Fabless chip and software maker Broadcom (NASDAQ:AVGO) beat analysts' expectations in Q1 FY2024, with revenue up 34.2% year on year to $11.96 billion. The company expects the full year's revenue to be around $50 billion, in line with analysts' estimates. It made a non-GAAP profit of $10.99 per share, improving from its profit of $10.33 per share in the same quarter last year.

Broadcom (AVGO) Q1 FY2024 Highlights:

- Revenue: $11.96 billion vs analyst estimates of $11.72 billion (2.1% beat)

- EPS (non-GAAP): $10.99 vs analyst estimates of $10.42 (5.4% beat)

- The company reconfirmed its revenue guidance for the full year of $50 billion at the midpoint

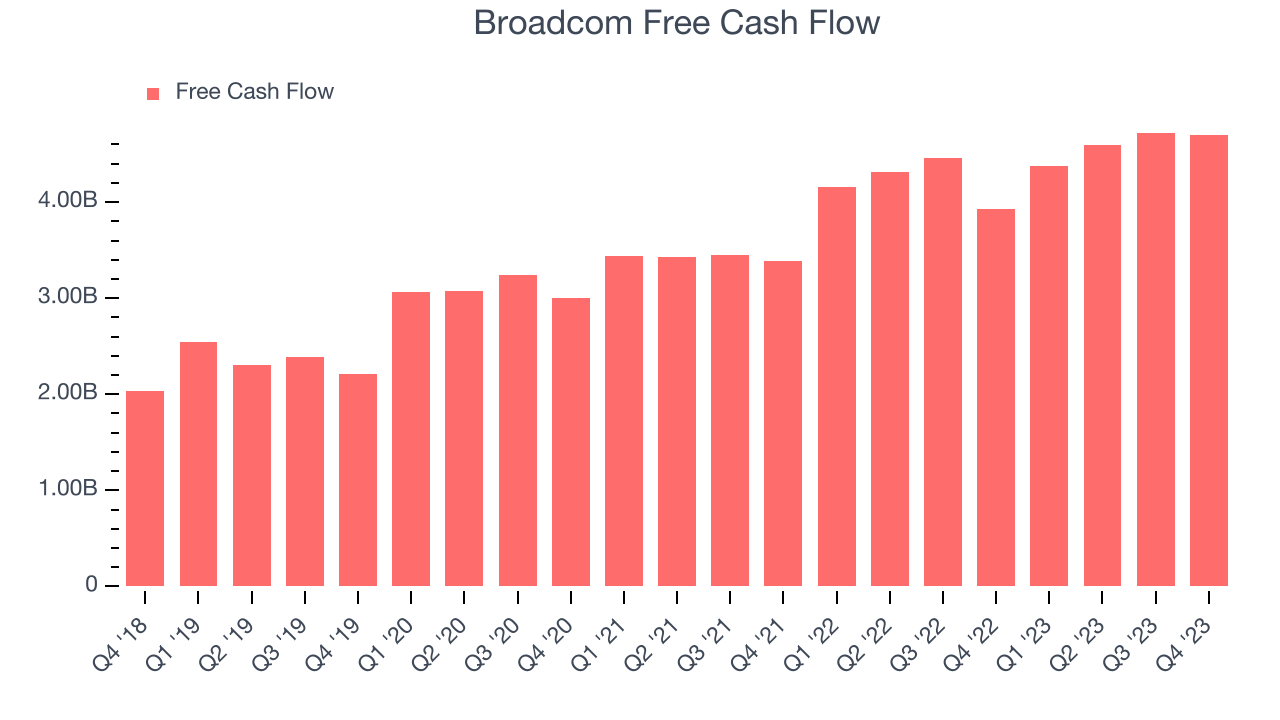

- Free Cash Flow of $4.69 billion, similar to the previous quarter

- Inventory Days Outstanding: 38, down from 71 in the previous quarter

- Gross Margin (GAAP): 61.7%, down from 73.4% in the same quarter last year

- Market Capitalization: $625.6 billion

Originally the semiconductor division of Hewlett Packard, Broadcom (NASDAQ:AVGO) is a semiconductor conglomerate that spans wireless, networking, data storage, and industrial end markets along with an infrastructure software business focused on mainframes and cybersecurity.

Today’s Broadcom traces its roots to the chip division of Agilent Technologies, which was acquired by private equity giants KKR and Silver Lake in 2005, renamed Avago and put under the guidance of CEO Hock Tan. Since 2005, its strategy has been to acquire leading infrastructure technology providers, and improve their margins and FCF by integrating their back office and sales functions into its platform and running the businesses with an emphasis on profitability over growth at any cost.

Over time, the acquired companies diversified Broadcom’s business model and the improved free cash flow provides the capital for further acquisitions. In the past decade Hock Tan’s Avago has spent over $70 billion acquiring CYOptics, LSI, Emulex, Broadcom (whose name it adopted), Brocade, CA, and Symantec’s enterprise security business.

Broadcom’s semiconductor business provides chips used in smartphones, data centers, set top boxes, servers, telecom, and networking systems. Its software business focuses on infrastructure and security, with key businesses in database, application development, endpoint security, and identity management.

Broadcom’s peers and competitors in semiconductors include Analog Devices (NASDAQ: ADI), Cisco Systems (NASDAQ: CSCO), Intel (NASDAQ:INTC), MediaTek (TWSE:2454), Marvell Technology (NASDAQ:MRVL), NXP Semiconductors NV (NASDAQ:NXPI), Qualcomm (NASDAQ:QCOM), Qorvo (NASDAQ: QRVO), and Skyworks (NASDAQ:SWKS). Its software rivals are Atlassian (NASDAQ:TEAM), CrowdStrike (NASDAQ:CRWD), IBM (NYSE:IBM), Oracle (NYSE:ORCL), ServiceNow (NASDAQ:NOW), Splunk (NASDAQ:SPLK), and VMware (NYSE: VMW).Processors and Graphics Chips

Chips need to keep getting smaller in order to advance on Moore’s law, and that is proving increasingly more complicated and expensive to achieve with time. That has caused most digital chip makers to become “fabless” designers, rather than manufacturers, instead relying on contracted foundries like TSMC to manufacture their designs. This has benefitted the digital chip makers’ free cash flow margins, as exiting the manufacturing business has removed large cash expenses from their business models.

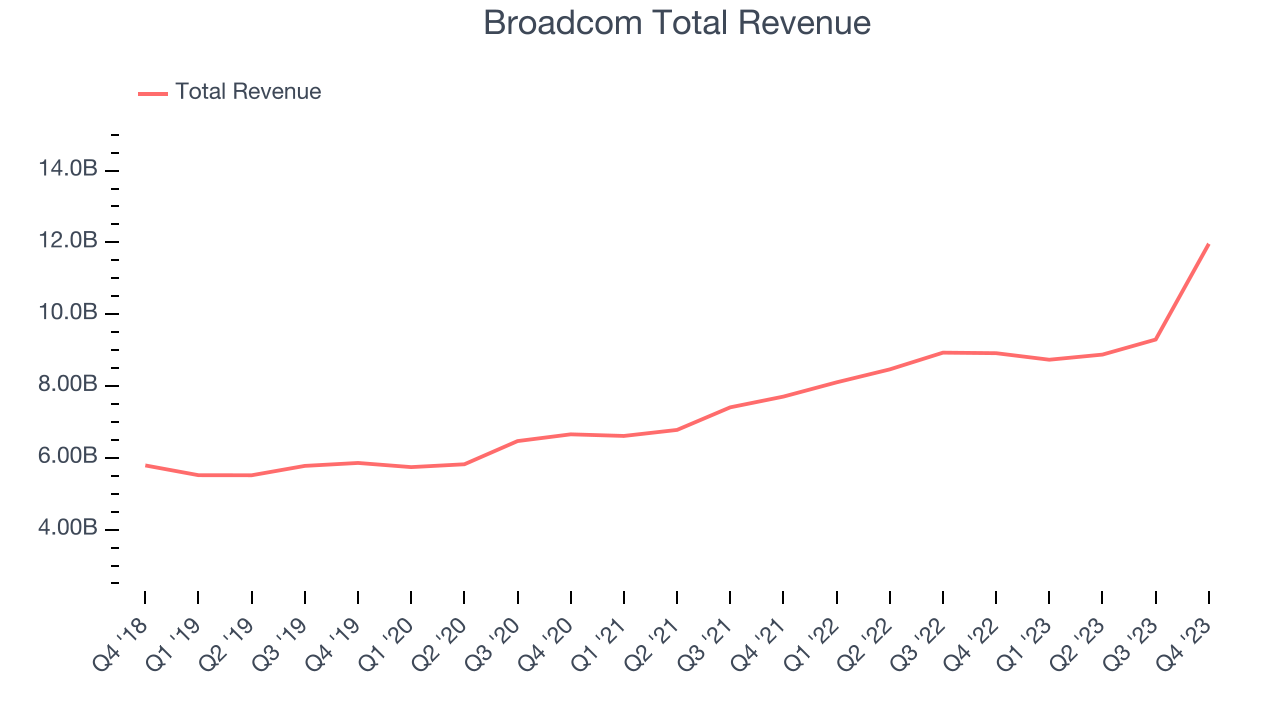

Sales Growth

Broadcom's revenue growth over the last three years has been mediocre, averaging 16.4% annually. But as you can see below, this quarter wasn't particularly strong, with revenue growing from $8.92 billion in the same quarter last year to $11.96 billion. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

Broadcom had a strong quarter as its revenue grew 34.2% year on year, topping analysts' estimates by 2.1%.

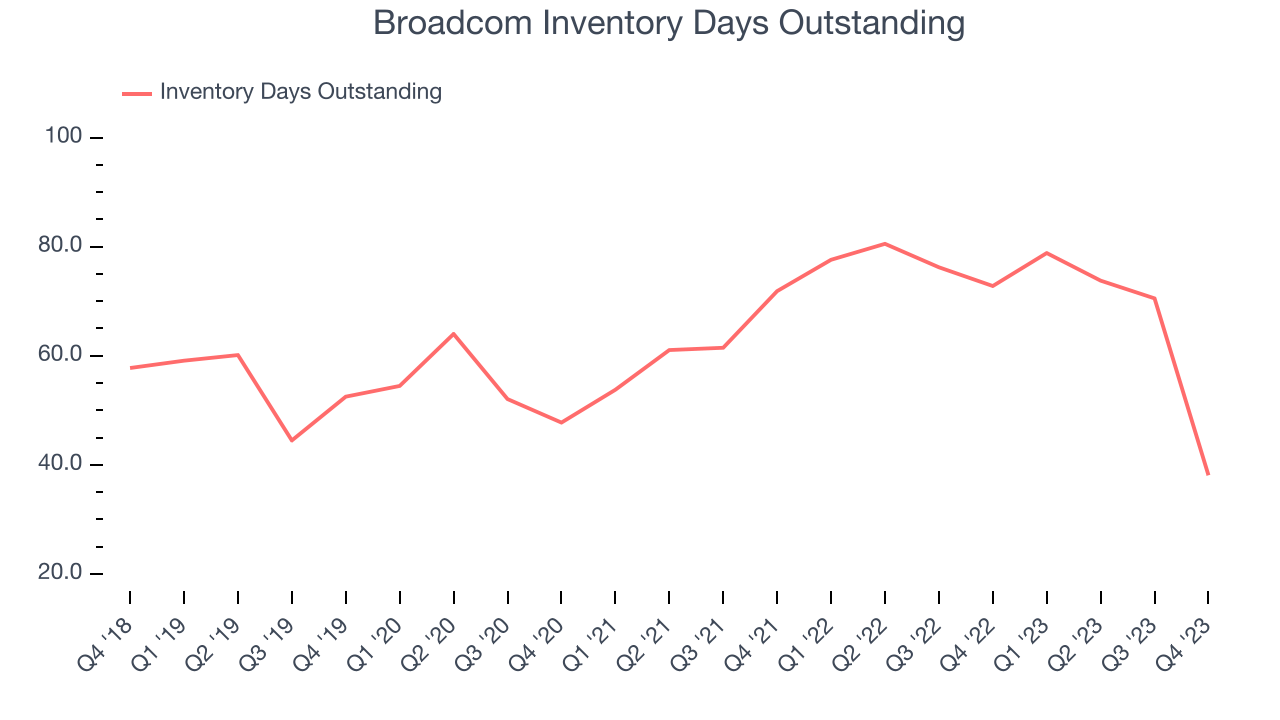

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business' capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Broadcom's DIO came in at 38, which is 24 days below its five-year average. At the moment, these numbers show no indication of an excessive inventory buildup.

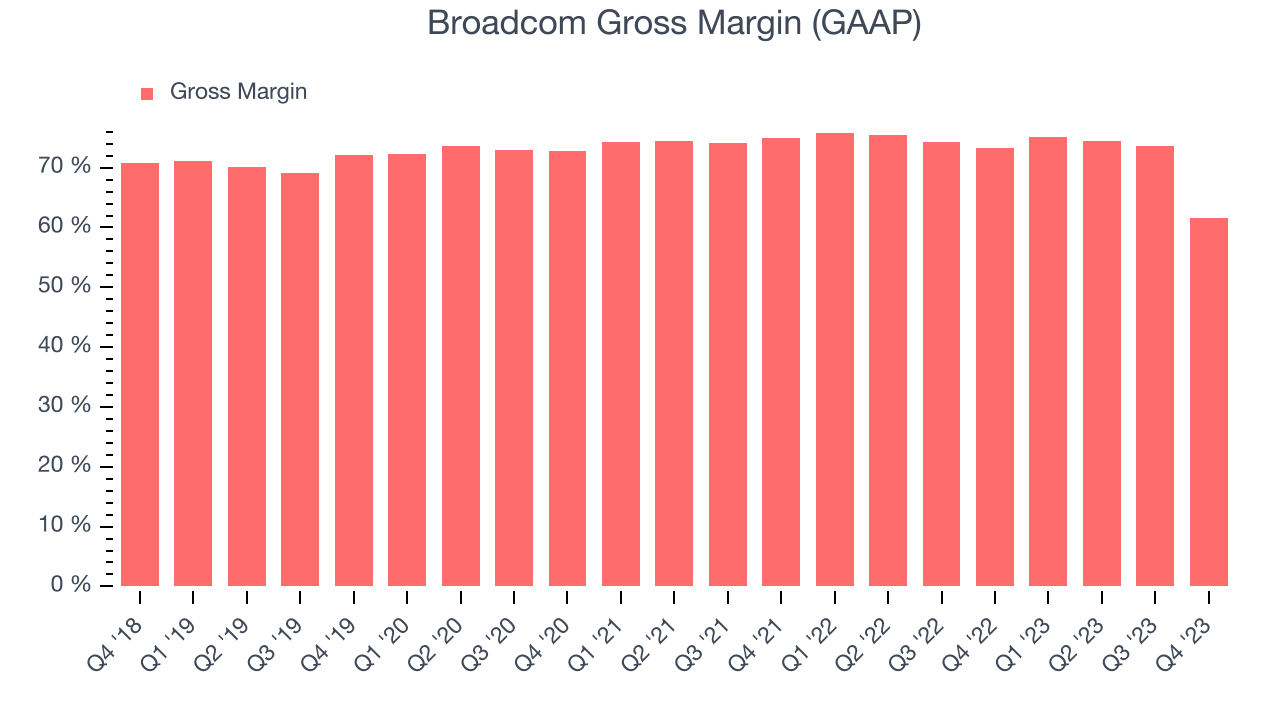

Pricing Power

In the semiconductor industry, a company's gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor. Broadcom's gross profit margin, which shows how much money the company gets to keep after paying key materials, input, and manufacturing costs, came in at 61.7% in Q1, down 11.7 percentage points year on year.

Gross margins have been trending down over the last year, averaging 70.5%. However, Broadcom's elite margins are some of the best in the semiconductor industry, driven by strong pricing power from its differentiated, value-add products.

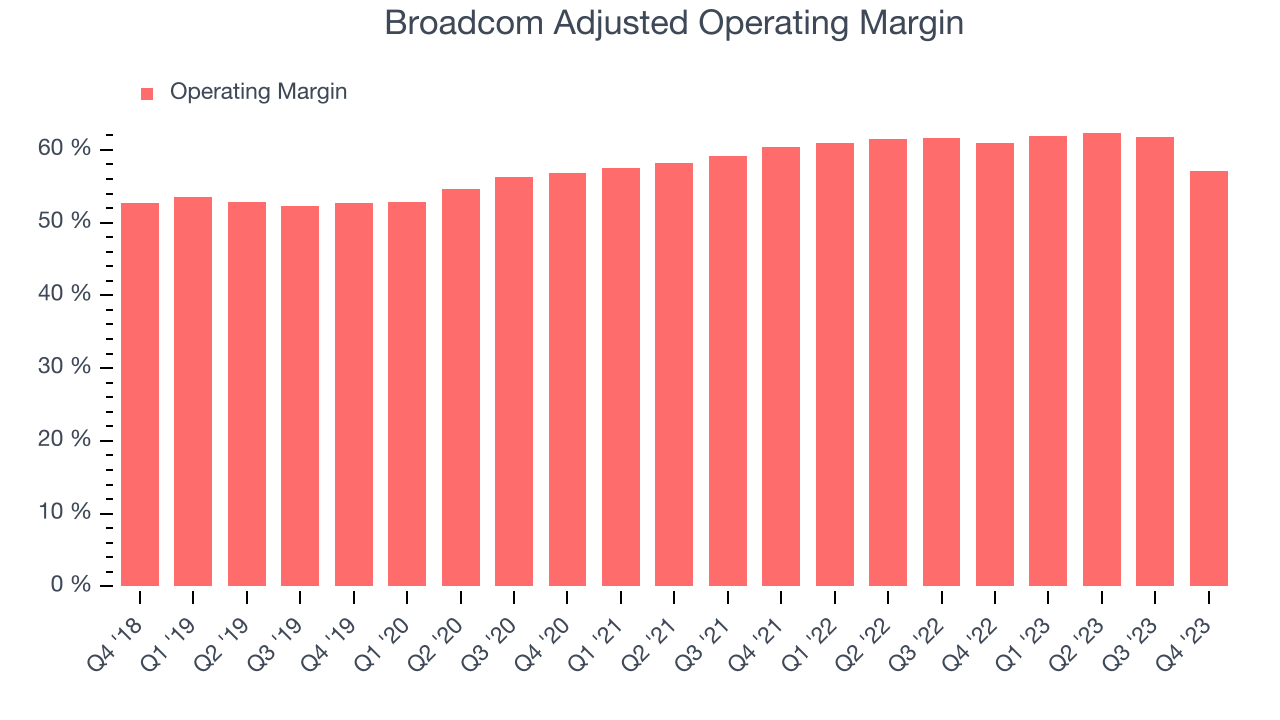

Profitability

Broadcom reported an operating margin of 57.1% in Q1, down 3.8 percentage points year on year. Operating margins are one of the best measures of profitability because they tell us how much money a company takes home after manufacturing its products, marketing and selling them, and, importantly, keeping them relevant through research and development.

Broadcom's operating margins have been stable over the last year, averaging 60.5%. Furthermore, the company's margins are higher than most in the semiconductor industry, showcasing how efficiently the business is managed.

Earnings, Cash & Competitive Moat

Analysts covering Broadcom expect earnings per share to grow 17% over the next 12 months, although estimates will likely change after earnings.

Although earnings are important, we believe cash is king because you can't use accounting profits to pay the bills. Broadcom's free cash flow came in at $4.69 billion in Q1, up 19.3% year on year.

As you can see above, Broadcom produced $18.39 billion in free cash flow over the last 12 months, an eye-popping 47.3% of revenue. This is a great result; Broadcom's free cash flow conversion places it among the best semiconductor companies and, if sustainable, puts the company in an advantageous position to invest in new products while remaining resilient during industry downturns.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Although Broadcom has shown solid business quality lately, it historically did a subpar job investing in profitable business initiatives. Its five-year average ROIC was 16.5%, somewhat low compared to the best semiconductor companies that consistently pump out 35%+.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last two years, Broadcom's ROIC averaged 15.3 percentage point increases each year. The company's rising ROIC is a good sign and could suggest its competitive advantage or profitable business opportunities are expanding.

Key Takeaways from Broadcom's Q1 Results

We were impressed by Broadcom's strong improvement in inventory levels. We were also excited its revenue and EPS outperformed Wall Street's estimates. On the other hand, its gross margin significantly fell, raising a yellow flag (although not perfect comparisons, Nvidia saw a big increase in its gross margin while AMD and Qualcomm's were flat). Looking ahead, its full-year 2024 revenue and EPS were in line with estimates. We think this was still a decent, albeit mixed, quarter, showing that the company is staying on track. The market was likely expecting more, and the stock is down 3.3% after reporting, trading at $1,358 per share.

Is Now The Time?

When considering an investment in Broadcom, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

There are numerous reasons why we think Broadcom is one of the best semiconductor companies out there. For starters, its revenue growth has been solid over the last three years, and its growth over the next 12 months is expected to exceed that. Additionally, its powerful free cash generation enables it to sustainably invest in growth initiatives while maintaining an ample cash cushion, and its impressive gross margins indicate robust pricing power.

Broadcom's price-to-earnings ratio based on the next 12 months is 28.0x. Looking at the semiconductors landscape today, Broadcom's qualities really stand out, and we really like it at this price.

Wall Street analysts covering the company had a one-year price target of $1,258 per share right before these results (compared to the current share price of $1,358).

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.