As Q1 earnings season comes to a close, it’s time to take stock of this quarters’ best and worst performers amongst the processors and graphics chips stocks, including Broadcom (NASDAQ:AVGO) and its peers.

The biggest demand drivers for processors (CPUs) and graphics chips at the moment are secular trends related to 5G and Internet of Things, autonomous driving, and high performance computing in the data center space, specifically around AI and machine learning. Like all semiconductor companies, digital chip makers exhibit a degree of cyclicality, driven by supply and demand imbalances and exposure to PC and Smartphone product cycles.

The 6 processors and graphics chips stocks we track reported a decent Q1; on average, revenues beat analyst consensus estimates by 2.89%, while on average next quarter revenue guidance was 0.12% above consensus. Tech stocks have had a rocky start in 2022 and while some of the processors and graphics chips stocks have fared somewhat better, they have not been spared, with share price declining 12.4% since earnings, on average.

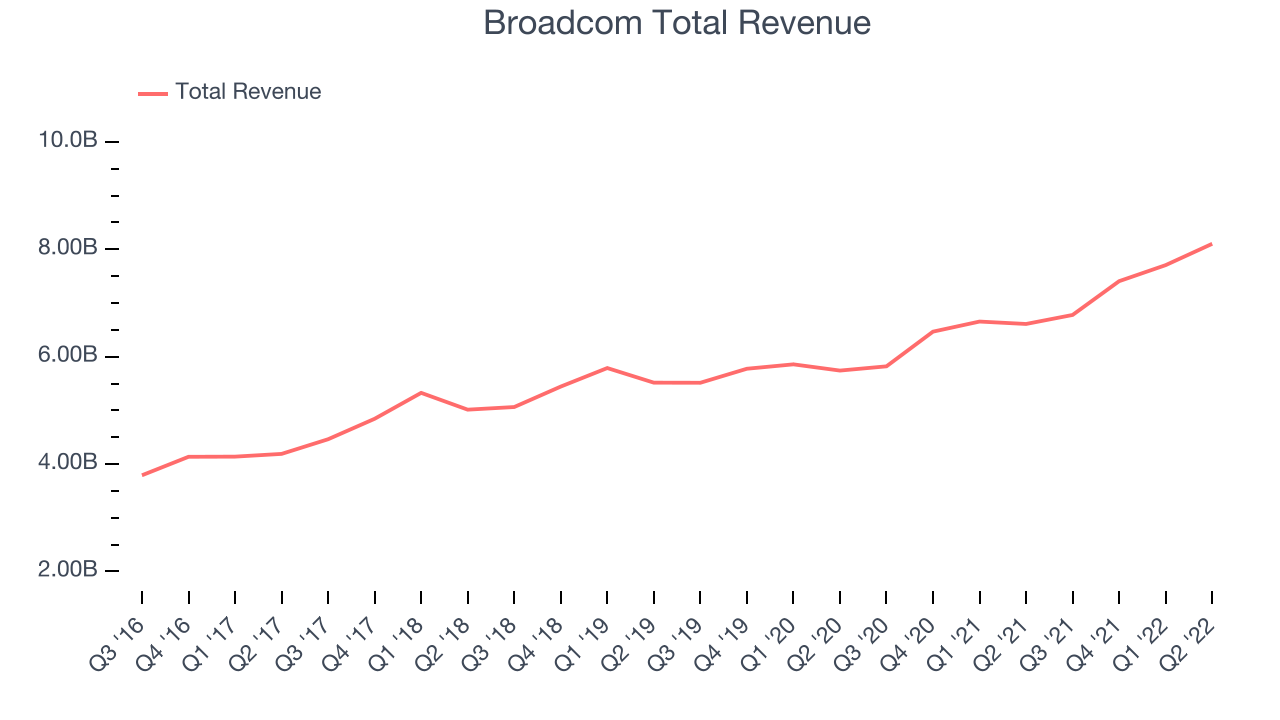

Broadcom (NASDAQ:AVGO)

Originally the semiconductor division of Hewlett Packard, Broadcom (NASDAQ:AVGO) is a semiconductor conglomerate that spans wireless, networking, data storage, and industrial end markets along with an infrastructure software business focused on mainframes and cybersecurity.

Broadcom reported revenues of $8.1 billion, up 22.5% year on year, beating analyst expectations by 2.46%. It was a decent quarter for the company, with a very optimistic guidance for the next quarter but an increase in inventory levels.

"Broadcom's second quarter revenue accelerated sequentially, and was driven by strength in networking and server storage," said Hock Tan, President and CEO of Broadcom Inc.

The stock is down 5.87% since the results and currently trades at $500.49.

Broadcom is in talks to acquire VMware for about $61 billion in cash and stock.

Is now the time to buy Broadcom? Access our full analysis of the earnings results here, it's free.

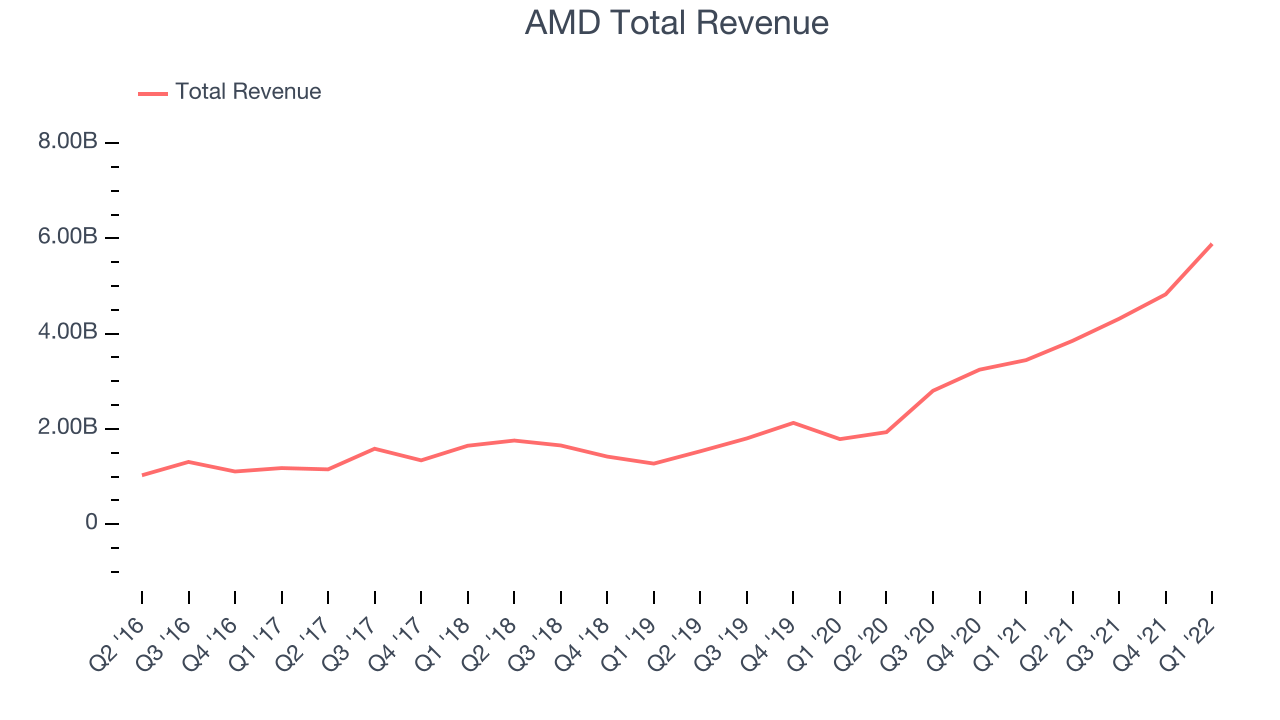

Best Q1: AMD (NASDAQ:AMD)

Founded in 1969 by a group of former Fairchild semiconductor executives led by Jerry Sanders, Advanced Micro Devices or AMD (NASDAQ:AMD) is one of the leading designers of computer processors and graphics chips used in PCs and data centers.

AMD reported revenues of $5.88 billion, up 70.8% year on year, beating analyst expectations by 5.62%. It was a very strong quarter for the company, with a beat on the bottom line and a significant improvement in operating margin.

AMD delivered the strongest analyst estimates beat, fastest revenue growth, and highest full year guidance raise among its peers. The stock is down 10% since the results and currently trades at $82.06.

Is now the time to buy AMD? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Intel (NASDAQ:INTC)

Inventor of the x86 processor that powered decades of technological innovation in PCs, data centers, and numerous other markets, Intel (NASDAQ: INTC) is the leading manufacturer of computer processors and graphics chips.

Intel reported revenues of $18.3 billion, down -6.71% year on year, in line with analyst expectations. It was a weak quarter for the company, with a slow revenue growth and an underwhelming revenue guidance for the next quarter.

Intel had the weakest performance against analyst estimates, slowest revenue growth, and weakest full year guidance update in the group. The stock is down 19.9% since the results and currently trades at $37.49.

Read our full analysis of Intel's results here.

Nvidia (NASDAQ:NVDA)

Founded in 1993 by Jensen Huang and two former Sun Microsystems engineers, Nvidia (NASDAQ:NVDA) is a leading fabless designer of chips used in gaming, PCs, data centers, automotive, and a variety of end markets.

Nvidia reported revenues of $8.28 billion, up 46.4% year on year, beating analyst expectations by 2.4%. Despite the solid top-line results, it was a weaker quarter for the company, with an underwhelming revenue guidance for the next quarter and an increase in inventory levels.

The stock is down 7.98% since the results and currently trades at $156.18.

Read our full, actionable report on Nvidia here, it's free.

Qualcomm (NASDAQ:QCOM)

Having been at the forefront of developing the standards for cellular connectivity for over four decades, Qualcomm (NASDAQ:QCOM), is a leading innovator and a fabless manufacturer of wireless technology chips used in smartphones, autos and internet of things appliances.

Qualcomm reported revenues of $11.1 billion, up 40.6% year on year, beating analyst expectations by 5.32%. It was a very strong quarter for the company, with a beat on the bottom line.

The stock is down 10.1% since the results and currently trades at $121.50.

Read our full, actionable report on Qualcomm here, it's free.

The author has no position in any of the stocks mentioned