Hospitality industry software provider Agilysys (NASDAQ:AGYS) reported results in line with analysts' expectations in Q1 CY2024, with revenue up 17.6% year on year to $62.22 million. The company's outlook for the full year was also close to analysts' estimates with revenue guided to $277.5 million at the midpoint. It made a non-GAAP profit of $0.32 per share, improving from its profit of $0.26 per share in the same quarter last year.

Agilysys (AGYS) Q1 CY2024 Highlights:

- Revenue: $62.22 million vs analyst estimates of $61.95 million (small beat)

- EPS (non-GAAP): $0.32 vs analyst estimates of $0.28 (13.3% beat)

- Management's revenue guidance for the upcoming financial year 2025 is $277.5 million at the midpoint, in line with analyst expectations and implying 16.9% growth (vs 19.9% in FY2024)

- Gross Margin (GAAP): 61.5%, up from 60.8% in the same quarter last year

- Free Cash Flow of $29.34 million, up 161% from the previous quarter

- Market Capitalization: $2.20 billion

Originally a subsidiary of Pioneer-Standard Electronics that distributed electronic components, Agilysys (NASDAQ:AGYS) offers a software-as-service platform that helps hotels, resorts, restaurants, and other hospitality businesses manage their operations and workflows.

Overall, the operations of a hospitality provider can be complex and fast-moving given the constant ebb and flow of guests and the products and services to address guest needs (they can be pretty demanding!). As consumers increasingly use an omnichannel approach to shop for, book, and alter their reservations, hospitality providers also need to digitize their operations to meet their customers and to increase speed and efficiency.

Agilysys’ key product, the Agilysys Hospitality Solutions Suite, addresses these challenges in hospitality. The platform helps manage reservations, check-ins, point-of-sale, and inventory. It can also automate workflows such as updating room availability on a hotel’s website, which means better inventory turnover and fewer human errors. Lastly, the analytics capabilities native to the Agilysys Hospitality Solutions Suite mean that customers can make data-driven decisions for better outcomes such as higher customer satisfaction.

Agilysys’ key customers include hotels, resorts, restaurants, and other hospitality businesses. The company generates revenue by selling software licenses and also charges customers for support and professional services such as implementation that can improve customer time to value and success.

Hospitality & Restaurant Software

Enterprise resource planning (ERP) and customer relationship management (CRM) are two of the largest software categories dominated by the likes of Microsoft, Oracle, and Salesforce.com. Today, the secular trend of mass customization is driving vertical software that customizes ERP and CRM functions for specific industry requirements. Restaurants are a prime example where a set of customized software providers have sprung up in recent years to create unique operating systems that blend tax and accounting software, order management and delivery, along with supply chain management. Hotels and other hospitality providers are another example.

Competitors offering hospitality software solutions include Oracle (NYSE:ORCL) Hospitality OPERA Property Management System and private companies SkyTouch Technology and Maestro PMS.Sales Growth

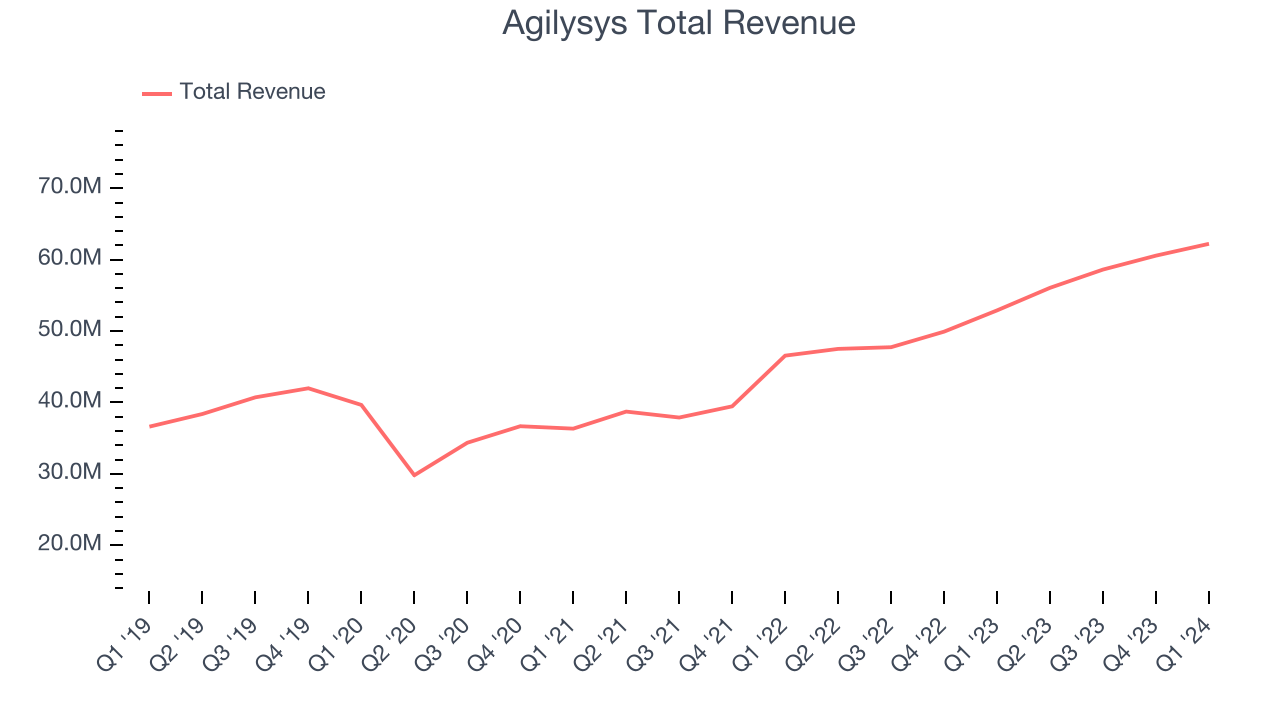

As you can see below, Agilysys's revenue growth has been strong over the last three years, growing from $36.34 million in Q4 2021 to $62.22 million this quarter.

This quarter, Agilysys's quarterly revenue was once again up 17.6% year on year. However, its growth did slow down a little compared to last quarter as the company increased revenue by $1.66 million in Q1 compared to $1.95 million in Q4 CY2023. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

For the upcoming financial year, management expects revenue to be $277.5 million at the midpoint, growing 16.9% year on year compared to the 19.9% increase in FY2024.

Profitability

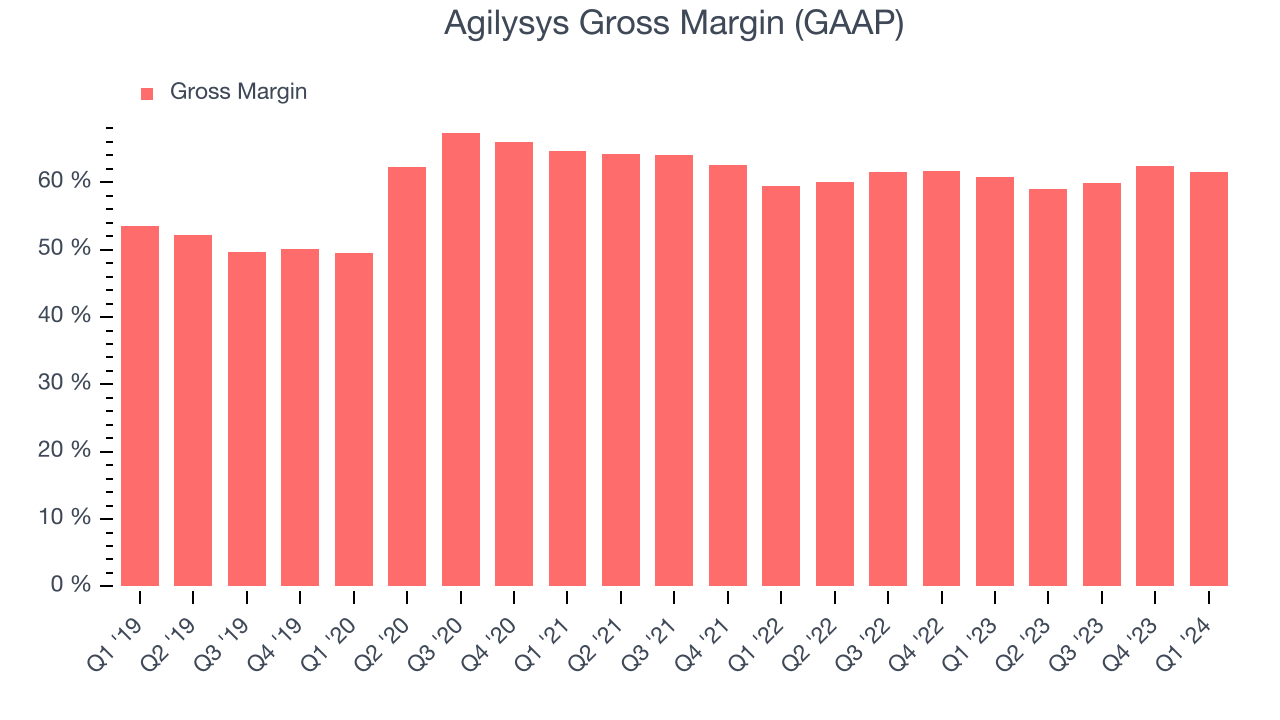

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Agilysys's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 61.5% in Q1.

That means that for every $1 in revenue the company had $0.62 left to spend on developing new products, sales and marketing, and general administrative overhead. Agilysys's gross margin is poor for a SaaS business and it's dropped significantly since the previous quarter. This is probably the exact opposite of what shareholders would like to see.

Cash Is King

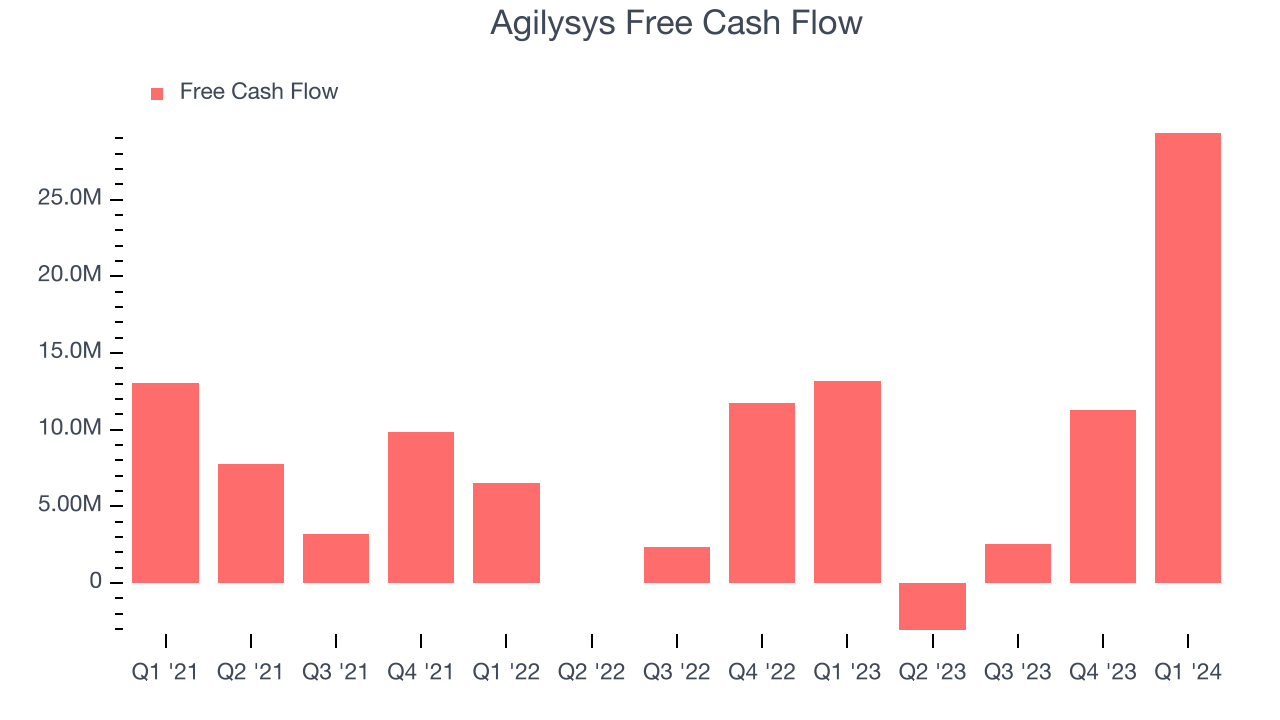

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Agilysys's free cash flow came in at $29.34 million in Q1, up 123% year on year.

Agilysys has generated $40.06 million in free cash flow over the last 12 months, a solid 16.9% of revenue. This strong FCF margin stems from its asset-lite business model, giving it optionality and plenty of cash to reinvest in its business.

Key Takeaways from Agilysys's Q1 Results

We feel positive about Agilysys's free cash flow generation this quarter, which beat analysts' estimates. We were also glad its revenue forecast for next year was in line with expectations. On the other hand, its gross margin fell. Zooming out, we think this was still a decent, albeit mixed, quarter, showing that the company is staying on track. The stock is up 4.8% after reporting and currently trades at $84.22 per share.

Is Now The Time?

When considering an investment in Agilysys, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

Although Agilysys isn't a bad business, it probably wouldn't be one of our picks. Although its revenue growth has been solid over the last three years, Wall Street expects growth to deteriorate from here. On top of that, its gross margins show its business model is much less lucrative than the best software businesses.

Given its price-to-sales ratio of 8.1x based on the next 12 months, the market is certainly expecting long-term growth from Agilysys. We can find things to like about Agilysys, and there's no doubt it's a bit of a market darling, at least for some. However, we think there are better opportunities elsewhere right now.

Wall Street analysts covering the company had a one-year price target of $100 right before these results (compared to the current share price of $84.22).

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.