Web content delivery and security company Akamai (NASDAQ:AKAM) missed analyst expectations in Q1 FY2022 quarter, with revenue up 7.23% year on year to $903.6 million. Akamai made a GAAP profit of $119.1 million, down on its profit of $155.6 million, in the same quarter last year.

Is now the time to buy Akamai? Access our full analysis of the earnings results here, it's free.

Akamai (AKAM) Q1 FY2022 Highlights:

- Revenue: $903.6 million vs analyst estimates of $904.8 million (small miss)

- EPS (non-GAAP): $1.39 vs analyst expectations of $1.42 (2.23% miss)

- Free cash flow of $91 million, down 74.9% from previous quarter

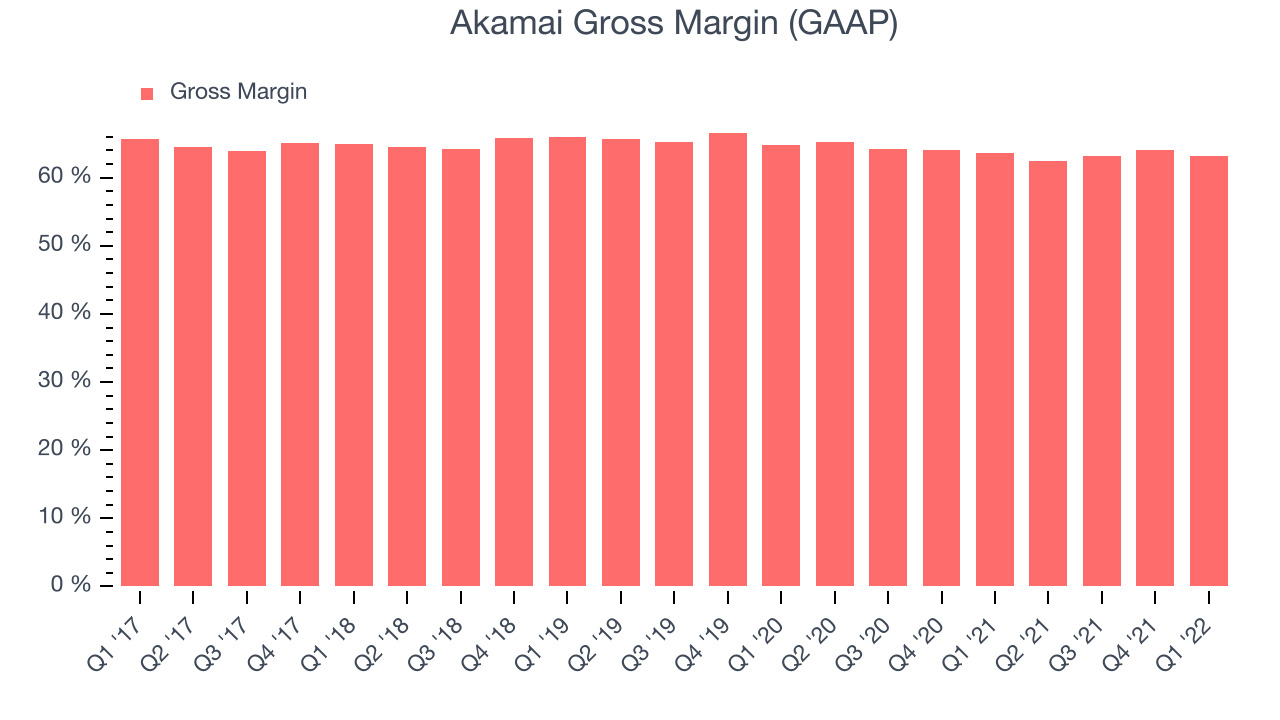

- Gross Margin (GAAP): 63.1%, in line with same quarter last year

"Despite a challenging global environment and the headwinds associated with the strengthening U.S. dollar, Akamai delivered results in line with our Q1 guidance," said Dr. Tom Leighton, Akamai's Chief Executive Officer. "

Founded in 1999 by two engineers from MIT, Akamai (NASDAQ:AKAM) provides software for organizations to efficiently deliver web content to their customers.

The amount of content on the internet is exploding, whether it is music, movies and or e-commerce stores. Consumer demand for this content creates network congestion, much like a digital traffic jam which drives demand for specialized content delivery networks (CDN) services that alleviate potential network bottlenecks.

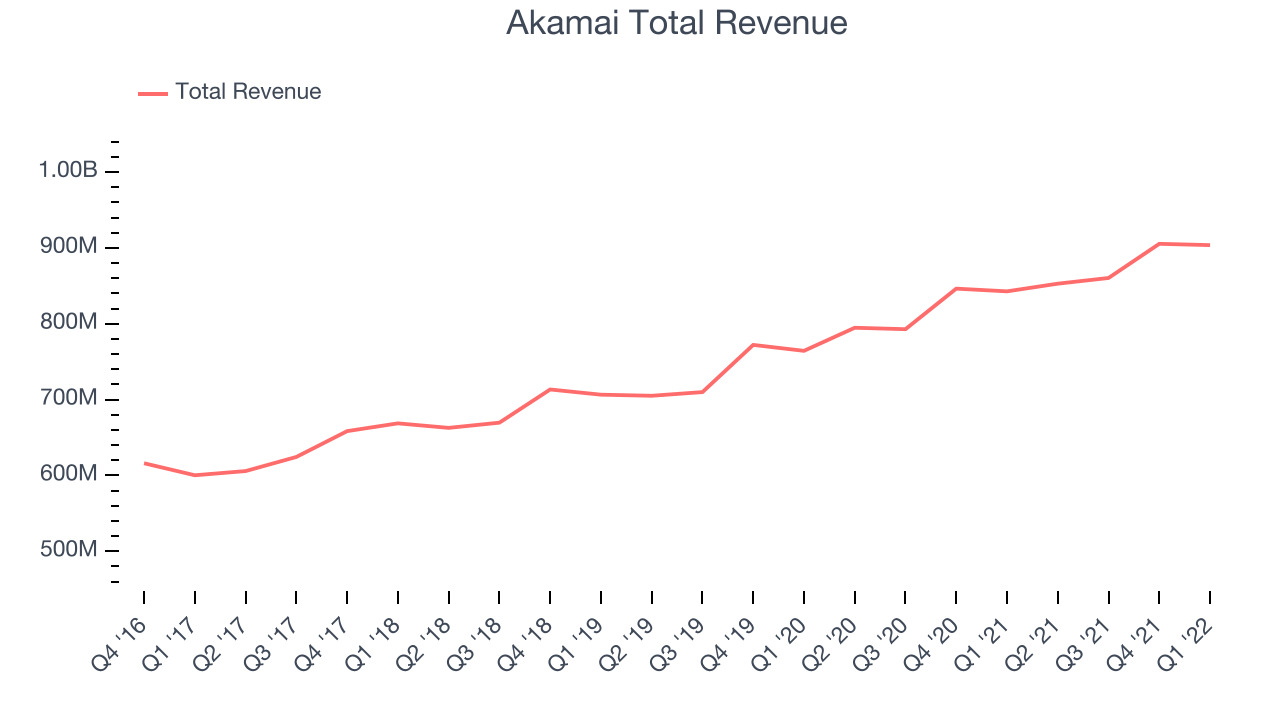

Sales Growth

As you can see below, Akamai's revenue growth has been unimpressive over the last year, growing from quarterly revenue of $842.7 million, to $903.6 million.

Akamai's quarterly revenue was only up 7.23% year on year, which would likely disappoint many shareholders. But the revenue actually decreased by $1.71 million in Q1, compared to $45 million increase in Q4 2021. Akamai's sales do seem to have a seasonal pattern to them.

Ahead of the earnings results the analysts covering the company were estimating sales to grow 11% over the next twelve months.

There are others doing even better than Akamai. Founded by ex-Google engineers, a small company making software for banks has been growing revenue 90% year on year and is already up more than 150% since the IPO last December. You can find it on our platform for free.

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Akamai's gross profit margin, an important metric measuring how much money there is left after paying for servers, licenses, technical support and other necessary running expenses was at 63.1% in Q1.

That means that for every $1 in revenue the company had $0.63 left to spend on developing new products, marketing & sales and the general administrative overhead. This would be considered a low gross margin for a SaaS company and it has dropped significantly from the previous quarter, which is probably the opposite of what shareholders would like it to do.

Key Takeaways from Akamai's Q1 Results

With a market capitalization of $18 billion, more than $506.8 million in cash and with free cash flow over the last twelve months being positive, the company is in a very strong position to invest in growth.

We struggled to find many strong positives in these results. On the other hand, it was less good to see that the revenue growth was quite weak and it missed analysts' revenue expectations. Overall, this quarter's results could have been better. The company is down 6.8% on the results and currently trades at $106.07 per share.

Akamai may have had a tough quarter, but does that actually create an opportunity to invest right now? It is important that you take into account its valuation and business qualities, as well as what happened in the latest quarter. We look at that in our actionable report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.