Avocado company Mission Produce (NASDAQ:AVO) announced better-than-expected results in Q1 CY2024, with revenue up 34.6% year on year to $297.6 million. It made a non-GAAP profit of $0.14 per share, improving from its loss of $0.07 per share in the same quarter last year.

Is now the time to buy Mission Produce? Find out by accessing our full research report, it's free.

Mission Produce (AVO) Q1 CY2024 Highlights:

- Revenue: $297.6 million vs analyst estimates of $226.5 million (31.4% beat)

- EPS (non-GAAP): $0.14 vs analyst estimates of -$0.01 ($0.15 beat)

- Gross Margin (GAAP): 10.4%, up from 8.2% in the same quarter last year

- Free Cash Flow was -$4.8 million compared to -$400,000 in the previous quarter

- Sales Volumes rose 8% year on year (19% in the same quarter last year)

- Market Capitalization: $818.3 million

“We are pleased to deliver a second consecutive quarter of record adjusted EBITDA results, demonstrating continued strong momentum in per-unit margins which resulted in a $12.6 million or 166% improvement in our adjusted EBITDA performance, versus prior year,” commented Steve Barnard, CEO of Mission.

Founded in 1983 in California, Mission Produce (NASDAQ:AVO) grows, packages, and distributes avocados.

Perishable Food

The perishable food industry is diverse, encompassing large-scale producers and distributors to specialty and artisanal brands. These companies sell produce, dairy products, meats, and baked goods and have become integral to serving modern American consumers who prioritize freshness, quality, and nutritional value. Investing in perishable food stocks presents both opportunities and challenges. While the perishable nature of products can introduce risks related to supply chain management and shelf life, it also creates a constant demand driven by the necessity for fresh food. Companies that can efficiently manage inventory, distribution, and quality control are well-positioned to thrive in this competitive market. Navigating the perishable food industry requires adherence to strict food safety standards, regulations, and labeling requirements.

Sales Growth

Mission Produce is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale.

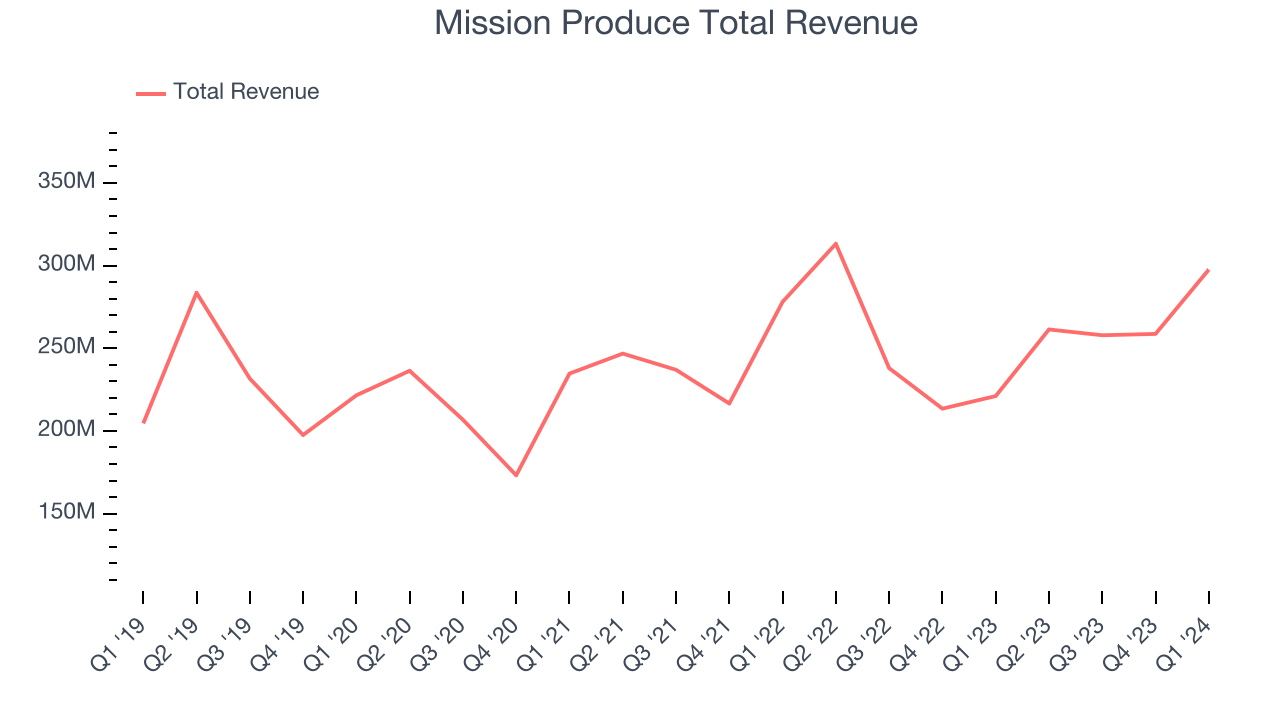

As you can see below, the company's annualized revenue growth rate of 8.1% over the last three years was decent for a consumer staples business.

This quarter, Mission Produce reported wonderful year-on-year revenue growth of 34.6%, and its $297.6 million in revenue exceeded Wall Street's estimates by 31.4%. Looking ahead, Wall Street expects revenue to decline 5.6% over the next 12 months, a deceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Volume Growth

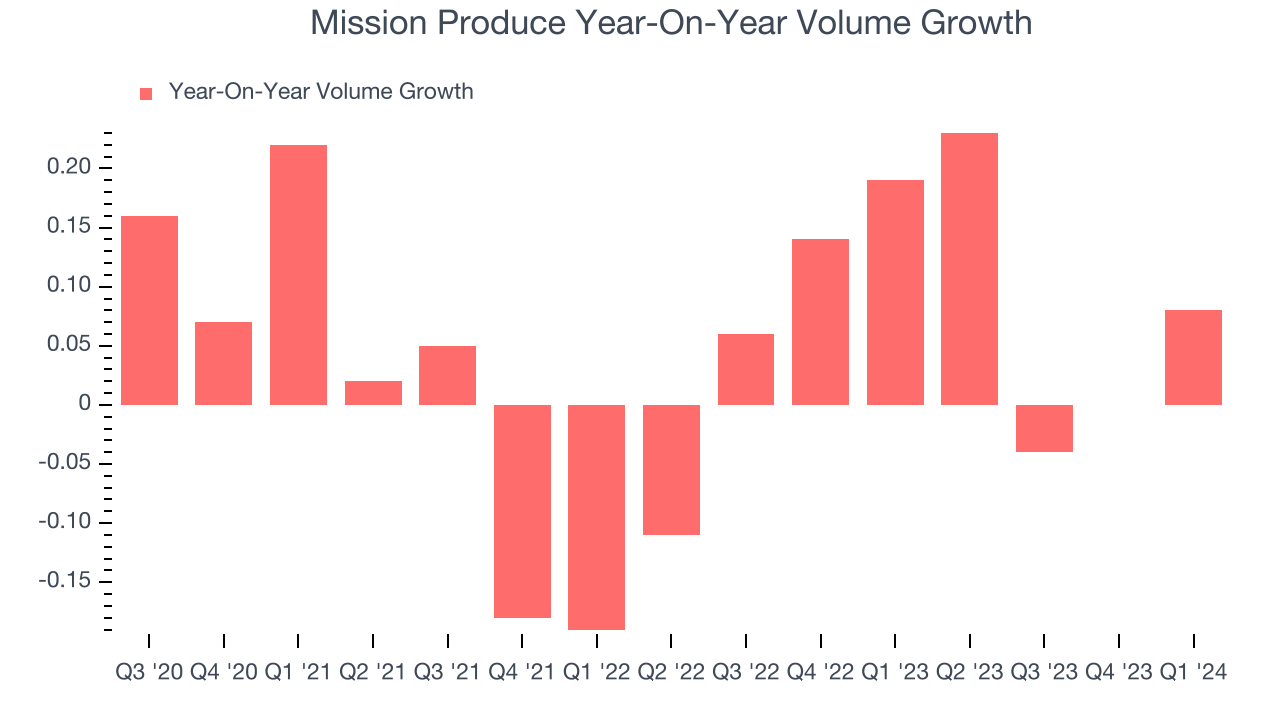

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Mission Produce's average quarterly volume growth was a robust 6.9% over the last two years. This is good because meaningful volume growth is hard to come by in the stable consumer staples sector.

In Mission Produce's Q1 2024, sales volumes jumped 8% year on year. By the company's standards, this result was a meaningful deceleration from the 19% year-on-year increase it posted 12 months ago. We'll be watching Mission Produce closely to see if it can reaccelerate demand for its products.

Key Takeaways from Mission Produce's Q1 Results

We were impressed by how significantly Mission Produce blew past analysts' EPS expectations this quarter. We were also excited its gross margin outperformed Wall Street's estimates. Zooming out, we think this was a great quarter that shareholders will appreciate. The stock is up 8.6% after reporting and currently trades at $12.40 per share.

Mission Produce may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.