Web content delivery and security company Akamai (NASDAQ:AKAM) reported results in line with analysts' expectations in Q1 CY2024, with revenue up 7.8% year on year to $987 million. On the other hand, next quarter's revenue guidance of $976.5 million was less impressive, coming in 2.5% below analysts' estimates. It made a GAAP profit of $1.11 per share, improving from its profit of $0.62 per share in the same quarter last year.

Akamai (AKAM) Q1 CY2024 Highlights:

- Revenue: $987 million vs analyst estimates of $989.2 million (small miss)

- EPS: $1.11 vs analyst estimates of $1.00 (11.1% beat)

- Revenue Guidance for Q2 CY2024 is $976.5 million at the midpoint, below analyst estimates of $1.00 billion

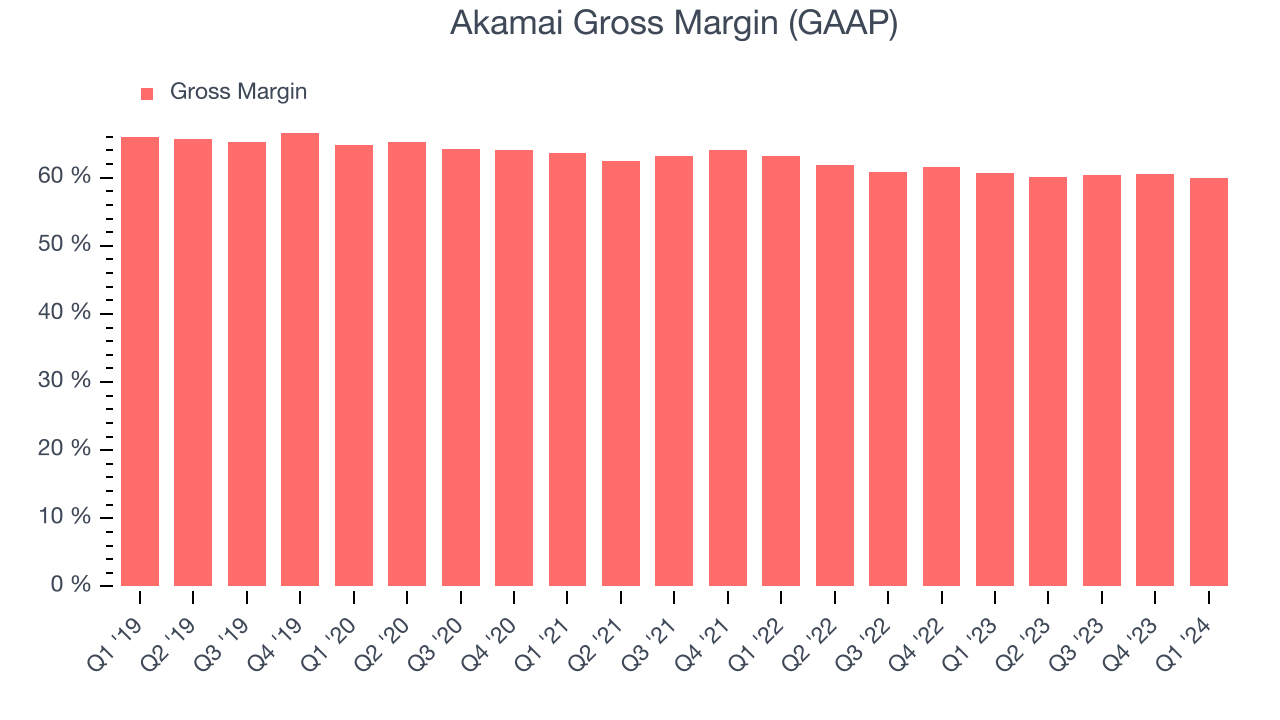

- Gross Margin (GAAP): 60%, down from 60.7% in the same quarter last year

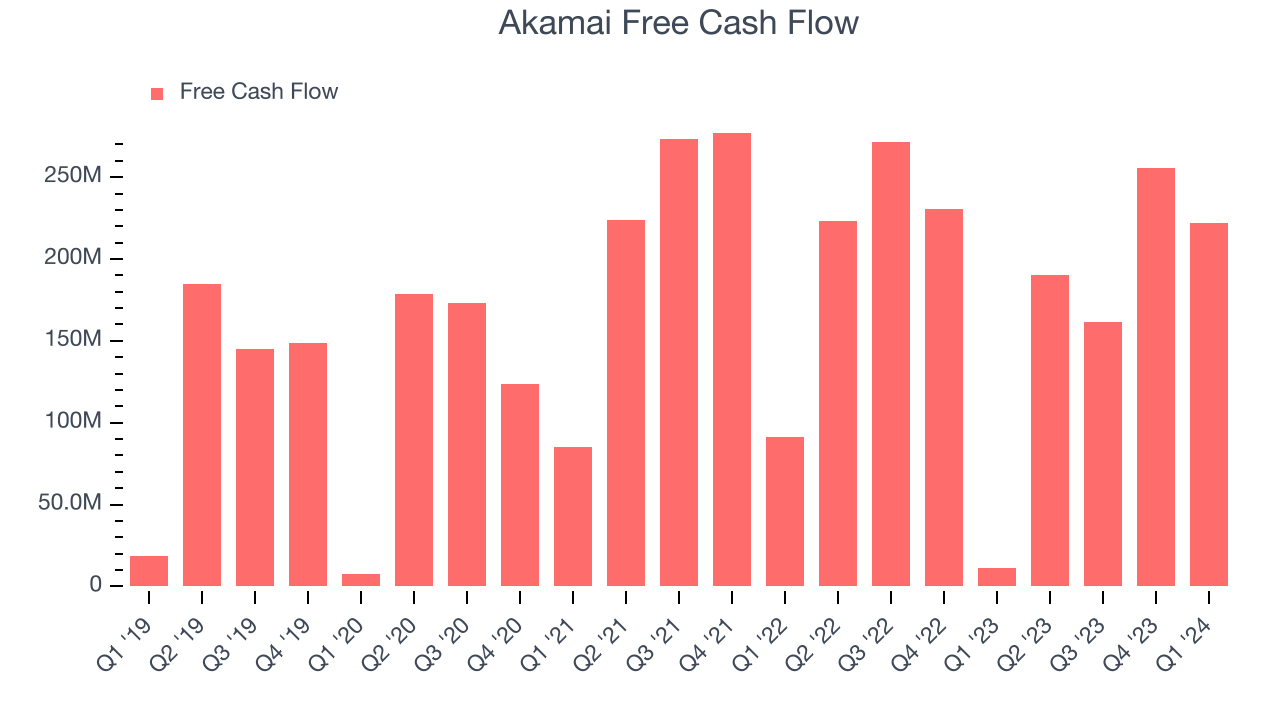

- Free Cash Flow of $221.8 million, down 13.1% from the previous quarter

- Market Capitalization: $15.65 billion

Founded in 1999 by two engineers from MIT, Akamai (NASDAQ:AKAM) provides software for organizations to efficiently deliver web content to their customers.

When streaming videos to a large number of viewers, operating a high traffic ecommerce site or a gaming portal, the server providing the content can get overwhelmed by the number of requests, resulting in a slow response time, dropped connections and frustrated customers. Using Akamai’s Content Delivery Network, organizations can provide quality and uninterrupted access to websites or applications to their customers, even at a really large scale.

Akamai operates a network of servers around the world and uses them to store copies of web content owned by its customers on servers closest to the user, to improve download speed. By moving web content closer to users, Akamai also helps to prevent cybercriminals from hijacking internet traffic, which is more vulnerable when transmitted over long distances.

For example, many customers visit online shopping sites during the holiday season to access exclusive offers on days like Black Friday. To cope with the enormous volume of traffic experienced during this period, Akamai works in the background to automatically check the location of every user accessing the shopping site and serves them the website from the Akamai server geographically closest to them, without the user noticing anything. This means users in the UK can enjoy the same web experience as users in the US when accessing a website located in the US.

Content Delivery

The amount of content on the internet is exploding, whether it is music, movies and or e-commerce stores. Consumer demand for this content creates network congestion, much like a digital traffic jam which drives demand for specialized content delivery networks (CDN) services that alleviate potential network bottlenecks.

Akamai competes with content delivery network providers such as Cloudflare (NYSE:NET), Google (NASDAQ:GOOG) (NASDAQ:GOOGL), Amazon (NASDAQ:AMZN), and Microsoft (NASDAQ:MSFT) as well as innovators in edge computing such as Fastly (NYSE:FSLY).

Sales Growth

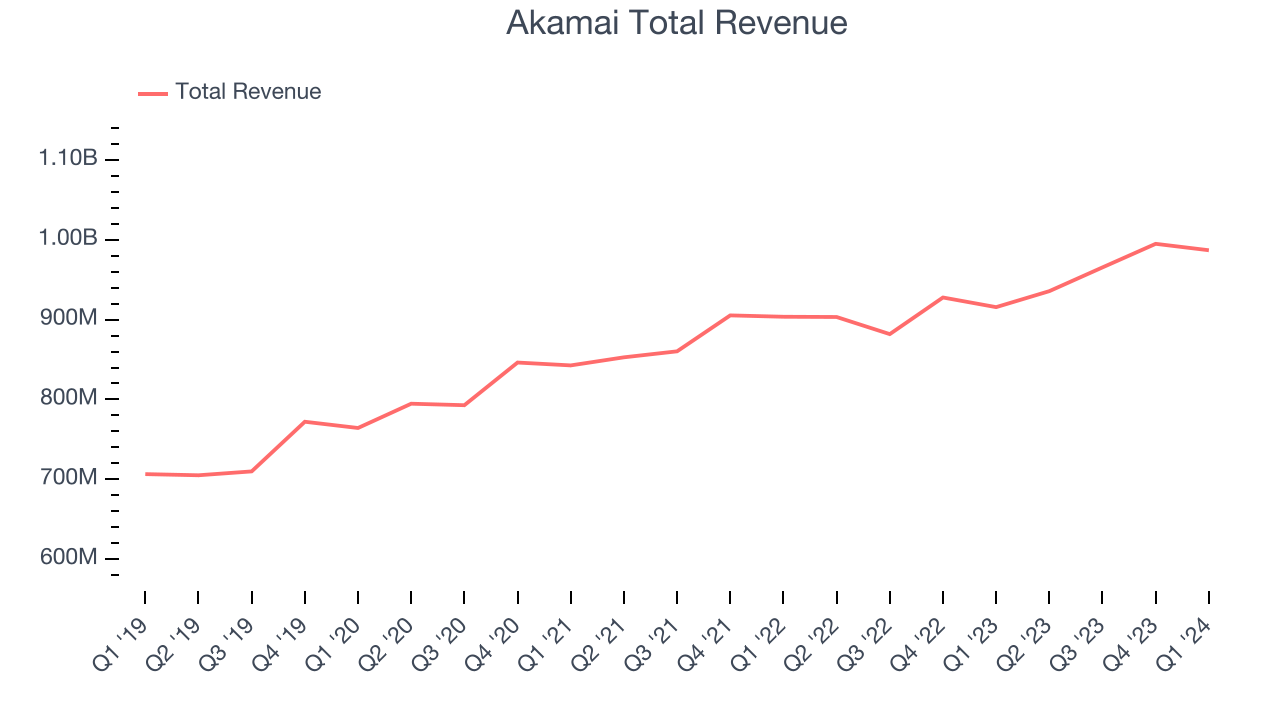

As you can see below, Akamai's revenue growth has been unimpressive over the last three years, growing from $842.7 million in Q1 2021 to $987 million this quarter.

Akamai's quarterly revenue was only up 7.8% year on year, which might disappoint some shareholders. On top of that, the company's revenue actually decreased by $8.05 million in Q1 compared to the $29.53 million increase in Q4 CY2023. This situation is worth monitoring as Akamai's sales have historically followed a seasonal pattern but management is guiding for a further revenue drop in the next quarter.

Next quarter's guidance suggests that Akamai is expecting revenue to grow 4.4% year on year to $976.5 million, improving on the 3.6% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 6.9% over the next 12 months before the earnings results announcement.

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Akamai's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 60% in Q1.

That means that for every $1 in revenue the company had $0.60 left to spend on developing new products, sales and marketing, and general administrative overhead. Akamai's gross margin is poor for a SaaS business and we'd like to see it start improving.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Akamai's free cash flow came in at $221.8 million in Q1, up 1,870% year on year.

Akamai has generated $828.9 million in free cash flow over the last 12 months, an impressive 21.3% of revenue. This high FCF margin stems from its asset-lite business model and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a cash cushion.

Key Takeaways from Akamai's Q1 Results

We struggled to find many strong positives in these results. Although its EPS beat Wall Street's estimates, its full-year revenue guidance missed analysts' expectations, sending the stock down. Company outlooks have been the big focus this earnings season. On the bright side, the Board authorized a new three-year, $2.0 billion share repurchase program. Overall, the results could have been better. The company is down 8.9% on the results and currently trades at $93.5 per share.

Is Now The Time?

When considering an investment in Akamai, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We cheer for everyone who's making the lives of others easier through technology, but in case of Akamai, we'll be cheering from the sidelines. Its revenue growth has been weak over the last three years, and analysts expect growth to deteriorate from here. And while its bountiful generation of free cash flow empowers it to invest in growth initiatives, the downside is its customer acquisition is less efficient than many comparable companies. On top of that, its gross margins show its business model is much less lucrative than the best software businesses.

Akamai's price-to-sales ratio based on the next 12 months is 3.9x, suggesting the market has lower expectations for the business relative to the hottest tech stocks. While there are some things to like about Akamai and its valuation is reasonable, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $125.95 right before these results (compared to the current share price of $93.50).

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.