Engineering simulation software provider Ansys (NASDAQ:ANSS) fell short of analysts' expectations in Q3 FY2023, with revenue down 2.9% year on year to $458.8 million. Next quarter's outlook also missed expectations with revenue guided to $794.2 million at the midpoint, or 3.56% below analysts' estimates. Turning to EPS, ANSYS made a GAAP profit of $0.64 per share, down from its profit of $1.10 per share in the same quarter last year.

Is now the time to buy ANSYS? Find out by accessing our full research report, it's free.

ANSYS (ANSS) Q3 FY2023 Highlights:

- Revenue: $458.8 million vs analyst estimates of $466.7 million (1.7% miss)

- EPS (non-GAAP): $1.41 vs analyst estimates of $1.27 (11.2% beat)

- Revenue Guidance for Q4 2023 is $794.2 million at the midpoint, below analyst estimates of $823.6 million

- Gross Margin (GAAP): 85.8%, down from 90.5% in the same quarter last year

“Ansys continues to see robust, broad-based demand for our technology and products. We were tracking to deliver on our third quarter guidance commitments when we were notified by the U.S. Department of Commerce of incremental export restrictions and enhanced approval processes for certain products and services. This disrupted our business in the quarter by adding restrictions on sales to certain Chinese entities and elongating the transaction cycle for certain prospects. Despite these developments, Ansys delivered a strong quarter, marked by double-digit growth in ACV. Given the critical role that Ansys solutions play in our customers’ product development initiatives and the strength of the underlying foundation of our business, I am confident in our ability to execute on our short- and long-term objectives," stated Ajei Gopal, Ansys president and CEO.

Used to help design the Mars Rover, Ansys (NASDAQ:ANSS) offers a software-as-a-service platform that enables simulation for engineering and design.

Design Software

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

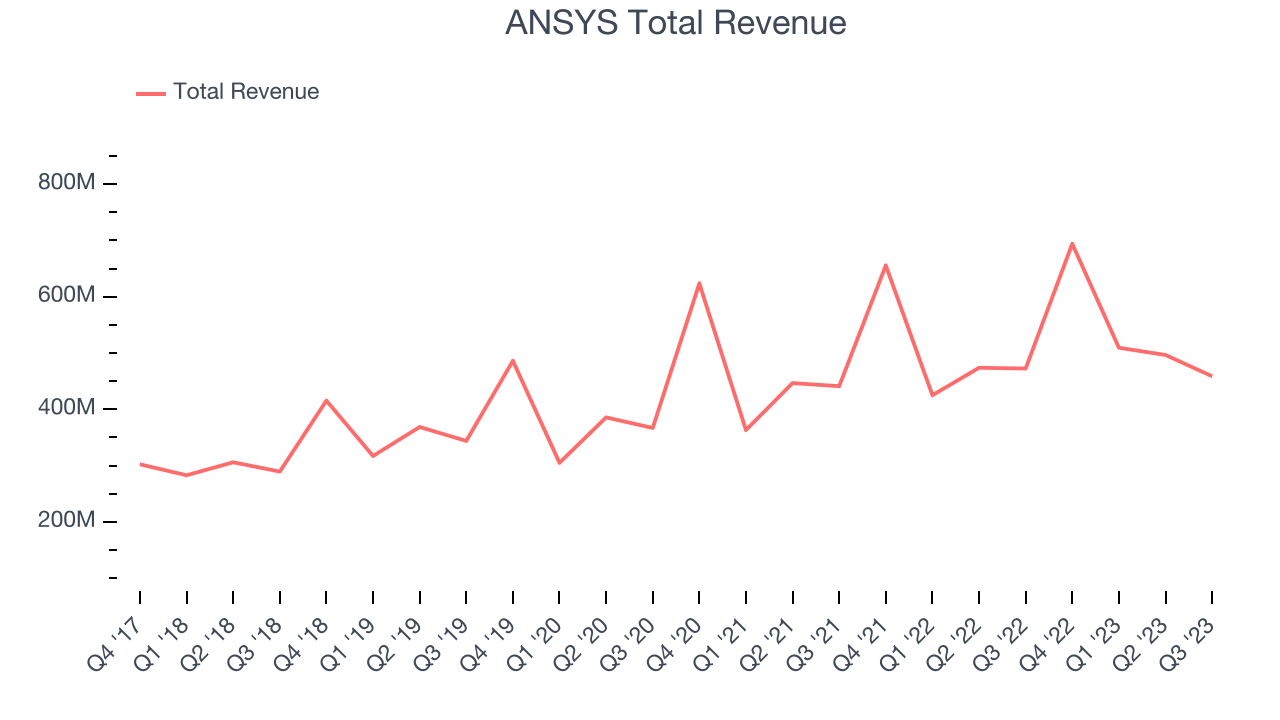

Sales Growth

As you can see below, ANSYS's revenue growth has been unimpressive over the last two years, growing from $441.2 million in Q3 FY2021 to $458.8 million this quarter.

This quarter, ANSYS's revenue was down 2.9% year on year, which might disappointment some shareholders.

Next quarter's guidance suggests that ANSYS is expecting revenue to grow 14.4% year on year to $794.2 million, improving on the 5.86% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 13.4% over the next 12 months before the earnings results announcement.

The pandemic fundamentally changed several consumer habits. There is a founder-led company that is massively benefiting from this shift. The business has grown astonishingly fast, with 40%+ free cash flow margins. Its fundamentals are undoubtedly best-in-class. Still, the total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

Key Takeaways from ANSYS's Q3 Results

With a market capitalization of $24.2 billion and more than $639.5 million in cash on hand, ANSYS can continue prioritizing growth.

Ansys' revenue missed expectations and its revenue guidance for next quarter also missed Wall Street's estimates. Overall, this was a difficult quarter for ANSYS. The company is down 10.2% on the results and currently trades at $249.98 per share.

ANSYS may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned in this report.