Engineering simulation software provider Ansys (NASDAQ:ANSS) reported results ahead of analysts' expectations in Q4 FY2023, with revenue up 16% year on year to $805.1 million. It made a non-GAAP profit of $3.94 per share, improving from its profit of $3.09 per share in the same quarter last year.

ANSYS (ANSS) Q4 FY2023 Highlights:

- Revenue: $805.1 million vs analyst estimates of $795.9 million (1.2% beat)

- EPS (non-GAAP): $3.94 vs analyst estimates of $3.70 (6.5% beat)

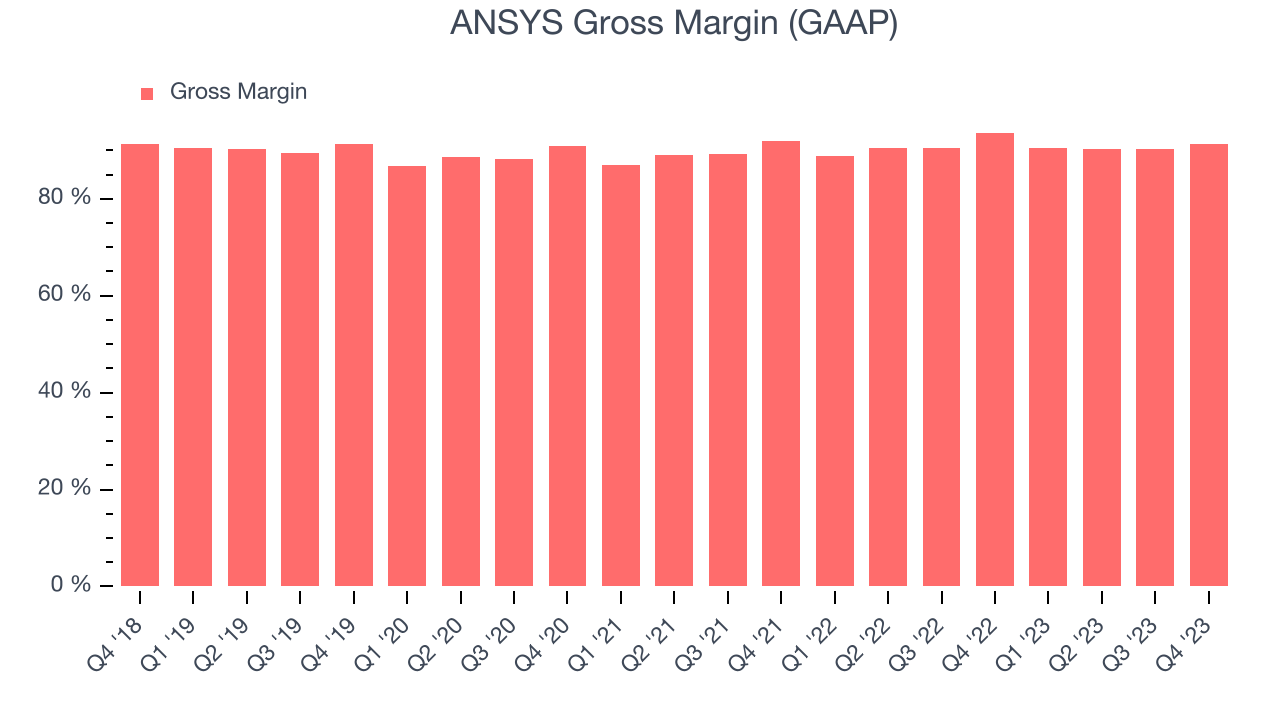

- Gross Margin (GAAP): 91.3%, down from 93.7% in the same quarter last year

- Market Capitalization: $28.85 billion

Used to help design the Mars Rover, Ansys (NASDAQ:ANSS) offers a software-as-a-service platform that enables simulation for engineering and design.

The company’s product suite includes Ansys Fluent for fluid dynamics analysis, Ansys Mechanical for structural assessments, and Ansys Electronics for electromagnetic testing. These products provide engineers with the ability to simulate and analyze complex designs, identify potential issues, and optimize performance before production. Ansys software is also compatible with third-party CAD and product lifecycle management (PLM) tools, making engineers' lives easier because it integrates into their favorite tools.

Product development and design optimization would be an extremely expensive and time-consuming (as well as frustrating) process if manufactured goods could only be tested after production, only to be redesigned and produced again and again. Instead, simulations in different thermal environments or testing the structural integrity of a product can be done using Ansys’ software. This saves resources and time, as designs can be altered over and over before going to final production.

Ansys principally generates revenue by selling seat licenses for its software suite, based on number of users in a customer’s organization. In addition, the company generates a smaller portion of revenue from training, consulting, and support services to ensure that customers succeed with the Ansys software suite.

Design Software

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

Competitors in engineering and design software include Aspen Technology (NASDAQ:AZPN), Cadence Design Systems (NASDAQ:CDNS), and Bentley (NASDAQ:BSY).Sales Growth

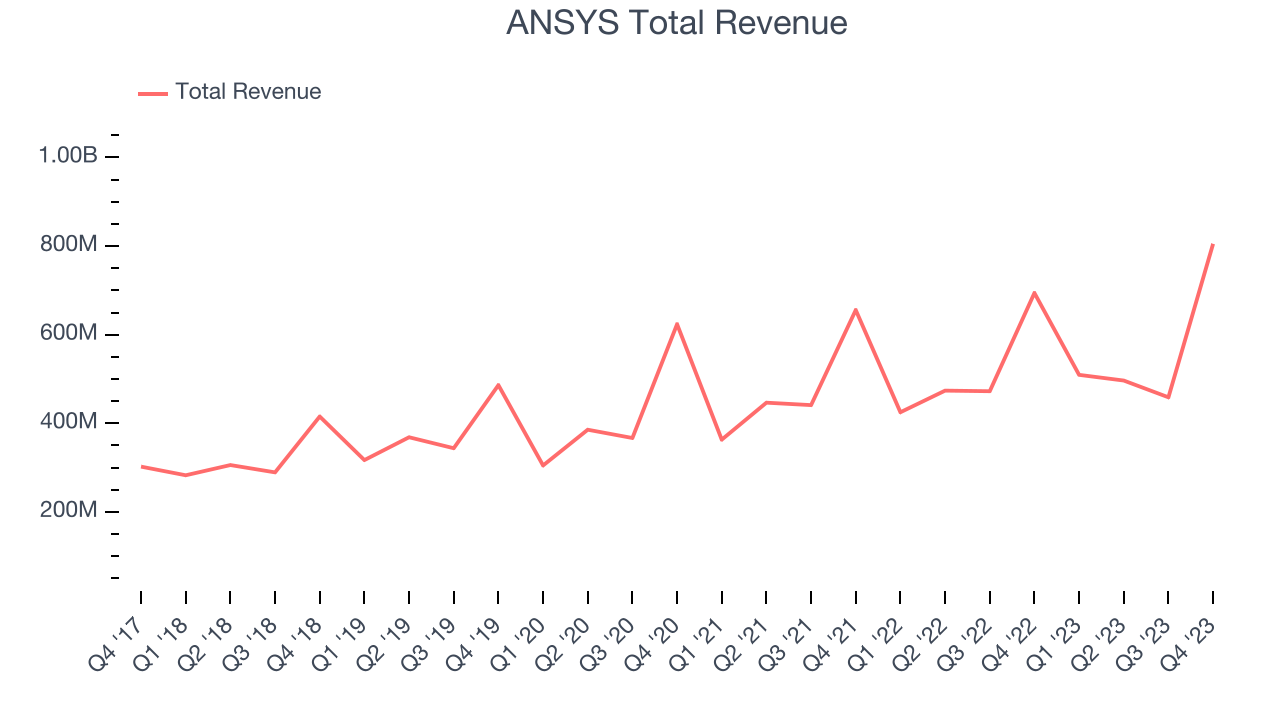

As you can see below, ANSYS's revenue growth has been unremarkable over the last two years, growing from $655.7 million in Q4 FY2021 to $805.1 million this quarter.

This quarter, ANSYS's quarterly revenue was up 16% year on year, above the company's historical trend. On top of that, its revenue increased $346.3 million quarter on quarter, a strong improvement from the $37.8 million decrease in Q3 2023. This is a sign of acceleration of growth and very nice to see indeed.

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. ANSYS's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 91.3% in Q4.

That means that for every $1 in revenue the company had $0.91 left to spend on developing new products, sales and marketing, and general administrative overhead. Significantly up from the last quarter, ANSYS's excellent gross margin allows it to fund large investments in product and sales during periods of rapid growth and achieve profitability when reaching maturity.

Key Takeaways from ANSYS's Q4 Results

It was good to see ANSYS slightly improve its gross margin this quarter. We were also happy its revenue narrowly outperformed Wall Street's estimates. Zooming out, we think this was a decent quarter, showing that the company is staying on target. The stock is up 1.3% after reporting and currently trades at $333.08 per share.

Is Now The Time?

When considering an investment in ANSYS, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

Although we have other favorites, we understand the arguments that ANSYS isn't a bad business. Although its with analysts expecting growth to slow from here, its bountiful generation of free cash flow empowers it to invest in growth initiatives. Investors should still be cautious, however, as its customer acquisition is less efficient than many comparable companies.

ANSYS's price-to-sales ratio based on the next 12 months of 11.6x indicates that the market is definitely optimistic about its growth prospects. In the end, beauty is in the eye of the beholder. While ANSYS wouldn't be our first pick, if you like the business, the shares are trading at a pretty interesting price point right now.

Wall Street analysts covering the company had a one-year price target of $347.37 per share right before these results (compared to the current share price of $333.08).

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.