The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how semiconductor manufacturing stocks fared in Q2, starting with Amtech (NASDAQ:ASYS).

The semiconductor industry is driven by demand for advanced electronic products like smartphones, PCs, servers, and data storage. The need for technologies like artificial intelligence, 5G networks, and smart cars is also creating the next wave of growth for the industry. Keeping up with this dynamism requires new tools that can design, fabricate, and test chips at ever smaller sizes and more complex architectures, creating a dire need for semiconductor capital manufacturing equipment.

The 14 semiconductor manufacturing stocks we track reported a solid Q2. As a group, revenues beat analysts’ consensus estimates by 1.9% while next quarter’s revenue guidance was 2.7% below.

Stocks, especially growth stocks with cash flows further into the future, had a good end of 2023. On the other hand, this year has seen more volatile stock market swings due to mixed inflation data, and semiconductor manufacturing stocks have had a rough stretch. On average, share prices are down 9.6% since the latest earnings results.

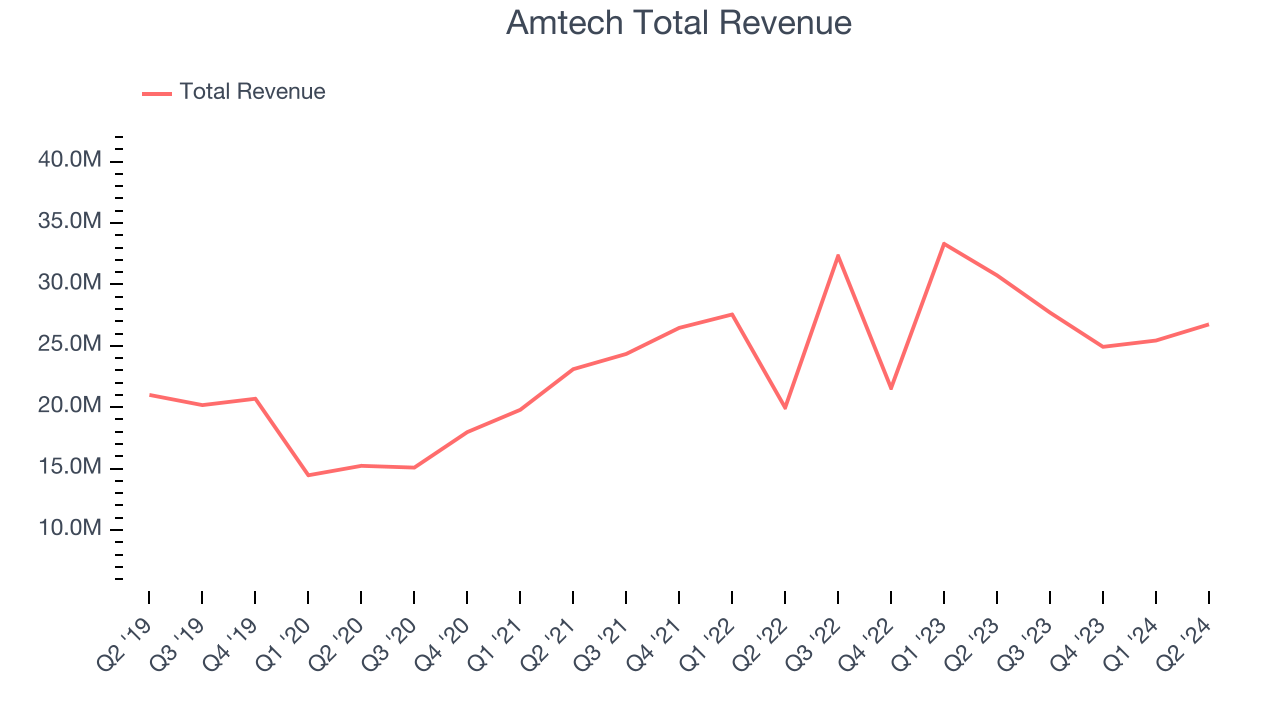

Amtech (NASDAQ:ASYS)

Focusing on the silicon carbide and power semiconductor sectors, Amtech Systems (NASDAQ:ASYS) produces the machinery and related chemicals needed for manufacturing semiconductors.

Amtech reported revenues of $26.75 million, down 13% year on year. This print exceeded analysts’ expectations by 10.8%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ EPS estimates and a significant improvement in its operating margin.

“In the third quarter we continued to align our cost structure with current market conditions and lay the foundation for meaningful operating leverage as our markets recover. Revenue of $26.7 million exceeded the high-end of our guidance range, and we achieved adjusted EBITDA of $2.3 million. This is the third consecutive quarter of positive adjusted EBITDA and operating cash flow. I am pleased that we are seeing the financial benefits of the approximately $7 million of annualized operating cost reductions taken over the past few quarters,” commented Mr. Bob Daigle, Chief Executive Officer of Amtech.

Amtech scored the biggest analyst estimates beat of the whole group. Unsurprisingly, the stock is up 16.3% since reporting and currently trades at $6.15.

Is now the time to buy Amtech? Access our full analysis of the earnings results here, it’s free.

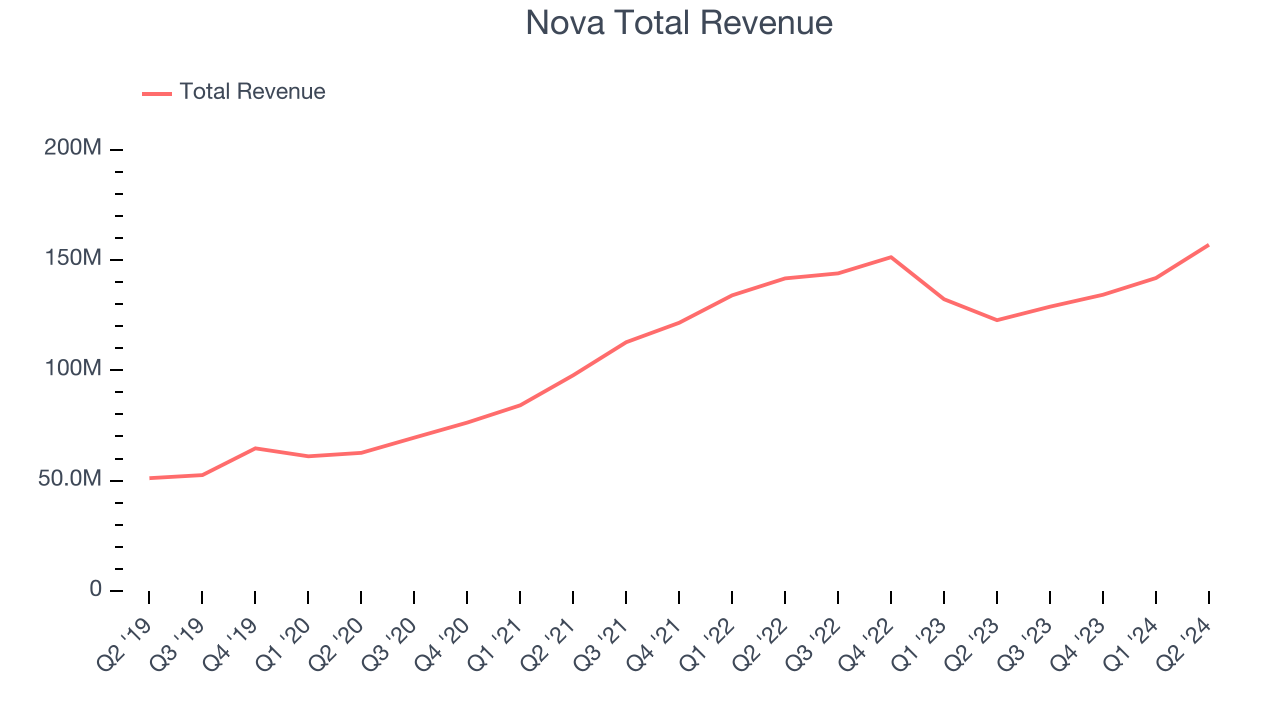

Best Q2: Nova (NASDAQ:NVMI)

Headquartered in Israel, Nova (NASDAQ:NVMI) is a provider of quality control systems used in semiconductor manufacturing.

Nova reported revenues of $156.9 million, up 27.8% year on year, outperforming analysts’ expectations by 5.9%. It was an exceptional quarter for the company with an impressive beat of analysts’ EPS estimates and a significant improvement in its operating margin.

Nova scored the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 10.2% since reporting. It currently trades at $199.83.

Is now the time to buy Nova? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: IPG Photonics (NASDAQ:IPGP)

Both a designer and manufacturer of its products, IPG Photonics (NASDAQ:IPGP) is a provider of high-performance fiber lasers used for cutting, welding, and processing raw materials.

IPG Photonics reported revenues of $257.6 million, down 24.2% year on year, in line with analysts’ expectations. It was a weak quarter for the company with underwhelming revenue guidance for the next quarter.

IPG Photonics posted the slowest revenue growth in the group. As expected, the stock is down 25.8% since the results and currently trades at $65.

Read our full analysis of IPG Photonics’s results here.

Teradyne (NASDAQ:TER)

Sporting most major chip manufacturers as its customers, Teradyne (NASDAQ:TER) is a US-based supplier of automated test equipment for semiconductors as well as other technologies and devices.

Teradyne reported revenues of $729.9 million, up 6.6% year on year, surpassing analysts’ expectations by 4.1%. Revenue aside, it was a solid quarter for the company with a significant improvement in its inventory levels and an impressive beat of analysts’ EPS estimates.

The stock is down 12% since reporting and currently trades at $126.06.

Read our full, actionable report on Teradyne here, it’s free.

FormFactor (NASDAQ:FORM)

With customers across the foundry and fabless markets, FormFactor (NASDAQ:FORM) is a US-based provider of test and measurement technologies for semiconductors.

FormFactor reported revenues of $197.5 million, up 26.7% year on year, surpassing analysts’ expectations by 1.3%. More broadly, it was an exceptional quarter for the company with a significant improvement in its gross margin and an impressive beat of analysts’ EPS estimates.

The stock is down 21.8% since reporting and currently trades at $41.88.

Read our full, actionable report on FormFactor here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.