Communications infrastructure platform Agora (NASDAQ:API) announced better-than-expected results in the Q1 FY2021 quarter, with revenue up 13.1% year on year to $40.2 million. Agora made a GAAP loss of $14.6 million, down on its profit of $2.98 million, in the same quarter last year.

Is now the time to buy Agora? Get early access to our full analysis of the earnings results here

Agora (NASDAQ:API) Q1 FY2021 Highlights:

- Revenue: $40.2 million vs analyst estimates of $36.7 million (9.5% beat)

- EPS (GAAP): -$0.14

- The company reconfirmed revenue guidance for the full year, at $180 million at the midpoint

- Free cash flow was negative -$7.98 million, compared to negative free cash flow of -$1.38 million in previous quarter

- Net Revenue Retention Rate: 131%, down from 179% previous quarter

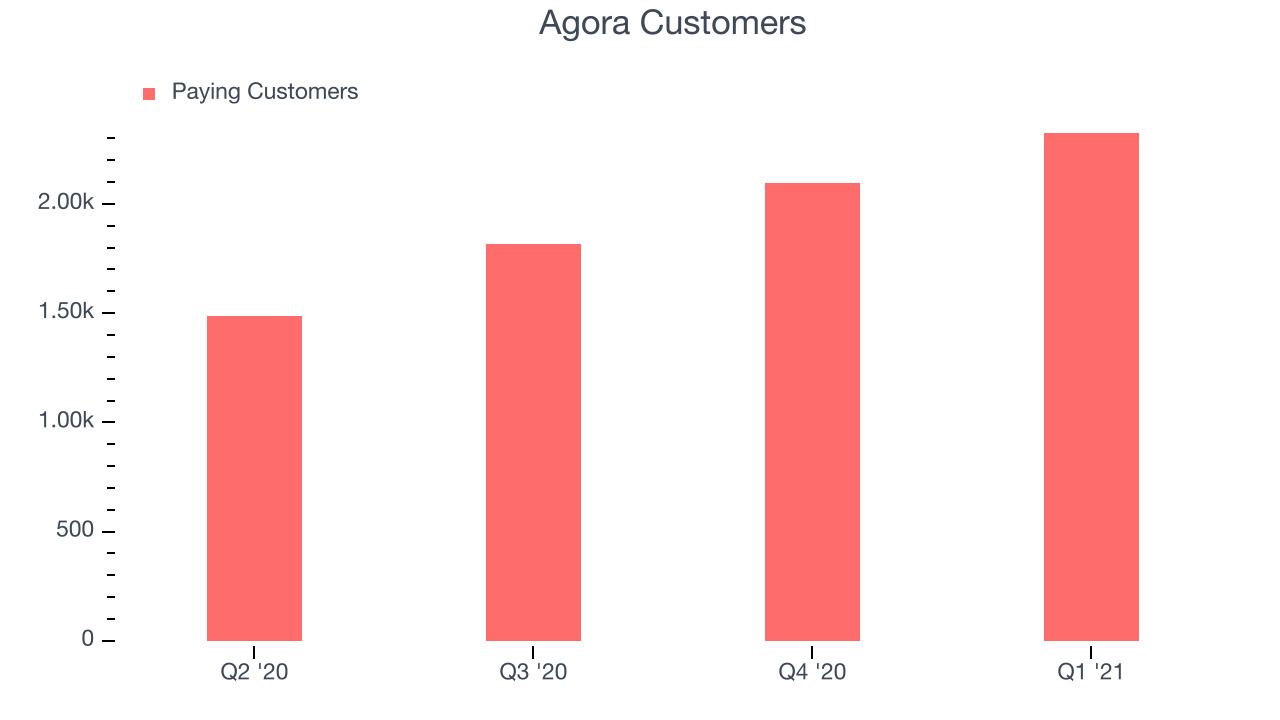

- Customers: 2,324, up from 2,095 in previous quarter

- Gross Margin (GAAP): 58.1%, down from 60.4% previous quarter

- Updated valuation: Agora is down at $39 and now trades at 31.4x price-to-sales (LTM), compared to 30.7x just before the results.

“We opened the year with another quarter of strong growth, as developers and innovators around the world continue to create new immersive experiences with our real time voice, video, chat and streaming APIs, transforming all industries,” said Tony Zhao, founder, chairman and CEO of Agora.

Cloud-based Communications Infrastructure

Founded in 2013 in China, Agora (NASDAQ:API) provides a cloud platform that makes it easy for developers to integrate real-time audio and video functionalities in their apps. For example, the audio-based social network Clubhouse, which took off during the Covid pandemic, was supposedly built on Agora within a week by only a couple of developers.

The demand for audio and video functionality inside apps is growing, and making tools for developers is a good business to be in, as Agora’s competitor Twilio (NYSE:TWLO) would confirm.

As you can see below, Agora's revenue growth has been solid over the last twelve months, growing from $35.5 million to $40.2 million.

This quarter, Agora's quarterly revenue was once again up 13.1% year on year. We can see that the company increased revenue by $6.97 million quarter on quarter. That's a solid improvement on the $2.4 million increase in Q4 2020, so shareholders should appreciate the re-acceleration of growth.

There are others doing even better. Founded by ex-Google engineers, a small company making software for banks has been growing revenue 90% year on year and is already up more than 400% since the IPO in December. You can find it on our platform for free.

Enabling Developers

Agora has made it really easy for developers to adopt its product, and even offers a free plan. Its customers range from educational technology business over to online retailers and social media, a large portion of them based in China.

You can see below that Agora reported 2,324 customers at the end of the quarter, an increase of 229 on last quarter. That is a bit slower customer growth than what we are used to seeing lately, suggesting that the customer acquisition momentum is slowing a little bit.

Key Takeaways from Agora's Q1 Results

With market capitalisation of $4.8 billion Agora is among smaller companies, but its more than $209.4 million in cash and the fact it is operating close to free cash flow break-even put it in a robust financial position to invest in growth.

We were impressed by how strongly Agora outperformed analysts’ revenue expectations this quarter. That feature of these results really stood out as a positive. On the other hand, it the revenue growth has slowed dropped off after the acceleration due to Covid and there was also a slowdown in customer growth. Zooming out, we think this was still a decent, albeit mixed, quarter. Agora seemed like a decent growth stock even before these results, and we'd argue that nothing we've seen today has significantly changed that.

PS. If you found this analysis useful, you will love our earnings alerts! We publish so fast, you often have the opportunity to buy or sell before the market has fully absorbed the information. Never miss out on the right time to invest again. Signup here for free early access.

The author has no position in any of the stocks mentioned.