Television broadcasting and production company AMC Networks (NASDAQ:AMCX) reported Q2 CY2024 results beating Wall Street analysts' expectations, with revenue down 7.8% year on year to $625.9 million. It made a non-GAAP profit of $1.24 per share, down from its profit of $1.60 per share in the same quarter last year.

Is now the time to buy AMC Networks? Find out by accessing our full research report, it's free.

AMC Networks (AMCX) Q2 CY2024 Highlights:

- Revenue: $625.9 million vs analyst estimates of $601.5 million (4.1% beat)

- Operating profit excluding impairment charge: $107.6 million vs analyst estimates of $104.5 million (3.0% beat)

- EPS (non-GAAP): $1.24 vs analyst expectations of $1.65 (25% miss)

- Gross Margin (GAAP): 55.2%, up from 52.6% in the same quarter last year

- EBITDA Margin: 4.2%, down from 23.9% in the same quarter last year

- Free Cash Flow of $95.17 million, down 34% from the previous quarter

- Market Capitalization: $453.6 million

Chief Executive Officer Kristin Dolan said: "AMC Networks continues to find opportunities in a strategic plan built around programming, partnerships and profitability. Key to our plan is the creation and curation of celebrated films and series, and making them available to audiences everywhere, including through an exciting new branded content licensing agreement with Netflix. In the first half of 2024, we’ve made significant progress against our strategic priority of generating strong free cash flow, and we’re well on our way to achieving our free cash flow guidance for the full year."

Originally the joint-venture of four cable television companies, AMC Networks (NASDAQ:AMCX) is a broadcaster producing a diverse range of television shows and movies.

Broadcasting

Broadcasting companies have been facing secular headwinds in the form of consumers abandoning traditional television and radio in favor of streaming services. As a result, many broadcasting companies have evolved by forming distribution agreements with major streaming platforms so they can get in on part of the action, but will these subscription revenues be as high quality and high margin as their legacy revenues? Only time will tell which of these broadcasters will survive the sea changes of technological advancement and fragmenting consumer attention.

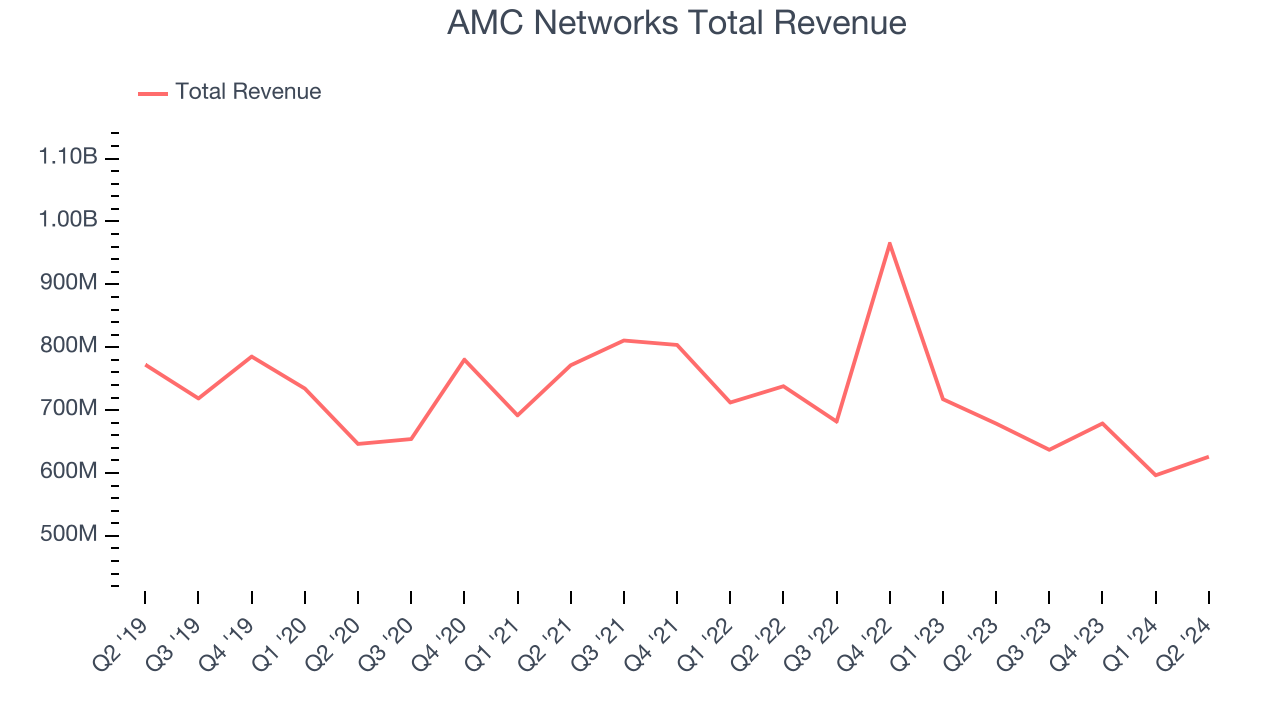

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones tend to grow for years. AMC Networks's demand was weak over the last five years as its sales fell by 3.5% annually, a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. AMC Networks's recent history shows its demand has stayed suppressed as its revenue has declined by 9% annually over the last two years.

AMC Networks also breaks out the revenue for its most important segments, Affiliate and Advertising, which are 27.5% and 23.8% of revenue. Over the last two years, AMC Networks's Affiliate revenue (retransmission and licensing fees) averaged 11.1% year-on-year declines while its Advertising revenue (marketing services) averaged 15.5% declines.

This quarter, AMC Networks's revenue fell 7.8% year on year to $625.9 million but beat Wall Street's estimates by 4.1%. Looking ahead, Wall Street expects revenue to decline 5% over the next 12 months.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

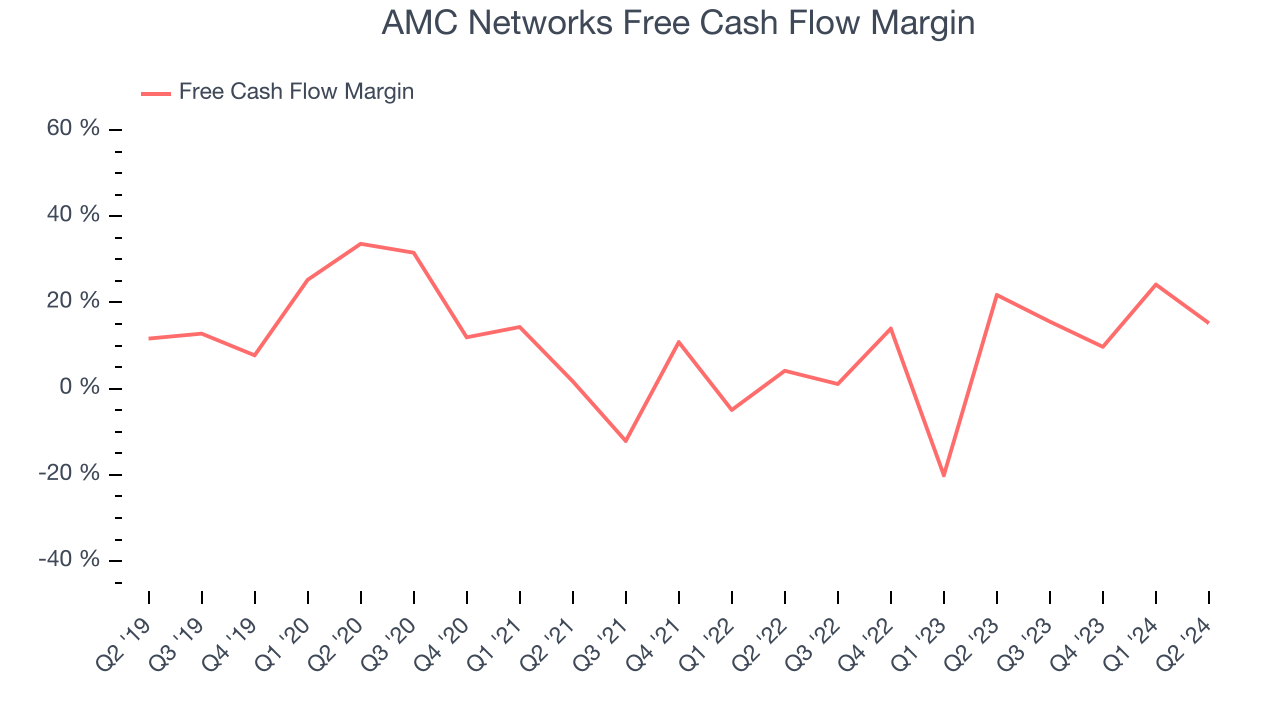

AMC Networks has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 9.9%, subpar for a consumer discretionary business.

AMC Networks's free cash flow clocked in at $95.17 million in Q2, equivalent to a 15.2% margin. The company's cash profitability regressed as it was 6.5 percentage points lower than in the same quarter last year, but it's still above its two-year average. We wouldn't read too much into this quarter's decline because investment needs can be seasonal, leading to short-term swings. Long-term trends carry greater meaning.

Over the next year, analysts predict AMC Networks's cash conversion will fall. Their consensus estimates imply its free cash flow margin of 15.9% for the last 12 months will decrease to 11.1%.

Key Takeaways from AMC Networks's Q2 Results

We enjoyed seeing AMC Networks exceed analysts' revenue expectations this quarter. It also beat operating profit expectations when we add back a one-time, non-recurring impairment charge. On the other hand, its Advertising revenue fell short of Wall Street's estimates. Overall, this was a mixed but overall fine quarter for AMC Networks. The stock remained flat at $10.22 immediately following the results.

AMC Networks may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.