Home services online marketplace ANGI (NASDAQ: ANGI) missed analyst expectations in Q3 FY2022 quarter, with revenue up 7.9% year on year to $498 million. Angi made a GAAP loss of $17.4 million, down on its loss of $16.6 million, in the same quarter last year.

Is now the time to buy Angi? Access our full analysis of the earnings results here, it's free.

Angi (ANGI) Q3 FY2022 Highlights:

- Revenue: $498 million vs analyst estimates of $501.3 million (0.66% miss)

- EPS: -$0.03 vs analyst estimates of -$0.03 (13.9% beat)

- Free cash flow was negative $29.1 million, compared to negative free cash flow of $27.5 million in previous quarter

- Gross Margin (GAAP): 78.1%, in line with same quarter last year

- Domestic Customer Service Requests : 7.78 million, down 923 thousand year on year

Created by IAC’s mergers of Angie’s List and HomeAdvisor, ANGI (NASDAQ: ANGI) operates the largest online marketplace for home services in the US.

The iPhone changed the world, ushering in the era of the “always-on” internet and “on-demand” services - anything someone could want is just a few taps away. Likewise, the gig economy sprang up in a similar fashion, with a proliferation of tech-enabled freelance labor marketplaces, which work hand and hand with many on demand services. Individuals can now work on demand too. What began with tech enabled platforms that aggregated riders and drivers has expanded over the past decade to include food delivery, groceries, and now even a plumber or graphic designer are all just a few taps away.

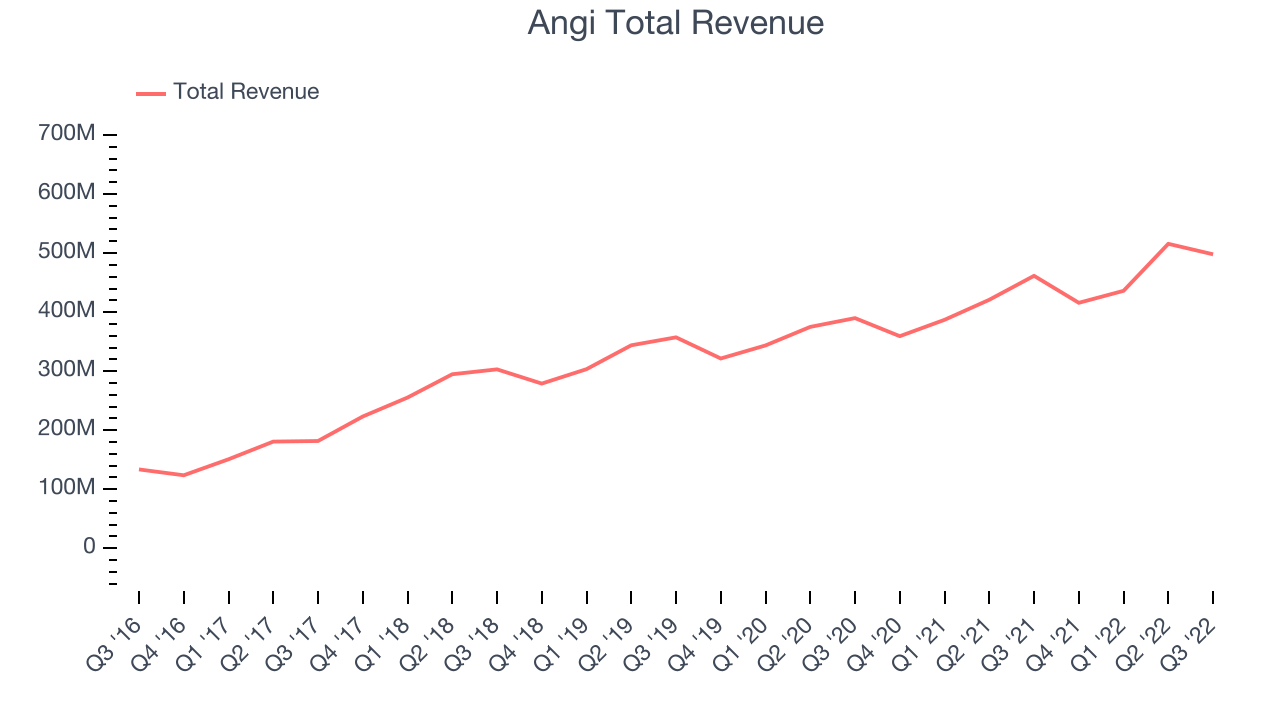

Sales Growth

Angi's revenue growth over the last three years has been mediocre, averaging 13.3% annually.

This quarter, Angi reported a slow 7.9% year on year revenue growth, and this result fell short of what analysts were expecting.

Ahead of the earnings results the analysts covering the company were estimating sales to grow 10.4% over the next twelve months.

In volatile times like these we look for robust businesses with strong pricing power. Unknown to most investors, this company is one of the highest-quality software companies in the world, and their software products have been the default standard in critical industries for decades. The result is an impressive business that is up an incredible 18,152% since the IPO. You can find it on our platform for free.

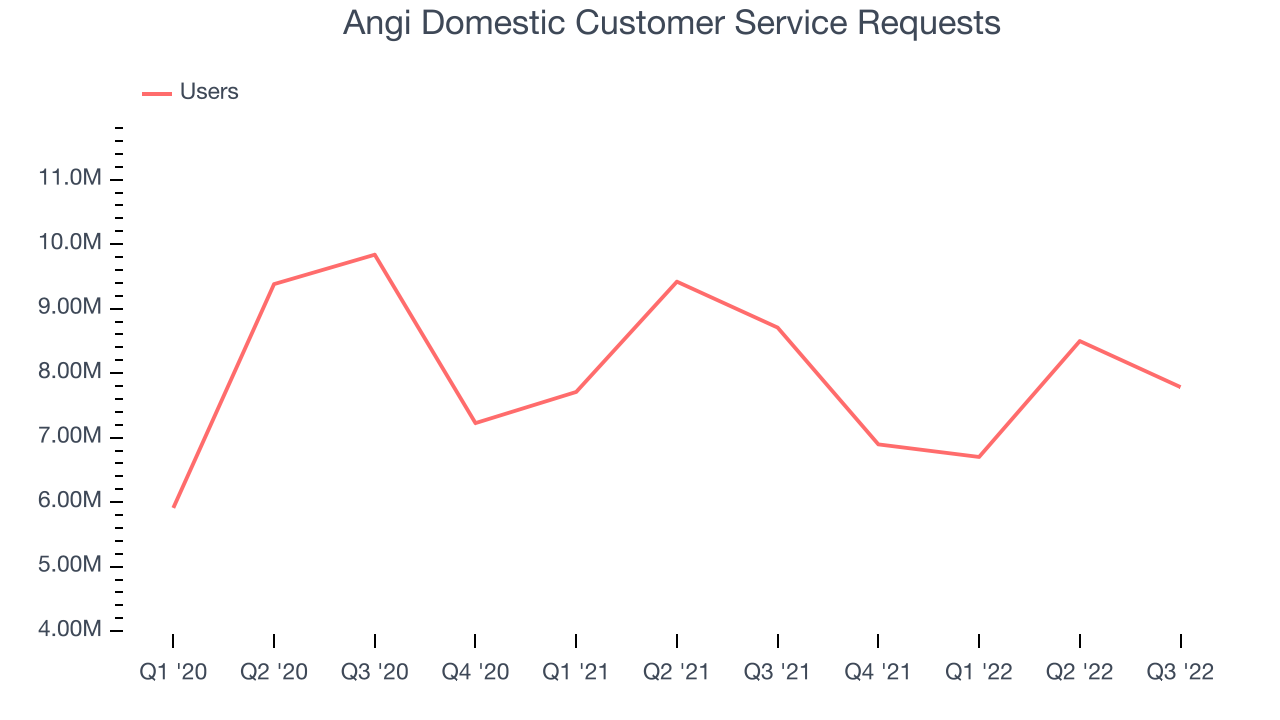

Usage Growth

As a gig economy marketplace, Angi generates revenue growth by a combination of the volume of services users order and how much commission it earns.

Angi has been struggling over the last two years as the number of service requests, a key usage metric for the company, declined 2.66% annually to 7.78 million. This is one of the lowest levels of growth in the consumer internet sector.

In Q3 the number of service requests decreased by 923 thousand, a 10.6% drop year on year.

Key Takeaways from Angi's Q3 Results

Since it has still been burning cash over the last twelve months it is worth keeping an eye on Angi’s balance sheet, but we note that with a market capitalization of $976.3 million and more than $328.7 million in cash, the company has the capacity to continue to prioritise growth over profitability.

We struggled to find many strong positives in these results. On the other hand, there was a decline in number of users and it missed analysts' revenue expectations. Overall, it seems to us that this was a complicated quarter for Angi. The company is down 0.78% on the results and currently trades at $1.9 per share.

Angi may have had a tough quarter, but does that actually create an opportunity to invest right now? It is important that you take into account its valuation and business qualities, as well as what happened in the latest quarter. We look at that in our actionable report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.