Design software company Autodesk (NASDAQ:ADSK) reported Q4 FY2024 results topping analysts' expectations, with revenue up 11.5% year on year to $1.47 billion. The company expects next quarter's revenue to be around $1.39 billion, in line with analysts' estimates. It made a non-GAAP profit of $2.09 per share, improving from its profit of $1.86 per share in the same quarter last year.

Autodesk (ADSK) Q4 FY2024 Highlights:

- Revenue: $1.47 billion vs analyst estimates of $1.43 billion (2.6% beat)

- EPS (non-GAAP): $2.09 vs analyst estimates of $1.95 (7.3% beat)

- Revenue Guidance for Q1 2025 is $1.39 billion at the midpoint, roughly in line with what analysts were expecting (however, non-GAAP EPS guidance for the period below Wall Street's expectations)

- Management's revenue guidance for the upcoming financial year 2025 is $6.04 billion at the midpoint, beating analyst estimates by 1% and implying 9.9% growth (vs 9.8% in FY2024) (however, non-GAAP EPS guidance for the period below Wall Street's expectations)

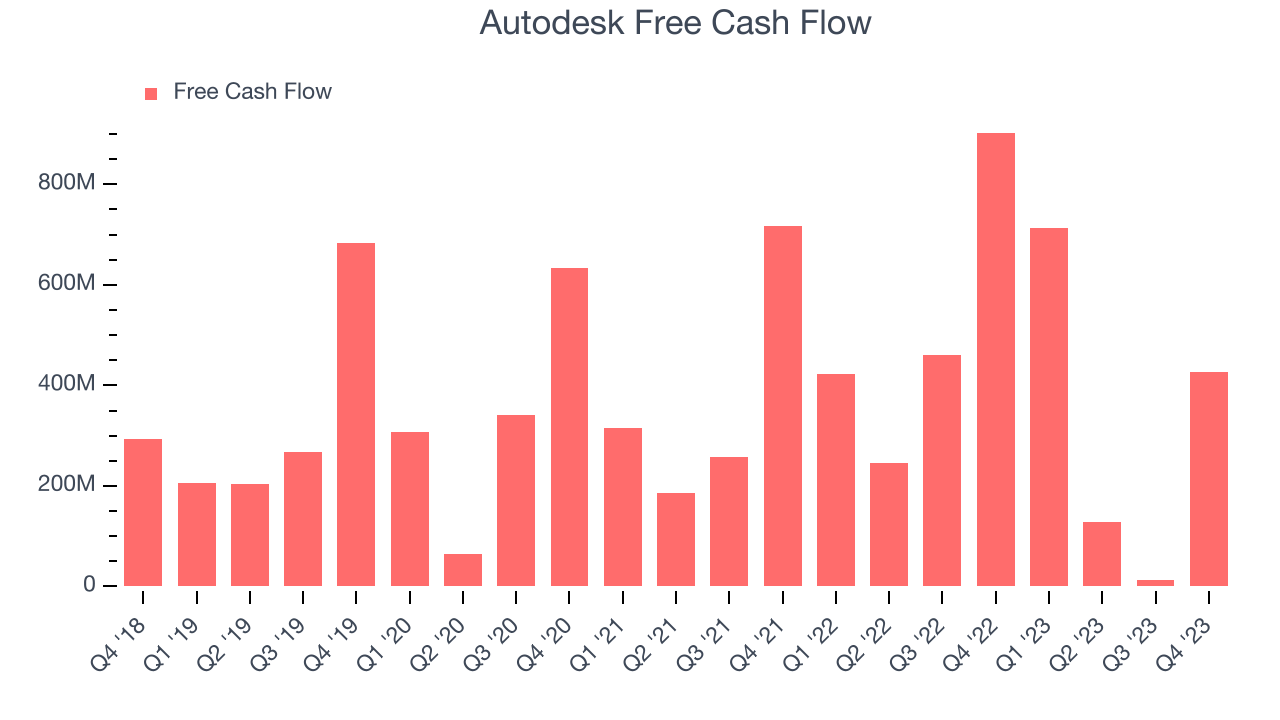

- Free Cash Flow of $427 million, up from $13 million in the previous quarter

- Gross Margin (GAAP): 91.2%, in line with the same quarter last year

- Market Capitalization: $54.6 billion

Founded in 1982 by John Walker and growing into one of the industry's behemoths, Autodesk (NASDAQ:ADSK) makes computer-aided design (CAD) software for engineering, construction, and architecture companies.

Autodesk is best known for its flagship software, AutoCAD, which is used to design buildings, cars, and bridges. Being the first CAD software to run on PC, AutoCAD by Autodesk accelerated the shift from paper-based engineering designs to digital designs. Paper-based designs were error-prone, difficult to keep up to date and made cooperation between teams hard. Autodesk and its collection of design tools have made these problems a thing of the past. AutoCAD not only makes edits easy but also allows designers and architects to create a library of components that can be reused later, making the design process much more efficient.

Today, even after 40 years, the software is still an essential go-to tool for a number of industries and its functionality has expanded far beyond its original scope, for example it comes with built-in tools that can analyze and remedy weaknesses in a building’s design. Autodesk also makes software for the entertainment and gaming industries. One of the tools, Maya, is a 3D animation software that is used to add special effects to video games and movies, and was essential in making movies such as Avatar, The Matrix, and Spider-Man.

Design Software

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

It is worth highlighting the competition in the design software space, which includes players such as Dassault Systèmes (OTC:DASTY), Adobe (NASDAQ:ADBE), Ansys (NASDAQ:ANSS), PTC (NASDAQ:PTC), and Bentley Systems (NASDAQ:BSY).

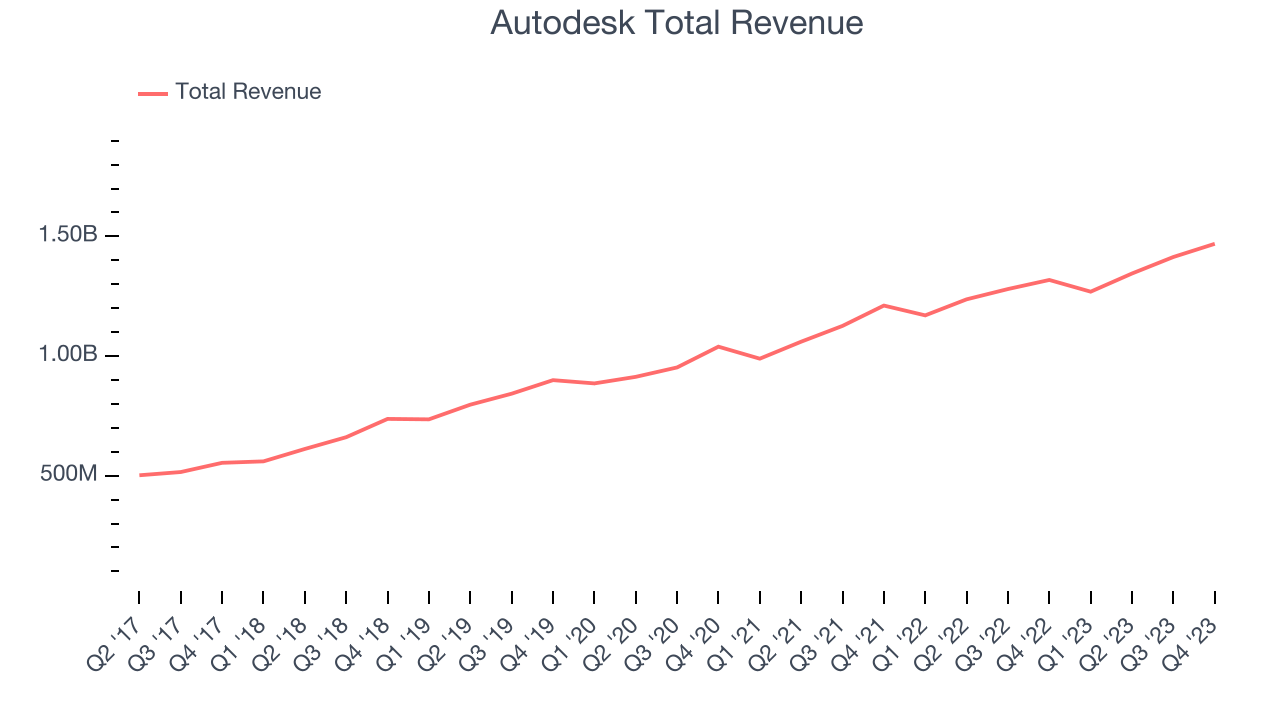

Sales Growth

As you can see below, Autodesk's revenue growth has been unremarkable over the last two years, growing from $1.21 billion in Q4 FY2022 to $1.47 billion this quarter.

This quarter, Autodesk's quarterly revenue was once again up 11.5% year on year. However, its growth did slow down compared to last quarter as the company's revenue increased by just $55 million in Q4 compared to $69 million in Q3 2024. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that Autodesk is expecting revenue to grow 9.7% year on year to $1.39 billion, improving on the 8.5% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $6.04 billion at the midpoint, growing 9.9% year on year compared to the 9.8% increase in FY2024.

Profitability

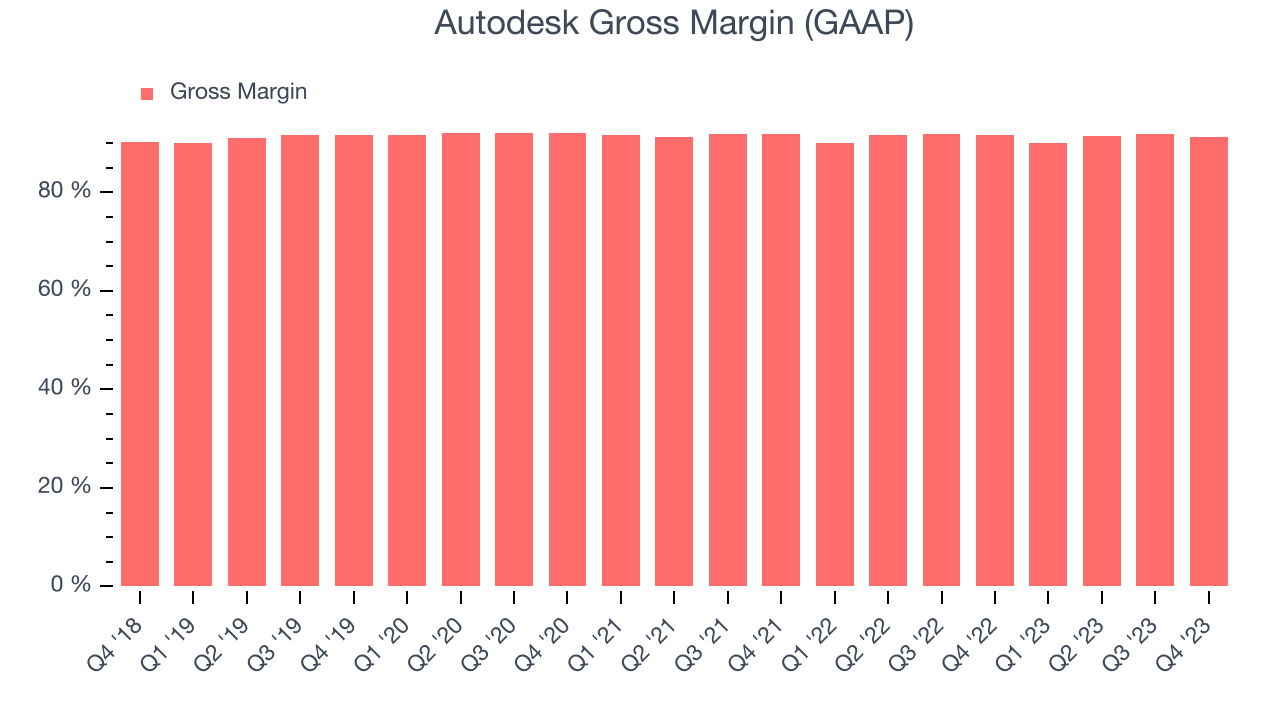

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Autodesk's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 91.2% in Q4.

That means that for every $1 in revenue the company had $0.91 left to spend on developing new products, sales and marketing, and general administrative overhead. Autodesk's excellent gross margin allows it to fund large investments in product and sales during periods of rapid growth and achieve profitability when reaching maturity. It's also comforting to see its gross margin remain stable, indicating that Autodesk is controlling its costs and not under pressure from its competitors to lower prices.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Autodesk's free cash flow came in at $427 million in Q4, down 52.7% year on year.

Autodesk has generated $1.28 billion in free cash flow over the last 12 months, an impressive 23.3% of revenue. This high FCF margin stems from its asset-lite business model and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a cash cushion.

Key Takeaways from Autodesk's Q4 Results

It was a good quarter, with revenue and non-GAAP EPS beating expectations. Revenue guidance was also solid for both next quarter and the full year. One negative was that guidance for non-GAAP EPS was below for both next quarter and the full year. Overall, this quarter's results seemed fairly solid. The stock is shrugging off the EPS guide and is up 7% after reporting and currently trades at $276.2 per share.

Is Now The Time?

When considering an investment in Autodesk, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We think Autodesk is a solid business. Although its with analysts expecting growth to slow from here, its impressive gross margins indicate excellent business economics.

The market is certainly expecting long-term growth from Autodesk given its price-to-sales ratio based on the next 12 months is 9.3x. There are definitely things to like about Autodesk and looking at the tech landscape right now, it seems that the company trades at a pretty interesting price point.

Wall Street analysts covering the company had a one-year price target of $254.33 per share right before these results (compared to the current share price of $276.20).

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.