Low code software development platform provider Appian (Nasdaq: APPN) reported Q1 FY2021 results that beat analyst expectations, with revenue up 12.6% year on year to $88.8 million. Appian made a GAAP loss of $13.5 million, down on it's loss of $11.6 million, in the same quarter last year.

Get access to the fastest analysis of earnings results on the market. Get investing superpowers with StockStory. Signup here for early access.

Appian (NASDAQ:APPN) Q1 FY2021 Highlights:

- Revenue: $88.8 million vs analyst estimates of $82.7 million (7.43% beat)

- EPS (non-GAAP): -$0.06 vs analyst estimates of -$0.14

- Revenue guidance for Q2 2021 is $77.5 million at the midpoint, below analyst estimates of $83.7 million

- The company reconfirmed revenue guidance for the full year, at $354 million at the midpoint

- Net Revenue Retention Rate: 118%, in line with previous quarter

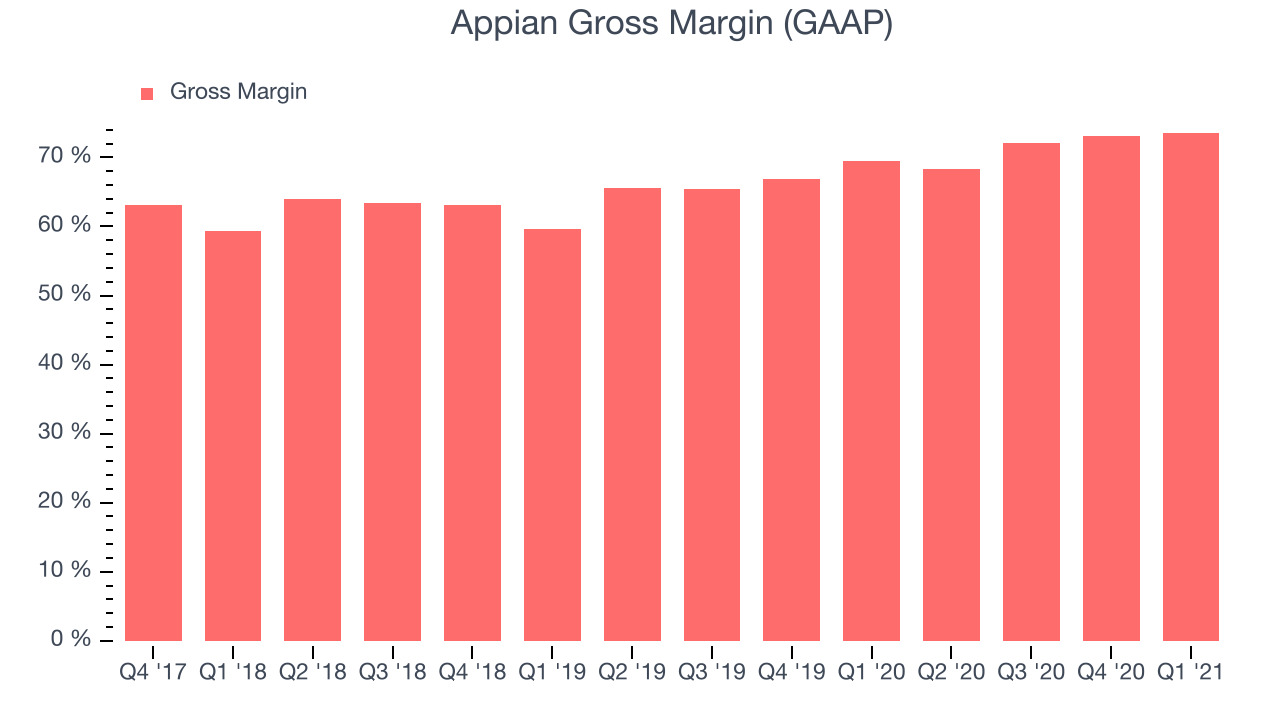

- Gross Margin (GAAP): 73.5%, in line with previous quarter

Once again, we exceeded our guidance, grew cloud subscription revenue by 38%, and set a new high mark for gross profit margin. Appian leads in unifying the Low-code Automation market and providing agility to our customers,” said Matt Calkins, CEO & Founder.

The Early Days Of Business Process Automation

Appian was founded in 1999 by four young friends, including long-serving CEO Matt Calkins who quit his job before settling on a business plan. It wasn't until a few years later that the company began to focus on business process management, helping companies become more efficient. Today, Appian can potentially allow any employee to develop the specific custom software that their business needs.

Appian sells a software platform that lets its users build applications without using much code, allowing them to create new software more quickly. By empowering existing teams within specialist organisations, Appian lets its diverse customers, from banks to wind farms, build the exact software they need. This might mean creating new interfaces for tellers, or building a process for acquiring and managing wind farm insurance. By making software development easier with pre-existing segments of code, Appian's customers can build and deploy new functionality far more quickly, and potentially at lower cost, than if they had to hire more team members to build it without Appian.

If we view automation as an inescapable mega-trend, then Appian may well be of interest. The more companies compete to automate their processes with new applications, the more they will need low code platforms like Appian to build faster. That means we'd expect Appian's revenue to grow. However, it's important to keep in mind that Appian has both recurring subscription revenue and professional services revenue, which may be more variable.

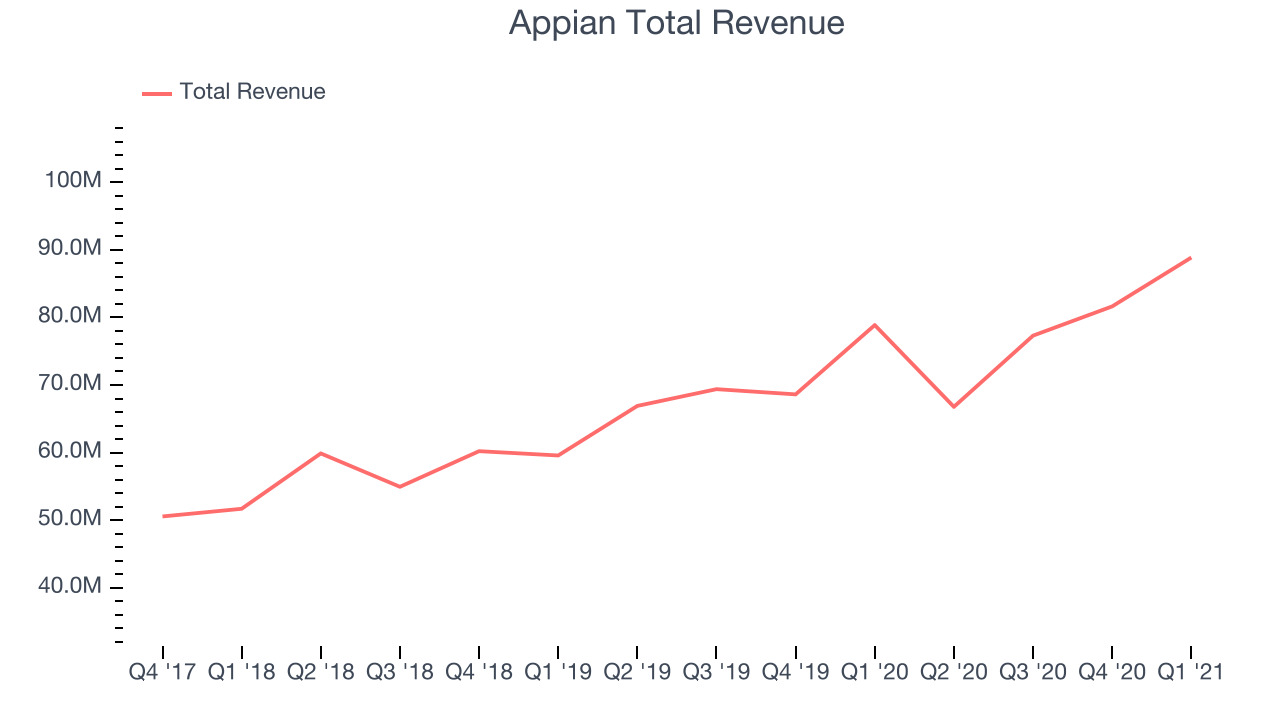

As you can see below, Appian's revenue growth has been solid over the last twelve months, growing from $78.8 million to $88.8 million.

This quarter, Appian's quarterly revenue was once again up 12.6% year on year. We can see that the company increased revenue by $7.22 million quarter on quarter. That's a solid improvement on the $4.32 million increase in Q4 2020, so shareholders should appreciate the acceleration of growth.

Improving Economics

Generally speaking, subscription services like Appian's low code platform can be very profitable because once they are build, it doesn't take much cost to provide the service to increasing numbers of customers. On the other hand, the company's professional services revenue is less profitable, because it is in a sense simply hiring out experts who work for Appian. As subscription revenue increases, we'd expect to see Appian's margins improve.

Appian's gross profit margin, an important metric measuring how much money there is left after paying for servers, licences, technical support and other necessary running expenses was at 73.5% in Q1. That means that for every $1 in revenue the company had $0.73 left to spend on developing new products, marketing & sales and the general administrative overhead. Trending up over the last year this is around the average what we typically see in SaaS businesses. Gross margin has a major impact on a company’s ability to invest in developing new products and sales & marketing, which may ultimately determine the winner in a competitive market, so it is important to track.

Key Takeaways from Appian's Q1 Results

With market capitalisation of $7.24 billion and more than $232.7 million in cash, the company has the capacity to continue to prioritise growth.

We were impressed by how strongly Appian outperformed analysts’ revenue expectations this quarter. That feature of these results really stood out as a positive. On the other hand, it was disappointing to see that the revenue guidance for the next quarter missed analysts' expectations. Zooming out, we think this was a mixed quarter. While Appian is worth watching, these results didn't make us much more excited about the company.

Get access to insights until now only reserved for the top hedge funds. Discover great tech investments the market is overlooking. Get investing superpowers with StockStory. Signup here for early access.

The author has no position in any of the stocks mentioned.