Online payroll and human resource software provider Asure (NASDAQ:ASUR) reported Q1 CY2024 results exceeding Wall Street analysts' expectations, with revenue down 4.3% year on year to $31.65 million. The company expects next quarter's revenue to be around $28.5 million, in line with analysts' estimates. It made a GAAP loss of $0.01 per share, down from its profit of $0.02 per share in the same quarter last year.

Is now the time to buy Asure? Find out by accessing our full research report, it's free.

Asure (ASUR) Q1 CY2024 Highlights:

- Revenue: $31.65 million vs analyst estimates of $31.04 million (2% beat)

- EPS: -$0.01 vs analyst estimates of $0 (-$0.01 miss)

- Revenue Guidance for Q2 CY2024 is $28.5 million at the midpoint, roughly in line with what analysts were expecting

- The company reconfirmed its revenue guidance for the full year of $127 million at the midpoint

- Gross Margin (GAAP): 71.4%, down from 73.8% in the same quarter last year

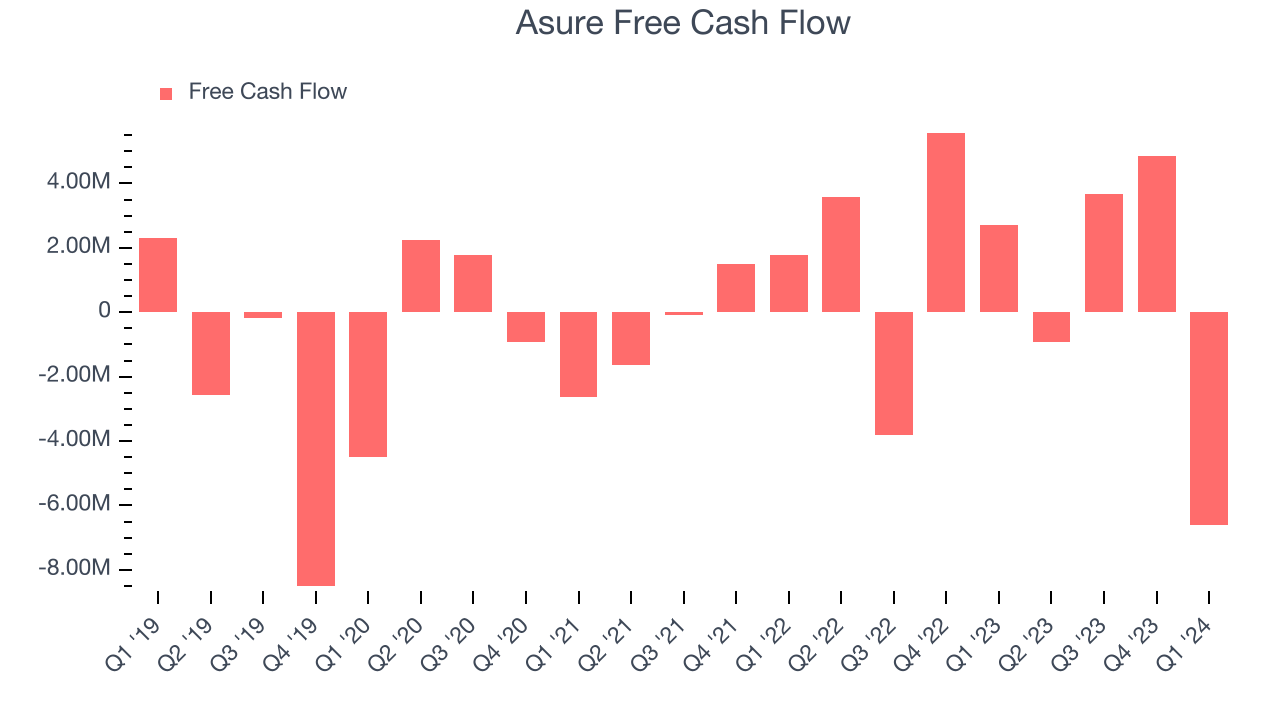

- Free Cash Flow was -$6.62 million, down from $4.85 million in the previous quarter

- Market Capitalization: $192.2 million

Asure Chairman and CEO Pat Goepel commented, “We continue to execute our growth strategy and are pleased to have delivered another solid performance for the first quarter of 2024.”

Created from the merger of two small workforce management companies in 2007, Asure (NASDAQ:ASUR) provides cloud based payroll and HR software for small and medium-sized businesses (SMBs).

HR Software

Modern HR software has two powerful benefits: cost savings and ease of use. For cost savings, businesses large and small much prefer the flexibility of cloud-based, web-browser-delivered software paid for on a subscription basis rather than the hassle and complexity of purchasing and managing on-premise enterprise software. On the usability side, the consumerization of business software creates seamless experiences whereby multiple standalone processes like payroll processing and compliance are aggregated into a single, easy-to-use platform.

Sales Growth

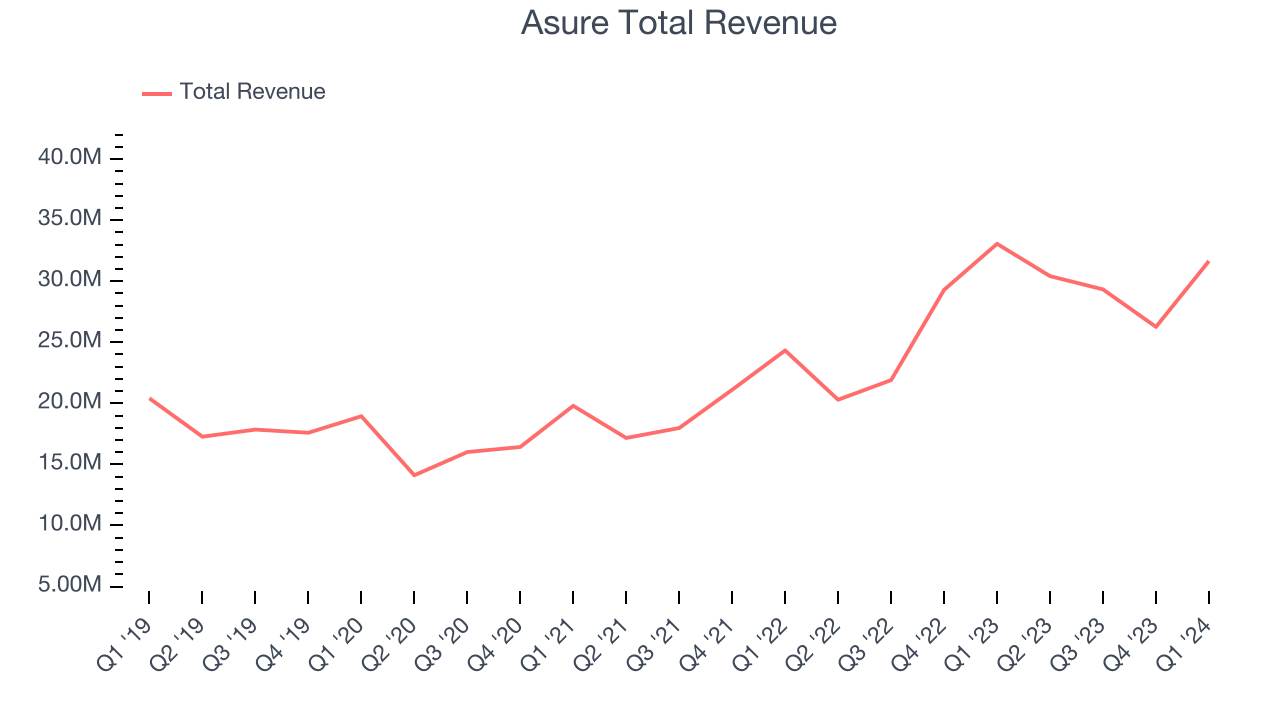

As you can see below, Asure's revenue growth has been strong over the last three years, growing from $19.8 million in Q1 2021 to $31.65 million this quarter.

This quarter, Asure's revenue was down 4.3% year on year, which might disappointment some shareholders.

Next quarter, Asure is guiding for a 6.3% year-on-year revenue decline to $28.5 million, a further deceleration from the 49.9% year-on-year decrease it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 7% over the next 12 months before the earnings results announcement.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Asure burned through $6.62 million of cash in Q1 despite being cash flow positive last year.

Asure broke even from a free cash flow perspective over the last 12 months. This below-average FCF margin stems from Asure's need to reinvest in its business to penetrate the market.

Key Takeaways from Asure's Q1 Results

We were impressed by Asure's gross margin improvement this quarter. We were also glad its full-year revenue guidance came in higher than Wall Street's estimates. On the other hand, its billings unfortunately missed analysts' expectations and its revenue guidance for next quarter came in slightly below Wall Street's estimates. Overall, the results could have been better. The stock is flat after reporting and currently trades at $7.96 per share.

So should you invest in Asure right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.