Low code software development platform provider Appian (Nasdaq: APPN) announced better-than-expected results in Q4 FY2023, with revenue up 15.5% year on year to $145.3 million. The company expects next quarter's revenue to be around $149 million, in line with analysts' estimates. It made a non-GAAP profit of $0.06 per share, improving from its loss of $0.28 per share in the same quarter last year.

Appian (APPN) Q4 FY2023 Highlights:

- Revenue: $145.3 million vs analyst estimates of $140.7 million (3.2% beat)

- EPS (non-GAAP): $0.06 vs analyst estimates of -$0.24 ($0.30 beat)

- Revenue Guidance for Q1 2024 is $149 million at the midpoint, roughly in line with what analysts were expecting

- Management's revenue guidance for the upcoming financial year 2024 is $616 million at the midpoint, in line with analyst expectations and implying 13% growth (vs 16.6% in FY2023)

- Free Cash Flow was -$9.60 million compared to -$65.47 million in the previous quarter

- Net Revenue Retention Rate: 119%, in line with the previous quarter

- Gross Margin (GAAP): 76.4%, up from 72% in the same quarter last year

- Market Capitalization: $2.44 billion

Founded by Matt Calkins and his three friends out of an apartment in Northern Virginia, Appian (NASDAQ:APPN) sells a software platform that lets its users build applications without using much code, allowing them to create new software more quickly.

By empowering existing teams within specialist organisations, Appian lets its diverse customers, from banks to wind farms, build the exact software they need. This might mean creating new interfaces for tellers, or building a process for acquiring and managing wind farm insurance. By making software development easier with pre-existing segments of code, Appian's customers can build and deploy new functionality far more quickly, and potentially at lower cost, than if they had to hire more team members to build it without Appian.

Appian was started by four young friends, including long-serving CEO Matt Calkins who quit his job before settling on a business plan. It wasn't until a few years later that the company began to focus on business process management, helping companies become more efficient. Today, Appian can potentially allow any employee to develop the specific custom software that their business needs.

Automation Software

The whole purpose of software is to automate tasks to increase productivity. Today, innovative new software techniques, often involving AI and machine learning, are finally allowing automation that has graduated from simple one- or two-step workflows to more complex processes integral to enterprises. The result is surging demand for modern automation software.

Other providers of low code software include Pegasystems (NASDAQ:PEGA), IBM (NYSE:IBM), and Oracle (NYSE:ORCL).

Sales Growth

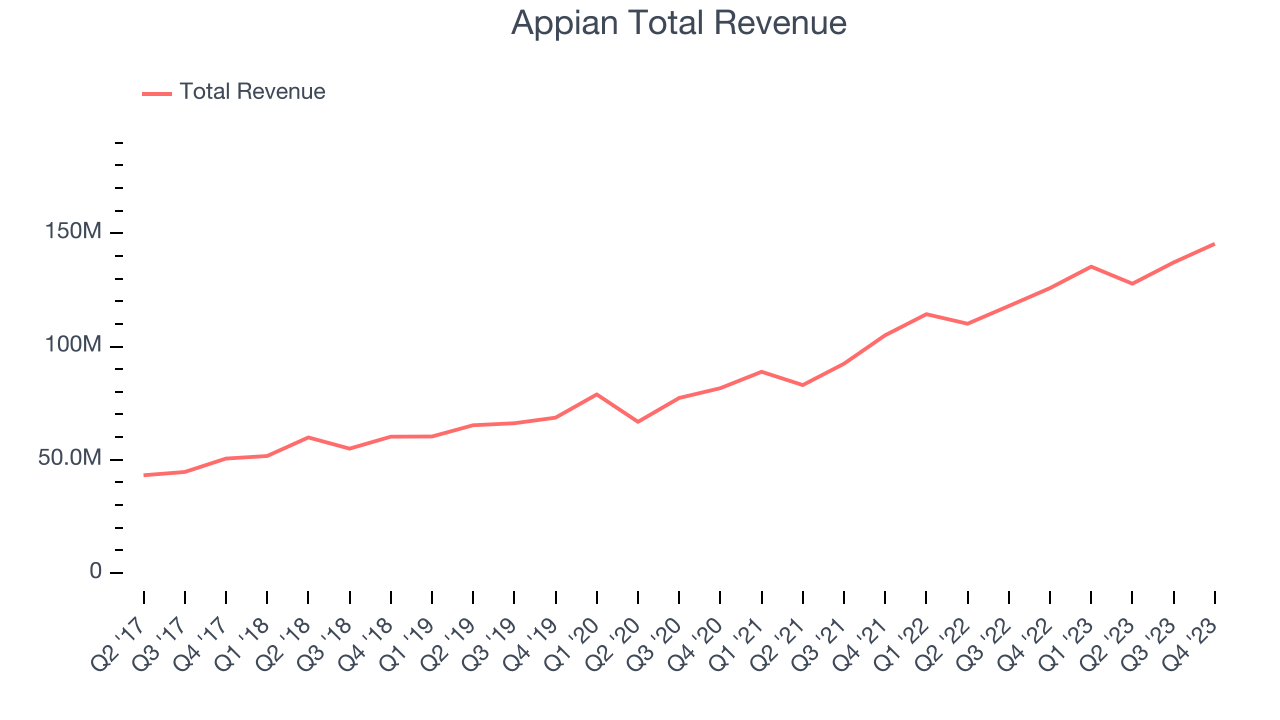

As you can see below, Appian's revenue growth has been strong over the last two years, growing from $105 million in Q4 FY2021 to $145.3 million this quarter.

This quarter, Appian's quarterly revenue was once again up 15.5% year on year. However, its growth did slow down a little compared to last quarter as the company increased revenue by $8.23 million in Q4 compared to $9.38 million in Q3 2023. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that Appian is expecting revenue to grow 10.2% year on year to $149 million, slowing down from the 18.4% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $616 million at the midpoint, growing 13% year on year compared to the 16.5% increase in FY2023.

Product Success

One of the best parts about the software-as-a-service business model (and a reason why SaaS companies trade at such high valuation multiples) is that customers typically spend more on a company's products and services over time.

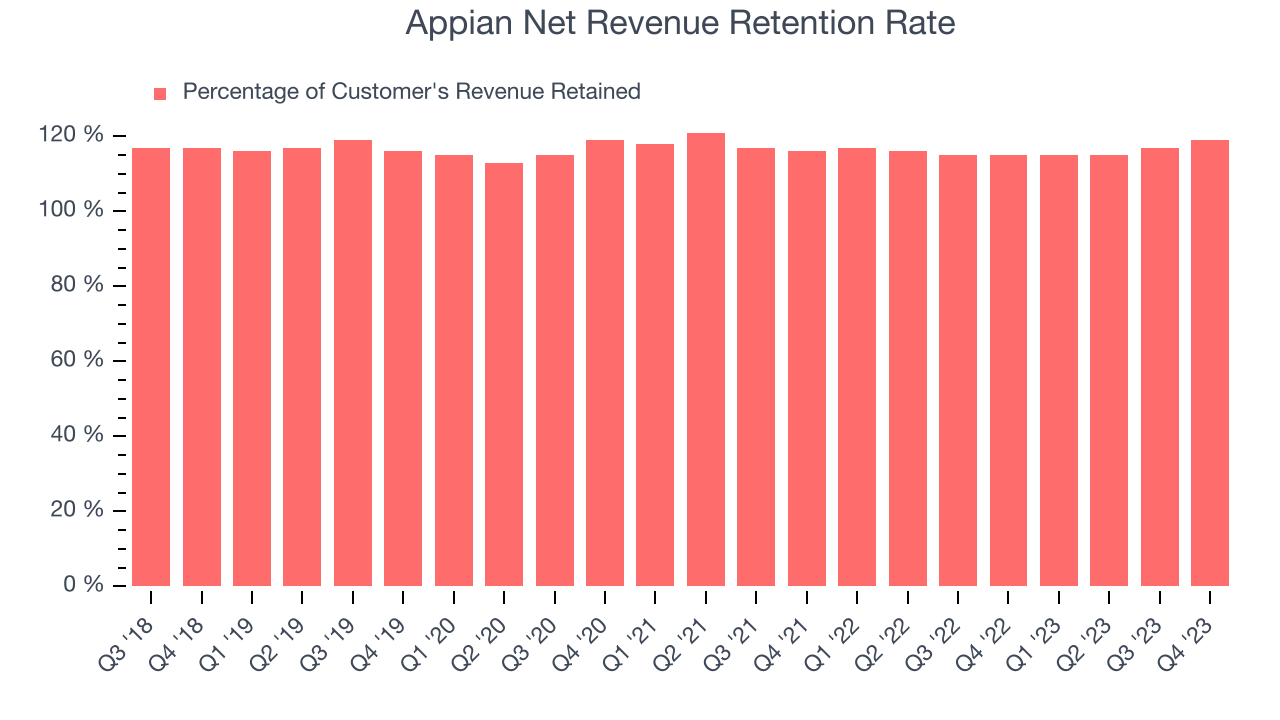

Appian's net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 119% in Q4. This means that even if Appian didn't win any new customers over the last 12 months, it would've grown its revenue by 19%.

Significantly up from the last quarter, Appian has a good net retention rate, proving that customers are satisfied with its software and getting more value from it over time, which is always great to see.

Profitability

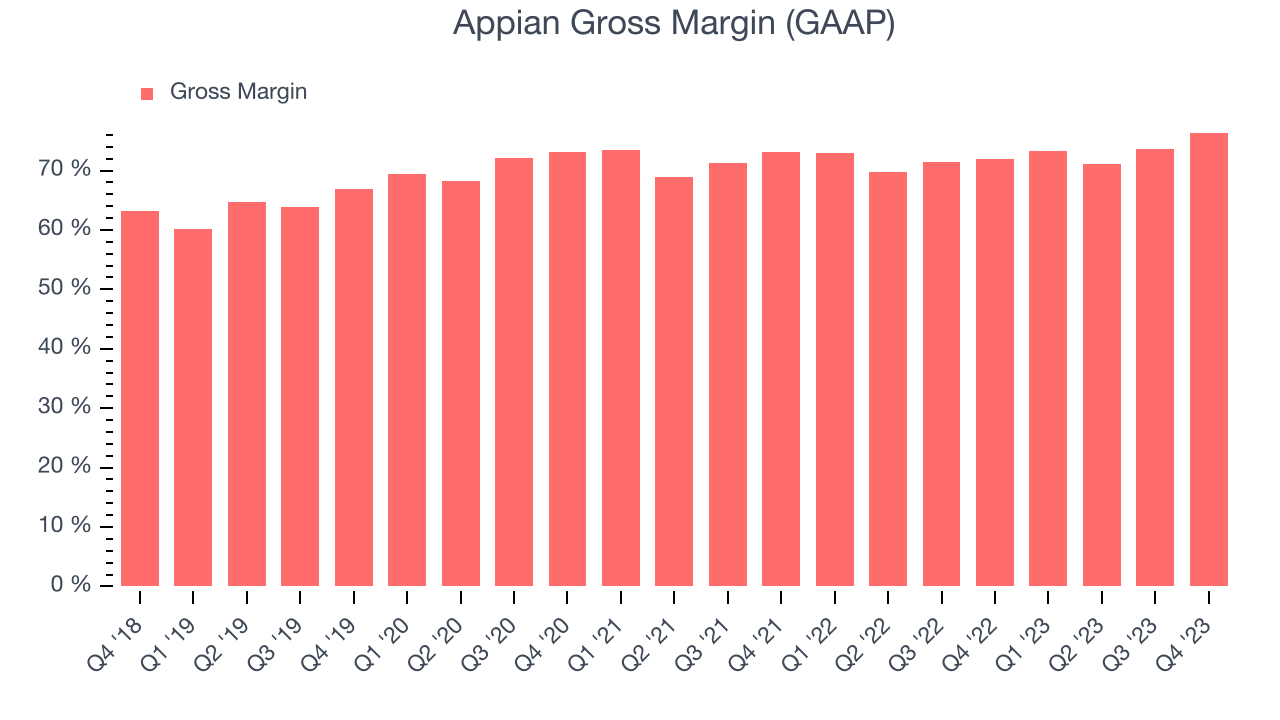

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Appian's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 76.4% in Q4.

That means that for every $1 in revenue the company had $0.76 left to spend on developing new products, sales and marketing, and general administrative overhead. Significantly up from the last quarter, Appian's impressive gross margin allows it to fund large investments in product and sales during periods of rapid growth and achieve profitability when reaching maturity.

Cash Is King

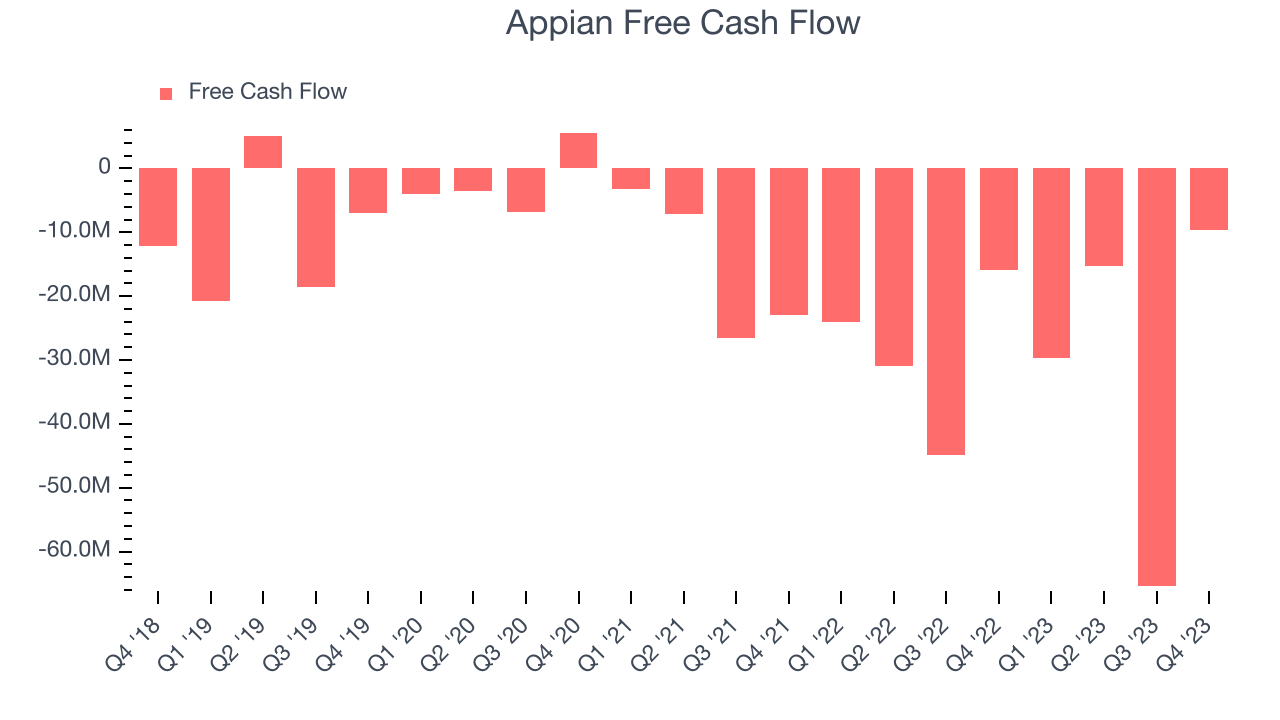

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Appian burned through $9.60 million of cash in Q4 , increasing its cash burn by 39.3% year on year.

Appian has burned through $120.1 million of cash over the last 12 months, resulting in a negative 22% free cash flow margin. This low FCF margin stems from Appian's poor unit economics or a constant need to reinvest in its business to stay competitive.

Key Takeaways from Appian's Q3 Results

Although Appian, which has a market capitalization of $2.86 billion, has been burning cash over the last 12 months, its more than $169.5 million in cash on hand gives it the flexibility to continue prioritizing growth over profitability.

Revenue and adjusted EPS both beat, and we enjoyed seeing Appian materially improve its gross margin this quarter. We were also glad its net revenue retention grew. On the other hand, its revenue and adjusted EBITDA guidance for next quarter underwhelmed and its full-year revenue guidance slightly missed Wall Street's estimates as well. This is driving weakness in the stock. Overall, this was a mediocre quarter for Appian. The company is down 6.43% on the results and currently trades at $39 per share.

Key Takeaways from Appian's Q4 Results

We were glad to see Appian's revenue outperform Wall Street's estimates along with solid revenue retention. Gross margin also improved, and cash burn improved from previous quarters. Guidance for next quarter and the full year were relatively in line with expectations, with full year adjusted EBITDA guidance actually better than Wall Street estimates, suggesting better profitability. Zooming out, we think this was a solid quarter, showing that the company is staying on track. The stock is up 10.9% after reporting and currently trades at $36.93 per share.

Is Now The Time?

When considering an investment in Appian, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

Although Appian isn't a bad business, it probably wouldn't be one of our picks. Although its , Wall Street expects growth to deteriorate from here. On top of that, its growth is coming at a cost of significant cash burn.

Appian's price-to-sales ratio based on the next 12 months is 4.0x, suggesting that the market has lower expectations of the business, relative to the high growth tech stocks. We can find things to like about Appian and there's no doubt it's a bit of a market darling, at least for some. But we are wondering whether there might be better opportunities elsewhere right now.

Wall Street analysts covering the company had a one-year price target of $43.78 per share right before these results (compared to the current share price of $36.93).

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.