The end of an earnings season can be a great time to assess how companies are handling the current business environment and discover new stocks. Let’s have a look at how Appian (NASDAQ:APPN) and the rest of the automation software stocks fared in Q4.

The whole purpose of software is to automate tasks to increase productivity. Today, innovative new software techniques, often involving AI and machine learning, are finally allowing automation that has graduated from simple one- or two-step workflows to more complex processes integral to enterprises. The result is surging demand for modern automation software.

The 6 automation software stocks we track reported a mixed Q4; on average, revenues beat analyst consensus estimates by 5.65%, while on average next quarter revenue guidance was 0.74% under consensus. Increasing interest rates hurt growth companies as investors search for near-term cash flows, but automation software stocks held their ground better than others, with share prices down 0.07% since the previous earnings results, on average.

Appian (NASDAQ:APPN)

Founded by Matt Calkins and his three friends out of an apartment in Northern Virginia, Appian (NASDAQ:APPN) sells a software platform that lets its users build applications without using much code, allowing them to create new software more quickly.

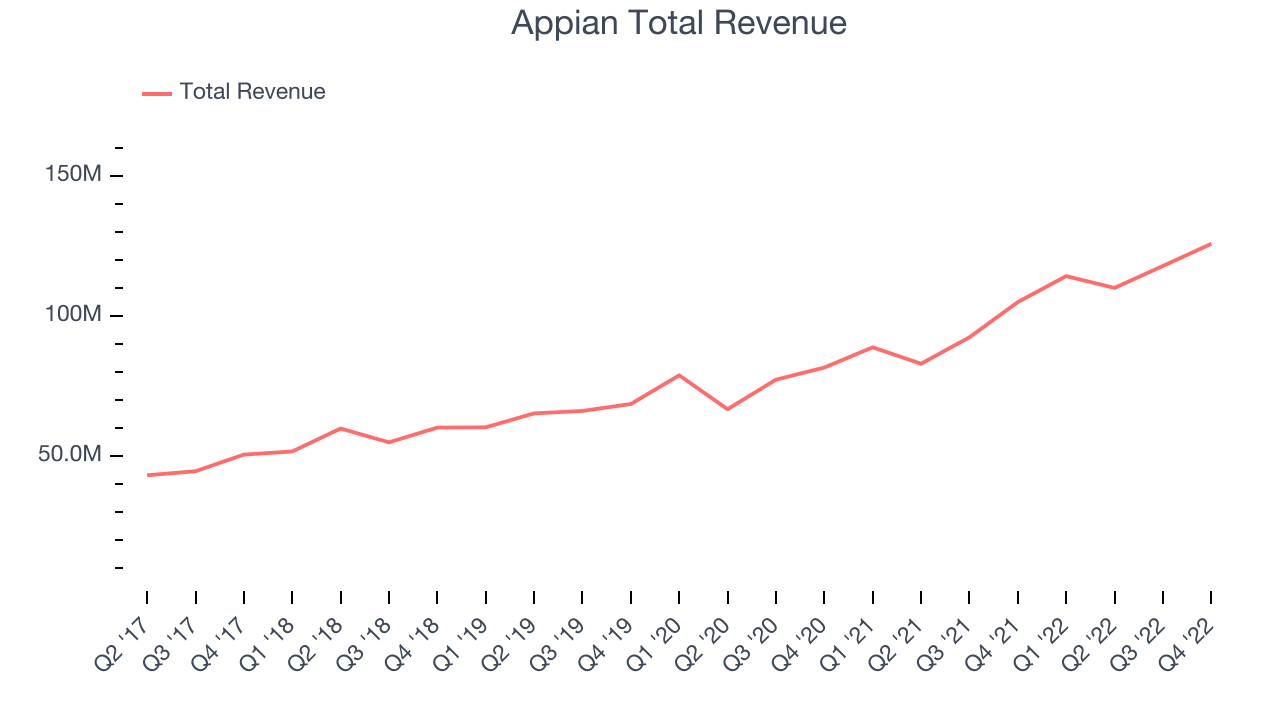

Appian reported revenues of $125.8 million, up 19.8% year on year, beating analyst expectations by 2.45%. It was a slower quarter for the company, with underwhelming guidance for the next year.

“Appian grew cloud subscriptions revenue 32% for the full year. Our loyal customers and high gross margins provide a strong foundation as we enter 2023. Organizations are choosing Appian to increase productivity, time to value, and return on investment during uncertain times,” said Matt Calkins, CEO & Founder.

The stock is down 8.78% since the results and currently trades at $40.92.

Read our full report on Appian here, it's free.

Best Q4: Pegasystems (NASDAQ:PEGA)

Founded by Alan Trefler in 1983, Pegasystems (NASDAQ:PEGA) offers a software-as-a-service platform to automate and optimize workflows in customer service and engagement.

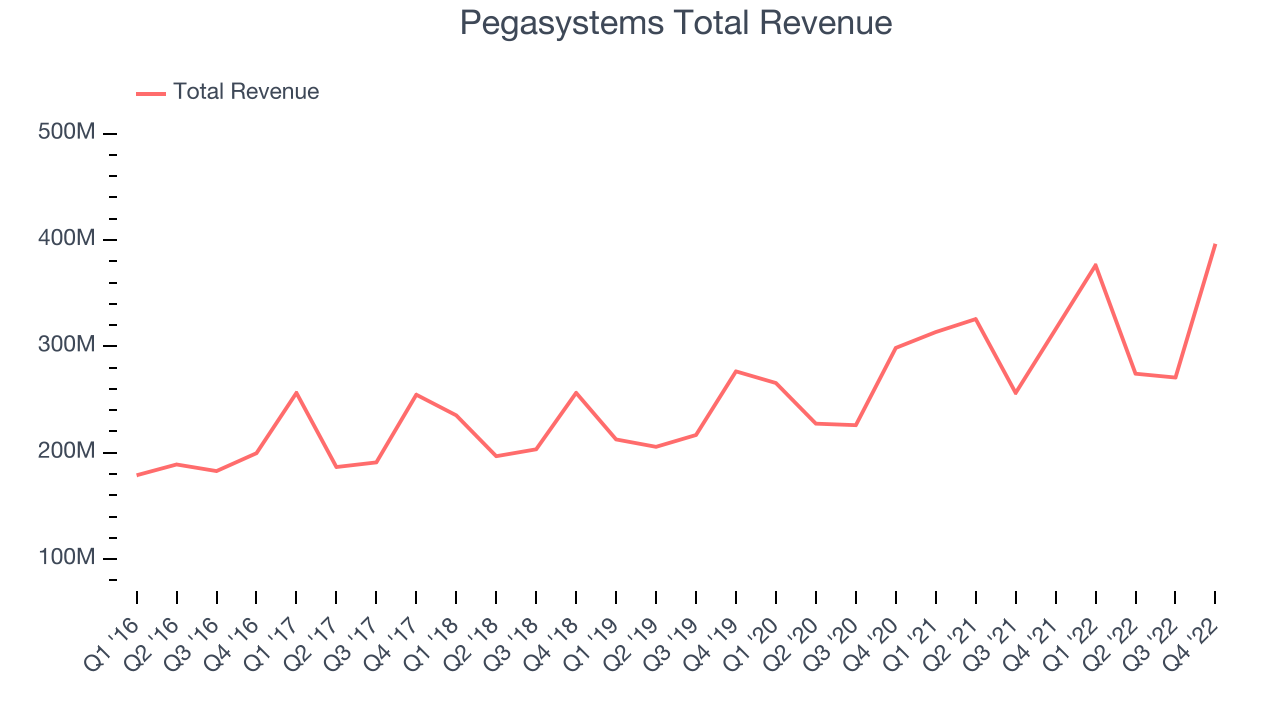

Pegasystems reported revenues of $396.5 million, up 25.4% year on year, beating analyst expectations by 18.8%. It was a strong quarter for the company, with a significant improvement in gross margin and an impressive beat of analyst estimates.

Pegasystems scored the strongest analyst estimates beat among its peers. The stock is up 13% since the results and currently trades at $48.24.

Is now the time to buy Pegasystems? Access our full analysis of the earnings results here, it's free.

Weakest Q4: Jamf (NASDAQ:JAMF)

Founded in 2002 by Zach Halmstad and Chip Pearson, right around the time when Apple began to dominate the personal computing market, Jamf (NASDAQ:JAMF) provides software for companies to manage Apple devices such as Macs, iPads, and iPhones.

Jamf reported revenues of $130.3 million, up 25.5% year on year, beating analyst expectations by 1.09%. It was a weak quarter for the company, with revenue guidance for the next quarter and the full year missing analysts' expectations.

Jamf scored the fastest revenue growth but had the weakest full year guidance update in the group. The stock is down 8.77% since the results and currently trades at $19.36.

Read our full analysis of Jamf's results here.

ServiceNow (NYSE:NOW)

Founded by Fred Luddy who wrote the code for the initial prototype on a single flight from San Francisco to London, ServiceNow (NYSE:NOW) offers software as a service platform that helps companies become more efficient by allowing them to automate workflows across IT, HR and Customer Service.

ServiceNow reported revenues of $1.94 billion, up 20.2% year on year, inline with analyst expectations. It was a solid quarter for the company, with accelerating growth in large customers .

ServiceNow had the weakest performance against analyst estimates among the peers. The company added 107 enterprise customers paying more than $1m annually to a total of 1,637. The stock is up 5.33% since the results and currently trades at $472.4.

Read our full, actionable report on ServiceNow here, it's free.

UiPath (NYSE:PATH)

Started in 2005 in Romania as a tech outsourcing company, UiPath (NYSE:PATH) makes software that helps companies automate repetitive computer tasks.

UiPath reported revenues of $308.5 million, up 6.51% year on year, beating analyst expectations by 10.7%. It was a solid quarter for the company, with an impressive beat of analyst estimates.

UiPath achieved the highest full year guidance raise but had the slowest revenue growth among the peers. The stock is up 11.5% since the results and currently trades at $16.36.

Read our full, actionable report on UiPath here, it's free.

The author has no position in any of the stocks mentioned