The end of an earnings season can be a great time to assess how companies are handling the current business environment and discover new stocks. Let’s have a look at how Amkor (NASDAQ:AMKR) and the rest of the semiconductor manufacturing stocks fared in Q2.

The semiconductor industry is driven by demand for advanced electronic products like smartphones, PCs, servers and data storage. The growth of data and technologies like artificial intelligence, 5G networks and smart cars are also creating a next wave of growth for the industry. To keep up with ever changing customer needs requires new tools that can design, fabricate and test at ever smaller sizes and more complex architectures, and that is driving the demand for semiconductor capital manufacturing equipment.

The 14 semiconductor manufacturing stocks we track reported a slower Q2; on average, revenues were in line with analyst consensus estimates, while on average next quarter revenue guidance was 1.39% under consensus. Technology stocks have been hit hard by fears of higher interest rates as investors search for near-term cash flows, and semiconductor manufacturing stocks have not been spared, with share prices down 11.2% since the previous earnings results, on average.

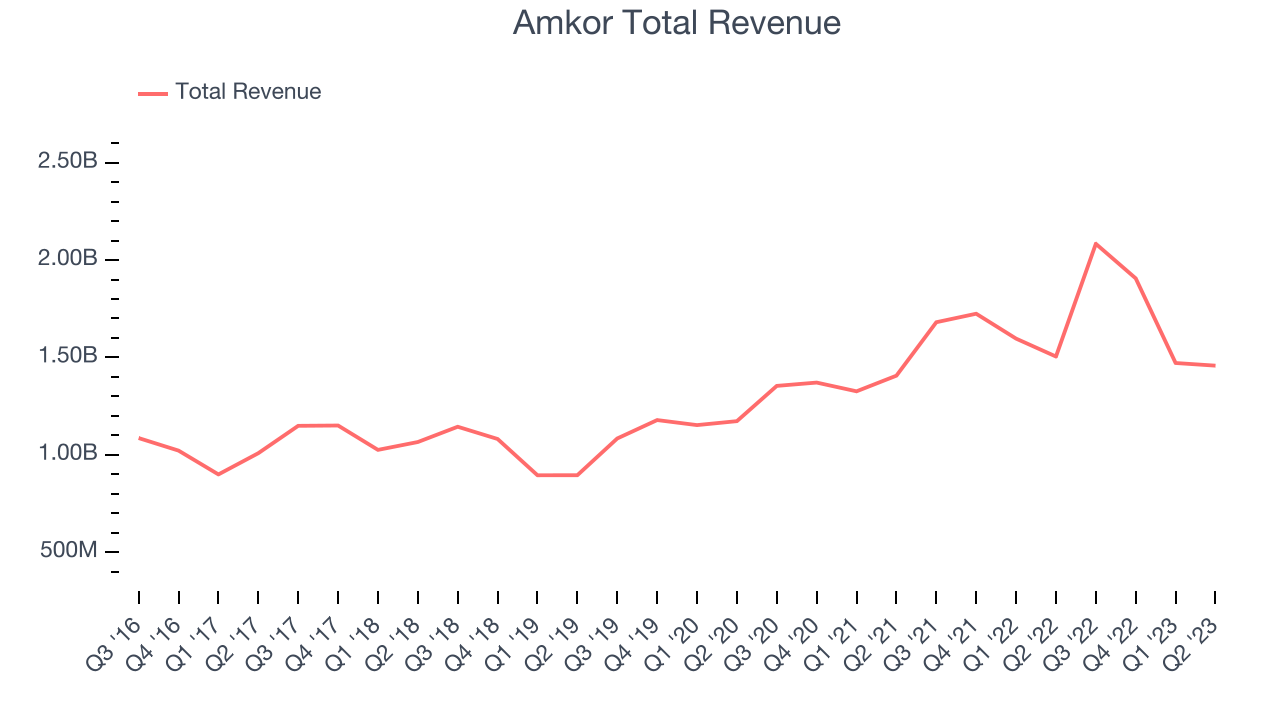

Amkor (NASDAQ:AMKR)

Operating through a largely Asian facility footprint, Amkor Technologies (NASDAQ:AMKR) provides outsourced packaging and testing for semiconductors.

Amkor reported revenues of $1.46 billion, down 3.12% year on year, missing analyst expectations by 1.32%. It was a weaker quarter for the company, with a miss of analysts' revenue estimates and a decline in its gross margin.

“Amkor’s second quarter performance was in line with our expectations, with demand for Advanced packaging solutions driving sequential growth in both the Computing and Consumer end markets,” said Giel Rutten, Amkor’s president and chief executive officer.

The stock is down 23.3% since the results and currently trades at $22.32.

Read our full report on Amkor here, it's free.

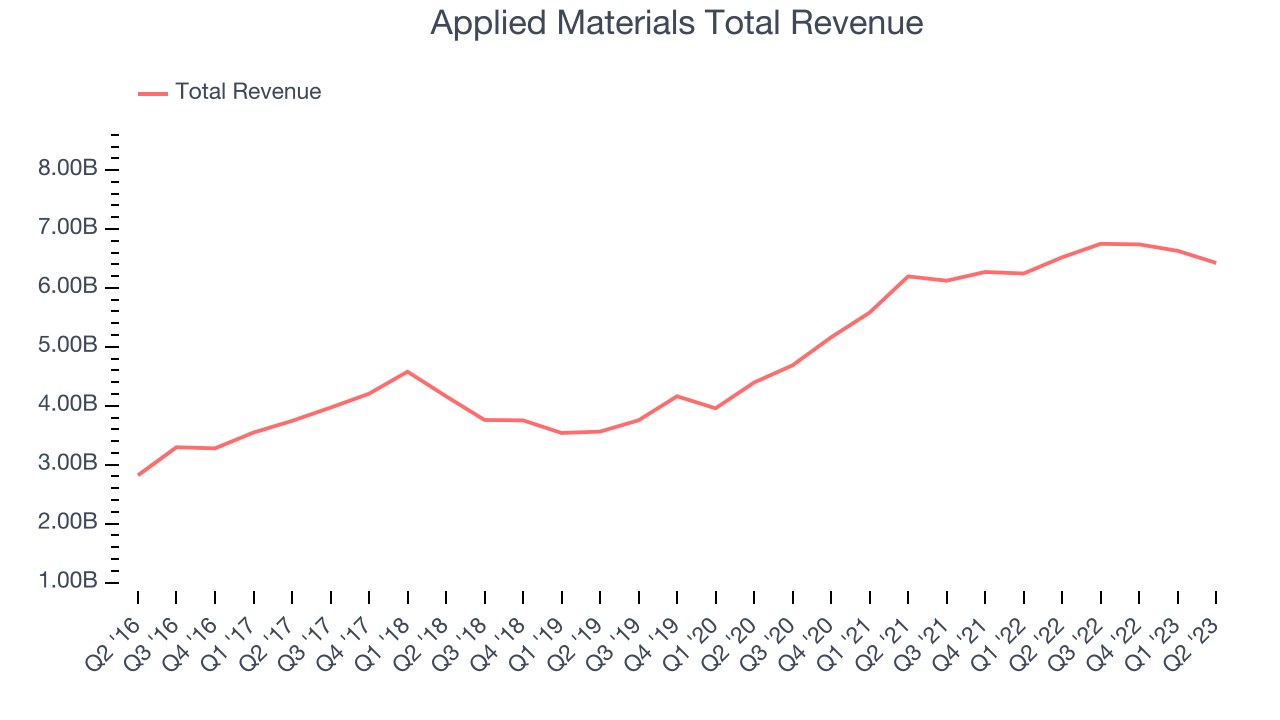

Best Q2: Applied Materials (NASDAQ:AMAT)

Founded in 1967 as the first company that built the tools for other companies to use to make semiconductors, Applied Materials (NASDAQ:AMAT) is the largest provider of semiconductor wafer fabrication equipment.

Applied Materials reported revenues of $6.43 billion, down 1.46% year on year, beating analyst expectations by 4.29%. It was a very strong quarter for the company, with an impressive beat of analysts' EPS estimates and optimistic revenue guidance for the next quarter.

Applied Materials delivered the strongest analyst estimates beat among its peers. The stock is up 0.46% since the results and currently trades at $138.03.

Is now the time to buy Applied Materials? Access our full analysis of the earnings results here, it's free.

Weakest Q2: IPG Photonics (NASDAQ:IPGP)

Both a designer and manufacturer of most of its products, IPG Photonics (NASDAQ:IPGP) is a provider of high-performance fiber lasers that are used for cutting, welding and processing raw materials.

IPG Photonics reported revenues of $340 million, down 9.83% year on year, missing analyst expectations by 1.79%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and a miss of analysts' revenue estimates.

The stock is down 23.9% since the results and currently trades at $100.06.

Read our full analysis of IPG Photonics's results here.

Entegris (NASDAQ:ENTG)

With fabs representing the company’s largest customer type, Entegris (NASDAQ:ENTG) supplies products that purify, protect, and generally ensure the integrity of raw materials needed for advanced semiconductor manufacturing.

Entegris reported revenues of $901 million, up 30.1% year on year, beating analyst expectations by 1.6%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and a decline in its operating margin.

The stock is down 10.8% since the results and currently trades at $92.42.

Read our full, actionable report on Entegris here, it's free.

Amtech (NASDAQ:ASYS)

Focusing on Silicon Carbide and Power Semiconductor sectors, Amtech Systems (NASDAQ:ASYS) produces machinery and related chemicals needed for manufacturing semiconductors.

Amtech reported revenues of $30.7 million, up 54% year on year, missing analyst expectations by 6.42%. It was a weak quarter for the company, with a miss of analysts' revenue estimates and a decline in its operating margin.

Additionally, the company announced that the CEO is stepping down, effective immediately. The company stated that "Michael Whang stepped down as Chief Executive Officer, effective August 8, 2023. The board has appointed Bob Daigle, current Chairman of the Board, with the additional role of Chief Executive Officer, effective August 8, 2023. To support the transition, Mr. Whang will remain as an advisor until February 8, 2024. "

Amtech pulled off the fastest revenue growth but had the weakest performance against analyst estimates among the peers. The stock is down 27.4% since the results and currently trades at $7.77.

Read our full, actionable report on Amtech here, it's free.

The author has no position in any of the stocks mentioned