Recreational products manufacturer American Outdoor Brands (NASDAQ:AOUT) reported Q4 CY2023 results beating Wall Street analysts' expectations, with revenue up 5% year on year to $53.43 million. It made a GAAP loss of $0.23 per share, down from its loss of $0.21 per share in the same quarter last year.

American Outdoor Brands (AOUT) Q4 CY2023 Highlights:

- Revenue: $53.43 million vs analyst estimates of $51.17 million (4.4% beat)

- EPS: -$0.23 vs analyst expectations of -$0.20 (15% miss)

- Gross Margin (GAAP): 42.7%, down from 47.1% in the same quarter last year

- Free Cash Flow of $9.72 million is up from -$8.76 million in the previous quarter

- Market Capitalization: $110.4 million

Spun off from Smith and Wesson in 2020, American Outdoor Brands (NASDAQ:AOUT) is an outdoor and recreational products company that offers firearms and firearm accessories.

The company’s firearms and accessories are used for a range of purposes, including personal carry, recreational sport shooting, and hunting. It also supplies law enforcement and military organizations with firearms and equipment.

American Outdoor’s products includes handguns, shotguns, automatic rifles, bolt-action rifles, knives, optics, and other related accessories under various brands like Smith & Wesson. It also sells camping equipment and sports shooting accessories sought after by recreationally competitive sports shooters.

The company’s primary revenue stream is the sale of firearms and accessories to military organizations, law enforcement, and individual consumers. Military organizations, including the United States Navy and United States Armed Forces, are its largest customers, which are secured via large-scale contracts. Law enforcement and individual consumers are its second and third largest customers. Revenue from the sale of camping accessories and competitive sports shooting equipment make up its other revenue streams.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

Other companies offering firearms and firearm complements include Ruger (NYSE:RGR) and private companies O.F. Mossberg & Sons and the Remington Arms Company.Sales Growth

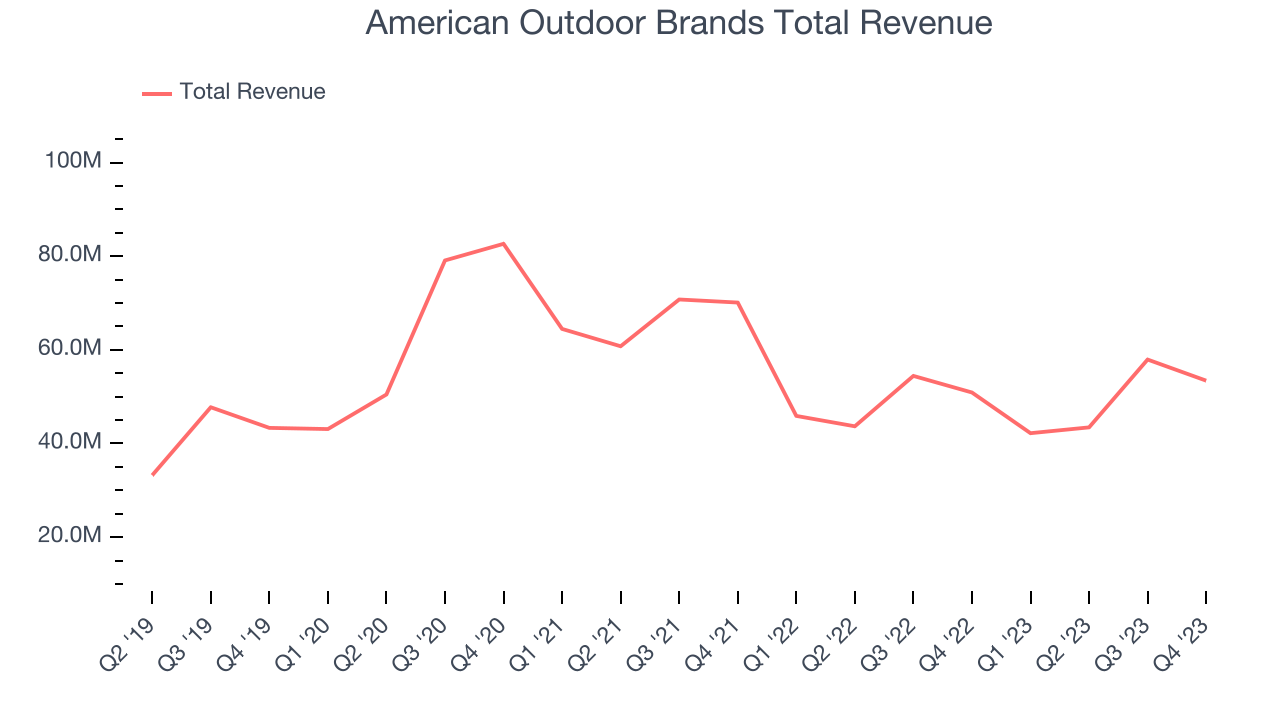

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. American Outdoor Brands's annualized revenue growth rate of 5.6% over the last four years was weak for a consumer discretionary business.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. American Outdoor Brands's recent history shows a reversal from its already weak four-year trend as its revenue has shown annualized declines of 14% over the last two years.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. American Outdoor Brands's recent history shows a reversal from its already weak four-year trend as its revenue has shown annualized declines of 14% over the last two years.

This quarter, American Outdoor Brands reported reasonable year-on-year revenue growth of 5%, and its $53.43 million of revenue topped Wall Street's estimates by 4.4%. Looking ahead, Wall Street expects sales to grow 3.4% over the next 12 months, a deceleration from this quarter.

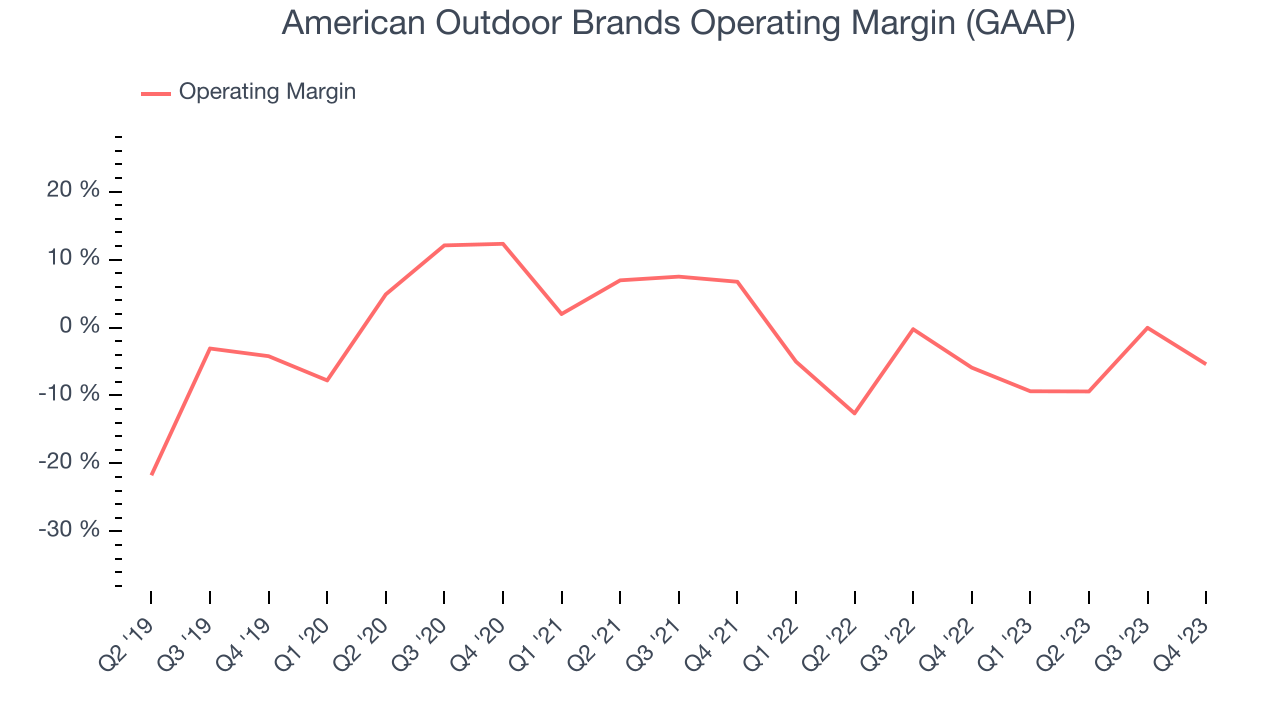

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Given the consumer discretionary industry's volatile demand characteristics, unprofitable companies should be scrutinized. Over the last two years, American Outdoor Brands's high expenses have contributed to an average operating margin of negative 5.6%.

In Q4, American Outdoor Brands generated an operating profit margin of negative 5.4%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

Over the next 12 months, Wall Street expects American Outdoor Brands to become profitable. Analysts are expecting the company’s LTM operating margin of negative 5.6% to rise to positive 4.5%.EPS

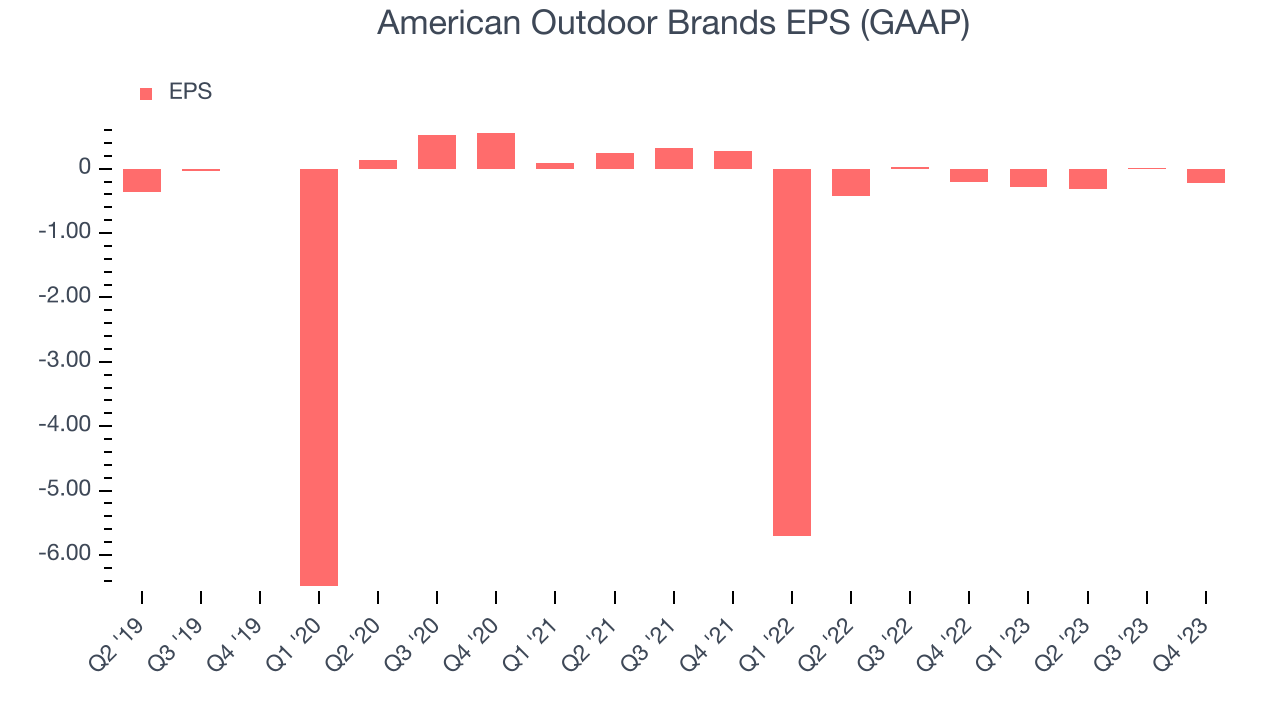

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability and efficiency of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Over the last four years, American Outdoor Brands's EPS dropped 33.8%, translating into 7.6% annualized declines. Thankfully, American Outdoor Brands has bucked its trend as of late, growing its EPS over the last three years. We'll see if the company's growth is sustainable.

In Q4, American Outdoor Brands reported EPS at negative $0.23, down from negative $0.21 in the same quarter a year ago. This print unfortunately missed analysts' estimates. Over the next 12 months, Wall Street expects American Outdoor Brands to improve its earnings losses. Analysts are projecting its LTM EPS of negative $0.83 to advance to negative $0.54.

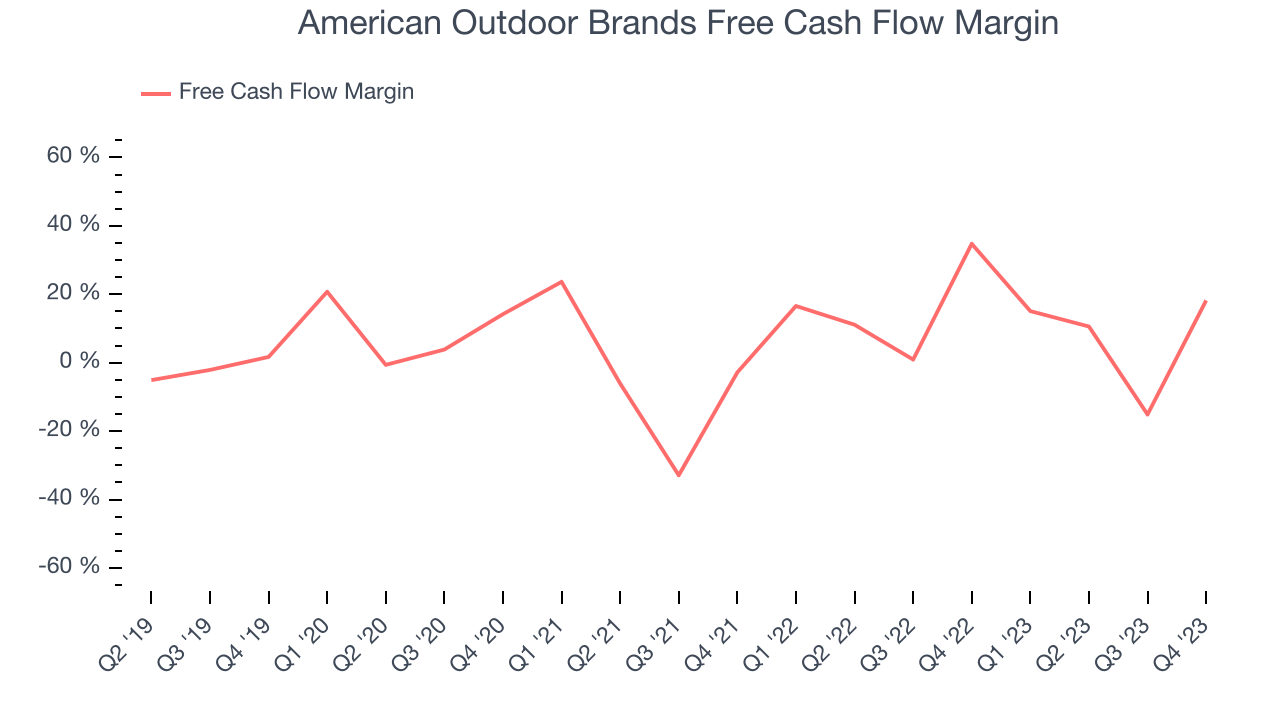

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Over the last two years, American Outdoor Brands has shown decent cash profitability, giving it some reinvestment opportunities. The company's free cash flow margin has averaged 10.9%, slightly better than the broader consumer discretionary sector.

American Outdoor Brands's free cash flow came in at $9.72 million in Q4, equivalent to a 18.2% margin and down 45.1% year on year.

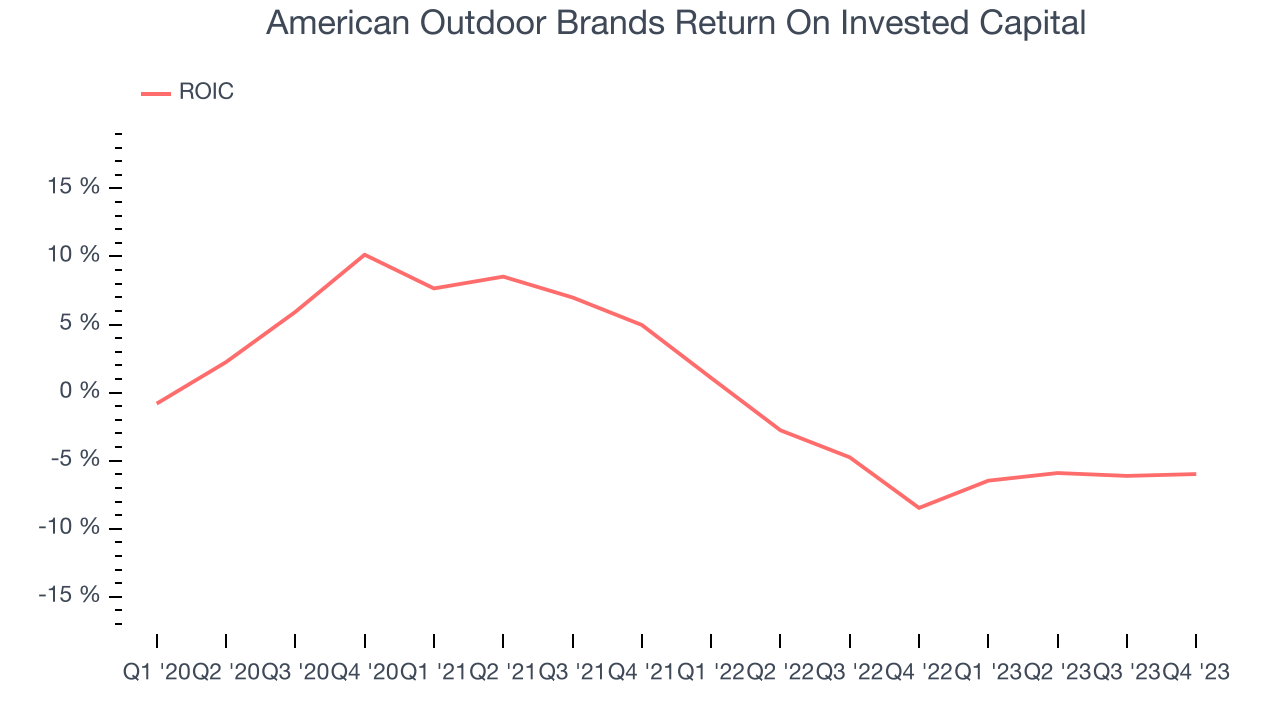

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

American Outdoor Brands's five-year average return on invested capital was 0.2%, somewhat low compared to the best consumer discretionary companies that pump out 25%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, American Outdoor Brands's ROIC averaged 14.8 percentage point decreases over the last few years. Paired with its already low returns, these declines suggest the company's profitable business opportunities are few and far between.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

American Outdoor Brands, which has $15.89 million of cash and $34.95 million of debt on its balance sheet, was unprofitable over the last 12 months. It posted negative $10.77 million of EBITDA, and as investors in high-quality companies, we seek to avoid indebted loss-making companies.

We implore our readers to do the same because credit agencies could downgrade American Outdoor Brands if its unprofitable ways continue, making incremental borrowing more expensive and restricting growth prospects. The company could also be backed into a corner if the market turns unexpectedly. We hope American Outdoor Brands can improve its profitability and remain cautious until then.

Key Takeaways from American Outdoor Brands's Q4 Results

We enjoyed seeing American Outdoor Brands exceed analysts' revenue expectations this quarter. On the other hand, its operating margin missed and its EPS fell short of Wall Street's estimates. Overall, this was a mixed quarter for American Outdoor Brands. The company is down 4.6% on the results and currently trades at $8.21 per share.

Is Now The Time?

American Outdoor Brands may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of American Outdoor Brands, we'll be cheering from the sidelines. Its revenue growth has been uninspiring over the last four years, and analysts expect growth to deteriorate from here. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its declining EPS over the last four years makes it hard to trust. On top of that, its relatively low ROIC suggests it has historically struggled to find compelling business opportunities.

American Outdoor Brands's price-to-earnings ratio based on the next 12 months is 21.0x. While we've no doubt one can find things to like about American Outdoor Brands, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $10.75 per share right before these results (compared to the current share price of $8.21).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.