Maker of machinery employed in semiconductor manufacturing, Applied Materials (NASDAQ:AMAT) reported Q1 FY2024 results topping analysts' expectations, with revenue flat year on year at $6.71 billion. Guidance for next quarter's revenue was also optimistic at $6.5 billion at the midpoint, 2.7% above analysts' estimates. It made a non-GAAP profit of $2.13 per share, improving from its profit of $2.03 per share in the same quarter last year.

Applied Materials (AMAT) Q1 FY2024 Highlights:

- Revenue: $6.71 billion vs analyst estimates of $6.49 billion (3.4% beat)

- EPS (non-GAAP): $2.13 vs analyst estimates of $1.91 (11.8% beat)

- Revenue Guidance for Q2 2024 is $6.5 billion at the midpoint, above analyst estimates of $6.33 billion

- Free Cash Flow of $2.10 billion, up 68.2% from the previous quarter

- Inventory Days Outstanding: 147 in line with previous quarter

- Gross Margin (GAAP): 47.8%, up from 46.7% in the same quarter last year

- Market Capitalization: $154.9 billion

Founded in 1967 as the first company to develop tools for other businesses in the semiconductor industry, Applied Materials (NASDAQ:AMAT) is the largest provider of semiconductor wafer fabrication equipment.

Applied Materials is the only semiconductor manufacturing (capital) equipment maker who provides tools used in each of the processes used to create semiconductors. Roughly half its systems’ revenues come from deposition technologies, with another 30% from cleaning or removal systems.

Applied Materials counts among its customers the biggest chip makers in the world: TSMC, Intel, Samsung, and Micron, although it tilts more towards foundry and logic chip makers than memory producers.

Its primary peers and competitors are ASML (NASDAQ:ASML), Lam Research (NASDAQ:LCRX), KLA Corp (NASDAQ: KLAC), and Tokyo Electron (TSE:8035).Semiconductor Manufacturing

The semiconductor capital (manufacturing) equipment group has become highly concentrated over the past decade. Suppliers have consolidated, and the increasing cost of innovation have made it unaffordable to almost everybody, except the largest companies, to produce leading edge chips. The result of the increased industry concentration has been higher operating margins and free cash generation through the cycle. Despite this structural improvement, the businesses can still be quite volatile, as demand fluctuations for the semiconductor equipment are magnified by the already cyclical nature of underlying semiconductor demand.

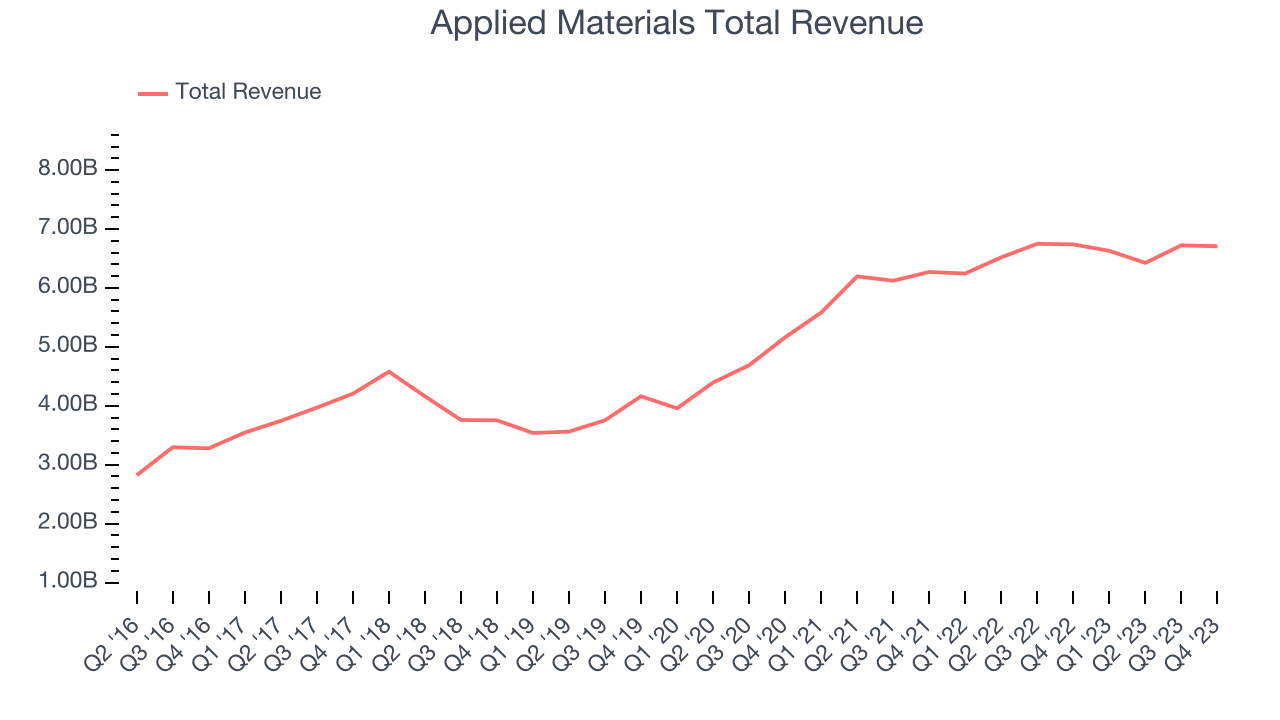

Sales Growth

Applied Materials's revenue growth over the last three years has been mediocre, averaging 14.4% annually. This quarter, its revenue declined from $6.74 billion in the same quarter last year to $6.71 billion. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

Even though Applied Materials surpassed analysts' revenue estimates, this was a slow quarter for the company as its revenue dropped 0.5% year on year. This could mean that the current downcycle is deepening.

Applied Materials may be headed for an upturn. Although the company is guiding for a year-on-year revenue decline of 2% next quarter, analysts are expecting revenue to grow 1.4% over the next 12 months.

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business' capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Applied Materials's DIO came in at 147, which is 4 days above its five-year average, suggesting that the company's inventory levels are higher than what we've seen in the past.

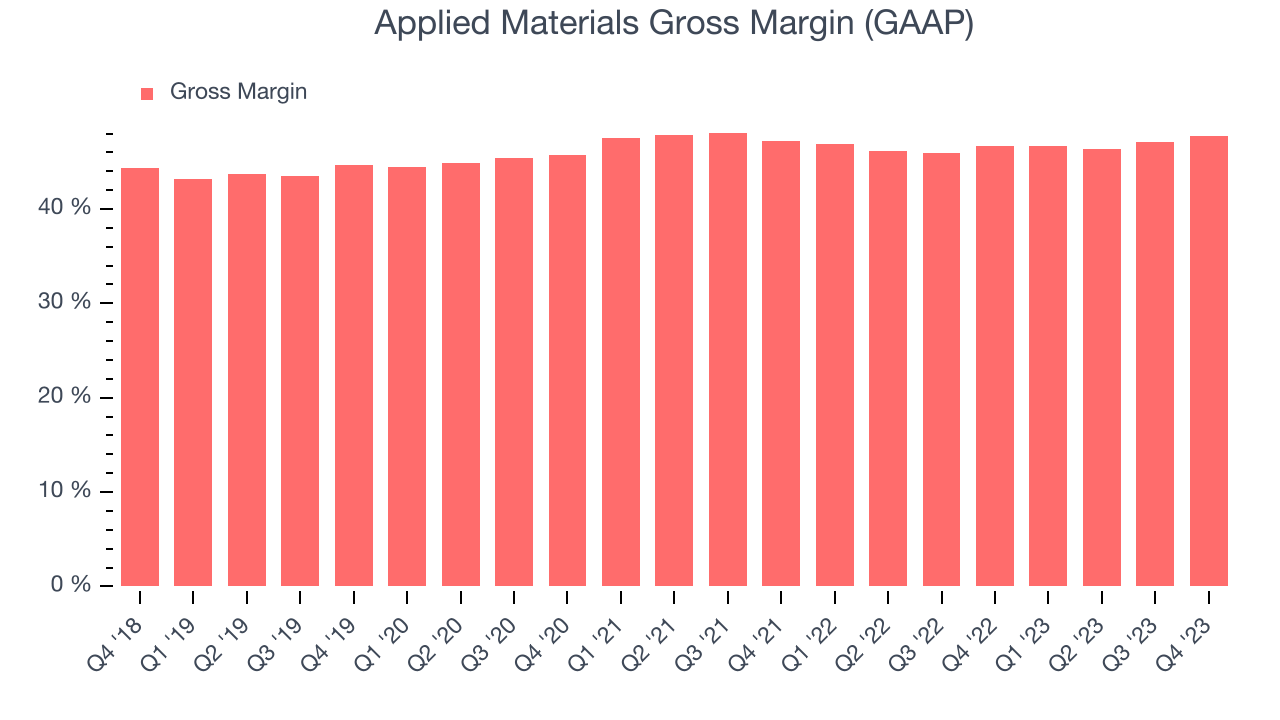

Pricing Power

In the semiconductor industry, a company's gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor. Applied Materials's gross profit margin, which shows how much money the company gets to keep after paying key materials, input, and manufacturing costs, came in at 47.8% in Q1, up 1.1 percentage points year on year.

Applied Materials's gross margins have been trending up over the last 12 months, averaging 47%. This is a welcome development, as Applied Materials's margins are slightly below the peer group average and rising margins could suggest improved demand and pricing power.

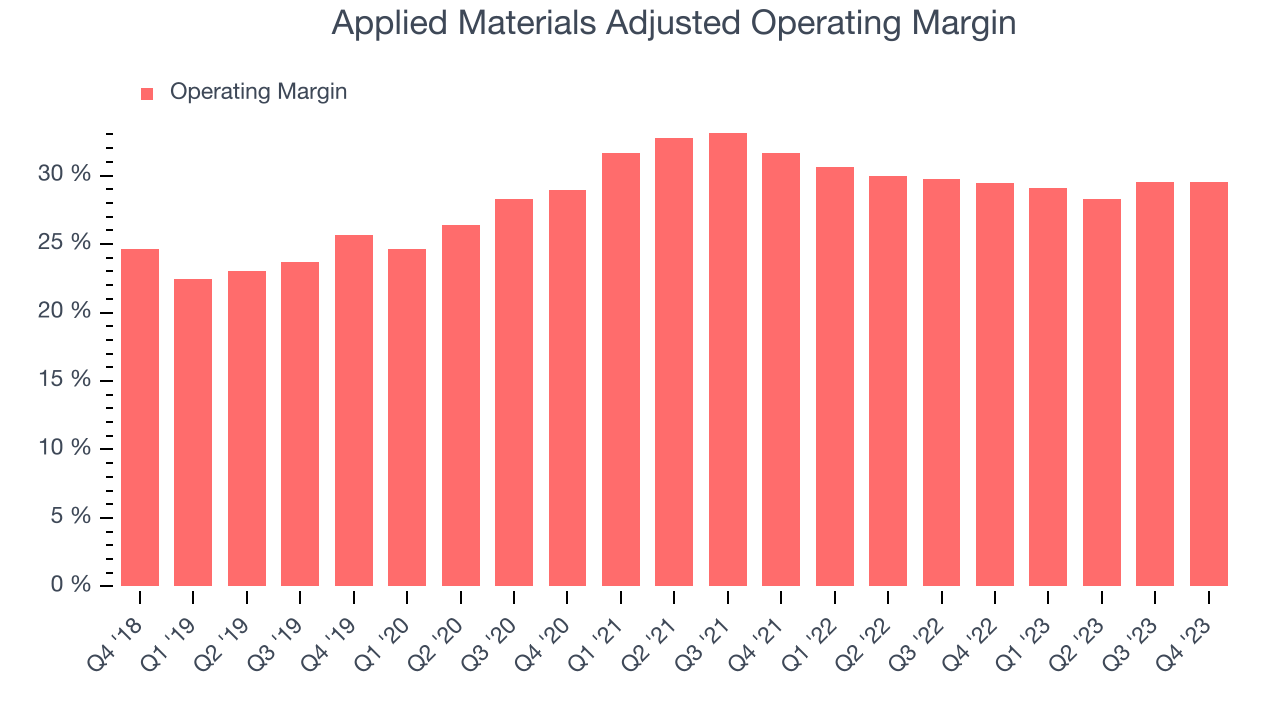

Profitability

Applied Materials reported an operating margin of 29.5% in Q1, up 0.1 percentage points year on year. Operating margins are one of the best measures of profitability because they tell us how much money a company takes home after manufacturing its products, marketing and selling them, and, importantly, keeping them relevant through research and development.

Applied Materials's operating margins have been trending down over the last year, averaging 29.1%. The company's profitability is in line with the broader semiconductor industry and it's working to appropriately manage its operating expenses.

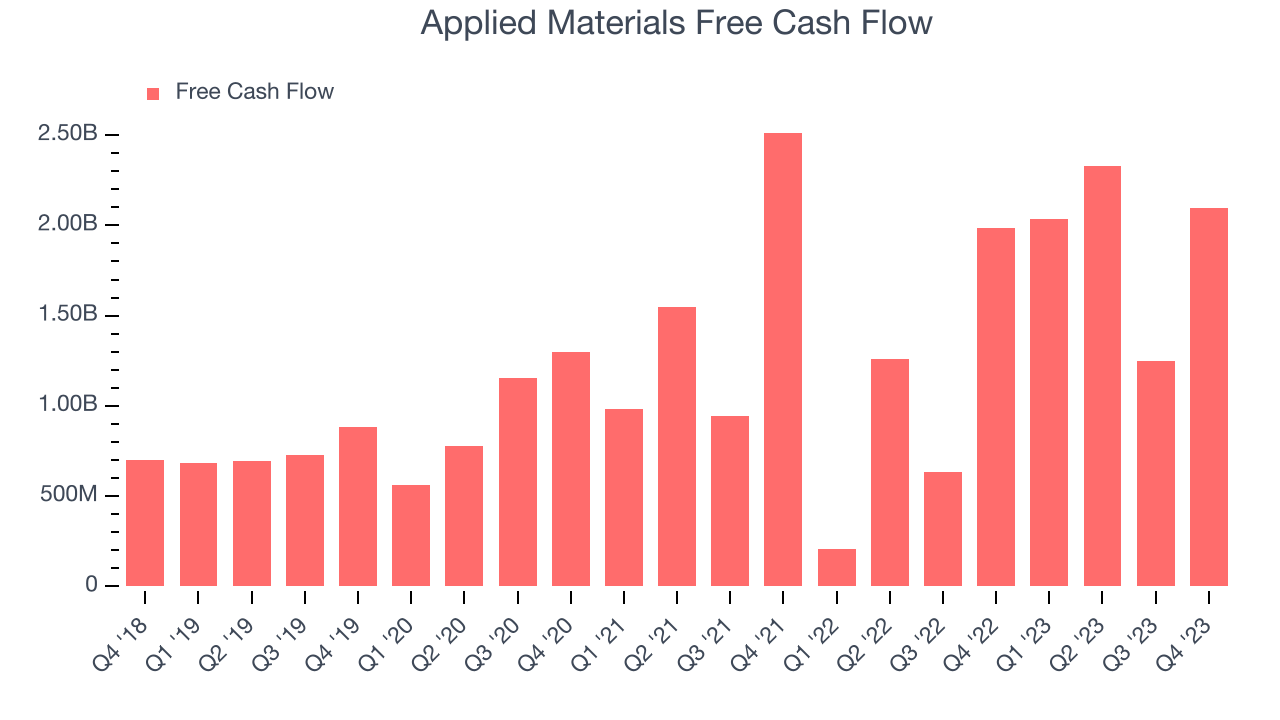

Earnings, Cash & Competitive Moat

Analysts covering Applied Materials expect earnings per share to be relatively flat over the next 12 months, although estimates will likely change after earnings.

Although earnings are important, we believe cash is king because you can't use accounting profits to pay the bills. Applied Materials's free cash flow came in at $2.10 billion in Q1, up 5.7% year on year.

As you can see above, Applied Materials produced $7.71 billion in free cash flow over the last 12 months, an eye-popping 29.1% of revenue. This is a great result; Applied Materials's free cash flow conversion places it among the best semiconductor companies and, if sustainable, puts the company in an advantageous position to invest in new products while remaining resilient during industry downturns.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Applied Materials's five-year average ROIC was 45.7%, placing it among the best semiconductor companies. Just as you’d like your investment dollars to generate returns, Applied Materials's invested capital has produced excellent profits.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last two years, Applied Materials's ROIC averaged a 10.4 percentage point increase each year. The company has historically shown the ability to generate good returns, and its rising ROIC is a great sign. It could suggest its competitive advantage or profitable business opportunities are expanding.

Key Takeaways from Applied Materials's Q1 Results

We were impressed by how significantly Applied Materials blew past analysts' EPS expectations this quarter. We were also excited its revenue outperformed Wall Street's estimates. Overall, we think this was still a really good quarter that should please shareholders. The stock is up 7.1% after reporting and currently trades at $200.99 per share.

Is Now The Time?

When considering an investment in Applied Materials, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We think Applied Materials is a solid business. Although its revenue growth has been mediocre over the last three years, its growth over the next 12 months is expected to be higher. And while its gross margins are weaker than its semiconductor peers we look at, its powerful free cash generation enables it to sustainably invest in growth initiatives while maintaining an ample cash cushion. On top of that, its stellar ROIC suggests it has been a well-run company historically.

Applied Materials's price-to-earnings ratio based on the next 12 months is 23.7x. There are definitely things to like about Applied Materials and looking at the semiconductors landscape right now, it seems that the company trades at a pretty interesting price point.

Wall Street analysts covering the company had a one-year price target of $173.85 per share right before these results (compared to the current share price of $200.99).

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.