Creative software maker Adobe (NASDAQ:ADBE) reported results in line with analysts' expectations in Q1 FY2024, with revenue up 11.3% year on year to $5.18 billion. On the other hand, the company expects next quarter's revenue to be around $5.28 billion, slightly below analysts' estimates. It made a non-GAAP profit of $4.48 per share, improving from its profit of $3.80 per share in the same quarter last year.

Adobe (ADBE) Q1 FY2024 Highlights:

- Revenue: $5.18 billion vs analyst estimates of $5.15 billion (small beat)

- EPS (non-GAAP): $4.48 vs analyst estimates of $4.38 (2.2% beat)

- Revenue Guidance for Q2 2024 is $5.28 billion at the midpoint, below analyst estimates of $5.31 billion

- EPS (non-GAAP) Guidance for Q2 2024 is $4.38 at the midpoint, roughly in line with what analysts were expecting

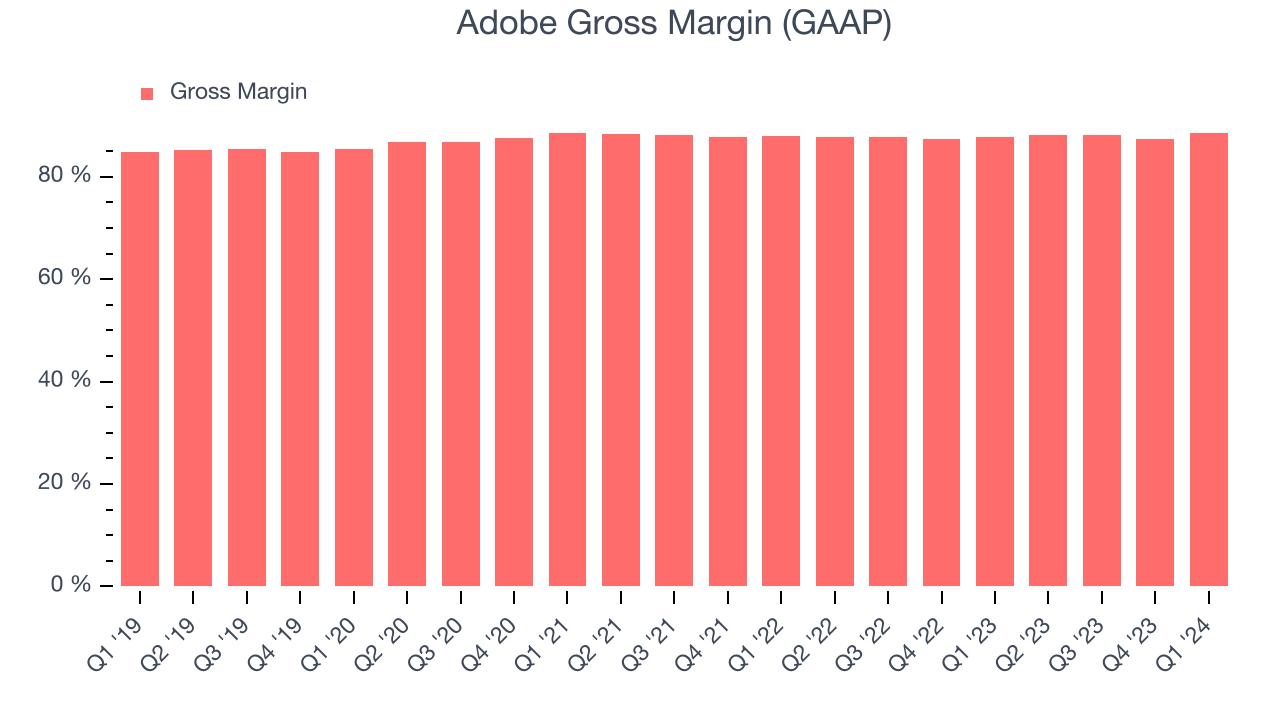

- Gross Margin (GAAP): 88.6%, in line with the same quarter last year

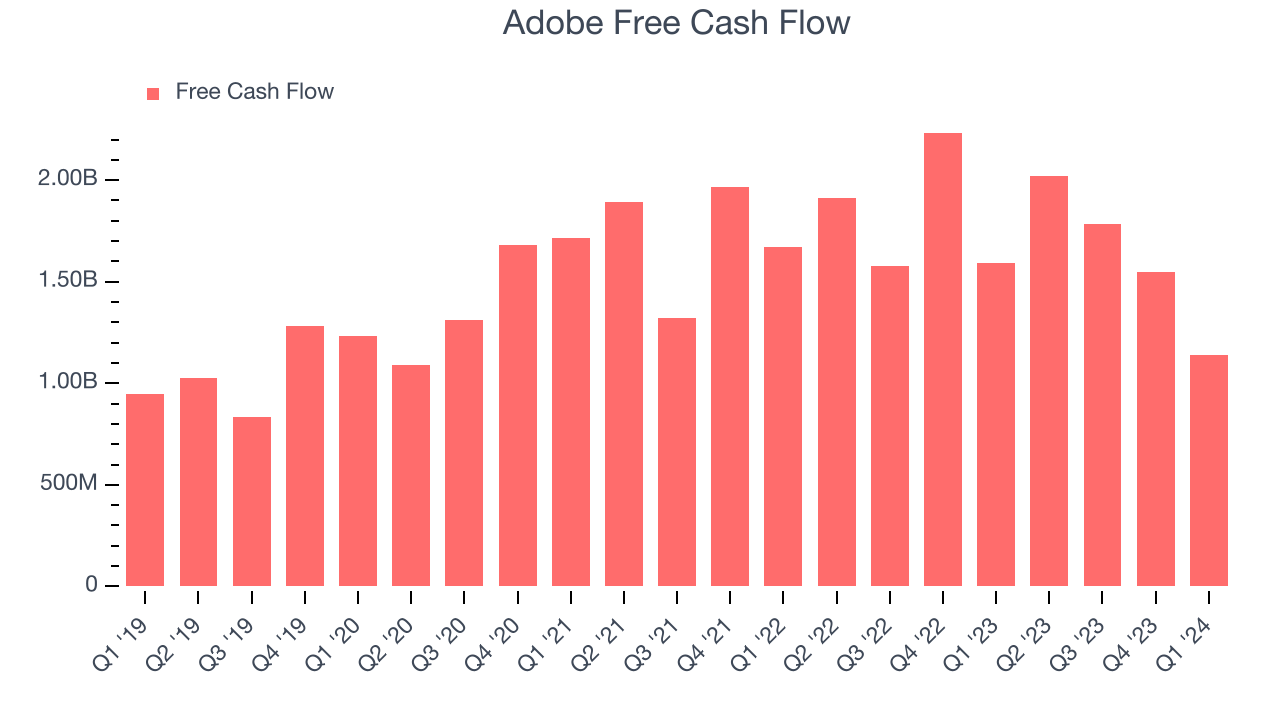

- Free Cash Flow of $1.14 billion, down 26.6% from the previous quarter

- Market Capitalization: $259.6 billion

One of the most well-known Silicon Valley software companies around, Adobe (NASDAQ:ADBE) is a leading provider of software as service in the digital design and document management space.

Adobe was originally founded in 1982 and famously Steve Jobs soon after attempted to acquire it for $5 million. The founders refused and instead negotiated an investment and a five year licencing deal with Apple (AAPL), which made them the first company in the history of Silicon Value to turn profit in its first year and started their impressive journey.

The company is famous for inventing the PDF format and its photo-editing and publishing software products like Photoshop or Illustrator which have become household names and leading industry standards. Over time Adobe leveraged the key role their products played in the lives of their customers and built a cloud ecosystem of products and services around them.

Today the company has a very strong portfolio of products, through its Creative Cloud offering it provides tools for digital design and publishing, such as Adobe Premiere that is used for professional movie production. The Document Cloud enables customers to create electronic documents and manage their lifecycle, offering the ability to sign legally binding documents electronically through Adobe Sign. Lately Adobe has been expanding into offering software for hosting content online and providing customers with the ability to monetize their readers via advertising.

Design Software

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

Competitors addressing the digital design and document management segments include Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL), Oracle (NYSE:ORCL), salesforce.com (NYSE:CRM), SAP (NYSE:SAP), and DocuSign (NASDAQ:DOCU).

Sales Growth

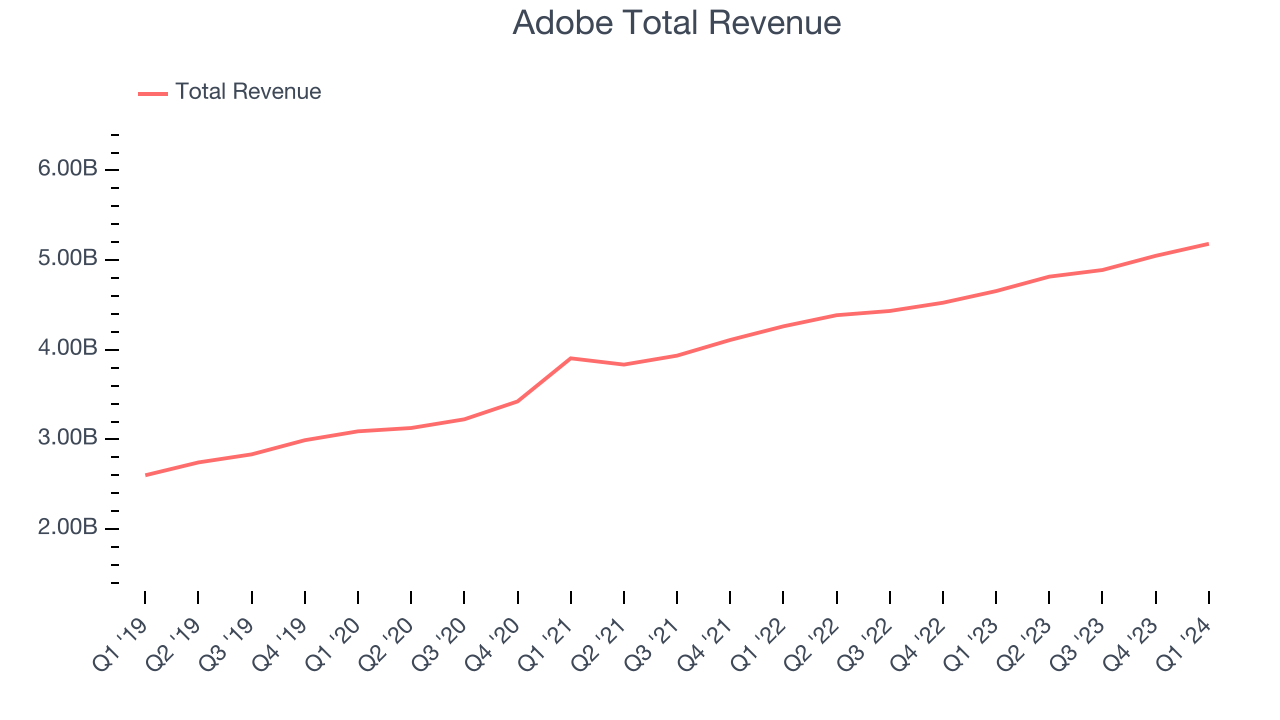

As you can see below, Adobe's revenue growth has been mediocre over the last three years, growing from $3.91 billion in Q1 2021 to $5.18 billion this quarter.

This quarter, Adobe's quarterly revenue was once again up 11.3% year on year. However, its growth did slow down a little compared to last quarter as the company increased revenue by $134 million in Q1 compared to $158 million in Q4 2023. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that Adobe is expecting revenue to grow 9.5% year on year to $5.28 billion, in line with the 9.8% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 10.6% over the next 12 months before the earnings results announcement.

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Adobe's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 88.6% in Q1.

That means that for every $1 in revenue the company had $0.89 left to spend on developing new products, sales and marketing, and general administrative overhead. Significantly up from the last quarter, Adobe's excellent gross margin allows it to fund large investments in product and sales during periods of rapid growth and achieve profitability when reaching maturity.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Adobe's free cash flow came in at $1.14 billion in Q1, down 28.6% year on year.

Adobe has generated $6.49 billion in free cash flow over the last 12 months, an eye-popping 32.5% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Key Takeaways from Adobe's Q1 Results

We enjoyed seeing Adobe exceed analysts' billings expectations this quarter. We were also glad its net new digital media ARR of $432 million beat estimates of $415 million, enabling the company to top Wall Street's revenue and EPS projections. On the other hand, its revenue guidance for next quarter missed analysts' expectations as its net new digital media ARR guidance of $440 million fell short of analysts' $468 million forecast.

During the earnings release, Adobe also announced a new $25 billion share repurchase program.

Zooming out, we think this was still a decent, albeit mixed, quarter, showing that the company is staying on track. The market was likely disappointed by its digital media segment guidance, however, and the stock is down 9.1% after reporting, trading at $520 per share.

Is Now The Time?

When considering an investment in Adobe, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We think Adobe is a good business. Although its revenue growth has been uninspiring over the last three years with analysts expecting growth to slow from here, its bountiful generation of free cash flow empowers it to invest in growth initiatives.

Adobe's price-to-sales ratio of 11.8x based on the next 12 months indicates the market is certainly optimistic about its growth prospects. There are definitely things to like about Adobe, and there's no doubt it's a bit of a market darling, at least for some. But when comparing the company against the broader tech landscape, it seems there's a lot of good news already priced in.

Wall Street analysts covering the company had a one-year price target of $645.10 right before these results (compared to the current share price of $520).

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.