As gig economy stocks’ Q4 earnings season wraps, let's examine the best and worst performers, including Angi (NASDAQ:ANGI) and its peers.

The iPhone changed the world, ushering in the era of the “always-on” internet and “on-demand” services - anything someone could want is just a few taps away. Likewise, the gig economy sprang up in a similar fashion, with a proliferation of tech-enabled freelance labor marketplaces, which work hand and hand with many on demand services. Individuals can now work on demand too. What began with tech-enabled platforms that aggregated riders and drivers has expanded over the past decade to include food delivery, groceries, and now even a plumber or graphic designer are all just a few taps away.

The 4 gig economy stocks we track reported a strong Q4; on average, revenues beat analyst consensus estimates by 3.72%, while on average next quarter revenue guidance was 0.2% above consensus. Tech stocks have been under pressure since the end of last year and gig economy stocks have not been spared, with share price down 23.9% since earnings, on average.

Weakest Q4: Angi (NASDAQ:ANGI)

Created by IAC’s mergers of Angie’s List and HomeAdvisor, ANGI (NASDAQ: ANGI) operates the largest online marketplace for home services in the US.

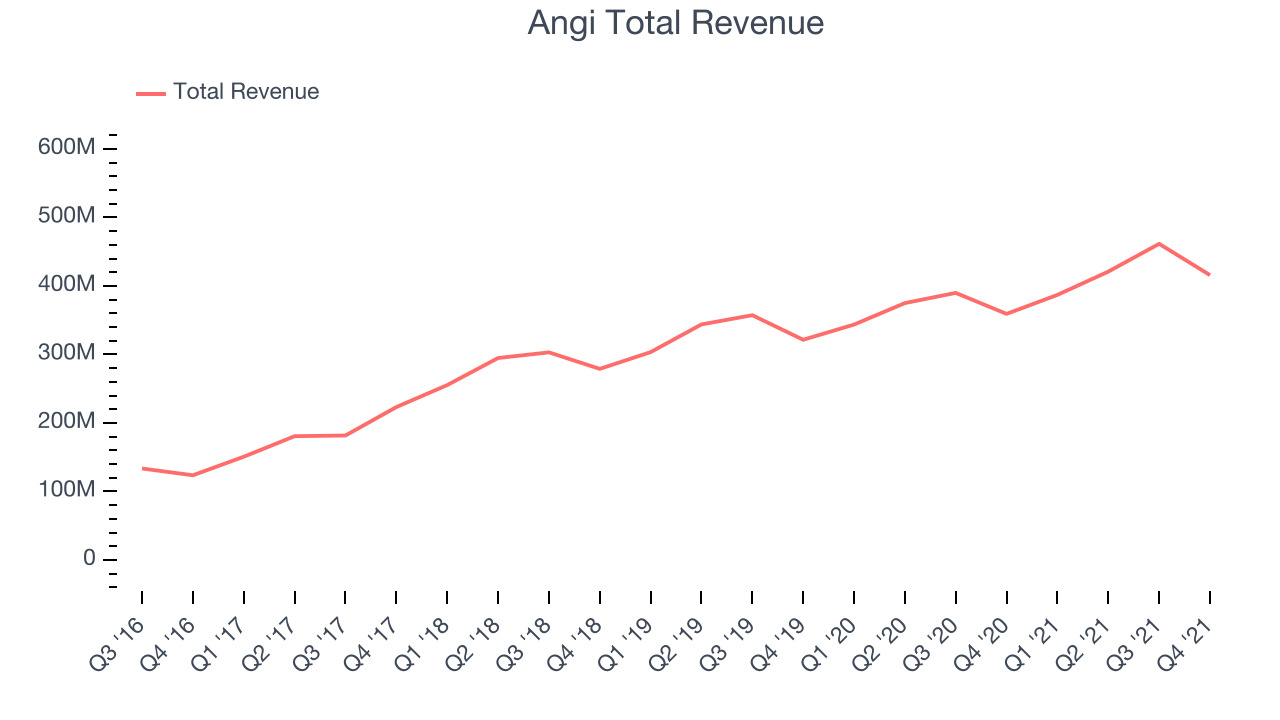

Angi reported revenues of $415.8 million, up 15.7% year on year, in line with analyst expectations. It was a weak quarter for the company, with a declining number of users and slow revenue growth.

Angi delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. The company reported 6.89 million service requests, down 4.57% year on year. The stock is down 44.1% since the results and currently trades at $4.96.

Read our full report on Angi here, it's free.

Best Q4: Uber (NYSE:UBER)

Born out of a winter night thought: "What if you could request a ride from your phone?" Uber (NYSE: UBER) operates a global network of on demand services, most prominently ride hailing and food delivery, and freight.

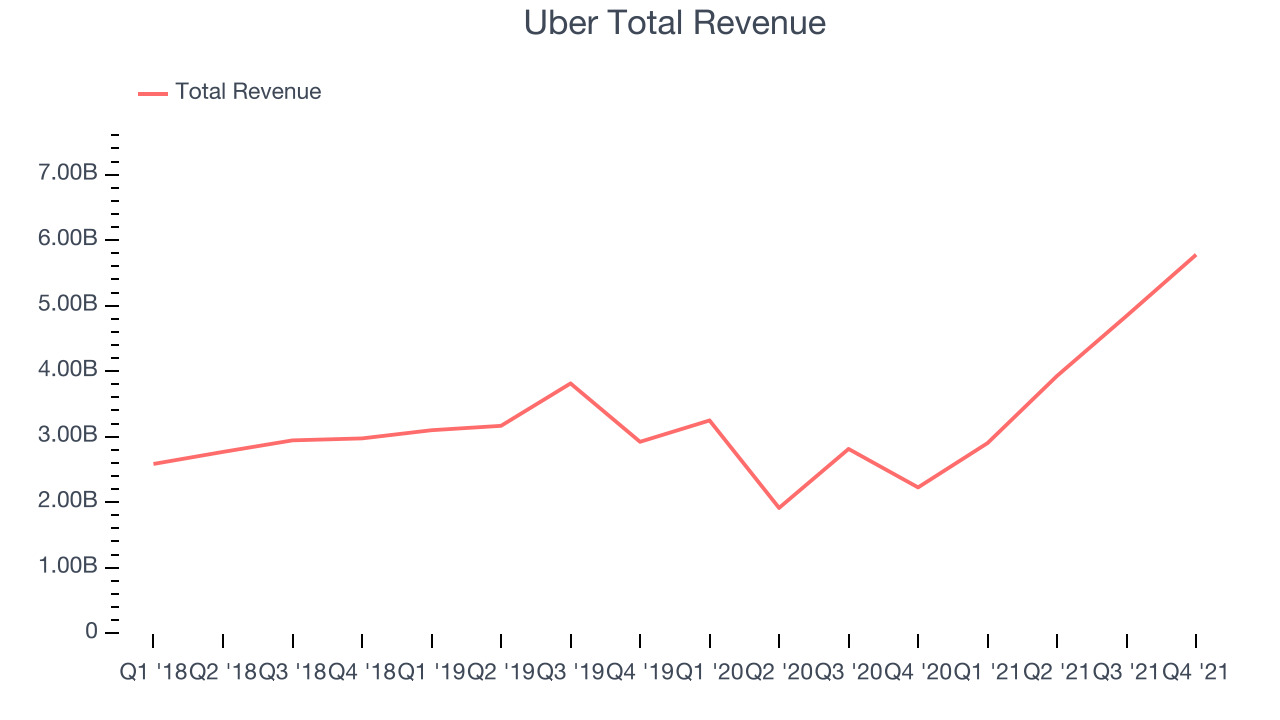

Uber reported revenues of $5.77 billion, up 83% year on year, beating analyst expectations by 7.85%. It was a very strong quarter for the company, with an exceptional revenue growth and an impressive beat of analyst estimates.

Uber scored the strongest analyst estimates beat and fastest revenue growth among its peers. The company reported 118 million paying users, up 26.8% year on year. The stock is down 16.4% since the results and currently trades at $33.55.

Is now the time to buy Uber? Access our full analysis of the earnings results here, it's free.

Fiverr (NYSE:FVRR)

Based in Tel Aviv, Fiverr (NYSE: FVRR) operates a fixed price global freelance marketplace for digital services.

Fiverr reported revenues of $79.7 million, up 42.7% year on year, beating analyst expectations by 3.81%. It was a strong quarter for the company, with an exceptional revenue growth and guidance for the next quarter slightly above analysts' estimates.

The company reported 4.2 million active buyers, up 23.5% year on year. The stock is down 22.3% since the results and currently trades at $58.88.

Read our full analysis of Fiverr's results here.

Lyft (NASDAQ:LYFT)

Founded by Logan Green and John Zimmer as a long-distance intercity carpooling company Zimride, Lyft (NASDAQ: LYFT) operates a ridesharing network in the US and Canada.

Lyft reported revenues of $969.9 million, up 70.1% year on year, beating analyst expectations by 3.08%. It was a very impressive quarter for the company, with an exceptional revenue growth and growing number of users.

The company reported 18.7 million paying users, up 49.2% year on year. The stock is down 12.7% since the results and currently trades at $36.

Read our full, actionable report on Lyft here, it's free.

The author has no position in any of the stocks mentioned