Online payroll and human resource software provider Asure (NASDAQ:ASUR) announced better-than-expected results in Q1 CY2024, with revenue down 4.3% year on year to $31.65 million. The company expects next quarter's revenue to be around $28.5 million, in line with analysts' estimates. It made a GAAP loss of $0.01 per share, down from its profit of $0.02 per share in the same quarter last year.

Asure (ASUR) Q1 CY2024 Highlights:

- Revenue: $31.65 million vs analyst estimates of $31.04 million (2% beat)

- EPS: -$0.01 vs analyst estimates of $0 (-$0.01 miss)

- Revenue Guidance for Q2 CY2024 is $28.5 million at the midpoint, roughly in line with what analysts were expecting

- The company reconfirmed its revenue guidance for the full year of $127 million at the midpoint

- Gross Margin (GAAP): 71.4%, down from 73.8% in the same quarter last year

- Free Cash Flow was -$6.62 million, down from $4.85 million in the previous quarter

- Market Capitalization: $192.2 million

Created from the merger of two small workforce management companies in 2007, Asure (NASDAQ:ASUR) provides cloud based payroll and HR software for small and medium-sized businesses (SMBs).

Human Capital Management (HCM) software is meant to streamline mundane, but vital, business functions like keeping attendance, running payroll, and keeping compliant with shifting Federal and local government taxes and labor laws. For many small and medium sized businesses, these are often handled by their accountant which is an unnecessarily expensive use of resources, or QuickBooks style spreadsheets which don’t have sufficient functionality.

Enter Asure, who offers inexpensive cloud-based subscription software that automates the full spectrum of HR tasks, from handling payroll to managing benefits or submitting leave requests.

The company has a unique go-to-market strategy that focuses on underserved customers, specifically SMBs located outside the Top 10 US metropolitan markets. In addition to a direct sales force, Asure leans heavily on resellers (e.g. regional payroll providers focused on a specific vertical) and referral partners (e.g. regional banks and benefits brokers) who will resell Asure's products under their own brand.

HR Software

Modern HR software has two powerful benefits: cost savings and ease of use. For cost savings, businesses large and small much prefer the flexibility of cloud-based, web-browser-delivered software paid for on a subscription basis rather than the hassle and complexity of purchasing and managing on-premise enterprise software. On the usability side, the consumerization of business software creates seamless experiences whereby multiple standalone processes like payroll processing and compliance are aggregated into a single, easy-to-use platform.

Asure’s main competitors are legacy providers ADP (NASDAQ:ADP) and Paychex (NASDAQ:PAYX), as churn from these two represent a large part of Asure’s new clients annually. Other cloud-first providers of HR solutions for small and medium-sized businesses include Ceridian (NYSE:CDAY), Paycom (NYSE:PAYC), Paycor (NASDAQ:PYCR), Paylocity (NASDAQ:PCTY), and Workday (NASDAQ:WDAY).

Sales Growth

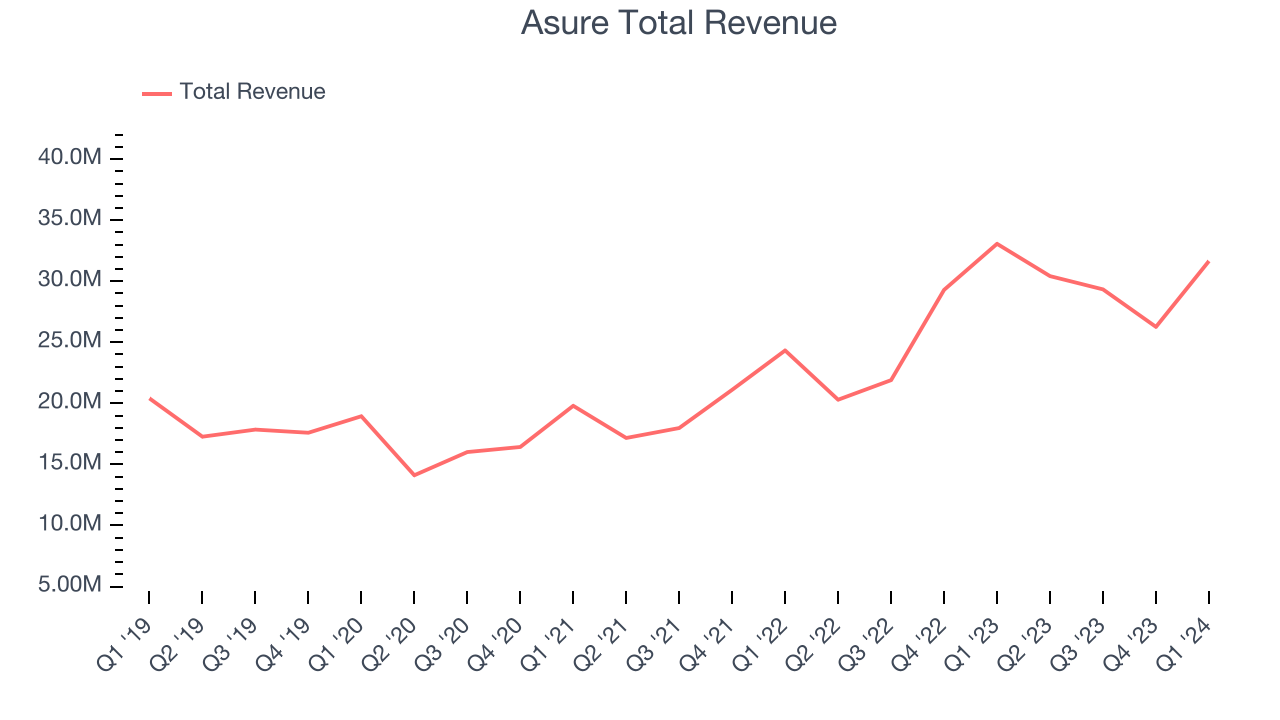

As you can see below, Asure's revenue growth has been strong over the last three years, growing from $19.8 million in Q1 2021 to $31.65 million this quarter.

This quarter, Asure's revenue was down 4.3% year on year, which might disappointment some shareholders.

Next quarter, Asure is guiding for a 6.3% year-on-year revenue decline to $28.5 million, a further deceleration from the 49.9% year-on-year decrease it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 7% over the next 12 months before the earnings results announcement.

Profitability

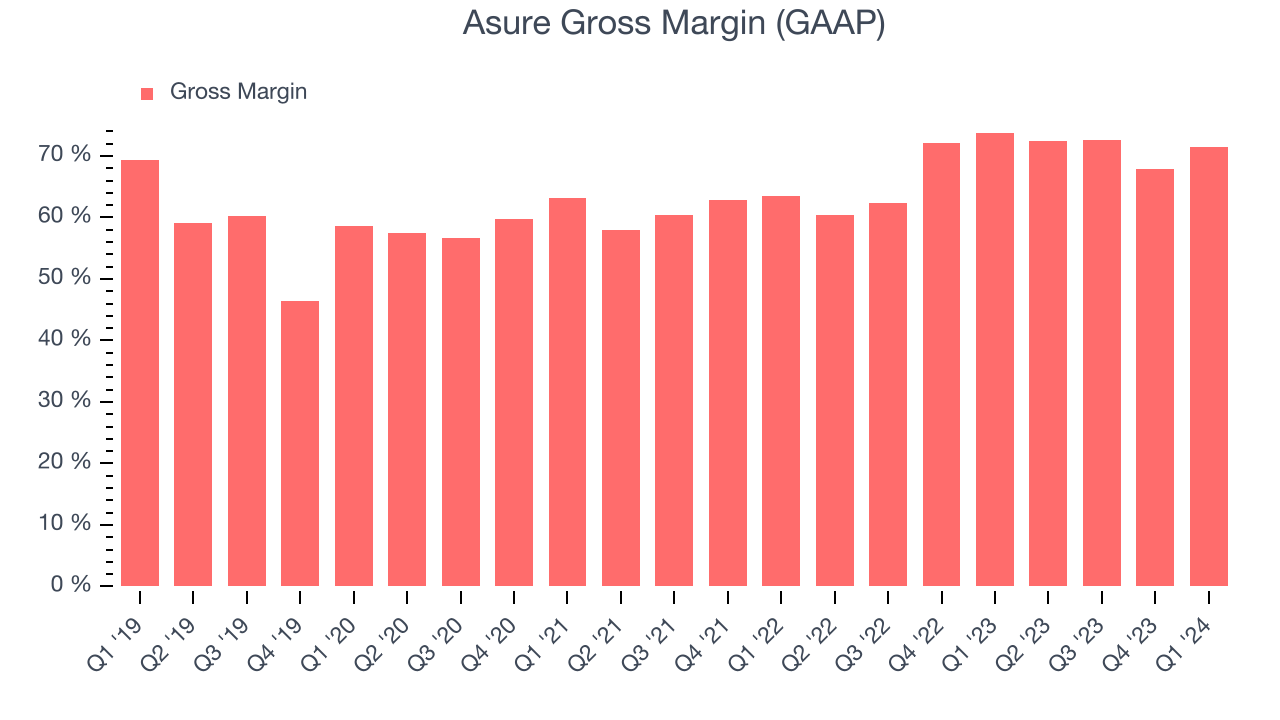

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Asure's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 71.4% in Q1.

That means that for every $1 in revenue the company had $0.71 left to spend on developing new products, sales and marketing, and general administrative overhead. Despite improving significantly since the last quarter, Asure's gross margin is still lower than that of a typical SaaS businesses. Gross margin has a major impact on a company’s ability to develop new products and invest in marketing, which may ultimately determine the winner in a competitive market. This makes it a critical metric to track for the long-term investor.

Cash Is King

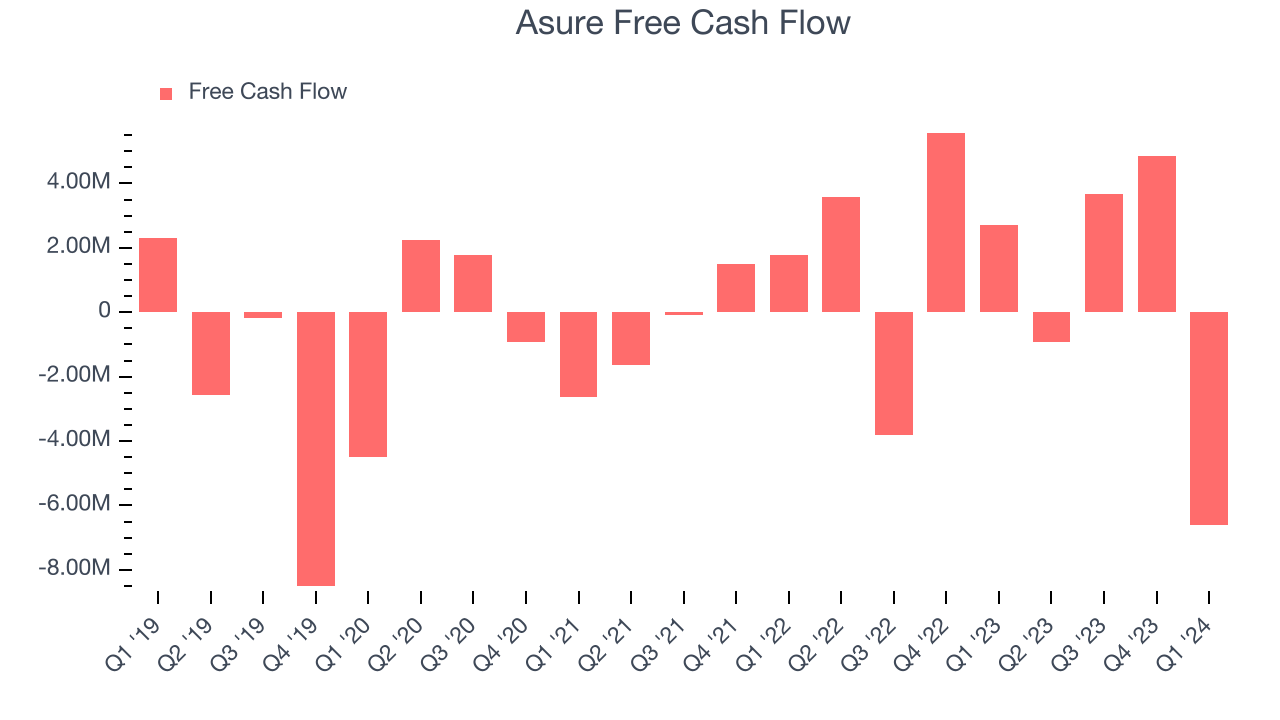

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Asure burned through $6.62 million of cash in Q1 despite being cash flow positive last year.

Asure broke even from a free cash flow perspective over the last 12 months. This below-average FCF margin stems from Asure's need to reinvest in its business to penetrate the market.

Key Takeaways from Asure's Q1 Results

We were impressed by Asure's gross margin improvement this quarter. We were also glad its full-year revenue guidance came in higher than Wall Street's estimates. On the other hand, its billings unfortunately missed analysts' expectations and its revenue guidance for next quarter came in slightly below Wall Street's estimates. Overall, this was a mediocre quarter for Asure. The stock is flat after reporting and currently trades at $7.96 per share.

Is Now The Time?

Asure may have had a bad quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for everyone who's making the lives of others easier through technology, but in case of Asure, we'll be cheering from the sidelines. Although its revenue growth has been solid over the last three years, Wall Street expects growth to deteriorate from here. On top of that, its customer acquisition is less efficient than many comparable companies and its low free cash flow margins give it little breathing room.

Asure's price-to-sales ratio based on the next 12 months is 1.6x, suggesting the market has lower expectations for the business relative to the hottest tech stocks. While there are some things to like about Asure and its valuation is reasonable, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $14.50 right before these results (compared to the current share price of $7.96).

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.