Home services online marketplace ANGI (NASDAQ: ANGI) missed analysts' expectations in Q4 FY2023, with revenue down 32% year on year to $300.4 million. It made a GAAP loss of $0.01 per share, improving from its loss of $0.02 per share in the same quarter last year.

Angi (ANGI) Q4 FY2023 Highlights:

- Revenue: $300.4 million vs analyst estimates of $309.1 million (2.8% miss)

- EPS: -$0.01 vs analyst estimates of -$0.02

- Free Cash Flow was -$6.3 million compared to -$2.77 million in the previous quarter

- Gross Margin (GAAP): 94.3%, up from 76.9% in the same quarter last year

- Domestic Customer Service Requests : 4.32 million, down 1.7 million year on year

- Market Capitalization: $1.26 billion

Created by IAC’s mergers of Angie’s List and HomeAdvisor, ANGI (NASDAQ: ANGI) operates the largest online marketplace for home services in the US.

Angi is an online marketplace focused on the large and very fragmented home services market. The marketplace seeks to match consumers' service requests with service professionals for a variety of home projects – everything from hanging a television to redoing a kitchen. Customers have the option to ask for a bid for a project or choose from a fixed price for a service, with the latter option the increasing focus for the business as consumers prefer the quicker time to service and lack of negotiation, while service providers who respond get assured revenue, rather than a negotiation or a fruitless waste of their advertising dollars.

For US homeowners who are generally faced with 6-10 household jobs per year, from replacing a dishwasher or boiler to wiring a new home entertainment system, Angi provides an aggregated collection of peer reviewed certified local service providers. For the service providers, Angi is another customer acquisition tool, where they can set defined budgets and measure how much business is coming in.

Many companies have tried their hand at building online marketplaces for home services but have struggled to match supply and demand; Angi is by far the largest platform in the US.

Gig Economy

The iPhone changed the world, ushering in the era of the “always-on” internet and “on-demand” services - anything someone could want is just a few taps away. Likewise, the gig economy sprang up in a similar fashion, with a proliferation of tech-enabled freelance labor marketplaces, which work hand and hand with many on demand services. Individuals can now work on demand too. What began with tech enabled platforms that aggregated riders and drivers has expanded over the past decade to include food delivery, groceries, and now even a plumber or graphic designer are all just a few taps away.

Angi (NASDAQ: ANGI) competitors include Thumbtack, Houzz, Meta Platforms (NASDAQ:FB), Yelp (NYSE: YELP), and Porch Group (NASDAQ: PRCH)

Sales Growth

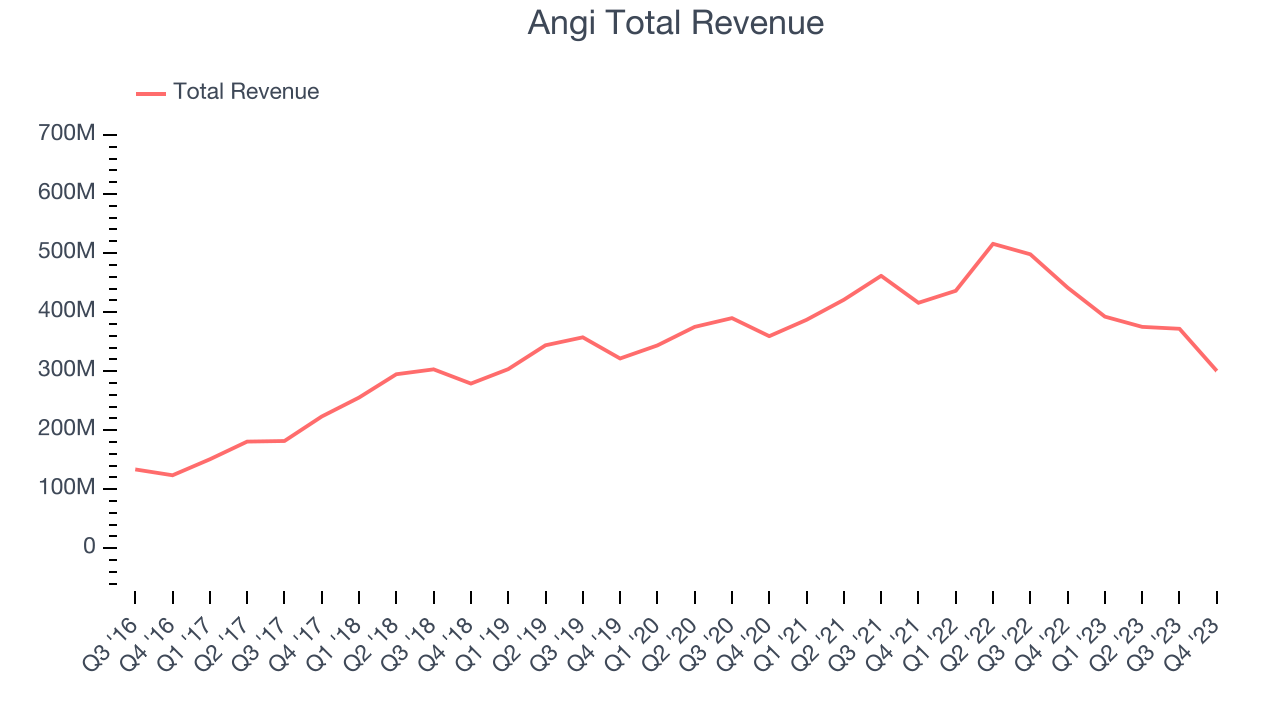

Angi's revenue has been declining over the last three years, dropping on average by 0.5% annually. This quarter, Angi reported a year on year revenue decline of 32%, missing analysts' expectations.

Usage Growth

As a gig economy marketplace, Angi generates revenue growth by expanding the number of services on its platform (e.g. rides, deliveries, freelance jobs) and raising the commission fee from each service provided.

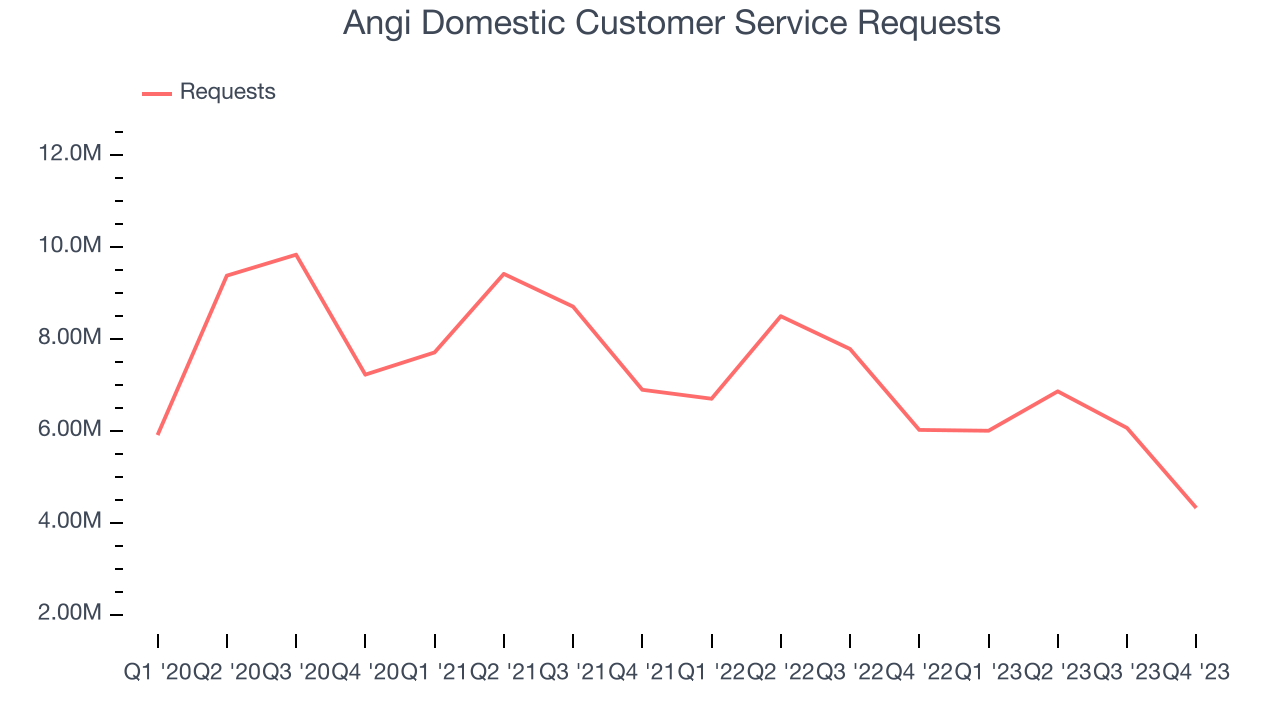

Angi has been struggling to grow its service requests, a key performance metric for the company. Over the last two years, its requests have declined 15.8% annually to 4.32 million. This is one of the lowest rates of growth in the consumer internet sector.

In Q4, Angi's service requests decreased by 1.7 million, a 28.2% drop since last year.

Revenue Per Request

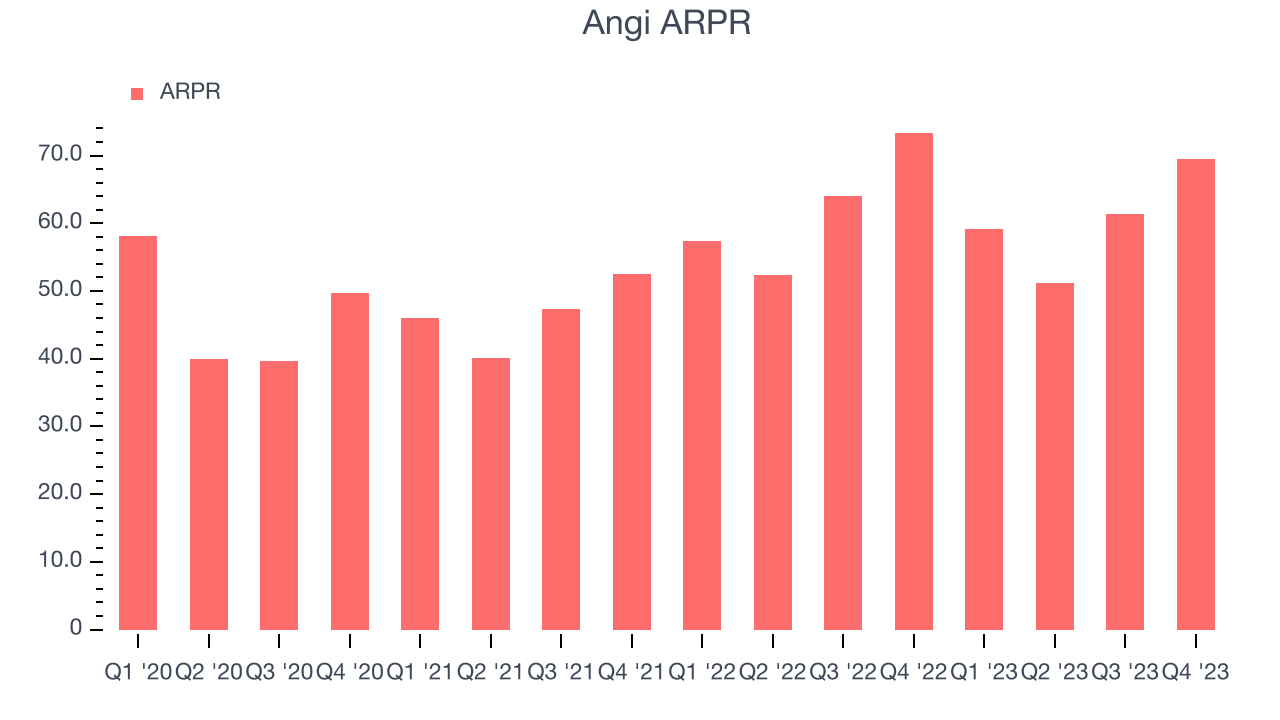

Average revenue per request (ARPR) is a critical metric to track for consumer internet businesses like Angi because it measures how much the company earns in transaction fees from each request. This number also informs us about Angi's take rate, which represents its pricing leverage over the ecosystem, or "cut" from each transaction.

Angi's ARPR growth has been impressive over the last two years, averaging 15.3%. Although its service requests have shrunk during this time, the company's ability to successfully increase prices demonstrates its platform's enduring value for existing requests. This quarter, ARPR declined 5.2% year on year to $69.48 per request.

Pricing Power

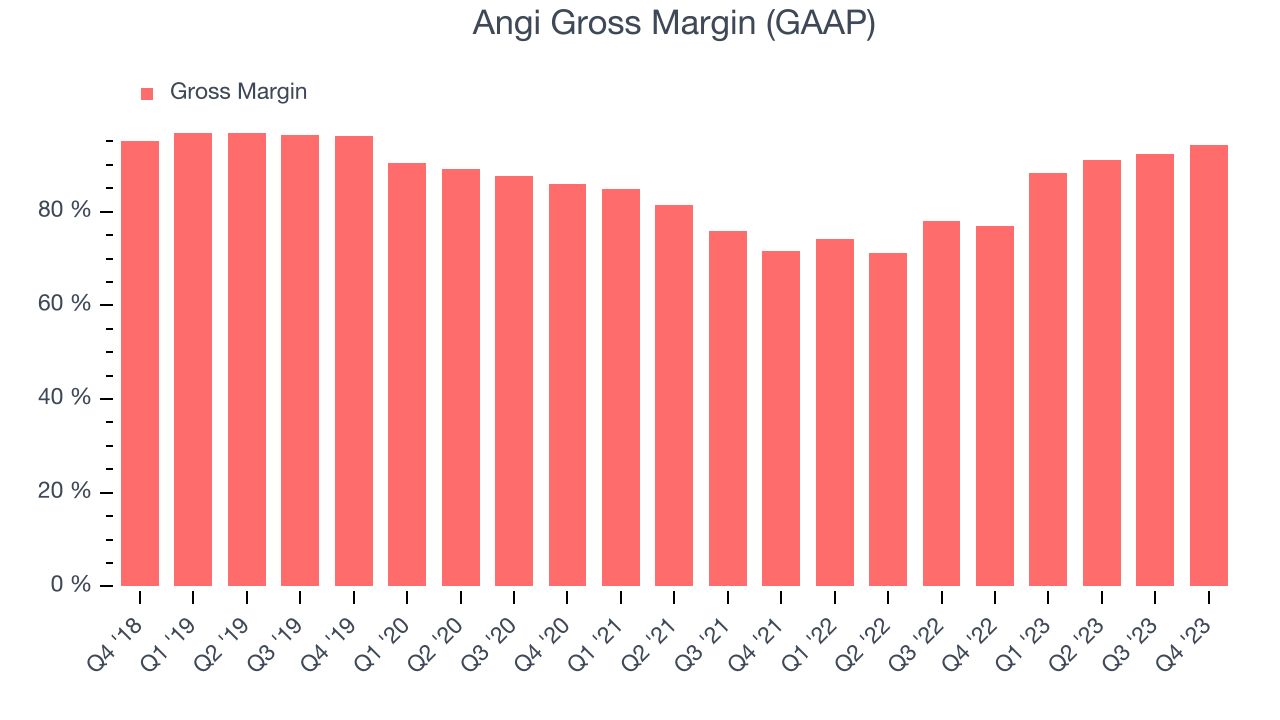

A company's gross profit margin has a major impact on its ability to exert pricing power, develop new products, and invest in marketing. These factors may ultimately determine the winner in a competitive market, making it a critical metric to track for the long-term investor. Angi's gross profit margin, which tells us how much money the company gets to keep after covering the base cost of its products and services, came in at 94.3% this quarter, up 17.3 percentage points year on year.

For gig economy businesses like Angi, these aforementioned costs typically include server hosting, customer support, and payment processing fees. Another cost of revenue could also be insurance to protect against liabilities arising from providing transportation, housing, or freelance work services. After paying for these expenses, Angi had $0.94 for every $1 in revenue to invest in marketing, talent, and the development of new products and services.

Gross margins have been trending up over the last 12 months, averaging 91.4%. Angi's margins are some of the highest in the consumer internet sector, enabling it to fund large investments in product and marketing during periods of rapid growth to stay one step ahead of the competition.

User Acquisition Efficiency

Consumer internet businesses like Angi grow from a combination of product virality, paid advertisement, and incentives (unlike enterprise software products, which are often sold by dedicated sales teams).

It's very expensive for Angi to acquire new users as the company has spent 61.7% of its gross profit on sales and marketing expenses over the last year. This inefficiency indicates a highly competitive environment with little differentiation between Angi and its peers.

Profitability & Free Cash Flow

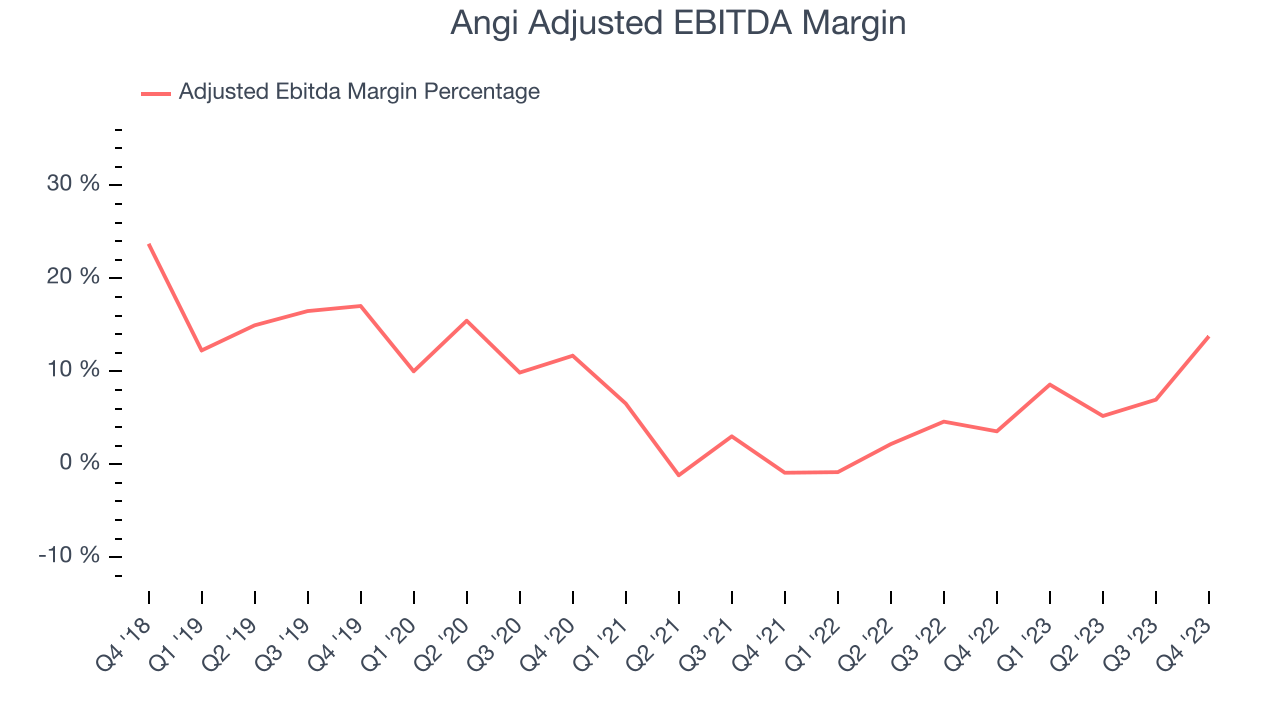

Investors frequently analyze operating income to understand a business's core profitability. Similar to operating income, adjusted EBITDA is the most common profitability metric for consumer internet companies because it removes various one-time or non-cash expenses, offering a more normalized view of a company's profit potential.

Angi's EBITDA was $41.4 million this quarter, translating into a 13.8% margin. The company has also shown above-average profitability for a consumer internet business over the last four quarters, with average EBITDA margins of 8.6%.

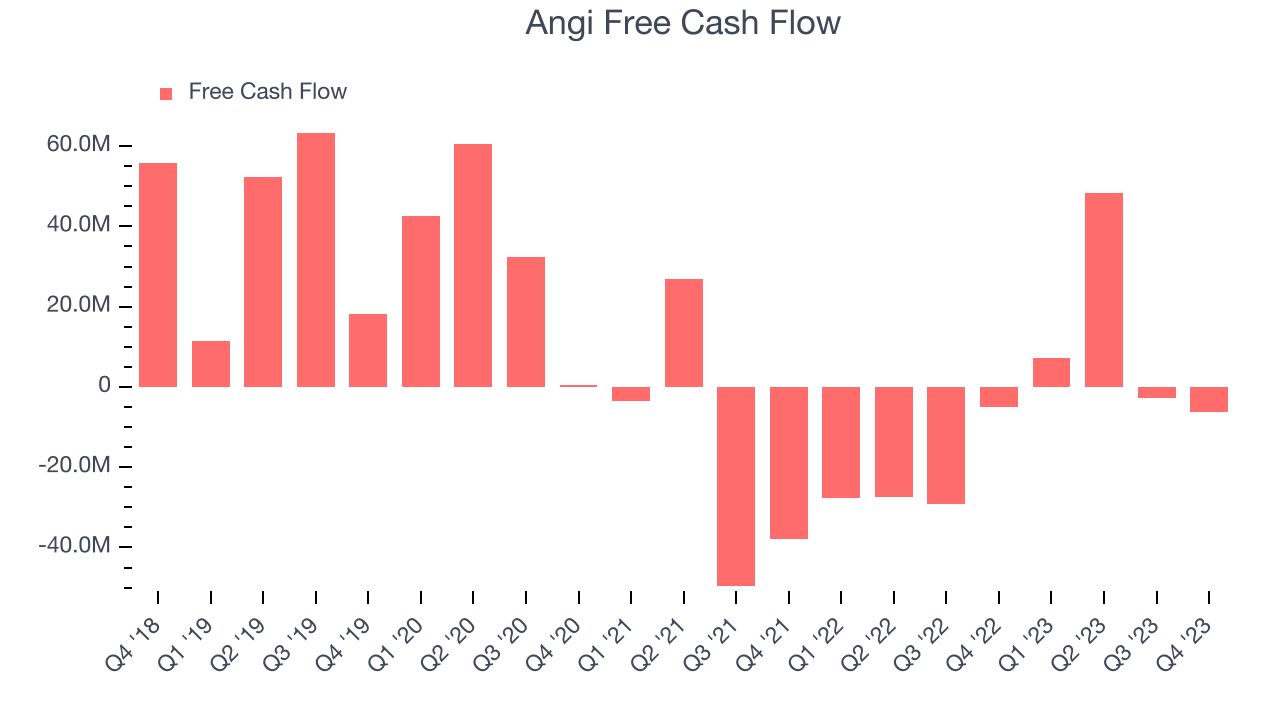

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Angi burned through $6.3 million in Q4,

Angi has generated $46.39 million in free cash flow over the last 12 months, or 3.2% of revenue. This FCF margin stems from its asset-lite business model and enables it to reinvest in its business without depending on the capital markets.

Key Takeaways from Angi's Q4 Results

Although Angi's revenue missed analysts' estimates thanks to lower-than-expected service requests and transacting service professionals, its adjusted EBITDA significantly beat ($41.4 million vs estimates of $28.6 million). Furthermore, its full-year 2024 EBITDA guidance topped Wall Street's projections. Overall, this was a mediocre quarter for Angi from a top-line perspective, but its improved profitability is helping the stock. Angi is up 7% after reporting and currently trades at $2.59 per share.

Is Now The Time?

When considering an investment in Angi, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We cheer for everyone who's making the lives of others easier through technology, but in the case of Angi, we'll be cheering from the sidelines. Its revenue has declined over the last three years, and analysts expect growth to deteriorate from here. And while its impressive gross margins are a wonderful starting point for the overall profitability of the business, the downside is its growth in service requests has been lackluster. On top of that, its sales and marketing spend is very high compared to other consumer internet businesses.

At the moment Angi trades at 10.2x next 12 months EV-to-EBITDA. While we have no doubt one can find things to like about the company, we think there might be better opportunities in the market and at the moment don't see many reasons to get involved.

Wall Street analysts covering the company had a one-year price target of $3.82 per share right before these results (compared to the current share price of $2.59).

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.