The end of an earnings season can be a great time to assess how companies are handling the current business environment and discover new stocks. Let’s have a look at how Agora (NASDAQ:API) and the rest of the software development stocks fared in Q2.

Software is eating the world, as Marc Andreessen says, and there is virtually no industry left that has been untouched by it. That in turn drives increasing demand for tools that help software developers do their jobs, whether it is monitoring critical cloud infrastructure, integrating audio and video functionality or ensuring smooth streaming of content.

The 14 software development stocks we track reported a mixed Q2; on average, revenues beat analyst consensus estimates by 3.49%, while on average next quarter revenue guidance was 0.45% above consensus. Tech multiples have reverted to the historical mean after reaching all time levels in early 2021 and software development stocks have not been spared, with share prices down 12% since the previous earnings results, on average.

Agora (NASDAQ:API)

Founded in 2014 by former engineers at WebEx and based in China, Agora (NASDAQ:API) provides a cloud platform that makes it easy for developers to integrate real-time audio and video functionalities in their apps.

Agora reported revenues of $40.9 million, down 3.2% year on year, beating analyst expectations by 1.95%. It was a decent quarter for the company, with accelerating customer growth but declining revenue growth.

"We delivered strong operational results this quarter as our top line returned to a quarter-over-quarter growth trajectory," said Tony Zhao, founder, chairman and CEO of Agora.

The company added 171 customers to a total of 2,877. The stock is down 28.7% since the results and currently trades at $3.38.

Is now the time to buy Agora? Access our full analysis of the earnings results here, it's free.

Best Q2: HashiCorp (NASDAQ:HCP)

Initially created as a research project at the University of Washington, HashiCorp (NASDAQ:HCP) provides software that helps companies operate their own applications in a multi-cloud environment.

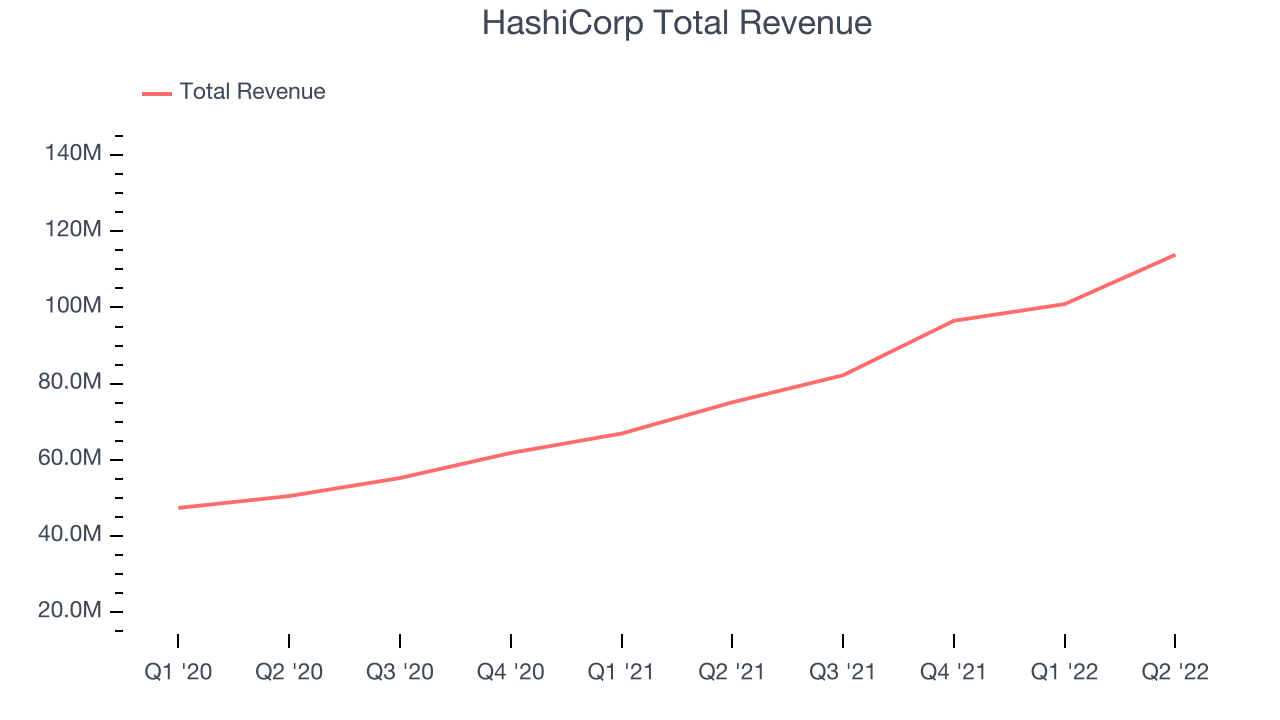

HashiCorp reported revenues of $113.8 million, up 51.5% year on year, beating analyst expectations by 11.2%. It was a stunning quarter for the company, with an impressive beat of analyst estimates and an exceptional revenue growth.

HashiCorp pulled off the strongest analyst estimates beat and highest full year guidance raise among its peers. The company added 30 enterprise customers paying more than $100,000 annually to a total of 734. The stock is up 3.1% since the results and currently trades at $31.19.

Is now the time to buy HashiCorp? Access our full analysis of the earnings results here, it's free.

Dynatrace (NYSE:DT)

Founded in Austria in 2005, Dynatrace (NYSE:DT) provides companies with software that allows them to monitor the performance of their full technology stack, from software applications to the infrastructure they run on.

Dynatrace reported revenues of $267.2 million, up 27.4% year on year, beating analyst expectations by 2.07%. It was a weak quarter for the company, with revenue guidance for both the next quarter and the full year missing analysts' expectations.

Dynatrace had the weakest full year guidance update in the group. The stock is down 9% since the results and currently trades at $34.86.

Read our full analysis of Dynatrace's results here.

PagerDuty (NYSE:PD)

Started by three former Amazon engineers, PagerDuty (NYSE:PD) is a software as a service platform that helps companies respond to IT incidents fast and make sure that any downtime is minimized.

PagerDuty reported revenues of $90.2 million, up 33.6% year on year, beating analyst expectations by 2.3%. It was a mixed quarter for the company, with a strong top line growth but a decline in gross margin.

The company added 134 customers to a total of 15,174. The stock is down 0.74% since the results and currently trades at $24.00.

Read our full, actionable report on PagerDuty here, it's free.

Cloudflare (NYSE:NET)

Founded by two grad students of Harvard Business School, Cloudflare (NYSE:NET) is a software as a service platform that helps improve security, reliability and loading times of internet applications and websites.

Cloudflare reported revenues of $234.5 million, up 53.8% year on year, beating analyst expectations by 3.08%. It was a solid quarter for the company, with an exceptional revenue growth.

The stock is down 6.96% since the results and currently trades at $54.36.

Read our full, actionable report on Cloudflare here, it's free.

The author has no position in any of the stocks mentioned