Low code software development platform provider Appian (Nasdaq: APPN) beat analyst expectations in Q3 FY2021 quarter, with revenue up 19.5% year on year to $92.4 million. Guidance for next quarter's revenue was $95.2 million at the midpoint, which is 1.16% above the analyst consensus. Appian made a GAAP loss of $25.3 million, down on its loss of $3.61 million, in the same quarter last year.

Is now the time to buy Appian? Access our full analysis of the earnings results here, it's free.

Appian (APPN) Q3 FY2021 Highlights:

- Revenue: $92.4 million vs analyst estimates of $91 million (1.49% beat)

- EPS (non-GAAP): -$0.22 vs analyst estimates of -$0.19

- Revenue guidance for Q4 2021 is $95.2 million at the midpoint, above analyst estimates of $94.1 million

- Free cash flow was negative $26.5 million, compared to negative free cash flow of -$7.13 million in previous quarter

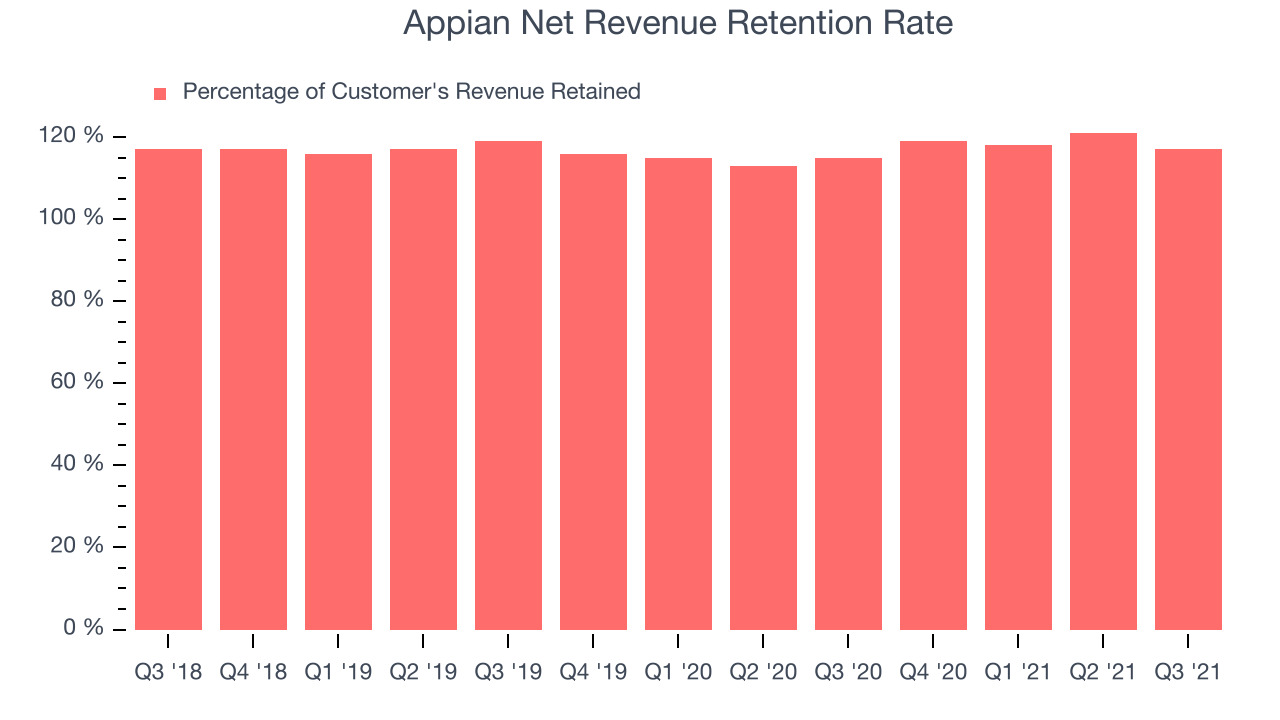

- Net Revenue Retention Rate: 117%, down from 121% previous quarter

- Gross Margin (GAAP): 71.3%, down from 72.1% same quarter last year

“Appian's cloud subscription revenue grew 36%, which is above the top end of our guidance. Appian is an 'engine for change' that is unifying process mining, workflow, and automation within a single low-code platform. Companies are choosing Appian to adapt quickly to the increasing pace of change,” said Matt Calkins, CEO & Founder.

Founded by Matt Calkins and his three friends out of an apartment in Northern Virginia, Appian (NASDAQ:APPN) sells a software platform that lets its users build applications without using much code, allowing them to create new software more quickly.

Automation seems to be an inescapable trend, and the more companies compete to automate their processes with new applications, the more they are likely to need low-code platforms to build faster.

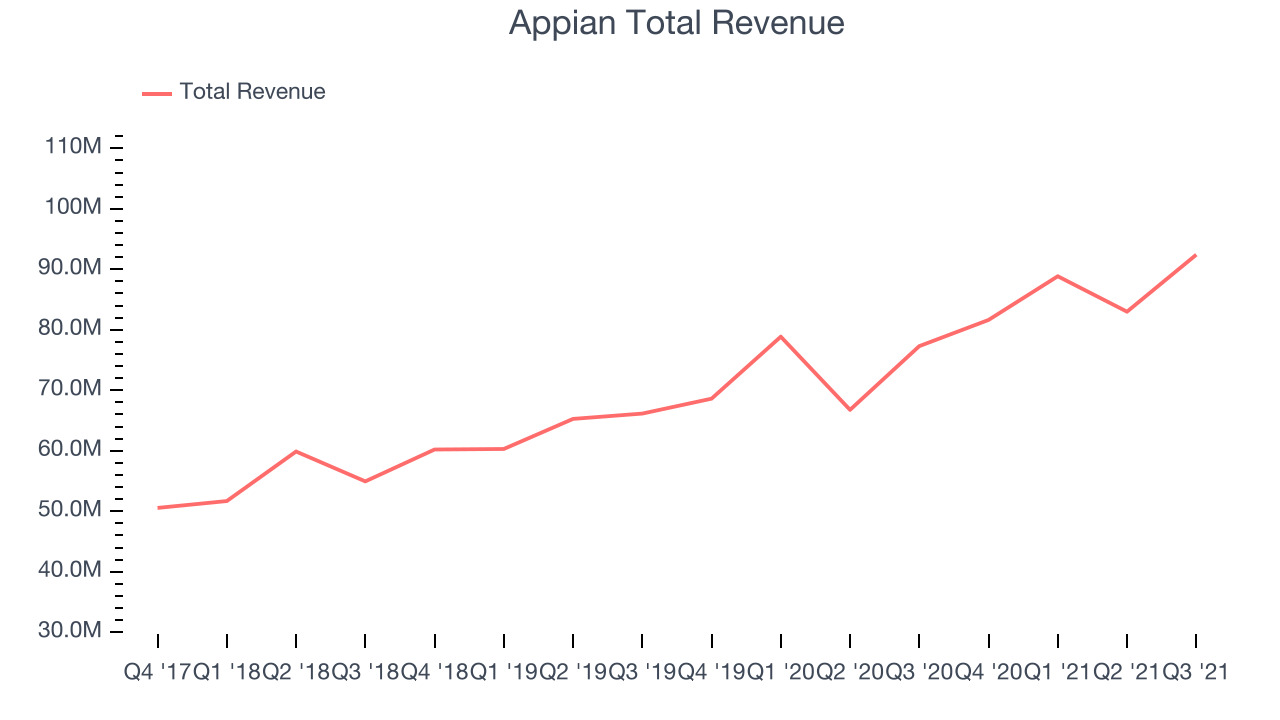

Sales Growth

As you can see below, Appian's revenue growth has been moderate over the last year, growing from quarterly revenue of $77.3 million, to $92.4 million.

This quarter, Appian's quarterly revenue was up 19.5% year on year. On top of that, revenue increased $9.41 million quarter on quarter, a strong improvement on the $5.85 million decrease in Q2 2021, and a sign of acceleration of growth, which is very nice to see indeed.

Analysts covering the company are expecting the revenues to grow 15.8% over the next twelve months, although estimates are likely to change post earnings.

There are others doing even better than Appian. Founded by ex-Google engineers, a small company making software for banks has been growing revenue 90% year on year and is already up more than 400% since the IPO in December. You can find it on our platform for free.

Product Success

One of the best things about software as a service businesses (and a reason why they trade at such high multiples) is that customers tend to spend more with the company over time.

Appian's net revenue retention rate, an important measure of how much customers from a year ago were spending at the end of the quarter, was at 117% in Q3. That means even if they didn't win any new customers, Appian would have grown its revenue 17% year on year. Despite the recent drop this is still a good retention rate and a proof that Appian's customers are satisfied with their software and are getting more value from it over time. That is good to see.

Key Takeaways from Appian's Q3 Results

Since it has been burning cash over the last twelve months it is worth keeping an eye on Appian’s balance sheet, but we note that with a market capitalization of $7.03 billion and more than $188.5 million in cash, the company has the capacity to continue to prioritise growth over profitability.

We enjoyed seeing Appian’s improve their gross margin materially this quarter. And we were also glad that the revenue guidance for the next quarter exceeded analysts' expectations. On the other hand, it was less good to see the deterioration in revenue retention rate. Zooming out, we think this was still a decent, albeit mixed, quarter, showing the company is staying on target. But investors might have been expecting more and the company is down 4.38% on the results and currently trades at $98.73 per share.

Should you invest in Appian right now? It is important that you take into account its valuation and business qualities, as well as what happened in the latest quarter. We look at that in our actionable report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.