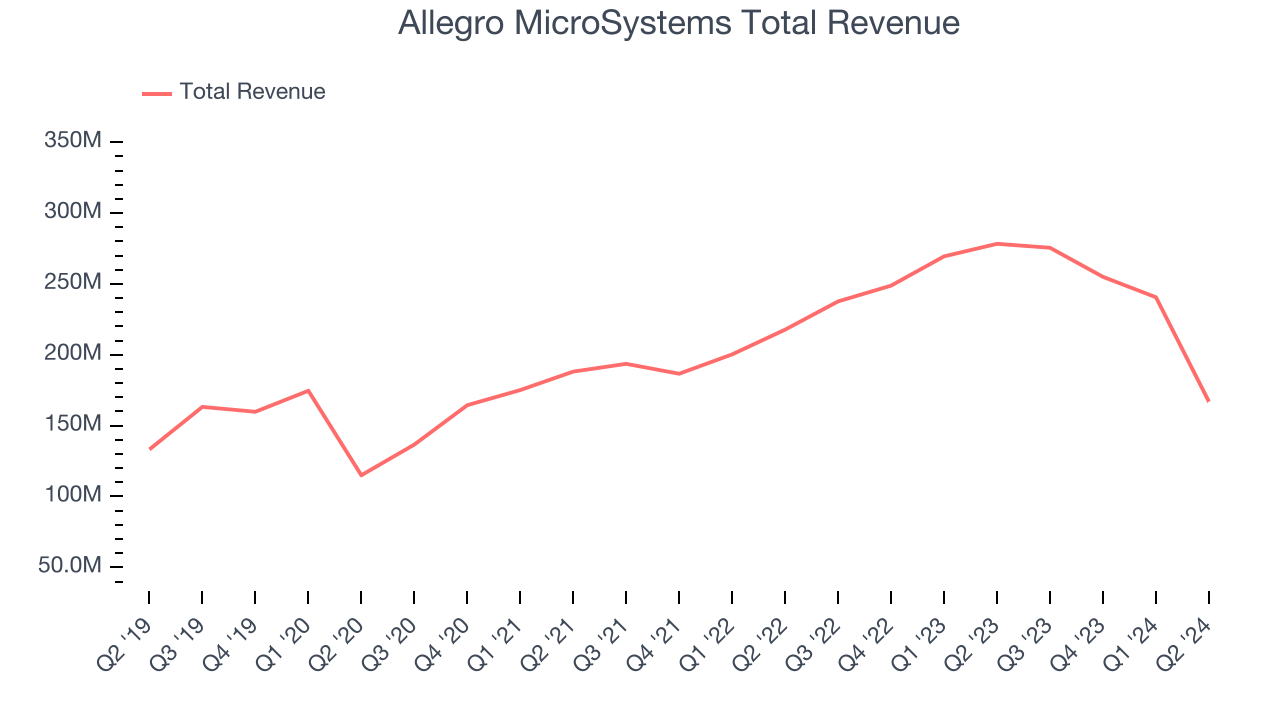

Chip designer Allegro MicroSystems (NASDAQ:ALGM) reported results ahead of analysts' expectations in Q2 CY2024, with revenue down 40% year on year to $166.9 million. The company expects next quarter's revenue to be around $187 million, in line with analysts' estimates. It made a non-GAAP profit of $0.03 per share, down from its profit of $0.39 per share in the same quarter last year.

Is now the time to buy Allegro MicroSystems? Find out by accessing our full research report, it's free.

Allegro MicroSystems (ALGM) Q2 CY2024 Highlights:

- Revenue: $166.9 million vs analyst estimates of $165 million (1.2% beat)

- Adjusted Operating Income: $9.97 million vs analyst estimates of $9.28 million (7.4% beat)

- EPS (non-GAAP): $0.03 vs analyst expectations of $0.02 (in line)

- Revenue Guidance for Q3 CY2024 is $187 million at the midpoint, roughly in line with what analysts were expecting

- Gross Margin (GAAP): 44.8%, down from 56.8% in the same quarter last year

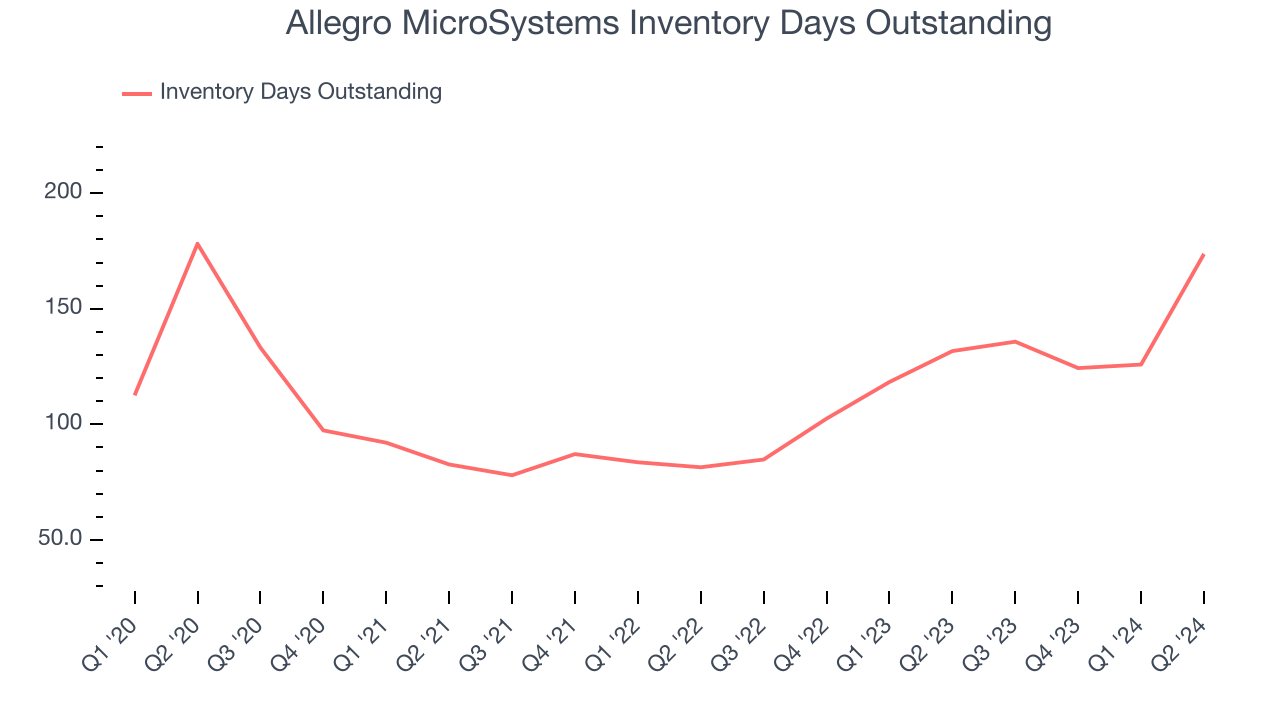

- Inventory Days Outstanding: 174, up from 126 in the previous quarter

- Free Cash Flow of $23.22 million is up from -$1.51 million in the previous quarter

- Market Capitalization: $5.26 billion

“We delivered results toward the higher end of our commitments while making progress on inventory rebalancing across the Automotive and Industrial markets. First quarter sales were $167 million, above the midpoint of our outlook, and non-GAAP EPS was $0.03, at the high end of our outlook,” said Vineet Nargolwala, President and CEO of Allegro.

The result of a spinoff from Sanken in Japan, Allegro MicroSystems (NASDAQ:ALGM) is a designer of power management chips and distance sensors used in electric vehicles and data centers.

Processors and Graphics Chips

The biggest demand drivers for processors (CPUs) and graphics chips at the moment are secular trends related to 5G and Internet of Things, autonomous driving, and high performance computing in the data center space, specifically around AI and machine learning. Like all semiconductor companies, digital chip makers exhibit a degree of cyclicality, driven by supply and demand imbalances and exposure to PC and Smartphone product cycles.

Sales Growth

Allegro MicroSystems's revenue growth over the last three years has been mediocre, averaging 14.3% annually. This quarter, its revenue declined from $278.3 million in the same quarter last year to $166.9 million. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

Even though Allegro MicroSystems surpassed analysts' revenue estimates, this was a slow quarter for the company as its revenue dropped 40% year on year. This could mean that the current downcycle is deepening.

Allegro MicroSystems's revenue growth has decelerated over the last three quarters and its management team projects revenue to fall next quarter. As such, the company is guiding for a 32.1% year-on-year revenue decline while analysts are expecting a 0.9% drop over the next 12 months.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business' capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Allegro MicroSystems's DIO came in at 174, which is 61 days above its five-year average, suggesting that the company's inventory has grown to higher levels than we've seen in the past.

Key Takeaways from Allegro MicroSystems's Q2 Results

We were impressed by how significantly Allegro MicroSystems blew past analysts' adjusted operating income expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street's estimates. On the other hand, its gross margin shrunk, but the market didn't seem to care too much. Overall, this was a decent quarter. The stock traded up 3.1% to $24.78 immediately following the results.

So should you invest in Allegro MicroSystems right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.