The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how data analytics stocks fared in Q2, starting with Amplitude (NASDAQ:AMPL).

Organizations generate a lot of data that is stored in silos, often in incompatible formats, making it slow and costly to extract actionable insights, which in turn drives demand for modern cloud-based data analysis platforms that can efficiently analyze the siloed data.

The 5 data analytics stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 2.6% while next quarter’s revenue guidance was in line.

The Fed cut its policy rate by 50bps (half a percent) in September 2024, the first in roughly four years. This marks the end of its most pointed inflation-busting campaign since the 1980s. While CPI (inflation) readings have been supportive lately, employment measures have bordered on worrisome. The markets will be assessing whether this rate cut's timing (and more potential ones in 2024 and 2025) is ideal for supporting the economy or a bit too late for a macro that has already cooled too much.

Luckily, data analytics stocks have performed well with share prices up 32.1% on average since the latest earnings results.

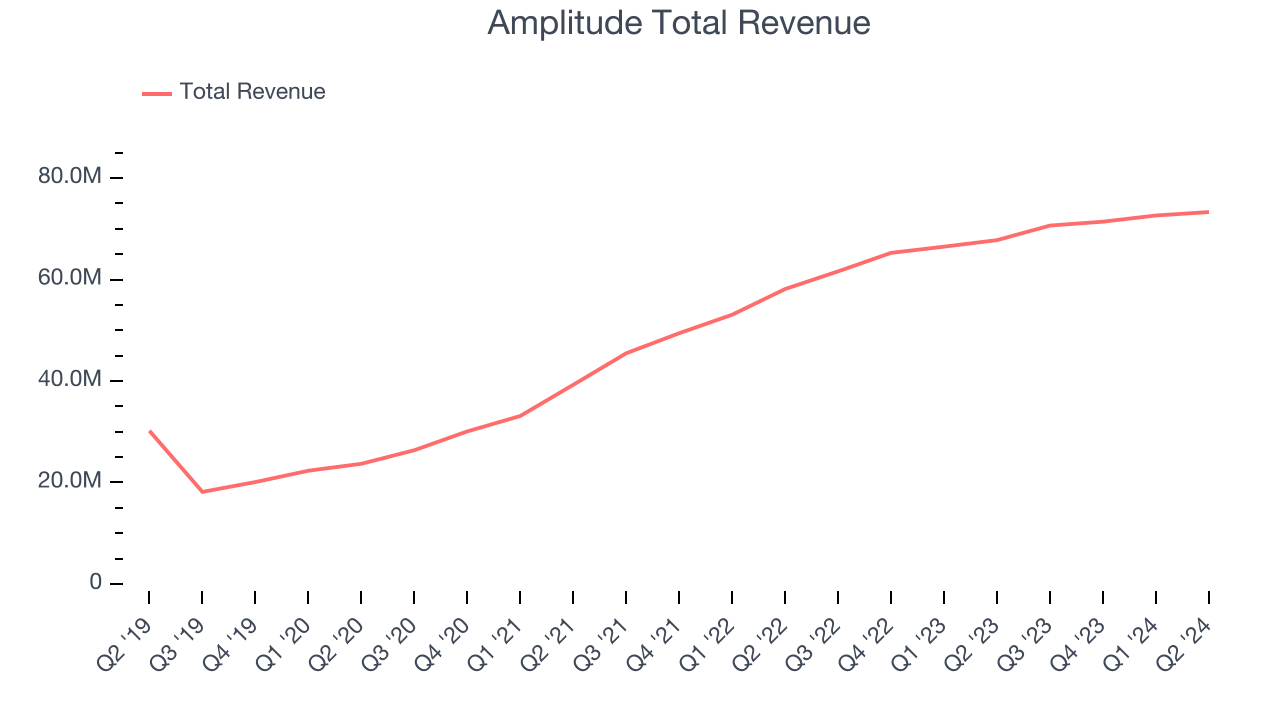

Amplitude (NASDAQ:AMPL)

Born out of a failed voice recognition startup by founder Spenser Skates, Amplitude (NASDAQ:AMPL) is data analytics software helping companies improve and optimize their digital products.

Amplitude reported revenues of $73.3 million, up 8.2% year on year. This print exceeded analysts’ expectations by 1.8%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ billings estimates and full-year revenue guidance exceeding analysts’ expectations.

"Today, companies win or lose based on their digital experience," said Spenser Skates, CEO and co-founder of Amplitude.

Interestingly, the stock is up 3% since reporting and currently trades at $8.21.

Is now the time to buy Amplitude? Access our full analysis of the earnings results here, it’s free.

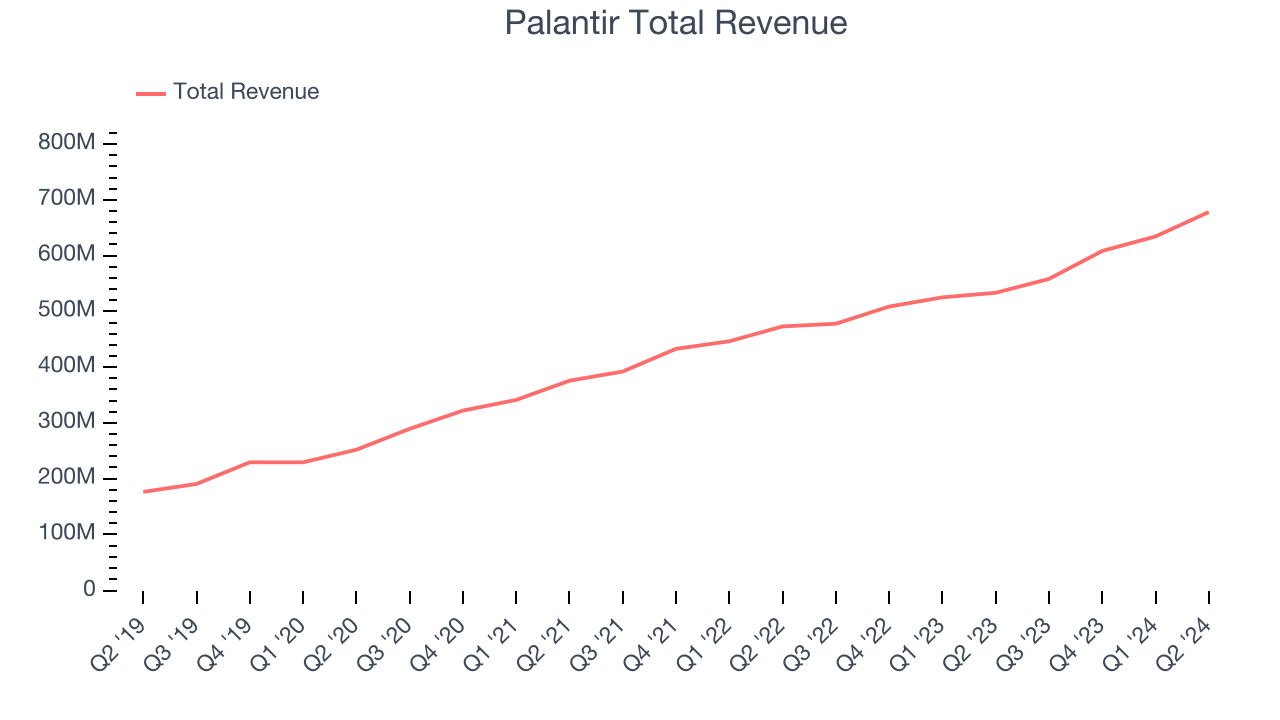

Best Q2: Palantir (NYSE:PLTR)

Started by Peter Thiel after seeing US defence agencies struggle in the aftermath of the 2001 terrorist attacks, Palantir (NYSE:PLTR) offers software as a service platform that helps government agencies and large enterprises use data to make better decisions.

Palantir reported revenues of $678.1 million, up 27.2% year on year, outperforming analysts’ expectations by 3.9%. The business had an exceptional quarter with an impressive beat of analysts’ billings estimates and full-year revenue guidance exceeding analysts’ expectations.

Palantir achieved the biggest analyst estimates beat and highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 80.4% since reporting. It currently trades at $43.45.

Is now the time to buy Palantir? Access our full analysis of the earnings results here, it’s free.

Slowest Q2: Health Catalyst (NASDAQ:HCAT)

Founded by healthcare professionals Tom Burton and Steve Barlow in 2008, Health Catalyst (NASDAQ:HCAT) provides data and analytics technology to healthcare organizations, enabling them to improve care and lower costs.

Health Catalyst reported revenues of $75.9 million, up 3.7% year on year, exceeding analysts’ expectations by 1.2%. Still, it was a mixed quarter as it posted a decline in its gross margin.

Health Catalyst delivered the weakest performance against analyst estimates in the group. Interestingly, the stock is up 50.9% since the results and currently trades at $8.30.

Read our full analysis of Health Catalyst’s results here.

Samsara (NYSE:IOT)

One of the few public companies where Marc Andreessen is a Board member, Samsara (NYSE:IOT) provides software and hardware to track industrial equipment, assets, and fleets.

Samsara reported revenues of $300.2 million, up 36.9% year on year. This number beat analysts’ expectations by 3.7%. Overall, it was a very strong quarter as it also logged an impressive beat of analysts’ billings estimates and full-year revenue guidance exceeding analysts’ expectations.

Samsara achieved the fastest revenue growth among its peers. The stock is up 30.3% since reporting and currently trades at $50.50.

Read our full, actionable report on Samsara here, it’s free.

Domo (NASDAQ:DOMO)

Founded by Josh James after selling his former business Omniture to Adobe, Domo (NASDAQ:DOMO) provides business intelligence software that allows managers to access and visualize critical business metrics in real-time, using their smartphones.

Domo reported revenues of $78.41 million, down 1.6% year on year. This print topped analysts’ expectations by 2.4%. Taking a step back, it was a mixed quarter as it also recorded full-year revenue guidance exceeding analysts’ expectations but a miss of analysts’ billings estimates.

Domo had the slowest revenue growth and weakest full-year guidance update among its peers. The stock is down 4% since reporting and currently trades at $7.40.

Read our full, actionable report on Domo here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.