results

It was good to see Adobe beat analysts’ revenue and EPS expectations this quarter. We were also glad its gross margin improved. On the other hand, its revenue guidance for next quarter (especially Net New Digital Media ARR, which the market watches closely) missed Wall Street’s estimates, sending shares lower. Overall, this quarter could have been better. The stock traded down 7.9% to $541 immediately after reporting.

Adobe may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.