As we reflect back on the just completed Q2 data analytics sector earnings season, we dig into the relative performance of Amplitude (NASDAQ:AMPL) and its peers.

Organizations generate a lot of data that is stored in silos, often in incompatible formats, making it slow and costly to extract actionable insights, which in turn drives demand for modern cloud-based data analysis platforms that can efficiently analyze the silo-ed data.

The 5 data analytics stocks we track reported a mixed Q2; on average, revenues beat analyst consensus estimates by 3.55%, while on average next quarter revenue guidance was 1.88% under consensus. There has been a stampede out of high valuation technology stocks as raising interest rates encourages investors to value profits over growth again and data analytics stocks have not been spared, with share prices down 17.5% since the previous earnings results, on average.

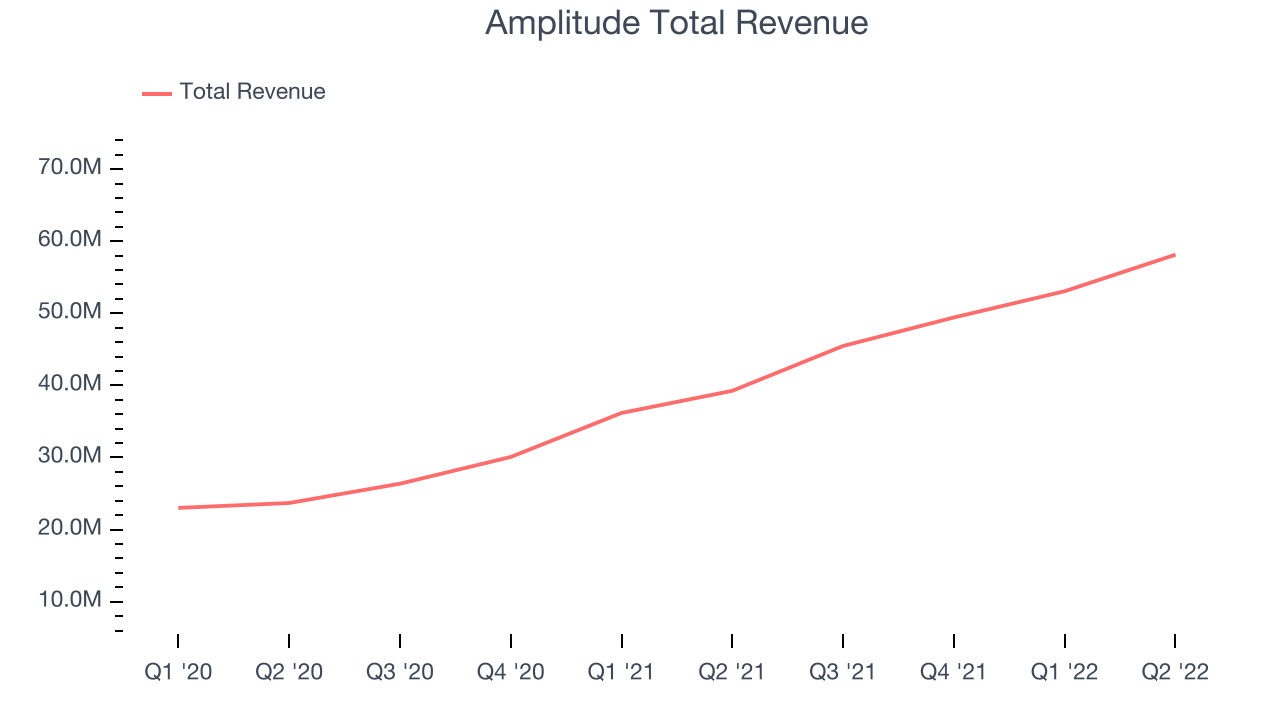

Amplitude (NASDAQ:AMPL)

Born out of a failed voice recognition startup by founder Spenser Skates, Amplitude (NASDAQ:AMPL) is data analytics software helping companies improve and optimize their digital products.

Amplitude reported revenues of $58.1 million, up 48% year on year, beating analyst expectations by 5.34%. It was a strong quarter for the company, with an exceptional revenue growth and a solid beat of analyst estimates.

"We want to help every company build better products through data,” said Spenser Skates, CEO and co-founder of Amplitude.

The stock is up 3.46% since the results and currently trades at $16.72.

Is now the time to buy Amplitude? Access our full analysis of the earnings results here, it's free.

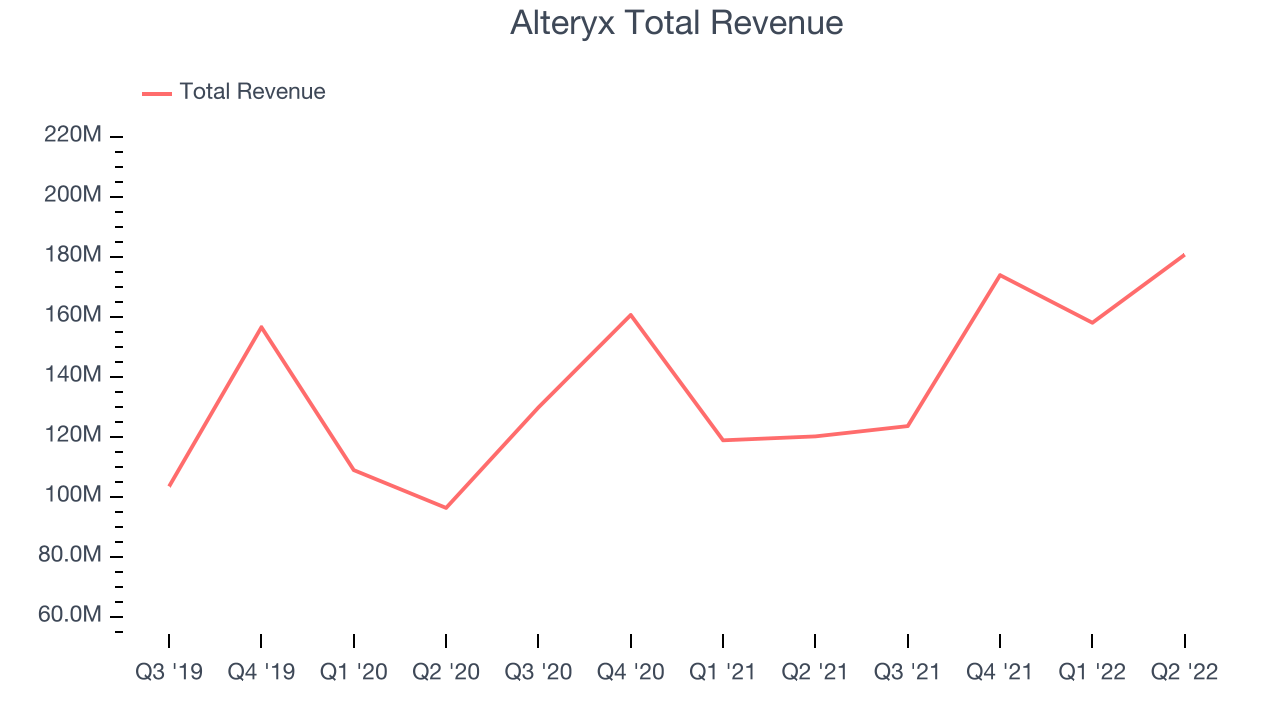

Best Q2: Alteryx (NYSE:AYX)

Initially created as a way to organise census data for the government, Alteryx (NYSE:AYX) provides software that helps companies automate and analyse their internal data processes.

Alteryx reported revenues of $180.6 million, up 50.4% year on year, beating analyst expectations by 12.2%. It was an incredible quarter for the company, with an impressive beat of analyst estimates and a very optimistic guidance for the next quarter.

Alteryx achieved the strongest analyst estimates beat, fastest revenue growth, and highest full year guidance raise among its peers. The company added 101 customers to a total of 8,296. The stock is up 12.4% since the results and currently trades at $56.96.

Is now the time to buy Alteryx? Access our full analysis of the earnings results here, it's free.

Weakest Q2: Domo (NASDAQ:DOMO)

Founded by Josh James after selling his former business Omniture to Adobe, Domo (NASDAQ:DOMO) provides business intelligence software that allows managers to access and visualize critical business metrics in real-time, using their smartphones.

Domo reported revenues of $75.5 million, up 20.2% year on year, missing analyst expectations by 1.13%. It was a weak quarter for the company, with revenue guidance for both the next quarter and full year missing analysts' expectations.

Domo had the weakest performance against analyst estimates in the group. The stock is down 35.1% since the results and currently trades at $18.52.

Read our full analysis of Domo's results here.

Health Catalyst (NASDAQ:HCAT)

Founded by healthcare professionals Tom Burton and Steve Barlow in 2008, Health Catalyst (NASDAQ:HCAT) provides data and analytics technology to healthcare organizations, enabling them to improve care and lower costs.

Health Catalyst reported revenues of $70.6 million, up 18.4% year on year, beating analyst expectations by 1.08%. It was a weak quarter for the company, with revenue guidance for both the next quarter and full year below analysts' expectations.

Health Catalyst had the slowest revenue growth and weakest full year guidance update among the peers. The stock is down 42.3% since the results and currently trades at $10.49.

Read our full, actionable report on Health Catalyst here, it's free.

Palantir (NYSE:PLTR)

Started by Peter Thiel after seeing US defence agencies struggle in the aftermath of the 2001 terrorist attacks, Palantir (NYSE:PLTR) offers software as a service platform that helps government agencies and large enterprises use data to make better decisions.

Palantir reported revenues of $473 million, up 25.9% year on year, in line with analyst expectations. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter.

The stock is down 26.3% since the results and currently trades at $8.43.

Read our full, actionable report on Palantir here, it's free.

The author has no position in any of the stocks mentioned