Mobile app advertising platform AppLovin (NASDAQ: APP) reported results ahead of analysts' expectations in Q4 FY2023, with revenue up 35.7% year on year to $953.3 million. It made a GAAP profit of $0.49 per share, improving from its profit of $0.25 per share in the same quarter last year.

Is now the time to buy AppLovin? Find out by accessing our full research report, it's free.

AppLovin (APP) Q4 FY2023 Highlights:

- Revenue: $953.3 million vs analyst estimates of $928 million (2.7% beat)

- EPS: $0.49 vs analyst estimates of $0.35 (39.3% beat)

- Q1 2024 revenue guidance of $965 million at the midpoint vs analyst estimates of $926 million (4.2% beat)

- Q1 2024 adjusted EBITDA guidance of $485 million at the midpoint vs analyst estimates of $437 million (11.1% beat)

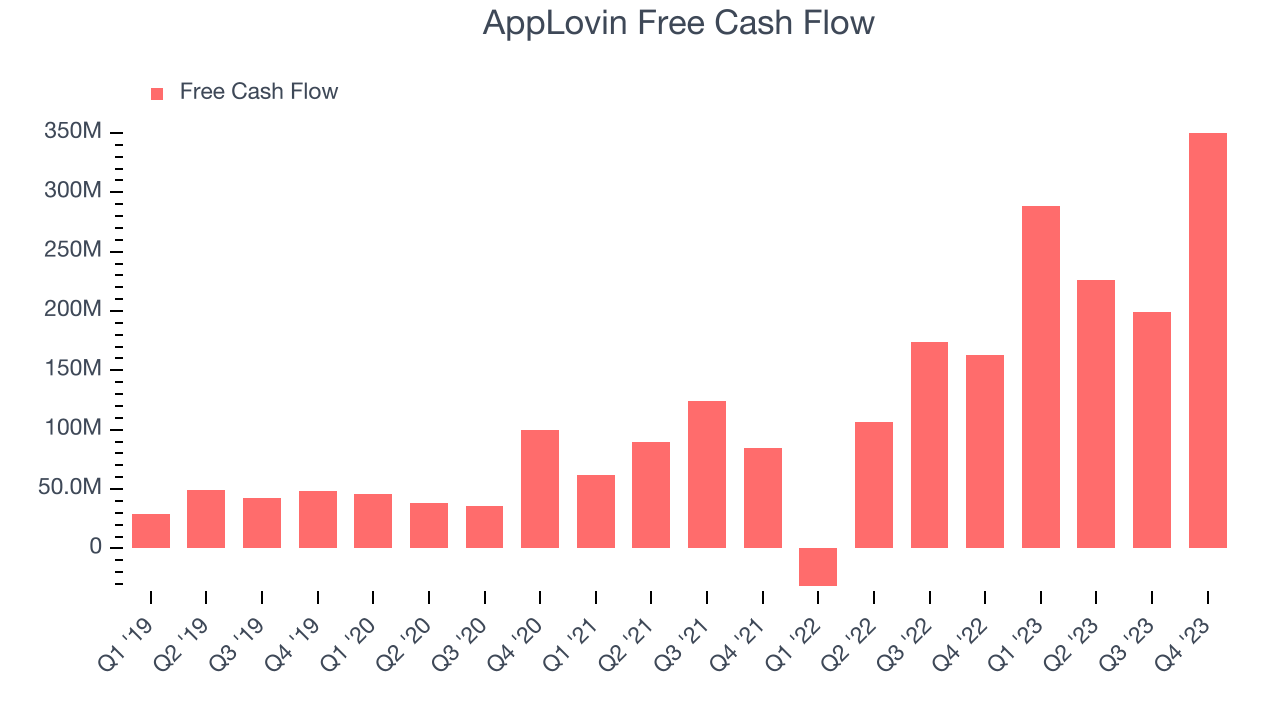

- Free Cash Flow of $350.3 million, up 76.1% from the previous quarter

- Gross Margin (GAAP): 71.3%, up from 55% in the same quarter last year

- Market Capitalization: $15.39 billion

Co-founded by Adam Foroughi, who was frustrated with not being able to find a good solution to market his own dating app, AppLovin (NASDAQ:APP) is both a mobile game studio and provider of marketing and monetization tools for mobile app developers.

Advertising Software

The digital advertising market is large, growing, and becoming more diverse, both in terms of audiences and media. As a result, there is a growing need for software that enables advertisers to use data to automate and optimize ad placements.

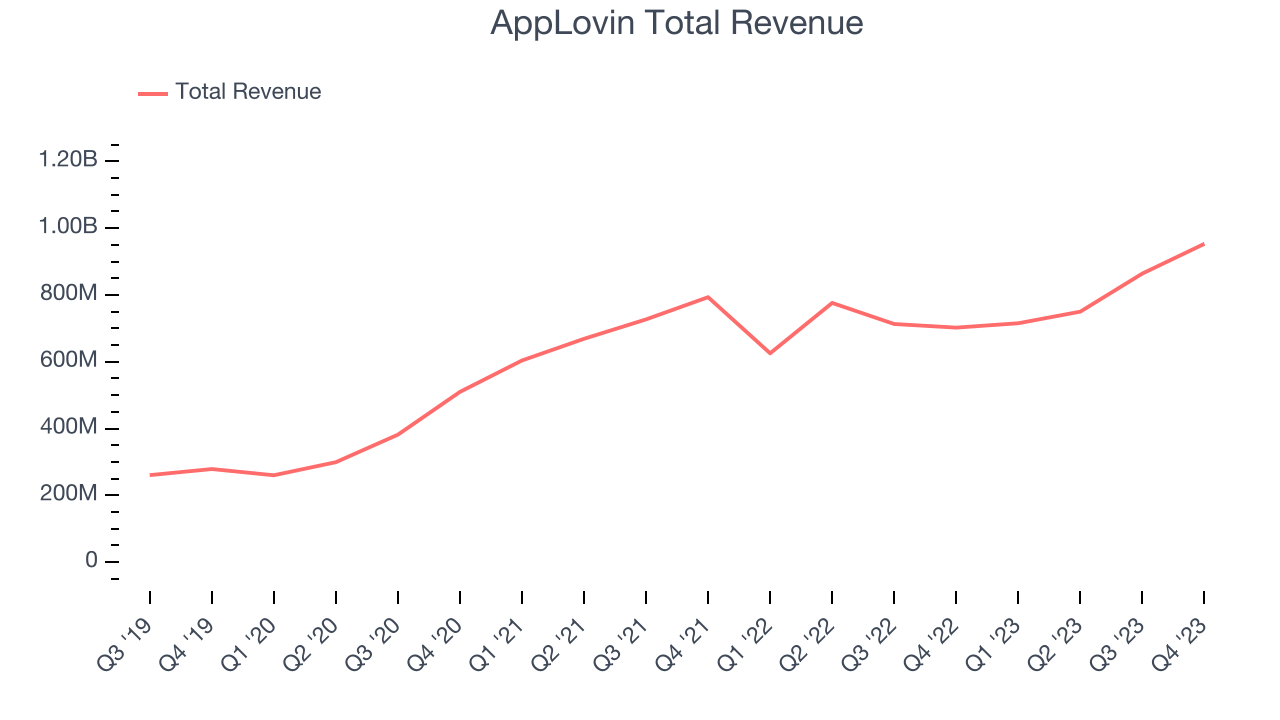

Sales Growth

As you can see below, AppLovin's revenue growth has been unremarkable over the last two years, growing from $793.5 million in Q4 FY2021 to $953.3 million this quarter.

This was a standout quarter for AppLovin with quarterly revenue up 35.7% year on year, above the company's historical trend. However, its growth did slow down compared to last quarter as the company's revenue increased by just $89.01 million in Q4 compared to $114.1 million in Q3 2023. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. AppLovin's free cash flow came in at $350.3 million in Q4, up 115% year on year.

AppLovin has generated $1.06 billion in free cash flow over the last 12 months, an eye-popping 32.6% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Key Takeaways from AppLovin's Q4 Results

It was great to see AppLovin beat and guide above expectations. Revenue and adjusted EBITDA beat. Guidance for Q1 2024 revenue and adjusted EBITDA were both convincingly ahead as well. Overall, we think this was a really good quarter that should please shareholders. The stock is up 13% after reporting and currently trades at $53 per share.

AppLovin may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.