Chip designer Allegro MicroSystems (NASDAQ:ALGM) reported Q2 FY2023 results that beat analyst expectations, with revenue up 22.7% year on year to $237.6 million. On top of that, guidance for next quarter's revenue was surprisingly good, being $245 million at the midpoint, 5.08% above what analysts were expecting. Allegro MicroSystems made a GAAP profit of $50.6 million, improving on its profit of $33.2 million, in the same quarter last year.

Is now the time to buy Allegro MicroSystems? Access our full analysis of the earnings results here, it's free.

Allegro MicroSystems (ALGM) Q2 FY2023 Highlights:

- Revenue: $237.6 million vs analyst estimates of $225 million (5.61% beat)

- EPS (non-GAAP): $0.31 vs analyst estimates of $0.26 (19.4% beat)

- Revenue guidance for Q3 2023 is $245 million at the midpoint, above analyst estimates of $233.1 million

- Free cash flow of $35.1 million, up 58.4% from previous quarter

- Inventory Days Outstanding: 85, up from 82 previous quarter

- Gross Margin (GAAP): 55.5%, up from 53.2% same quarter last year

“Allegro achieved another record quarter, reflecting our team’s strong execution and continued robust demand for our magnetic sensor and power IC products despite cross-currents in the broader macroeconomic environment,” said Vineet Nargolwala, President and CEO of Allegro MicroSystems.

The result of a spinoff from Sanken in Japan, Allegro MicroSystems (NASDAQ:ALGM) is a designer of power management chips and distance sensors used in electric vehicles and data centers.

The biggest demand drivers for processors (CPUs) and graphics chips at the moment are secular trends related to 5G and Internet of Things, autonomous driving, and high performance computing in the data center space, specifically around AI and machine learning. Like all semiconductor companies, digital chip makers exhibit a degree of cyclicality, driven by supply and demand imbalances and exposure to PC and Smartphone product cycles.

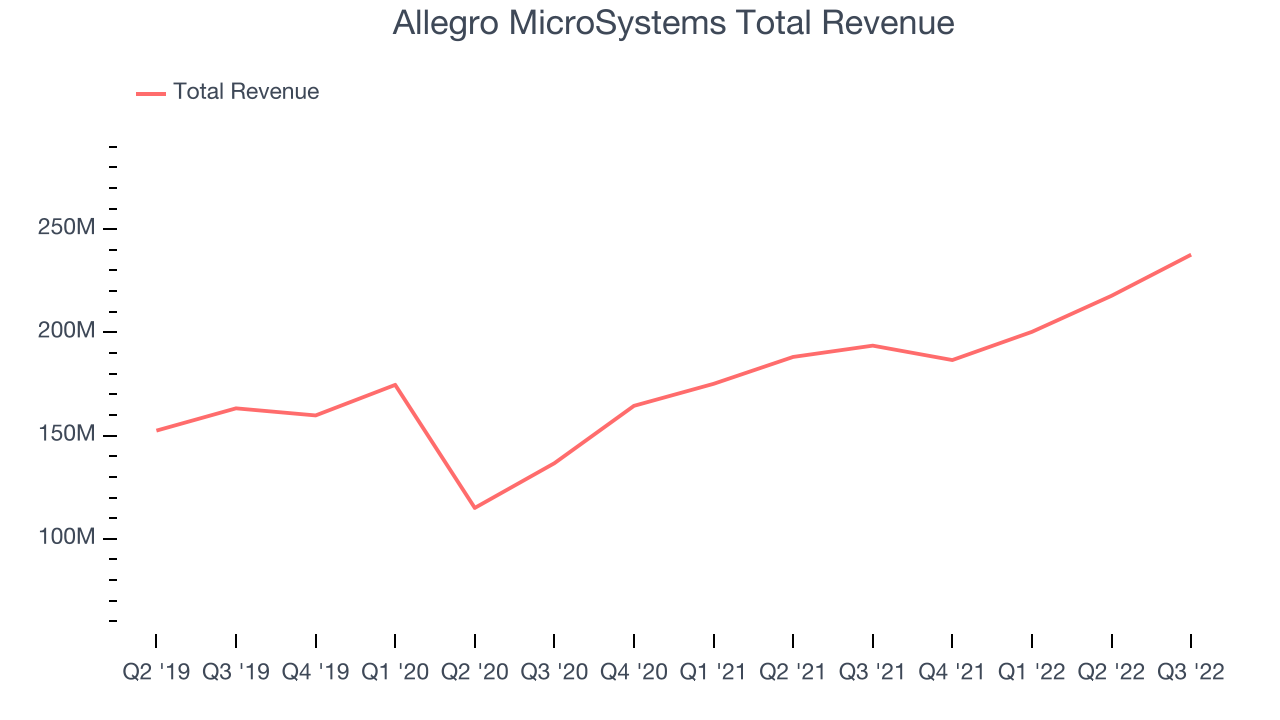

Sales Growth

Allegro MicroSystems's revenue growth over the last three years has been mediocre, averaging 13.3% annually. But as you can see below, last year has been stronger for the company, growing from quarterly revenue of $193.6 million to $237.6 million. Semiconductors are a cyclical industry and long-term investors should be prepared for periods of high growth, followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

This was a decent quarter for Allegro MicroSystems as revenues grew 22.7%, topping analyst estimates by 5.61%. This marks 8 straight quarters of revenue growth, which means the current upcycle has had a good run, as a typical upcycle tends to be 8-10 quarters.

However, Allegro MicroSystems believes the growth is set to even accelerate, and is guiding for revenue to grow 31.2% YoY next quarter, and Wall St analysts are estimating growth 15.8% over the next twelve months.

In volatile times like these we look for robust businesses with strong pricing power. Unknown to most investors, this company is one of the highest-quality software companies in the world, and their software products have been the default standard in critical industries for decades. The result is an impressive business that is up an incredible 18,152% since the IPO. You can find it on our platform for free.

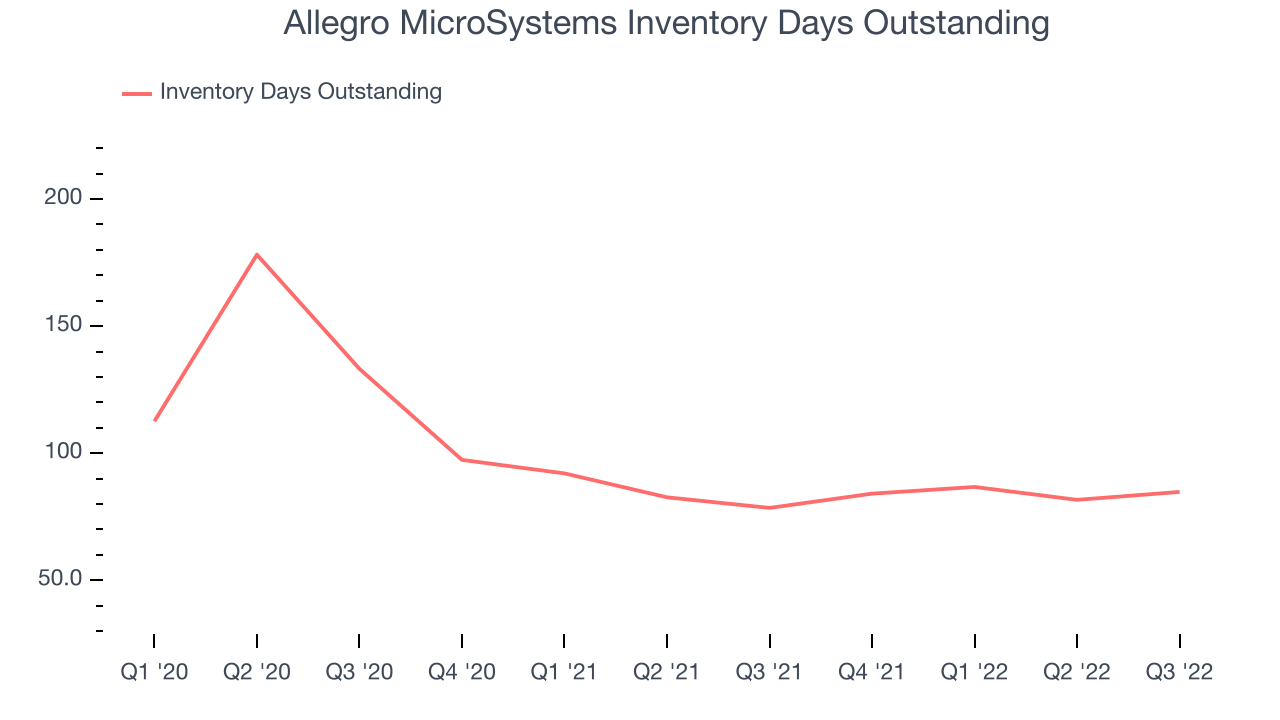

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) are an important metric for chipmakers, as it reflects the capital intensity of the business and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise the company may have to downsize production.

This quarter, Allegro MicroSystems’s inventory days came in at 85, 16 days below the five year average, showing that despite the recent increase there is no indication of an excessive inventory buildup at the moment.

Key Takeaways from Allegro MicroSystems's Q2 Results

With a market capitalization of $4.33 billion Allegro MicroSystems is among smaller companies, but its more than $293.5 million in cash and positive free cash flow over the last twelve months put it in a very strong position to invest in growth.

We were impressed by how strongly Allegro MicroSystems outperformed analysts’ earnings expectations this quarter. And we were also glad that the revenue guidance for the next quarter exceeded analysts' expectations. On the other hand, there was a slight increase in inventory levels. Overall, we think this was a strong quarter, that should leave shareholders feeling very positive. The company is up 5.69% on the results and currently trades at $23.95 per share.

Allegro MicroSystems may have had a good quarter, so should you invest right now? It is important that you take into account its valuation and business qualities, as well as what happened in the latest quarter. We look at that in our actionable report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.