Mobile app advertising platform AppLovin (NASDAQ: APP) announced better-than-expected results in Q1 CY2024, with revenue up 47.9% year on year to $1.06 billion. It made a GAAP profit of $0.67 per share, improving from its loss of $0.01 per share in the same quarter last year.

Is now the time to buy AppLovin? Find out by accessing our full research report, it's free.

AppLovin (APP) Q1 CY2024 Highlights:

- Revenue: $1.06 billion vs analyst estimates of $974.7 million (8.6% beat)

- Adjusted EBITDA: $549 million vs analyst estimates of $497 million (10.5% beat)

- EPS: $0.67 vs analyst estimates of $0.55 (21.5% beat)

- Q2 CY2024 revenue guidance of $1.07 billion at the midpoint vs analyst estimates of $1.00 billion (6.2% beat)

- Q2 CY2024 adjusted EBITDA guidance of $560 million at the midpoint vs analyst estimates of $522 million (7.2% beat)

- Gross Margin (GAAP): 72.2%, up from 63.4% in the same quarter last year

- Free Cash Flow of $392.8 million, up 14.3% from the previous quarter

- Market Capitalization: $25.4 billion

Co-founded by Adam Foroughi, who was frustrated with not being able to find a good solution to market his own dating app, AppLovin (NASDAQ:APP) is both a mobile game studio and provider of marketing and monetization tools for mobile app developers.

Advertising Software

The digital advertising market is large, growing, and becoming more diverse, both in terms of audiences and media. As a result, there is a growing need for software that enables advertisers to use data to automate and optimize ad placements.

Sales Growth

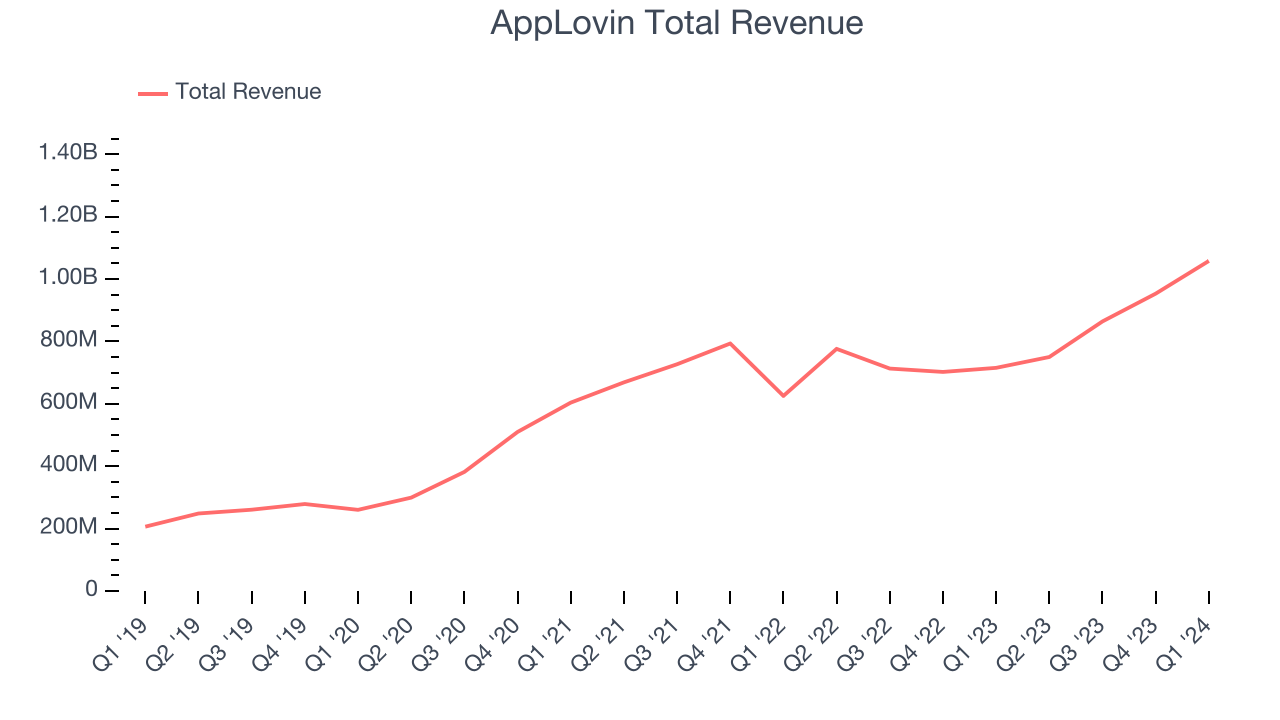

As you can see below, AppLovin's revenue growth has been strong over the last three years, growing from $603.9 million in Q1 2021 to $1.06 billion this quarter.

This was a standout quarter for AppLovin with quarterly revenue up 47.9% year on year, above the company's historical trend. On top of that, its revenue increased $104.9 million quarter on quarter, a solid improvement from the $89.01 million increase in Q4 CY2023. This is a sign of slight acceleration of growth.

Looking ahead, analysts covering the company were expecting sales to grow 15.8% over the next 12 months before the earnings results announcement.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Cash Is King

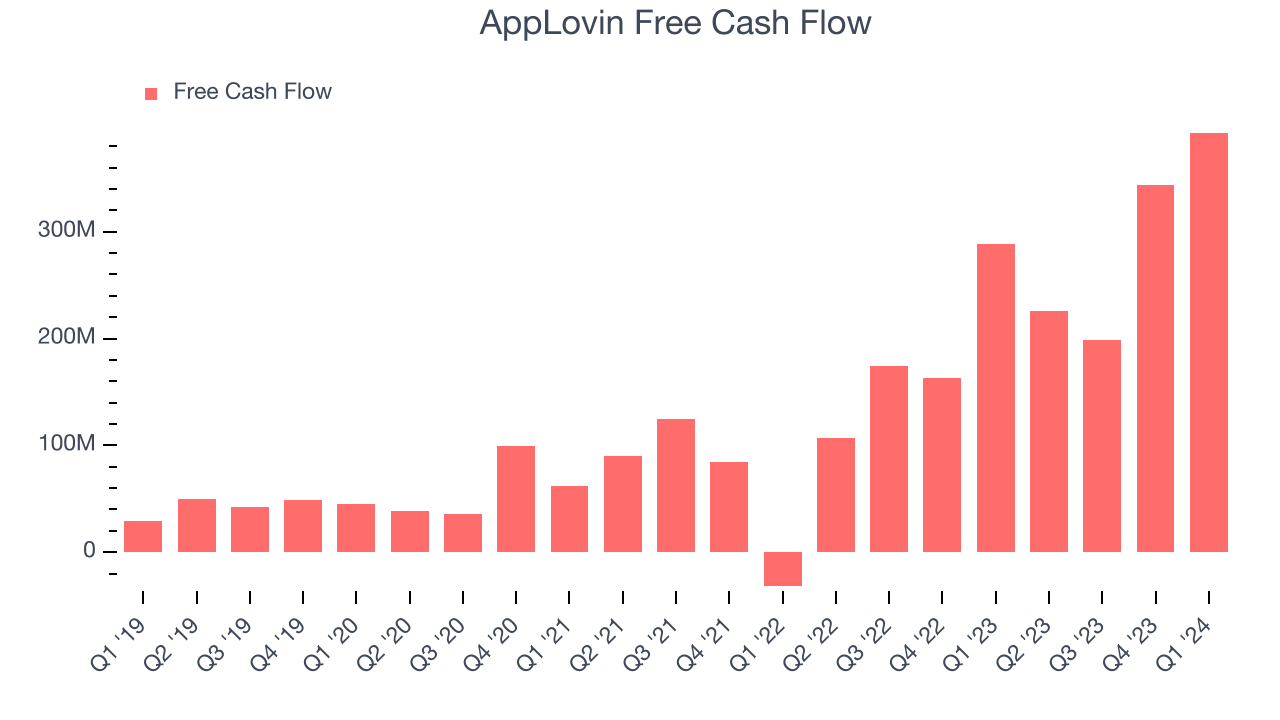

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. AppLovin's free cash flow came in at $392.8 million in Q1, up 36.1% year on year.

AppLovin has generated $1.16 billion in free cash flow over the last 12 months, an eye-popping 32% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Key Takeaways from AppLovin's Q1 Results

We were impressed by how strongly AppLovin blew past analysts' revenue and adjusted EBITDA expectations this quarter. We were also impressed that its revenue and adjusted EBITDA guidance for next quarter both exceeded expectations by a convincing amount. Zooming out, we think this was a great quarter that shareholders will appreciate. The stock is up 10.7% after reporting and currently trades at $82 per share.

AppLovin may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.