American Superconductor Corporation (AMSC) is a leading provider of megawatt-scale power resiliency solutions for the electrical grid and critical naval systems. announced better-than-expected results in Q2 CY2024, with revenue up 33.2% year on year to $40.29 million. Guidance for next quarter's revenue was also optimistic at $40 million at the midpoint, 6.6% above analysts' estimates.

Is now the time to buy American Superconductor? Find out by accessing our full research report, it's free.

American Superconductor (AMSC) Q2 CY2024 Highlights:

- Revenue: $40.29 million vs analyst estimates of $39.33 million (2.4% beat)

- Revenue Guidance for Q3 CY2024 is $40 million at the midpoint, above analyst estimates of $37.53 million

- Gross Margin (GAAP): 30.3%, up from 20.8% in the same quarter last year

- Adjusted EBITDA Margin: -5.7%, up from -13.1% in the same quarter last year

- Free Cash Flow of $3.14 million, up 62.4% from the previous quarter

- Market Capitalization: $789.4 million

"We are building a fundamentally stronger company and reporting another quarter of solid results to start our fiscal 2024. AMSC delivered over $3 million of operating cash flow, expanded gross margins and grew revenue by over 30% when compared to the same period last year,” said Daniel P. McGahn, Chairman, President and CEO, AMSC.

Founded in 1987, American Superconductor (NASDAQ:AMSC) has shifted from superconductor research to developing power systems, adapting to changing energy grid needs and naval technology requirements.

Renewable Energy

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

Sales Growth

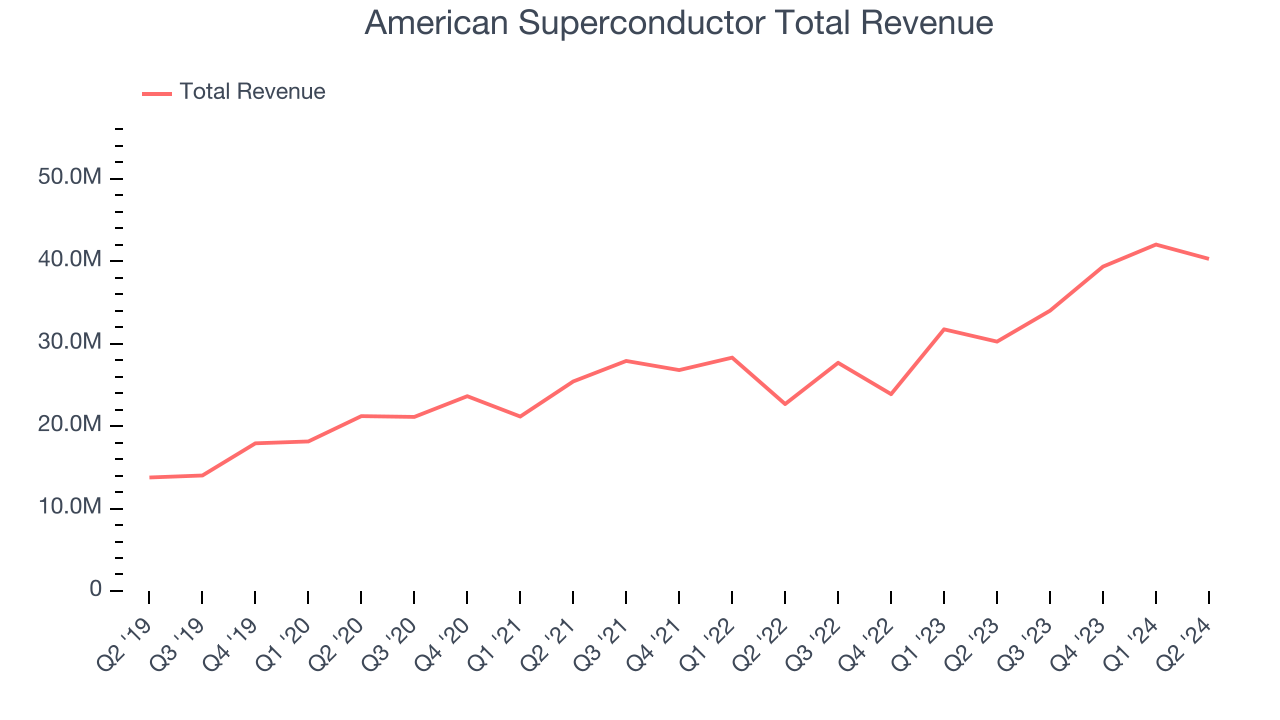

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones tend to grow for years. Luckily, American Superconductor's sales grew at an incredible 23.4% compounded annual growth rate over the last five years. This is a great starting point for our analysis because it shows American Superconductor's offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. American Superconductor's annualized revenue growth of 21.4% over the last two years is below its five-year trend, but we still think the results were good and suggest demand was strong. American Superconductor's recent history shows it’s one of the better Renewable Energy businesses as many of its peers faced declining sales because of cyclical headwinds.

This quarter, American Superconductor reported wonderful year-on-year revenue growth of 33.2%, and its $40.29 million of revenue exceeded Wall Street's estimates by 2.4%. The company is guiding for revenue to rise 17.6% year on year to $40 million next quarter, slowing from the 22.8% year-on-year increase it recorded in the same quarter last year. Looking ahead, Wall Street expects sales to grow 2.5% over the next 12 months, a deceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Operating Margin

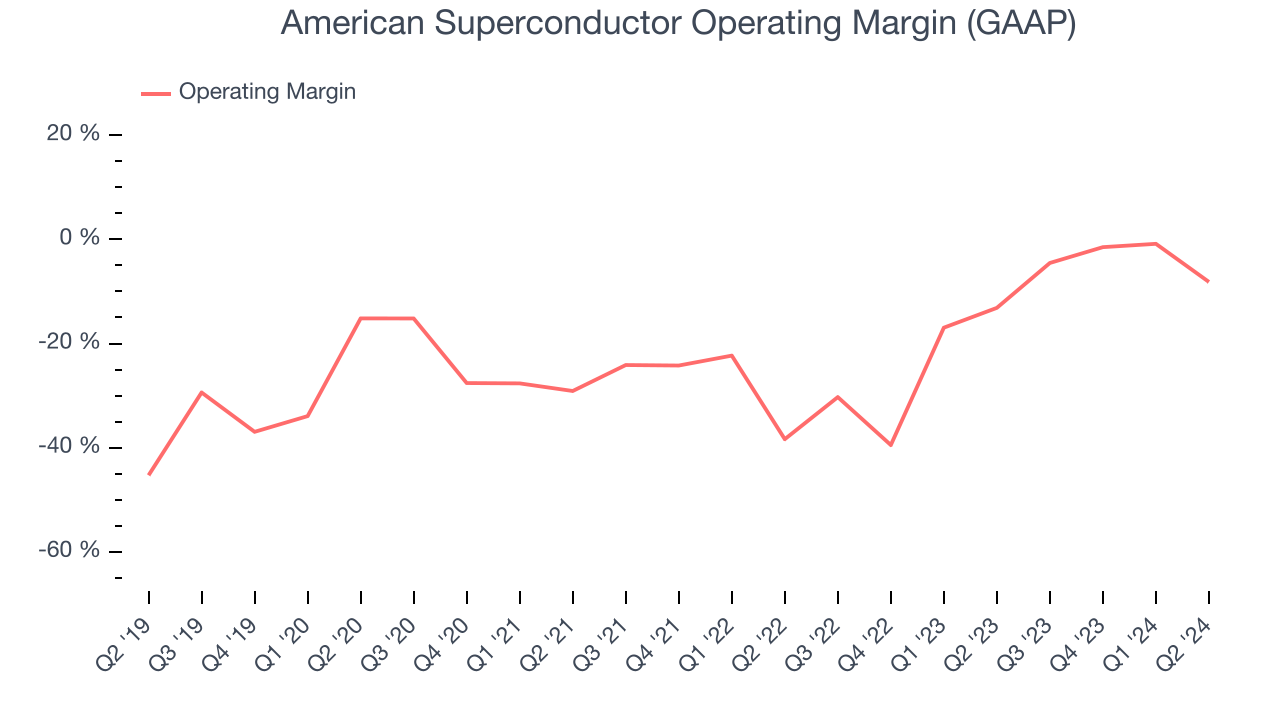

Unprofitable industrials companies require extra attention because they could get caught swimming naked if the tide goes out. It's hard to trust that American Superconductor can endure a full cycle as its high expenses have contributed to an average operating margin of negative 19.4% over the last five years. This result isn't too surprising given its low gross margin as a starting point.

On the bright side, American Superconductor's annual operating margin rose by 24.5 percentage points over the last five years, as its sales growth gave it immense operating leverage. Still, it will take much more for the company to reach long-term profitability.

In Q2, American Superconductor generated an operating profit margin of negative 8.2%, up 5 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

Cash Is King

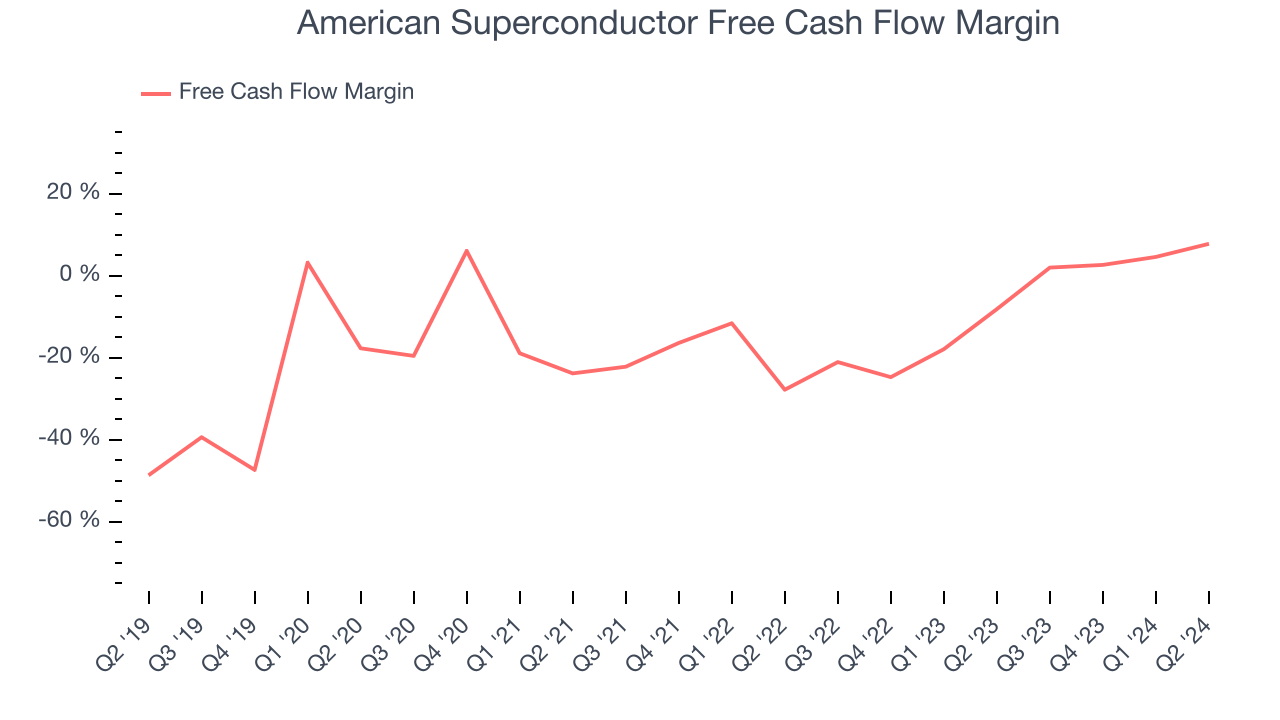

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

While American Superconductor posted positive free cash flow this quarter, the broader story hasn't been so clean. American Superconductor's demanding reinvestments have drained its resources over the last five years. Its free cash flow margin was among the worst in the industrials sector, averaging negative 11.7%.

Taking a step back, an encouraging sign is that American Superconductor's margin expanded by 28.5 percentage points during that time. In light of its glaring cash burn, however, this improvement is a bucket of hot water in a cold ocean.

American Superconductor's free cash flow clocked in at $3.14 million in Q2, equivalent to a 7.8% margin. This quarter's result was nice as its cash flow turned positive after being negative in the same quarter last year, marking a potential inflection point.

Key Takeaways from American Superconductor's Q2 Results

We were impressed by American Superconductor's revenue guidance for next quarter, which blew past analysts' expectations. We were also excited this quarter's revenue outperformed Wall Street's estimates. Zooming out, we think this was a solid quarter. Investors were likely expecting more, however, and the stock traded down 2.2% to $20.14 immediately after reporting.

So should you invest in American Superconductor right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.