Luxury furniture retailer Arhaus (NASDAQ:ARHS) reported Q1 CY2024 results beating Wall Street analysts' expectations, with revenue down 3.1% year on year to $295.2 million. On the other hand, next quarter's revenue guidance of $315 million was less impressive, coming in 4.5% below analysts' estimates. It made a GAAP profit of $0.11 per share, down from its profit of $0.24 per share in the same quarter last year.

Arhaus (ARHS) Q1 CY2024 Highlights:

- Revenue: $295.2 million vs analyst estimates of $264.3 million (11.7% beat)

- EPS: $0.11 vs analyst estimates of $0.02 ($0.10 beat)

- Revenue Guidance for Q2 CY2024 is $315 million at the midpoint, below analyst estimates of $329.9 million

- The company reconfirmed its revenue guidance for the full year of $1.35 billion at the midpoint

- Gross Margin (GAAP): 39%, down from 48.6% in the same quarter last year

- Free Cash Flow of $10.9 million is up from -$828,000 in the same quarter last year

- Same-Store Sales were down 9.5% year on year

- Store Locations: 90 at quarter end, increasing by 8 over the last 12 months

- Market Capitalization: $1.86 billion

With an aesthetic that features natural materials such as reclaimed wood, Arhaus (NASDAQ:ARHS) is a high-end furniture retailer that sells everything from sofas to rugs to bookcases.

The Arhaus core customer is affluent and values quality and a style that is not cookie-cutter. Arhaus’s aesthetic can be described as having rich, warm finishes and textures, such as handcrafted woodwork, natural stone, and organic fabrics. Some products are hand-crafted or one-of-a-kind, which speaks to customers who value uniqueness. The company also offers a range of eco-friendly products such as reclaimed wood products and other recycled materials for the customer who is especially concerned about the environment.

The average Arhaus store is around 20,000 square feet in size and is typically located in upscale shopping centers or lifestyle centers alongside other luxury brands. The stores are designed to feel like a home, with cozy seating areas and a relaxed, inviting atmosphere where customers are free to lounge and experience the products directly. Arhaus also has an e-commerce platform, launched in 2005, allowing customers to shop online and have products delivered directly to their homes. The company’s online platform also offers virtual design consultations.

Home Furniture Retailer

Furniture retailers understand that ‘home is where the heart is’ but that no home is complete without that comfy sofa to kick back on or a dreamy bed to rest in. These stores focus on providing not only what is practically needed in a house but also aesthetics, style, and charm in the form of tables, lamps, and mirrors. Decades ago, it was thought that furniture would resist e-commerce because of the logistical challenges of shipping large furniture, but now you can buy a mattress online and get it in a box a few days later; so just like other retailers, furniture stores need to adapt to new realities and consumer behaviors.

Competitors offering higher-end furniture include public companies Restoration Hardware (NYSE:RH), MillerKnoll (NASDAQ:MLKN), and Williams Sonoma (NYSE:WSM). Private company West Elm is also a competitor.Sales Growth

Arhaus is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale. On the other hand, one advantage is that its growth rates can be higher because it's growing off a small base.

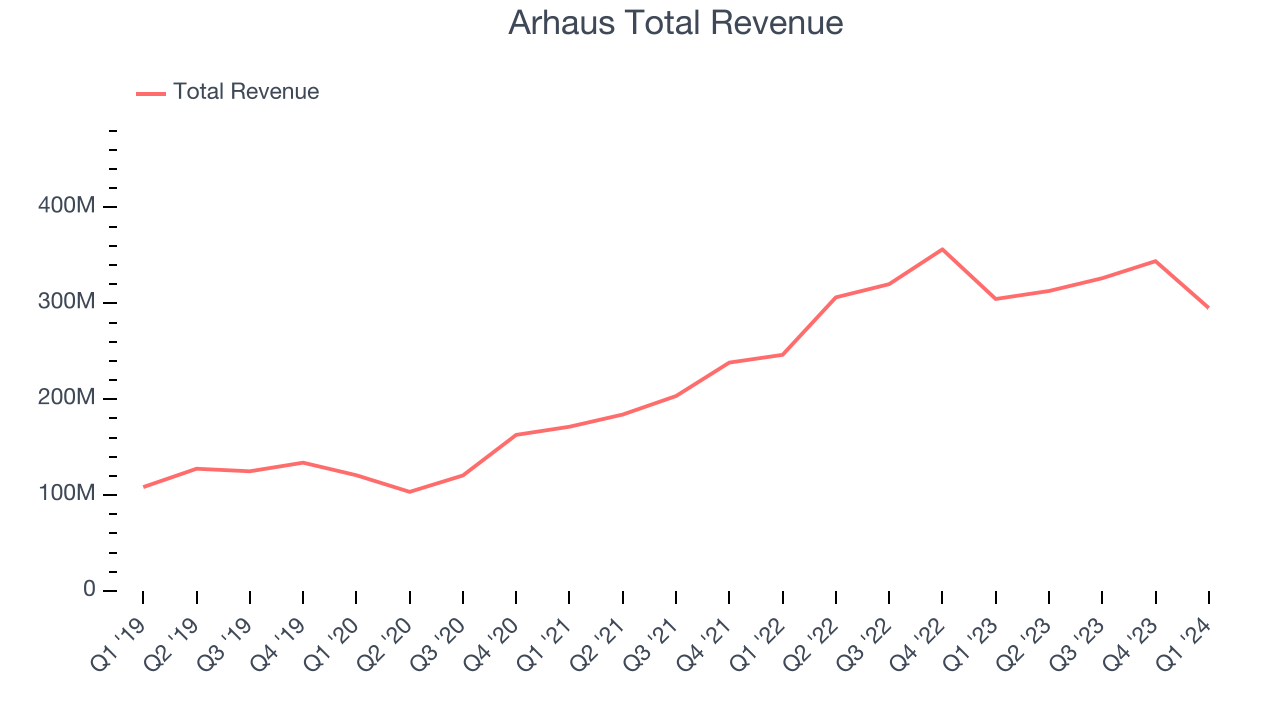

As you can see below, the company's annualized revenue growth rate of 26% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was incredible as it added more brick-and-mortar locations and increased sales at existing, established stores.

This quarter, Arhaus's revenue fell 3.1% year on year to $295.2 million but beat Wall Street's estimates by 11.7%. The company is guiding for revenue to rise 0.7% year on year to $315 million next quarter, slowing from the 2.2% year-on-year increase it recorded in the same quarter last year. Looking ahead, Wall Street expects sales to grow 9.1% over the next 12 months, an acceleration from this quarter.

Same-Store Sales

Same-store sales growth is an important metric that tracks demand for a retailer's established brick-and-mortar stores and e-commerce platform.

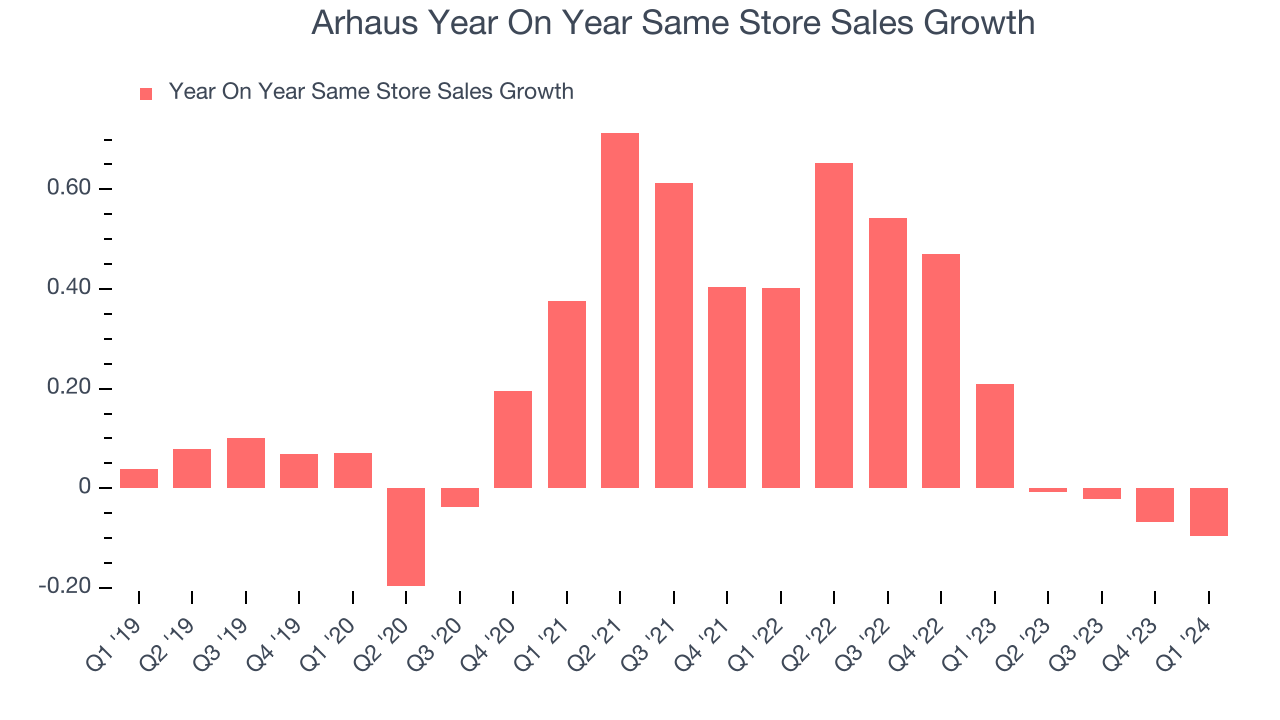

Arhaus's demand has been spectacular for a consumer retail business over the last eight quarters. On average, the company has increased its same-store sales by an impressive 21% year on year. This performance suggests that its steady rollout of new stores could be beneficial for shareholders. When a company has strong demand, more locations should help it reach more customers seeking its products.

In the latest quarter, Arhaus's same-store sales fell 9.5% year on year. This decline was a reversal from the 21% year-on-year increase it posted 12 months ago. We'll be keeping a close eye on the company to see if this turns into a longer-term trend.

Number of Stores

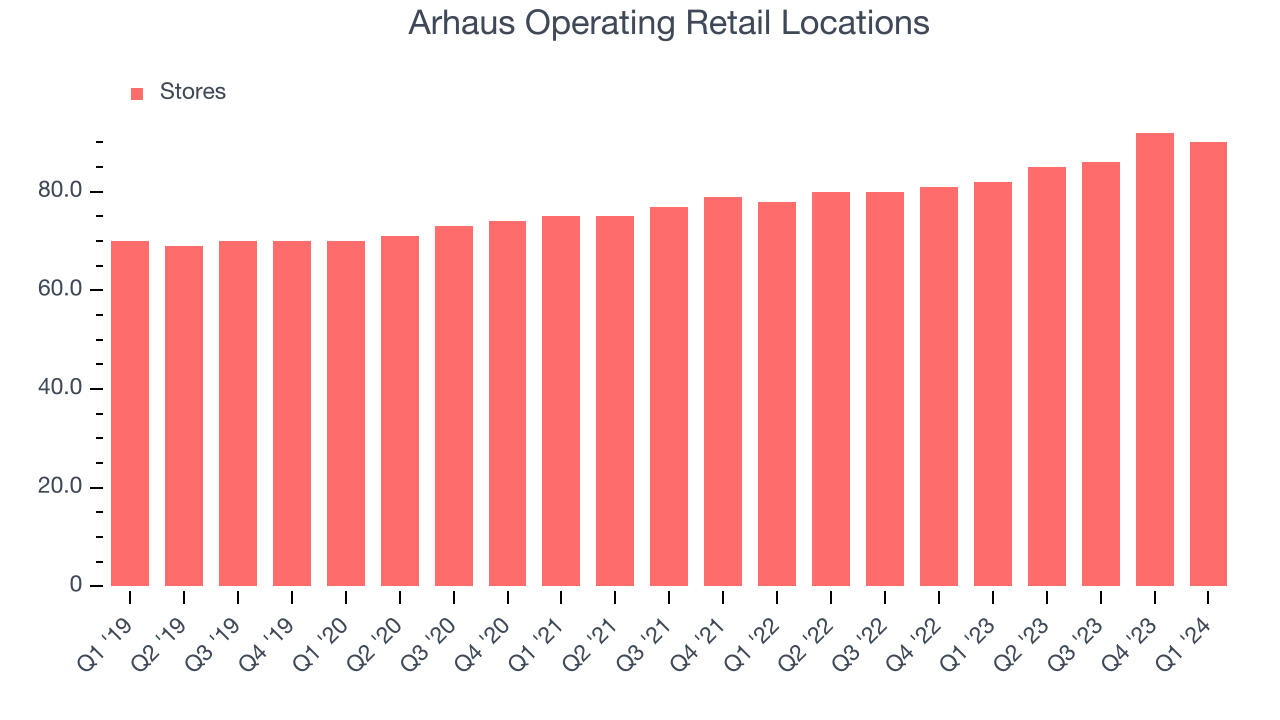

When a retailer like Arhaus is opening new stores, it usually means it's investing for growth because demand is greater than supply. Arhaus's store count increased by 8 locations, or 9.8%, over the last 12 months to 90 total retail locations in the most recently reported quarter.

Over the last two years, the company has opened new stores quickly and averaged 6.9% annual growth in new locations, meaningfully higher than other consumer retail businesses. With an expanding store base and demand, revenue growth can come from multiple vectors: sales from new stores, sales from e-commerce, or increased foot traffic and higher sales per customer at existing stores.

Gross Margin & Pricing Power

Gross profit margins tell us how much money a retailer gets to keep after paying for the goods it sells.

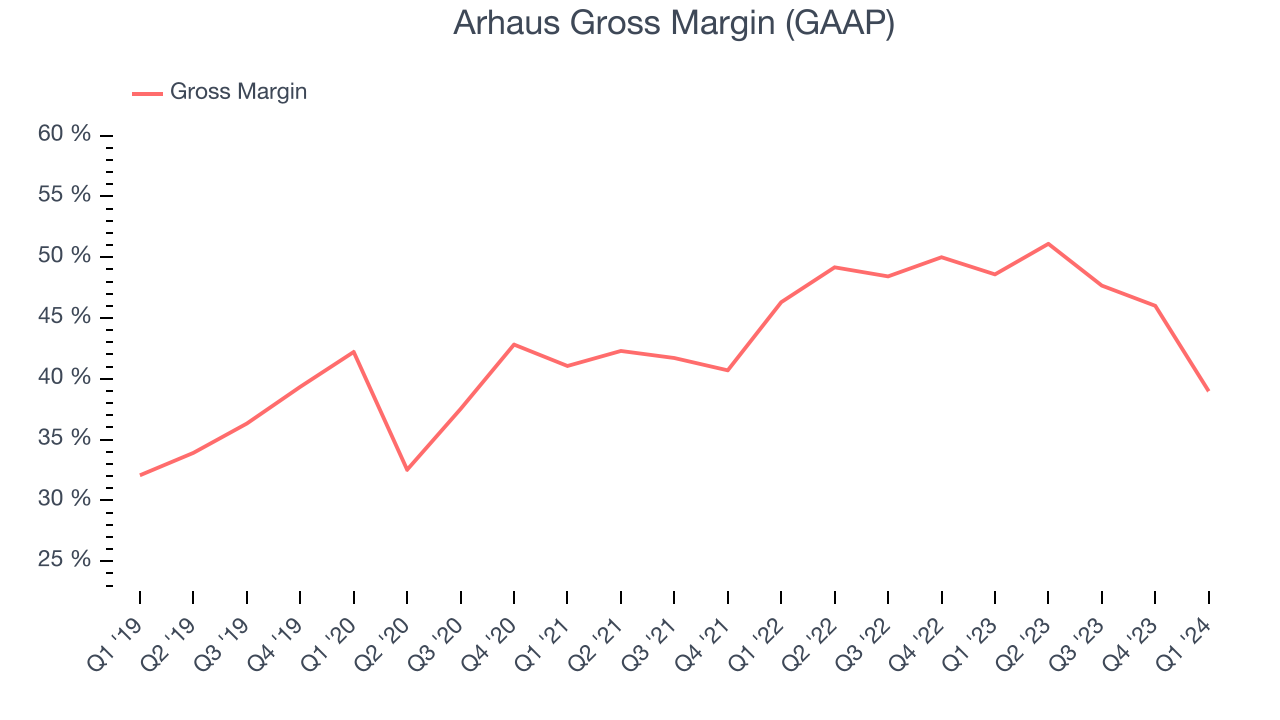

Arhaus has best-in-class unit economics for a retailer, enabling it to invest in areas such as marketing and talent to stay one step ahead of the competition. As you can see below, it's averaged an exceptional 47.6% gross margin over the last two years. This means the company makes $0.48 for every $1 in revenue before accounting for its operating expenses.

Arhaus's gross profit margin came in at 39% this quarter, marking a 9.6 percentage point decrease from 48.6% in the same quarter last year. Although the company could've performed better, we care more about its long-term trends rather than just one quarter. Additionally, a retailer's gross margin can often change due to factors outside its control, such as product discounting and dynamic input costs (think distribution and freight expenses to move goods). We'll keep a close eye on this.

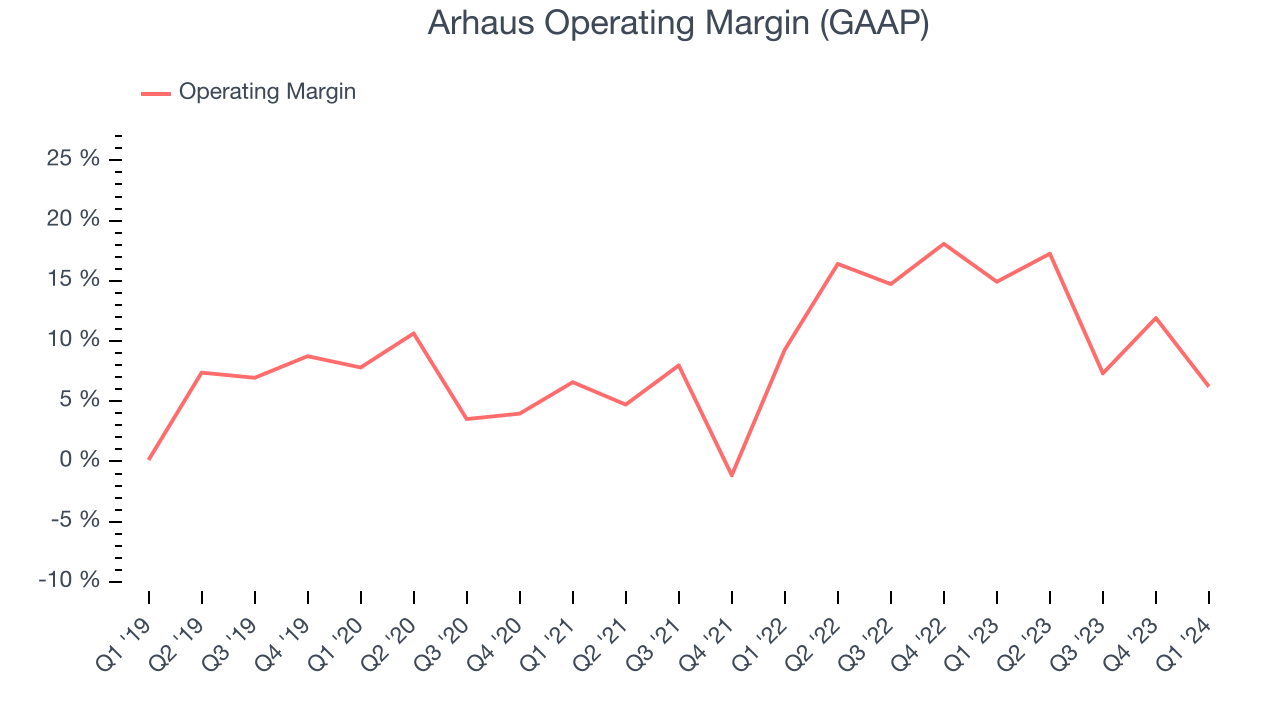

Operating Margin

Operating margin is an important measure of profitability for retailers as it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

This quarter, Arhaus generated an operating profit margin of 6.2%, down 8.7 percentage points year on year. This reduction was driven by weaker pricing power, as indicated by the company's larger drop in gross margin.

Zooming out, Arhaus has exercised operational efficiency over the last eight quarters. The company has demonstrated it can be wildly profitable for a consumer retail business, boasting an average operating margin of 13.4%. However, Arhaus's margin has declined by 5.4 percentage points year on year (on average). Although this isn't the end of the world, some investors were likely hoping for better results.

Zooming out, Arhaus has exercised operational efficiency over the last eight quarters. The company has demonstrated it can be wildly profitable for a consumer retail business, boasting an average operating margin of 13.4%. However, Arhaus's margin has declined by 5.4 percentage points year on year (on average). Although this isn't the end of the world, some investors were likely hoping for better results. EPS

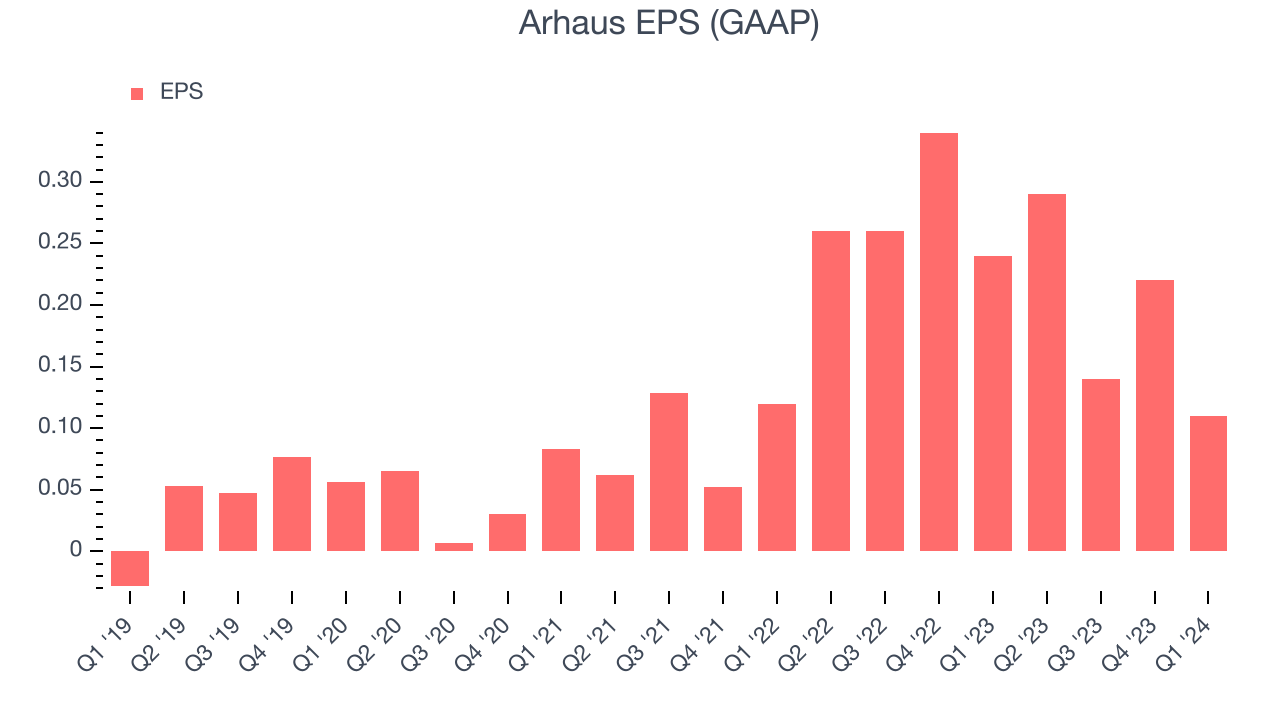

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

In Q1, Arhaus reported EPS at $0.11, down from $0.24 in the same quarter a year ago. This print easily cleared Wall Street's estimates, and shareholders should be content with the results.

Between FY2020 and FY2024, Arhaus's adjusted diluted EPS grew 225%, translating into a remarkable 34.3% compounded annual growth rate. Thanks to the magic of compound interest, this means that Arhaus will more than quadruple its EPS in five years if it can maintain this rate of growth.

Wall Street expects the company to continue growing earnings over the next 12 months, with analysts projecting an average 10.5% year-on-year increase in EPS.

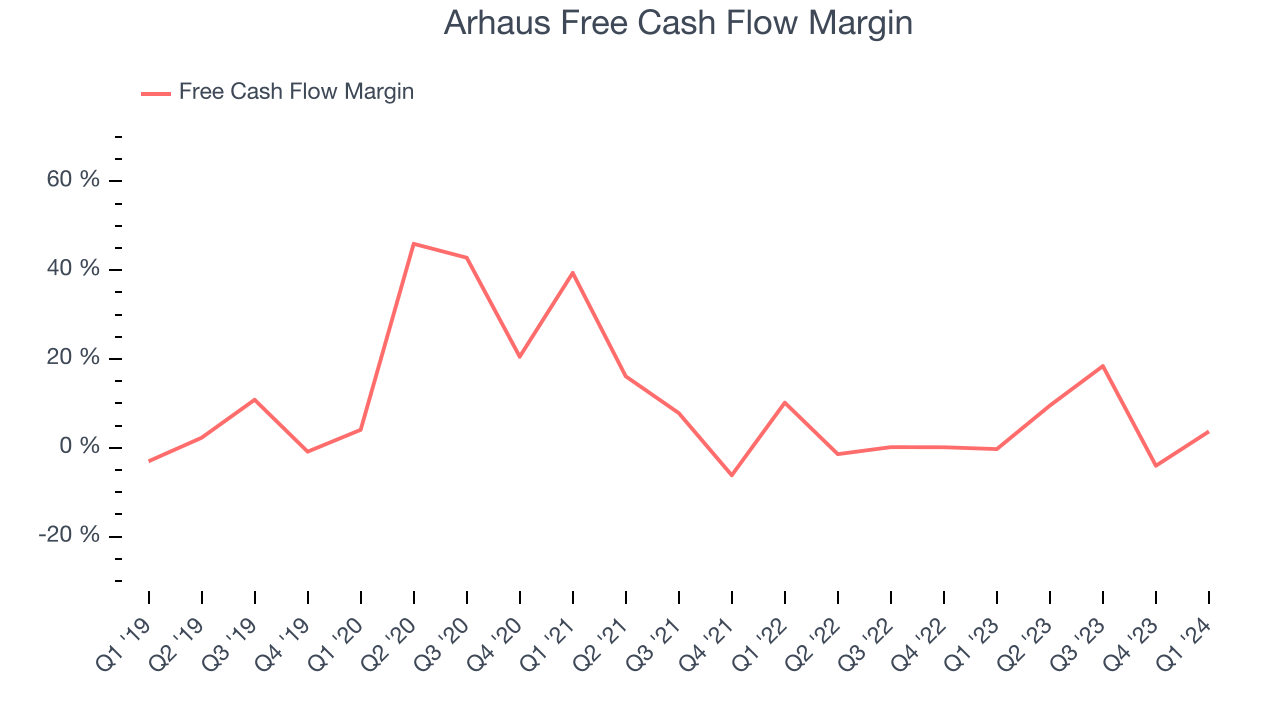

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe in the end, cash is king, and you can't use accounting profits to pay the bills.

Arhaus's free cash flow came in at $10.9 million in Q1, representing a 3.7% margin and flipping from negative in the same quarter last year to positive this quarter. Seasonal factors aside, this was great for the business.

Over the last two years, Arhaus has shown decent cash profitability, giving it some reinvestment opportunities. The company's free cash flow margin has averaged 3.2%, slightly better than the broader consumer retail sector. Furthermore, its margin has averaged year-on-year increases of 7.1 percentage points. This likely pleases the company's investors.

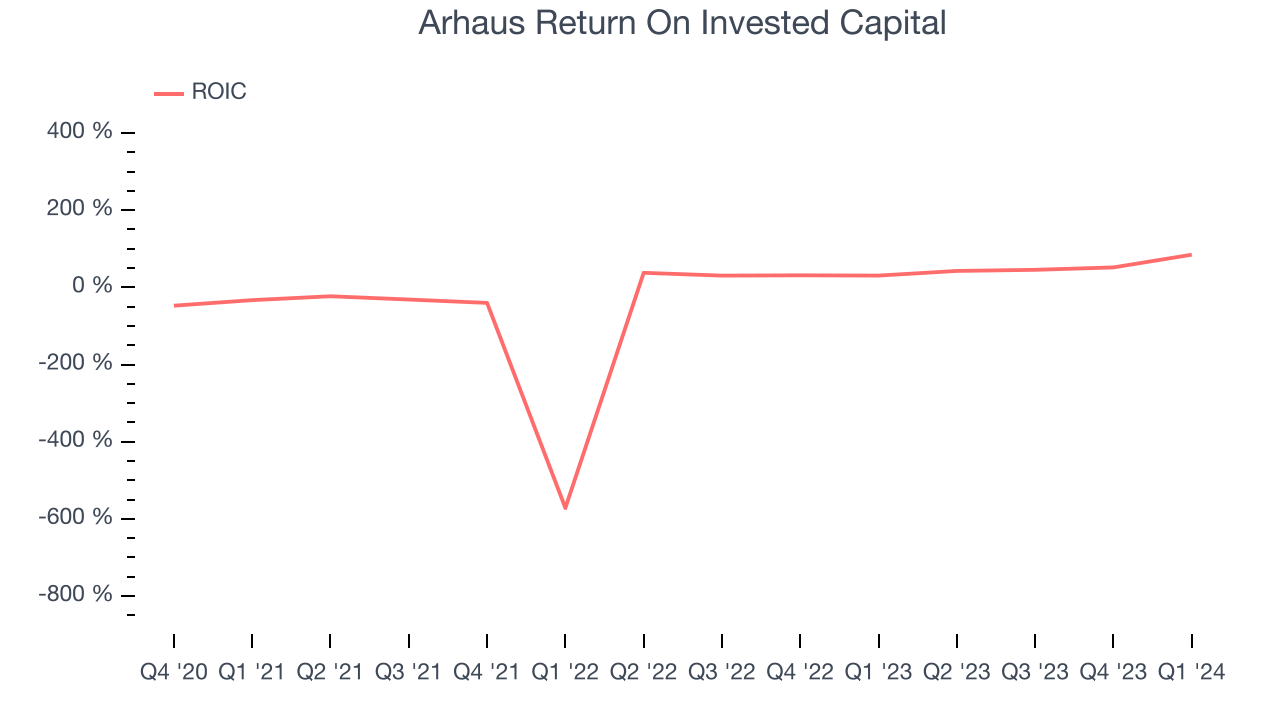

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Arhaus's five-year average ROIC was 27.4%, placing it among the best retail companies. Just as you’d like your investment dollars to generate returns, Arhaus's invested capital has produced excellent profits.

Key Takeaways from Arhaus's Q1 Results

We were impressed by how significantly Arhaus blew past analysts' EPS expectations this quarter. We were also excited its revenue outperformed Wall Street's estimates. On the other hand, its revenue guidance for next quarter missed analysts' expectations. Overall, we think this was a strong quarter that should satisfy shareholders. The stock is up 2.4% after reporting and currently trades at $13.5 per share.

Is Now The Time?

Arhaus may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

There are several reasons why we think Arhaus is a great business. For starters, its revenue growth has been exceptional over the last four years. And while its brand caters to a niche market, its impressive gross margins are a wonderful starting point for the overall profitability of the business. On top of that, its stellar ROIC suggests it has been a well-run company historically.

Arhaus's price-to-earnings ratio based on the next 12 months is 16.1x. Looking at the consumer landscape today, Arhaus's qualities as one of the best businesses really stand out, and despite the higher valuation, we still like it at this price.

Wall Street analysts covering the company had a one-year price target of $17.50 per share right before these results (compared to the current share price of $13.50), implying they saw upside in buying Arhaus in the short term.

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.