Home services online marketplace ANGI (NASDAQ: ANGI) reported Q2 CY2024 results beating Wall Street analysts' expectations, with revenue down 16% year on year to $315.1 million. It made a GAAP profit of $0.01 per share, improving from its loss of $0.03 per share in the same quarter last year.

Is now the time to buy Angi? Find out by accessing our full research report, it's free.

Angi (ANGI) Q2 CY2024 Highlights:

- Revenue: $315.1 million vs analyst estimates of $304.4 million (3.5% beat)

- EPS: $0.01 vs analyst estimates of -$0.01 ($0.02 beat)

- Gross Margin (GAAP): 95.5%, up from 91.6% in the same quarter last year

- Adjusted EBITDA Margin: 13.4%, up from 4.9% in the same quarter last year

- Free Cash Flow of $59.5 million, up from $9.5 million in the previous quarter

- Transacting Service Professionals: 4.94 million, down 1.92 million year on year

- Market Capitalization: $988.4 million

Created by IAC’s mergers of Angie’s List and HomeAdvisor, ANGI (NASDAQ: ANGI) operates the largest online marketplace for home services in the US.

Gig Economy

The iPhone changed the world, ushering in the era of the “always-on” internet and “on-demand” services - anything someone could want is just a few taps away. Likewise, the gig economy sprang up in a similar fashion, with a proliferation of tech-enabled freelance labor marketplaces, which work hand and hand with many on demand services. Individuals can now work on demand too. What began with tech enabled platforms that aggregated riders and drivers has expanded over the past decade to include food delivery, groceries, and now even a plumber or graphic designer are all just a few taps away.

Sales Growth

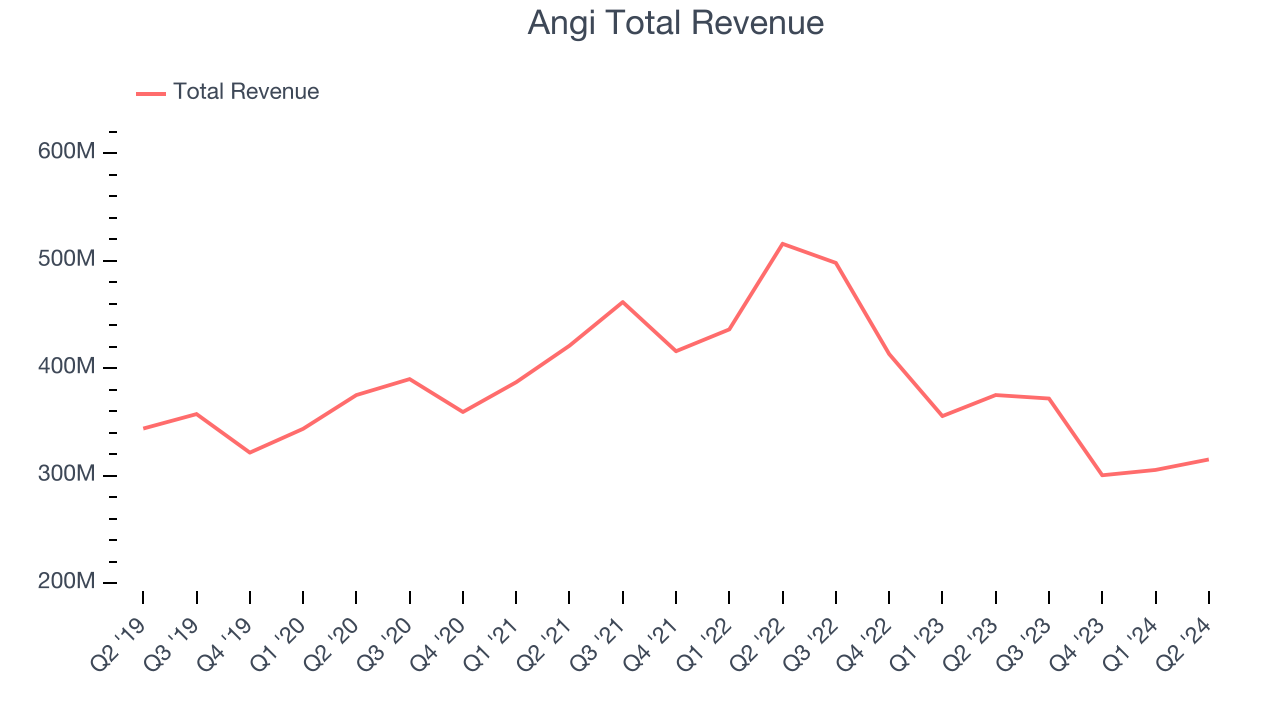

Angi's revenue has been declining over the last three years, dropping on average by 4.3% annually. This quarter, Angi beat analysts' estimates but reported a year on year revenue decline of 16%.

Before the earnings results were announced, analysts were projecting revenue to decline -6% over the next 12 months.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Usage Growth

As a gig economy marketplace, Angi generates revenue growth by expanding the number of services on its platform (e.g. rides, deliveries, freelance jobs) and raising the commission fee from each service provided.

Angi has been struggling to grow its service requests, a key performance metric for the company. Over the last two years, its requests have declined 21.1% annually to 4.94 million. This is one of the lowest rates of growth in the consumer internet sector.

In Q2, Angi's service requests decreased by 1.92 million, a 28% drop since last year.

Revenue Per Request

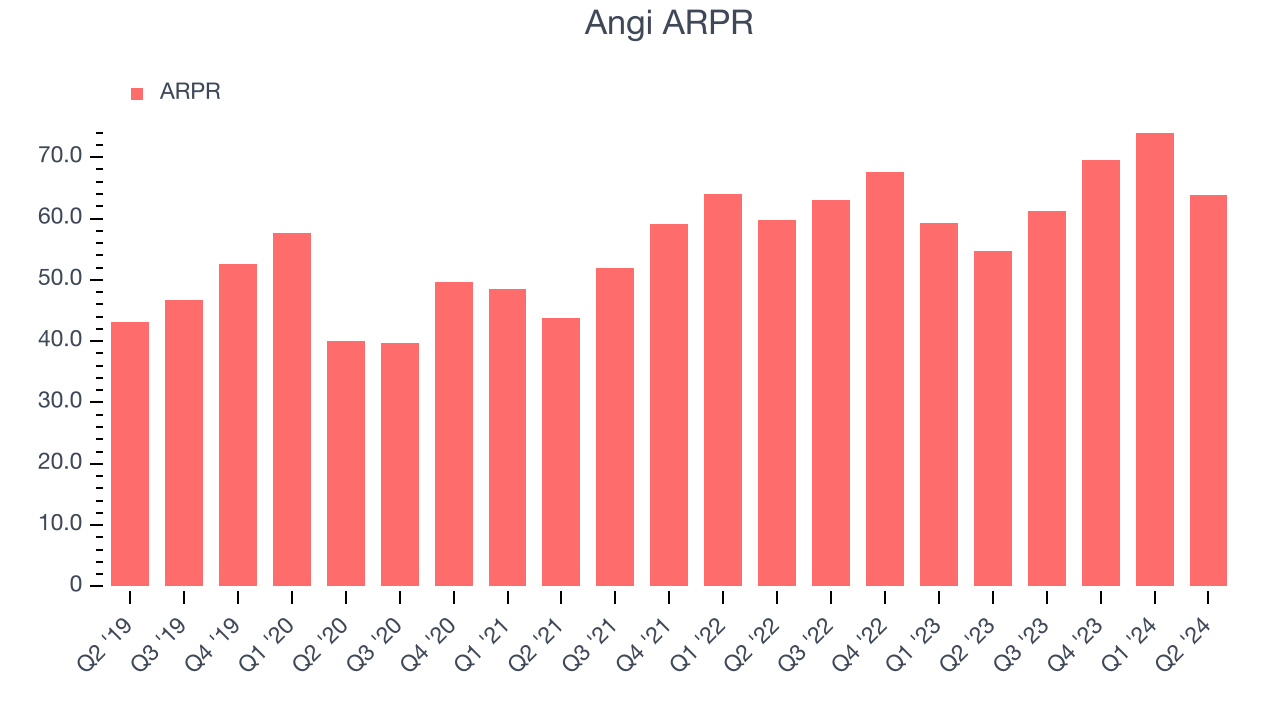

Average revenue per request (ARPR) is a critical metric to track for consumer internet businesses like Angi because it measures how much the company earns in transaction fees from each request. This number also informs us about Angi's take rate, which represents its pricing leverage over the ecosystem, or "cut" from each transaction.

Angi's ARPR growth has been decent over the last two years, averaging 7.7%. Although its service requests have shrunk during this time, the company's ability to increase prices demonstrates its platform's value for existing requests. This quarter, ARPR grew 16.7% year on year to $63.81 per request.

Key Takeaways from Angi's Q2 Results

It was good to see Angi beat analysts' revenue and service request expectations this quarter, but we note the sales growth was quite weak and its requests declined. Overall, this was a decent quarter for Angi. The stock traded up 1.5% to $2.00 immediately after reporting.

So should you invest in Angi right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.