Mobile app advertising platform AppLovin (NASDAQ: APP) beat analysts' expectations in Q1 CY2024, with revenue up 47.9% year on year to $1.06 billion. It made a GAAP profit of $0.67 per share, improving from its loss of $0.01 per share in the same quarter last year.

AppLovin (APP) Q1 CY2024 Highlights:

- Revenue: $1.06 billion vs analyst estimates of $974.7 million (8.6% beat)

- Adjusted EBITDA: $549 million vs analyst estimates of $497 million (10.5% beat)

- EPS: $0.67 vs analyst estimates of $0.55 (21.5% beat)

- Q2 CY2024 revenue guidance of $1.07 billion at the midpoint vs analyst estimates of $1.00 billion (6.2% beat)

- Q2 CY2024 adjusted EBITDA guidance of $560 million at the midpoint vs analyst estimates of $522 million (7.2% beat)

- Gross Margin (GAAP): 72.2%, up from 63.4% in the same quarter last year

- Free Cash Flow of $392.8 million, up 14.3% from the previous quarter

- Market Capitalization: $25.4 billion

Co-founded by Adam Foroughi, who was frustrated with not being able to find a good solution to market his own dating app, AppLovin (NASDAQ:APP) is both a mobile game studio and provider of marketing and monetization tools for mobile app developers.

AppLovin combines a mobile ad network, developer tools, and a portfolio of hundreds of free to play mobile games it has assembled through acquisitions and partnerships with game studios.

Today’s app developer journey has three key steps – make, market, and monetize. The ‘make’ step has never been easier, but developers still face key challenges in marketing and monetizing their apps. Because of the ease of creation, there are millions of apps on Apple and Google’s appstores, which creates discovery and marketing challenge for mobile app developers. A further issue is even after a user downloads an app, developers must compete for user engagement and screen time. Most mobile games rely on in-app purchases (IAPs) and in-game advertising for monetization, which present hurdles on how to price IAPs appropriately while navigating the mobile ad ecosystem is difficult for individual developers.

AppLovin solves for these issues through its unique business model. Originally a provider of marketing tools for mobile game developers, AppLovin altered its strategy in 2018 and began acquiring and partnering with game studios to launch its own mobile gaming apps. The data and insights generated from the hundreds of in-house mobile gaming apps generated a virtuous cycle which improved its marketing software’s pricing and advertising recommendations for its customers, enabling developers to improve their discovery, monetization, and engagement.

Advertising Software

The digital advertising market is large, growing, and becoming more diverse, both in terms of audiences and media. As a result, there is a growing need for software that enables advertisers to use data to automate and optimize ad placements.

AppLovin’s competitors can be broken into two groups: mobile game developers and mobile ad networks. On the gaming side, rivals include Zynga (NASDAQ:ZNGA), Playtika (NASDAQ: PLTK), and Roblox (NYSE: RBLX). Competitors in its ad network business are The Trade Desk (NASDAQ: TTD) and Unity Software (NYSE:U).

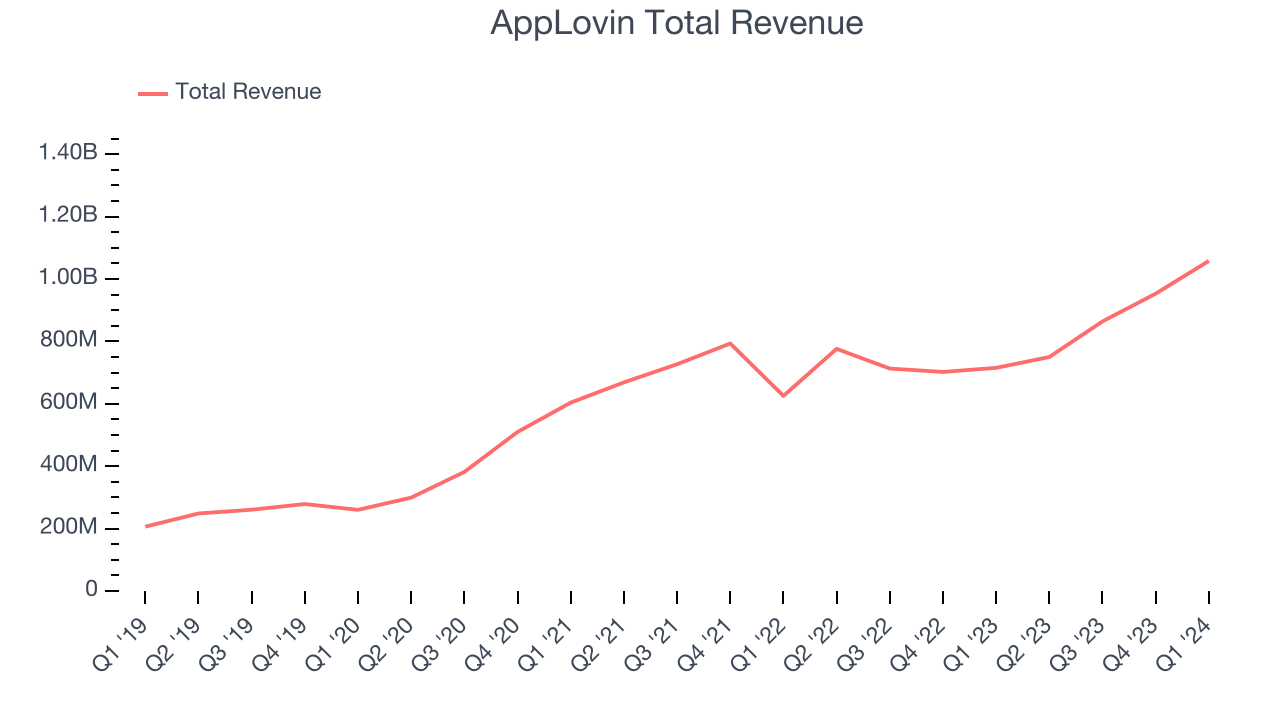

Sales Growth

As you can see below, AppLovin's revenue growth has been strong over the last three years, growing from $603.9 million in Q1 2021 to $1.06 billion this quarter.

This was a standout quarter for AppLovin with quarterly revenue up 47.9% year on year, above the company's historical trend. On top of that, its revenue increased $104.9 million quarter on quarter, a solid improvement from the $89.01 million increase in Q4 CY2023. This is a sign of slight acceleration of growth.

Looking ahead, analysts covering the company were expecting sales to grow 15.8% over the next 12 months before the earnings results announcement.

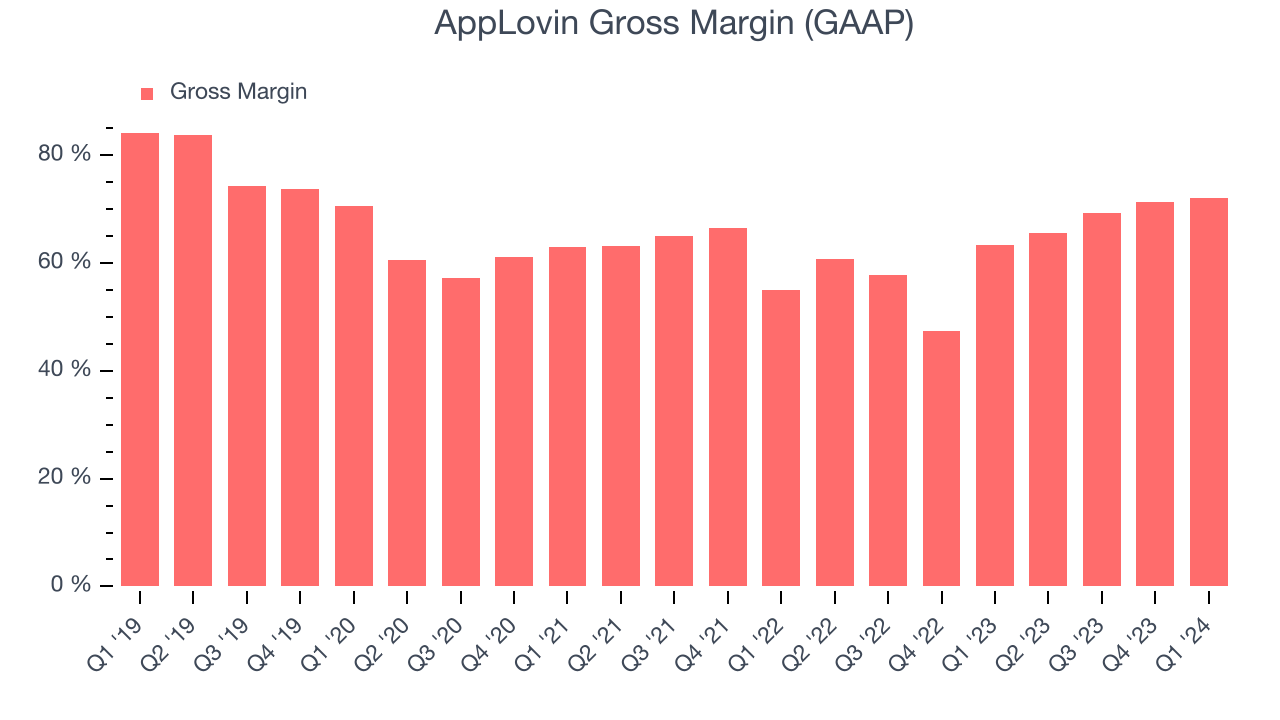

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. AppLovin's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 72.2% in Q1.

That means that for every $1 in revenue the company had $0.72 left to spend on developing new products, sales and marketing, and general administrative overhead. Despite improving significantly since the last quarter, AppLovin's gross margin is still lower than that of a typical SaaS businesses. Gross margin has a major impact on a company’s ability to develop new products and invest in marketing, which may ultimately determine the winner in a competitive market. This makes it a critical metric to track for the long-term investor.

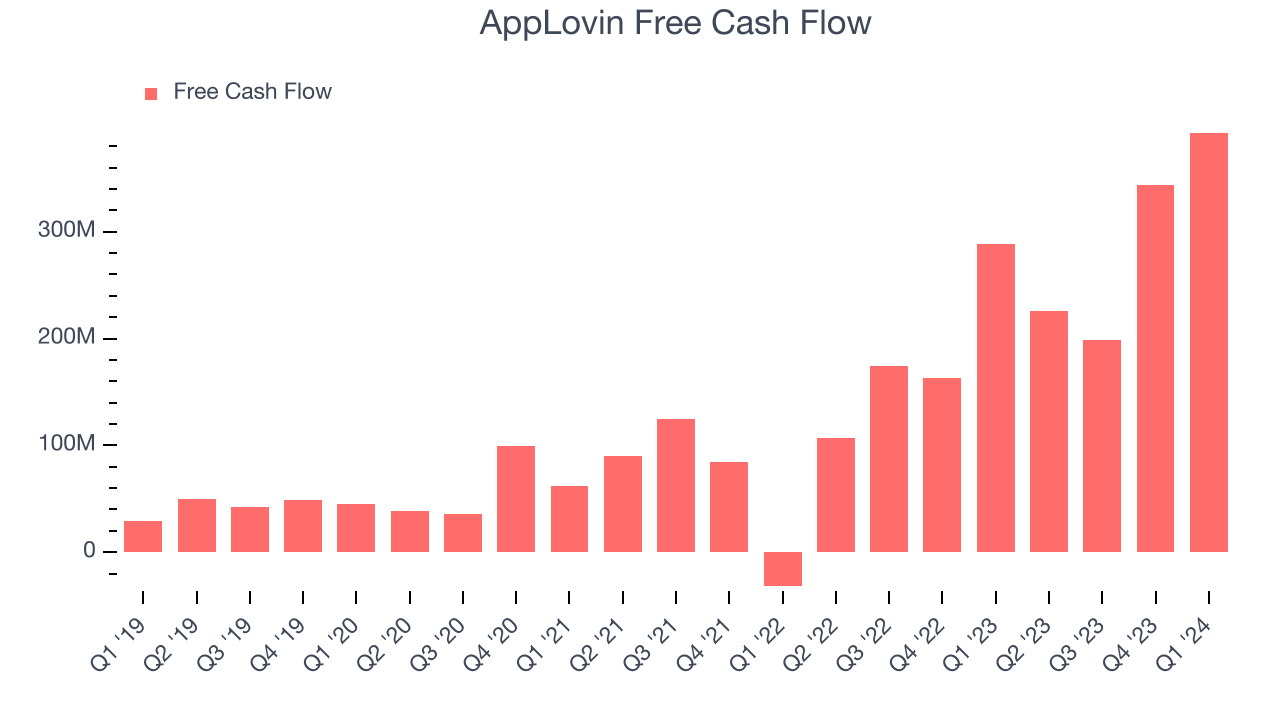

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. AppLovin's free cash flow came in at $392.8 million in Q1, up 36.1% year on year.

AppLovin has generated $1.16 billion in free cash flow over the last 12 months, an eye-popping 32% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Key Takeaways from AppLovin's Q1 Results

We were impressed by how strongly AppLovin blew past analysts' revenue and adjusted EBITDA expectations this quarter. We were also impressed that its revenue and adjusted EBITDA guidance for next quarter both exceeded expectations by a convincing amount. Zooming out, we think this was a great quarter that shareholders will appreciate. The stock is up 10.7% after reporting and currently trades at $82 per share.

Is Now The Time?

When considering an investment in AppLovin, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We think AppLovin is a good business. We'd expect growth rates to moderate from here, but its revenue growth has been strong over the last three years. On top of that, its bountiful generation of free cash flow empowers it to invest in growth initiatives and its efficient customer acquisition hints at the potential for strong profitability.

Given its price-to-sales ratio of 6.2x based on the next 12 months, the market is certainly expecting long-term growth from AppLovin. There are definitely a lot of things to like about AppLovin, and looking at the tech landscape right now, it seems to be trading at a reasonable price.

Wall Street analysts covering the company had a one-year price target of $74.68 right before these results (compared to the current share price of $82.97).

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.