As the craze of earnings season draws to a close, here's a look back at some of the most exciting (and some less so) results from Q3. Today we are looking at the semiconductor manufacturing stocks, starting with Amtech (NASDAQ:ASYS).

The semiconductor industry is driven by demand for advanced electronic products like smartphones, PCs, servers, and data storage. The need for technologies like artificial intelligence, 5G networks, and smart cars is also creating the next wave of growth for the industry. Keeping up with this dynamism requires new tools that can design, fabricate, and test chips at ever smaller sizes and more complex architectures, creating a dire need for semiconductor capital manufacturing equipment.

The 14 semiconductor manufacturing stocks we track reported a mixed Q3; on average, revenues beat analyst consensus estimates by 0.6% while next quarter's revenue guidance was 3.9% below consensus. Stocks have been under pressure as inflation (despite slowing) makes their long-dated profits less valuable, but semiconductor manufacturing stocks held their ground better than others, with the share prices up 31.4% on average since the previous earnings results.

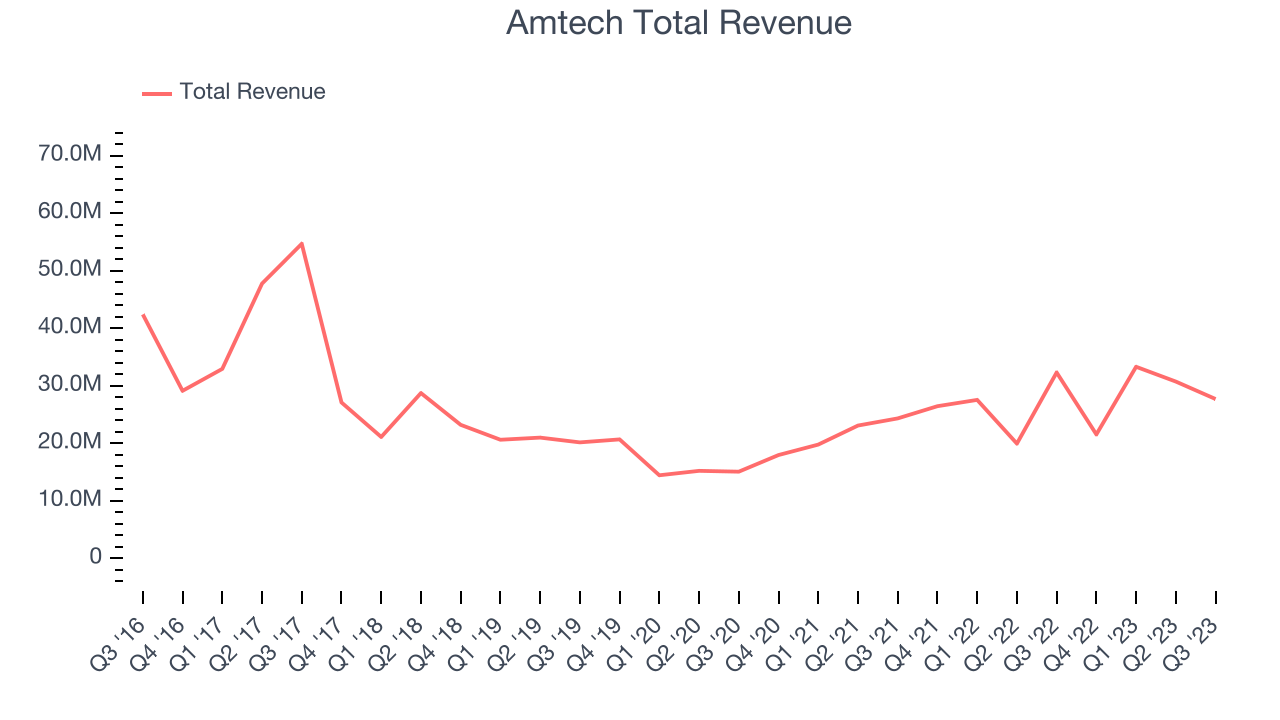

Weakest Q3: Amtech (NASDAQ:ASYS)

Focusing on the silicon carbide and power semiconductor sectors, Amtech Systems (NASDAQ:ASYS) produces the machinery and related chemicals needed for manufacturing semiconductors.

Amtech reported revenues of $27.71 million, down 14.3% year on year, falling short of analyst expectations by 10.2%. It was a weak quarter for the company, with a miss of analysts' revenue estimates and a decline in its operating margin.

Amtech delivered the weakest performance against analyst estimates of the whole group. The stock is up 8.8% since the results and currently trades at $4.46.

Read our full report on Amtech here, it's free.

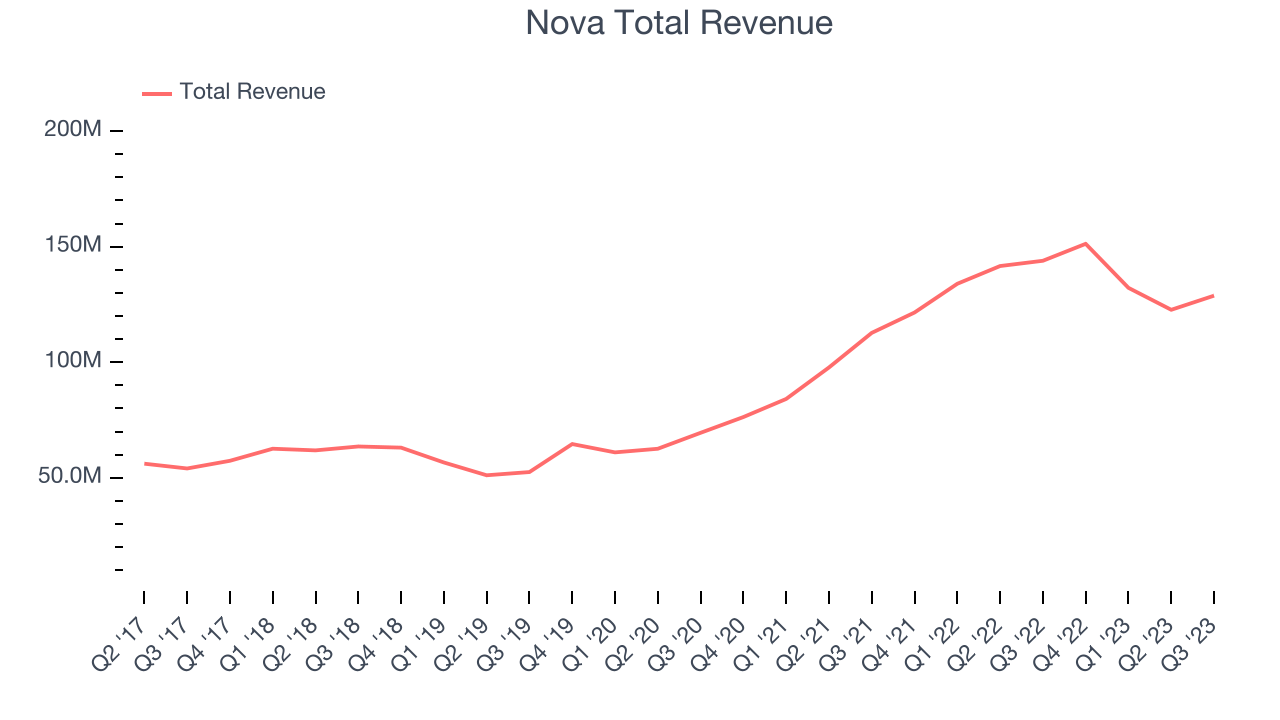

Best Q3: Nova (NASDAQ:NVMI)

Headquartered in Israel, Nova (NASDAQ: NVMI) is a provider of quality control systems used in semiconductor manufacturing.

Nova reported revenues of $128.8 million, down 10.5% year on year, outperforming analyst expectations by 4.6%. It was a strong quarter for the company, with a significant improvement in its inventory levels and an impressive beat of analysts' EPS estimates.

Nova scored the biggest analyst estimates beat among its peers. The stock is up 46.1% since the results and currently trades at $148.51.

Is now the time to buy Nova? Access our full analysis of the earnings results here, it's free.

IPG Photonics (NASDAQ:IPGP)

Both a designer and manufacturer of its products, IPG Photonics (NASDAQ:IPGP) is a provider of high-performance fiber lasers used for cutting, welding, and processing raw materials.

IPG Photonics reported revenues of $301.4 million, down 13.6% year on year, falling short of analyst expectations by 4%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter.

The stock is up 18.3% since the results and currently trades at $98.75.

Read our full analysis of IPG Photonics's results here.

Kulicke and Soffa (NASDAQ:KLIC)

Headquartered in Singapore, Kulicke & Soffa (NASDAQ: KLIC) is a provider of production equipment and tools used to assemble semiconductor devices

Kulicke and Soffa reported revenues of $202.3 million, down 29.3% year on year, surpassing analyst expectations by 1.1%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and a decline in its operating margin.

The stock is up 15.2% since the results and currently trades at $53.85.

Read our full, actionable report on Kulicke and Soffa here, it's free.

Marvell Technology (NASDAQ:MRVL)

Moving away from a low margin storage device management chips in one of the biggest semiconductor business model pivots of the past decade, Marvell Technology (NASDAQ: MRVL) is a fabless designer of special purpose data processing and networking chips used by data centers, communications carriers, enterprises, and autos.

Marvell Technology reported revenues of $1.42 billion, down 7.7% year on year, surpassing analyst expectations by 1.3%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and a decline in its gross margin.

The stock is up 28.4% since the results and currently trades at $71.5.

Read our full, actionable report on Marvell Technology here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned