Computer processor maker AMD (NASDAQ:AMD) reported results in line with analysts' expectations in Q1 CY2024, with revenue up 2.2% year on year to $5.47 billion. The company expects next quarter's revenue to be around $5.7 billion, in line with analysts' estimates. It made a non-GAAP profit of $0.62 per share, improving from its profit of $0.60 per share in the same quarter last year.

AMD (AMD) Q1 CY2024 Highlights:

- Revenue: $5.47 billion vs analyst estimates of $5.45 billion (small beat)

- EPS (non-GAAP): $0.62 vs analyst estimates of $0.61 (2% beat)

- Revenue Guidance for Q2 CY2024 is $5.7 billion at the midpoint, roughly in line with what analysts were expecting

- Gross Margin (GAAP): 51%, up from 49.8% in the same quarter last year

- Inventory Days Outstanding: 158, up from 129 in the previous quarter

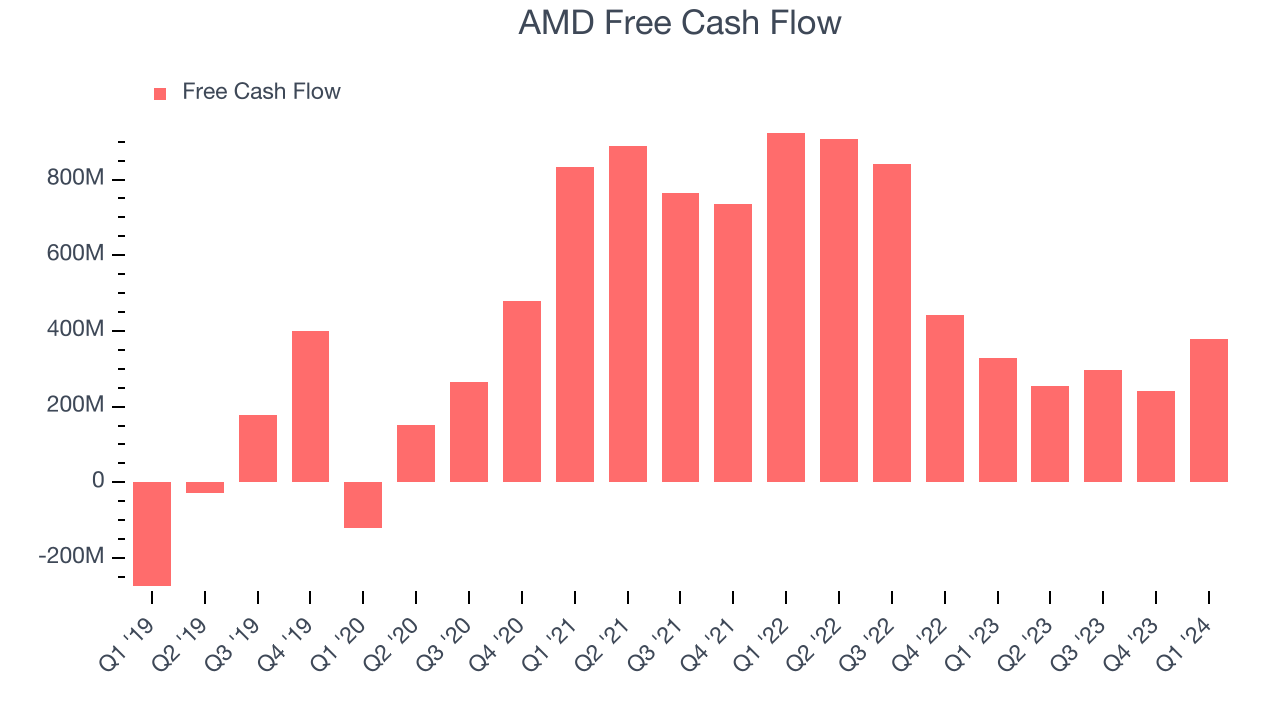

- Free Cash Flow of $379 million, up 56.6% from the previous quarter

- Market Capitalization: $258.9 billion

Founded in 1969 by a group of former Fairchild semiconductor executives led by Jerry Sanders, Advanced Micro Devices or AMD (NASDAQ:AMD) is one of the leading designers of computer processors and graphics chips used in PCs and data centers.

AMD began producing computer processors (CPUs) as a second source supplier for Intel as part of Intel’s original processor deal with IBM for the first PCs in the early 1980s.

For the next few decades, AMD would have intermittent success in creating its own chips that could better run Intel's own x86 processor architecture, at times grabbing market share from Intel in the data center with innovative designs like Athlon or Opteron, it was not able to find enduring competitive success.

Faced with bankruptcy after the Great Financial Crisis, AMD spun out its manufacturing arm, Global Foundries, becoming a far less capital intensive designer of semiconductors, allowing for higher profit margins The entrance of Dr. Lisa Su as CEO in 2016 led to a turning point in chip designs, AMD’s Epyc datacenter CPUs and the Ryzen PC CPUs would eventually surpass Intel due to superior higher performance at lower cost.

Where AMD traditionally could only compete with Intel at the low end, in the years since 2016 it has captured share in the most profitable portion of the business — high-end PCs and data center servers, where performance is paramount. Essentially, AMD improved the economics of its business by outsourcing its manufacturing, and competing successfully, but partnerships with chip manufacturers like Taiwan Semiconductor Manufacturing Company will be important for enduring success.

AMD’s primary competitors are Intel (NASDAQ:INTC), Nvidia (NASDAQ:NVDA), and Qualcomm (NASDAQ:QCOM).Processors and Graphics Chips

Chips need to keep getting smaller in order to advance on Moore’s law, and that is proving increasingly more complicated and expensive to achieve with time. That has caused most digital chip makers to become “fabless” designers, rather than manufacturers, instead relying on contracted foundries like TSMC to manufacture their designs. This has benefitted the digital chip makers’ free cash flow margins, as exiting the manufacturing business has removed large cash expenses from their business models.

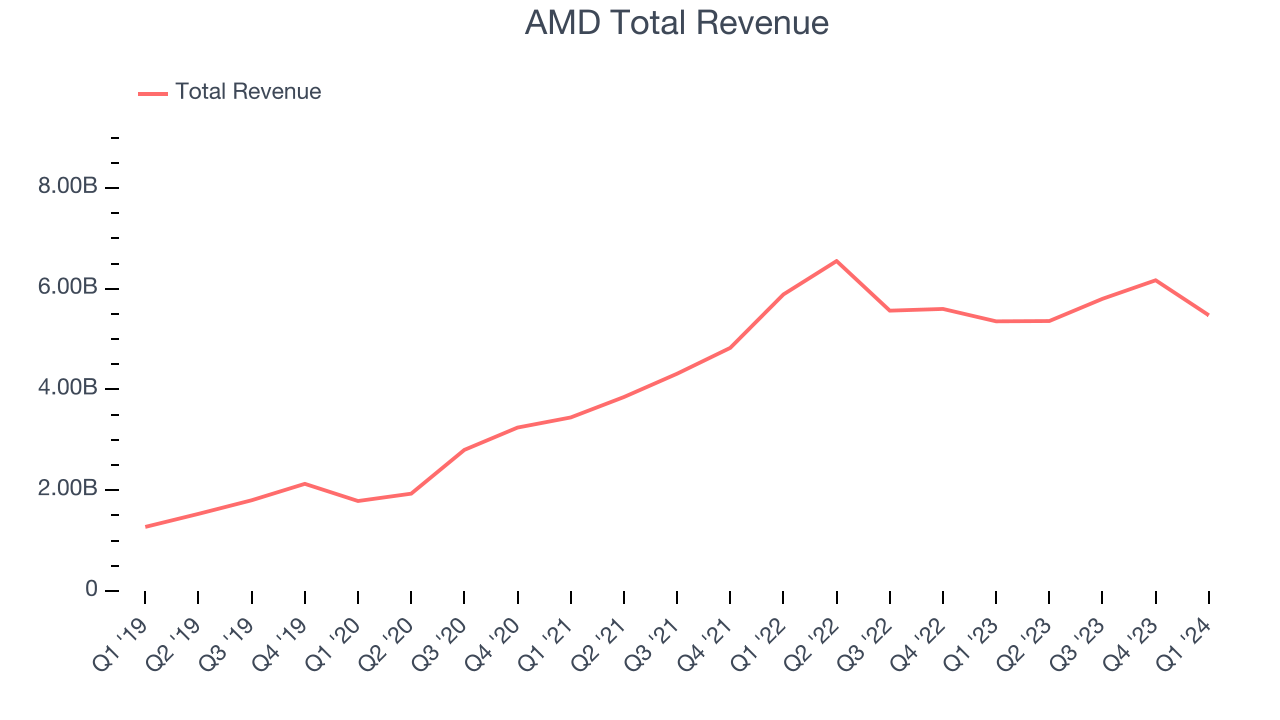

Sales Growth

AMD's revenue growth over the last three years has been very strong, averaging 31.5% annually. But as you can see below, this quarter wasn't particularly strong, with revenue growing from $5.35 billion in the same quarter last year to $5.47 billion. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

This was a sluggish quarter for the company as its revenue dropped 2.2% year on year, in line with analysts' estimates. This marks 3 straight quarters of growth, implying that AMD is in the middle of its cycle, as a typical upcycle generally lasts 8-10 quarters.

AMD's management team believes its revenue growth will accelerate, guiding to 6.4% year-on-year growth next quarter. Wall Street expects the company to grow its revenue by 20.4% over the next 12 months.

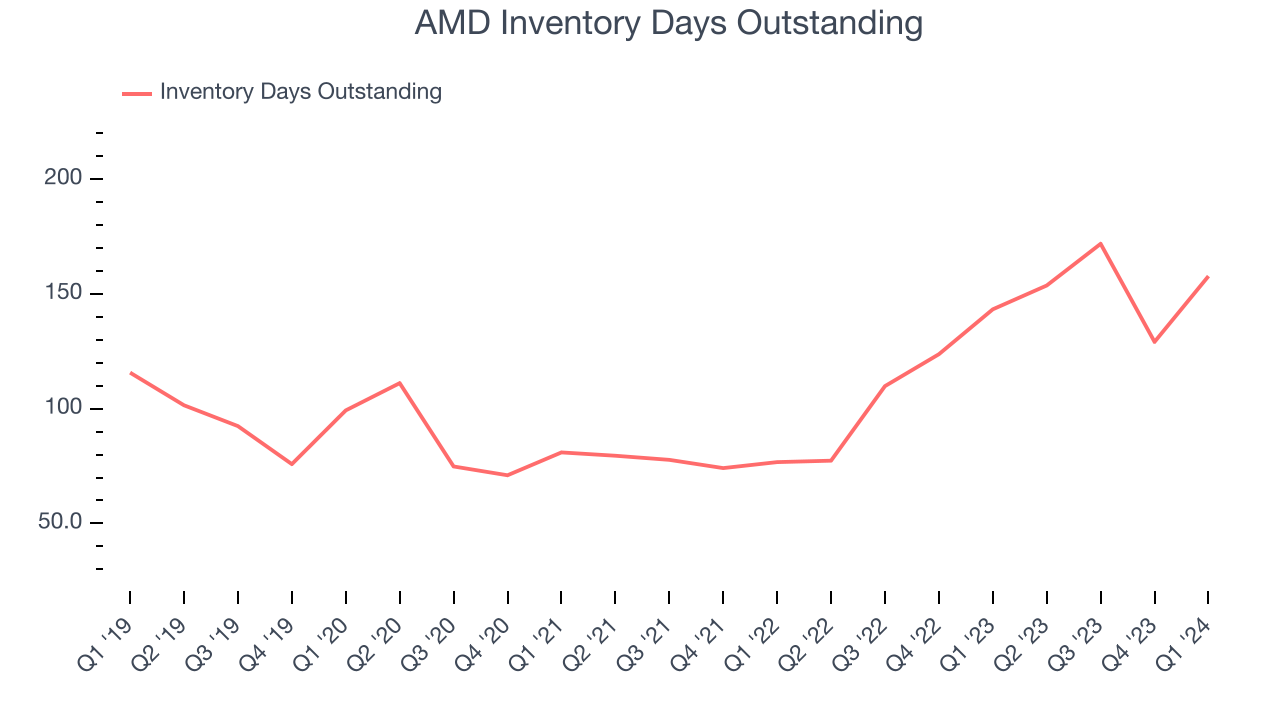

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business' capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, AMD's DIO came in at 158, which is 54 days above its five-year average, suggesting that the company's inventory has grown to higher levels than we've seen in the past.

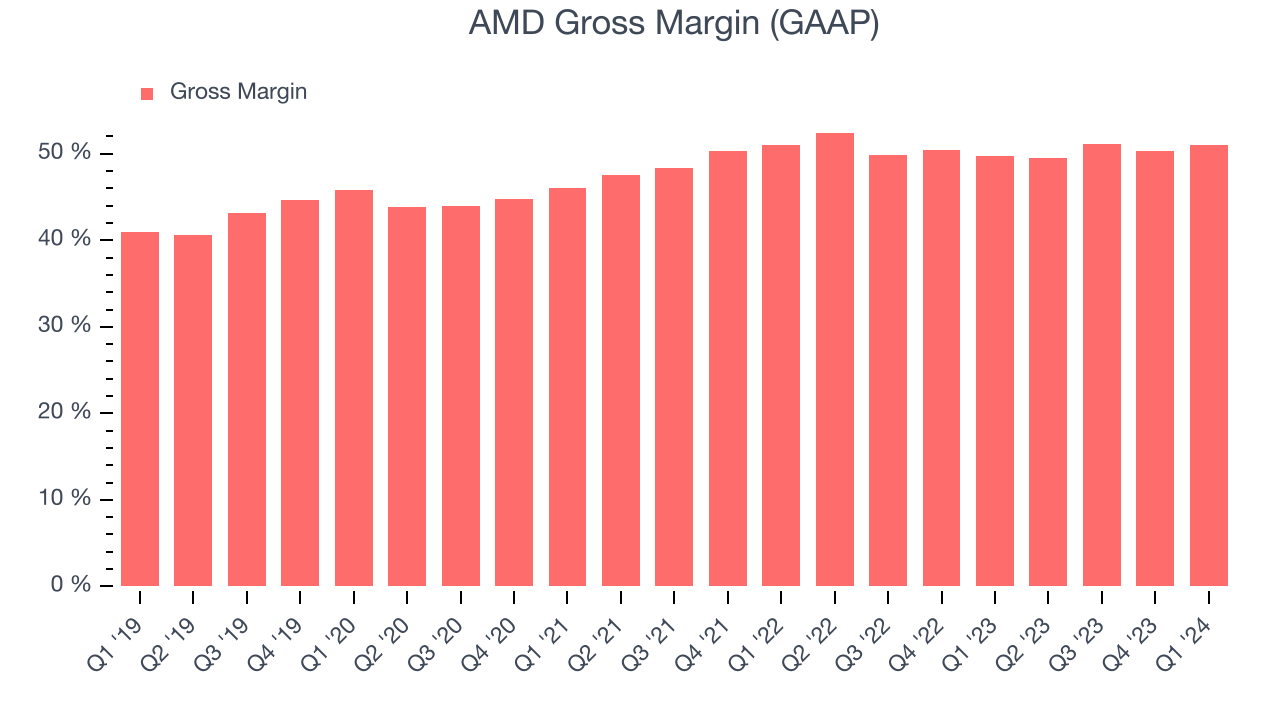

Pricing Power

In the semiconductor industry, a company's gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor. AMD's gross profit margin, which shows how much money the company gets to keep after paying key materials, input, and manufacturing costs, came in at 51% in Q1, up 1.2 percentage points year on year.

AMD's gross margins have been stable over the past year, averaging 50.5%. These margins are roughly in line with other semiconductor companies, pointing to a likely stable pricing environment and decent cost controls.

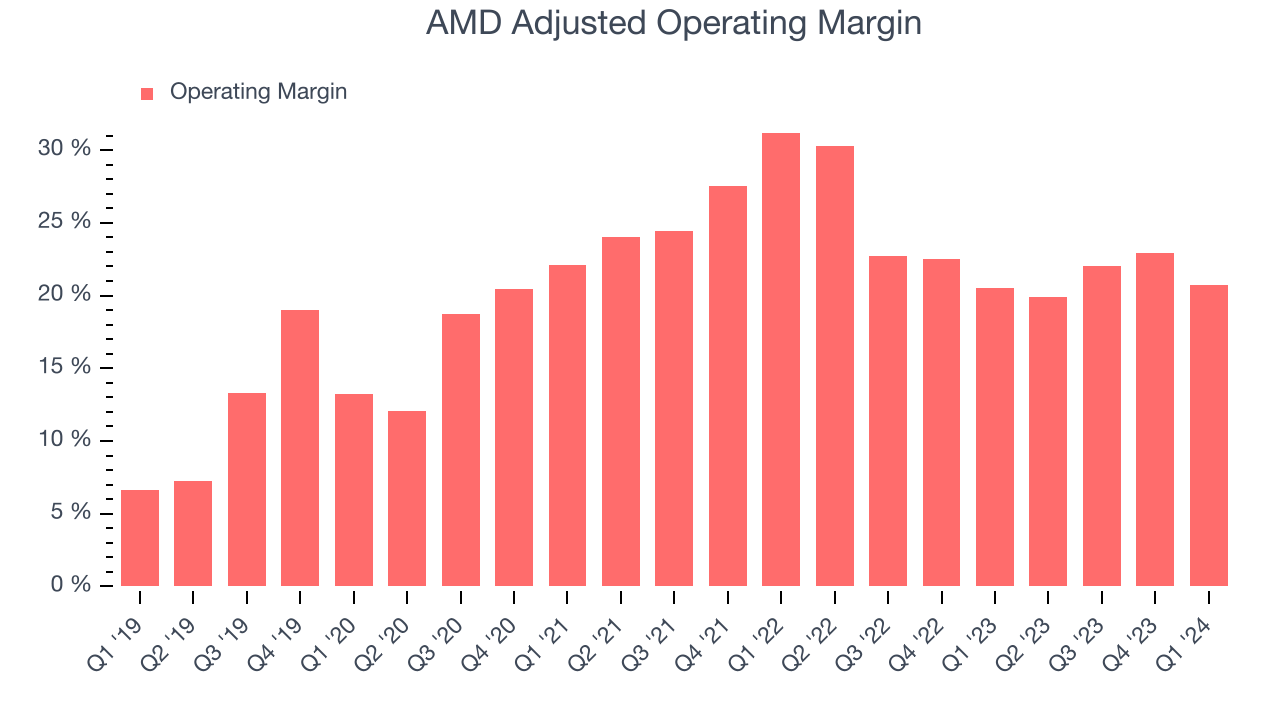

Profitability

AMD reported an operating margin of 20.7% in Q1, up 0.2 percentage points year on year. Operating margins are one of the best measures of profitability because they tell us how much money a company takes home after manufacturing its products, marketing and selling them, and, importantly, keeping them relevant through research and development.

AMD's operating margins have been trending down over the last year, averaging 21.4%. This is a bad sign for AMD, whose margins are already below average for semiconductor companies. To its credit, however, the company's margins suggest modest pricing power and cost controls.

Earnings, Cash & Competitive Moat

Analysts covering AMD expect earnings per share to grow 54.7% over the next 12 months, although estimates will likely change after earnings.

Although earnings are important, we believe cash is king because you can't use accounting profits to pay the bills. AMD's free cash flow came in at $379 million in Q1, up 15.5% year on year.

AMD has generated $1.17 billion in free cash flow over the last 12 months, or 5.1% of revenue. This FCF margin enables it to reinvest in its business without depending on the capital markets.

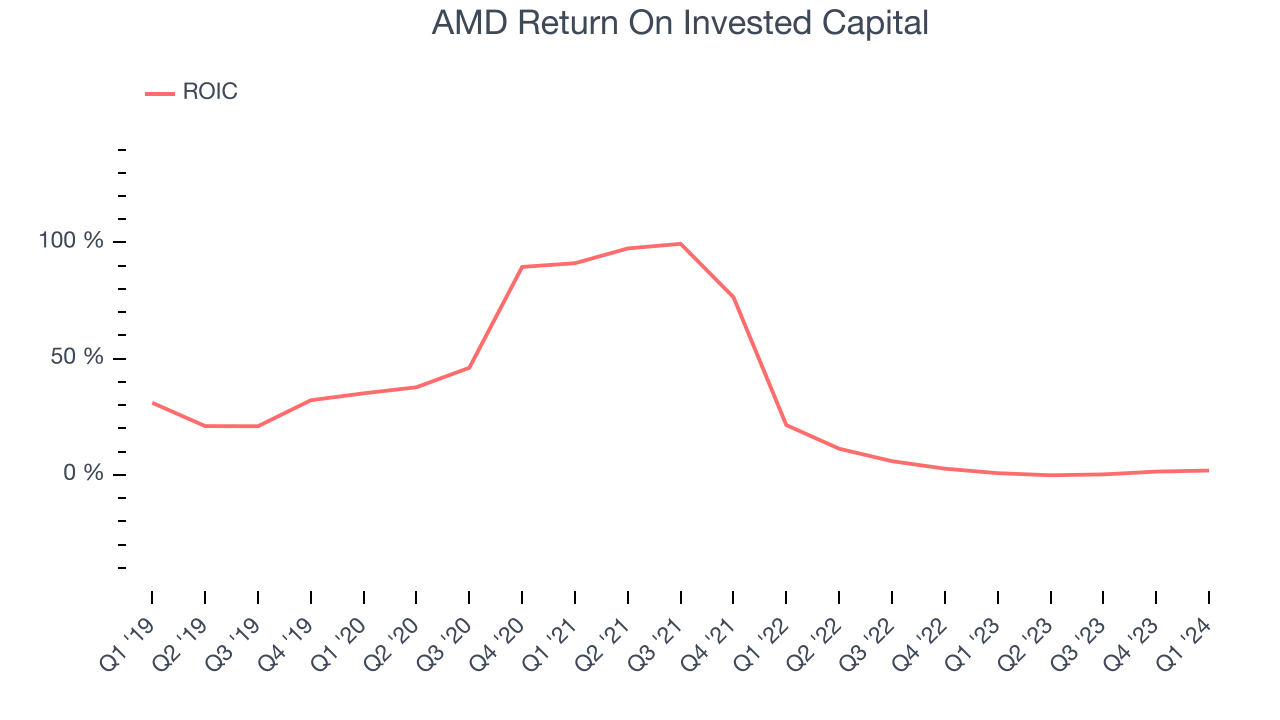

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

AMD's five-year average ROIC was 30.1%, beating other semiconductor companies by a wide margin. Just as you’d like your investment dollars to generate returns, AMD's invested capital has produced robust profits.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, AMD's ROIC significantly decreased over the last few years. The company has historically shown the ability to generate good returns, but they have gone the wrong way recently, making us a bit conscious.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

AMD is a profitable, well-capitalized company with $6.04 billion of cash and $3.00 billion of debt, meaning it could pay back all its debt tomorrow and still have $3.04 billion of cash on its balance sheet. This net cash position gives AMD the freedom to raise more debt, return capital to shareholders, or invest in growth initiatives.

Key Takeaways from AMD's Q1 Results

It was good to see AMD slightly beat analysts' EPS expectations this quarter. We were also glad its gross margin improved. The company's performance this quarter was driven by 80%+ year-on-year growth in its data center and client segments. Growth in the data center business was driven by its Instinct GPUs and EPYC CPUs while growth in the client division was propelled by Ryzen Series processor sales.

On the other hand, its inventory levels materially increased, and revenues in its gaming and embedded segments fell by more than 45% year on year (the market is less focused on these divisions, however, as AI solutions dominate AMD's story). Next quarter's revenue guidance was in line with Wall Street's projections.

Overall, this was a mixed quarter for AMD. The company is down 2.7% on the results and currently trades at $154.28 per share.

Is Now The Time?

When considering an investment in AMD, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We think AMD is a good business. We'd expect growth rates to moderate from here, but its impressive revenue growth over the last three years suggests it's increasing its market share. And while its low free cash flow margins give it little breathing room, the good news is its market-beating ROIC suggests it has been a well-managed company historically.

AMD's price-to-earnings ratio based on the next 12 months is 38.2x. There's definitely a lot of things to like about AMD and looking at the semiconductors landscape right now, it seems that the company trades at a pretty interesting price.

Wall Street analysts covering the company had a one-year price target of $196.30 per share right before these results (compared to the current share price of $154.28), implying they saw upside in buying AMD in the short term.

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.