Avocado company Mission Produce (NASDAQ:AVO) beat analysts' expectations in Q1 FY2024, with revenue up 21.2% year on year to $258.7 million. It made a non-GAAP profit of $0.09 per share, improving from its loss of $0.07 per share in the same quarter last year.

Mission Produce (AVO) Q1 FY2024 Highlights:

- Revenue: $258.7 million vs analyst estimates of $210.8 million (22.8% beat)

- EPS (non-GAAP): $0.09 vs analyst estimates of -$0.07 ($0.16 beat)

- Gross Margin (GAAP): 11.1%, up from 4.5% in the same quarter last year

- Free Cash Flow was -$400,000, down from $33.7 million in the previous quarter

- Market Capitalization: $780 million

Founded in 1983 in California, Mission Produce (NASDAQ:AVO) grows, packages, and distributes avocados.

The company began as a small and modest avocado distributor. Over time, however, Mission Produce grew organically and also capitalized on strategic acquisitions of avocado farms and processing plants that allowed the company to cement itself as a vertically-integrated and dominant player in the industry.

The product is self explanatory, but Mission Produce differentiates itself with the scale and technology that allows their product to reach consumers in near-peak or peak condition. Because let’s be honest, no one likes that rock-hard green avocado that takes a long time to ripen, and on the other side of the coin, no one likes an over-ripened or rotten avocado either.

The core customer tends to be a health conscious shopper, although avocados are making their way more into the mainstream through Mexican dishes, salads, and avocado toast. Mission Produce’s offering can be found in many locations selling fresh fruit and vegetables including supermarkets, club stores, and large-format general merchandise retailers that have grocery sections.

Packaged Food

Packaged food stocks are considered resilient investments because people always need to eat. These companies therefore can enjoy consistent demand as long as they stay on top of changing consumer preferences. But consumer preferences can be a double-edged sword, as companies that aren't at the front of trends such as health and wellness and natural ingredients can fall behind. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Competitors in the avocado industry include Calavo Growers (NASDAQ:CVGW), private company West Pak Avocado, and some smaller, independent growers and distributors.Sales Growth

Mission Produce is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale.

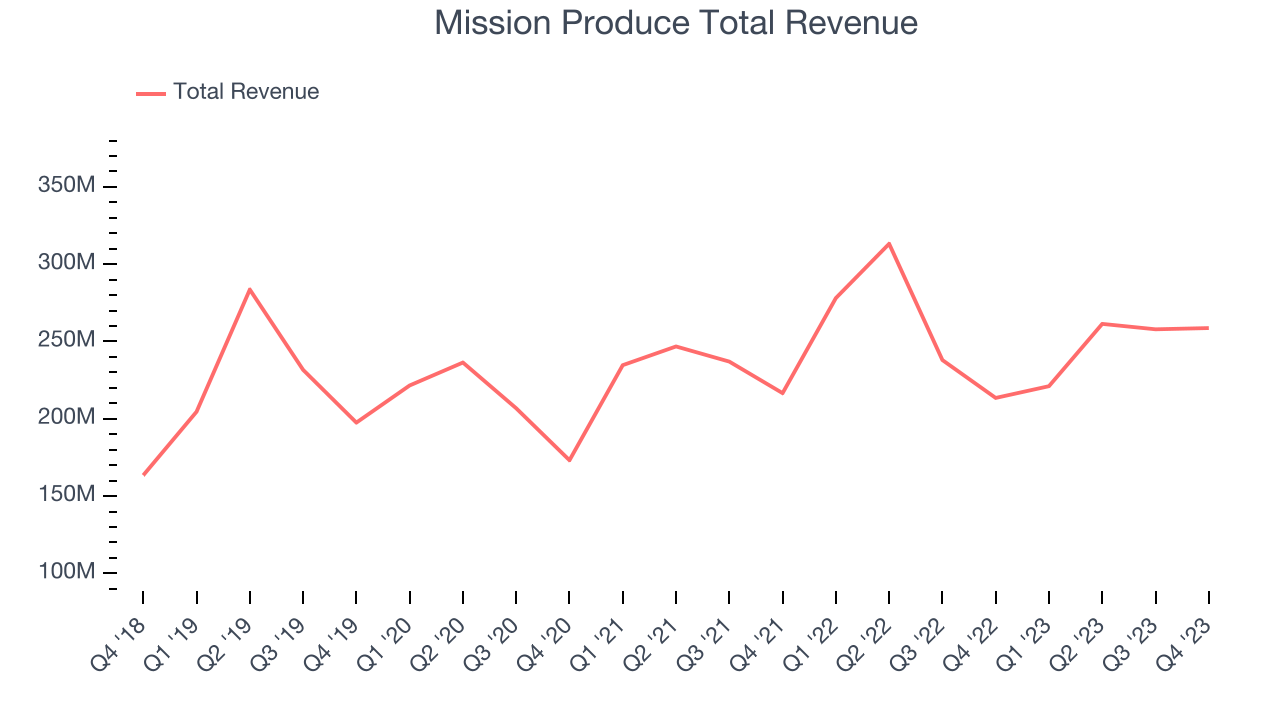

As you can see below, the company's annualized revenue growth rate of 6% over the last three years was mediocre for a consumer staples business.

This quarter, Mission Produce reported remarkable year-on-year revenue growth of 21.2%, and its $258.7 million in revenue topped Wall Street estimates by 22.8%. Looking ahead, Wall Street expects revenue to decline 2.6% over the next 12 months, a deceleration from this quarter.

Volume Growth

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

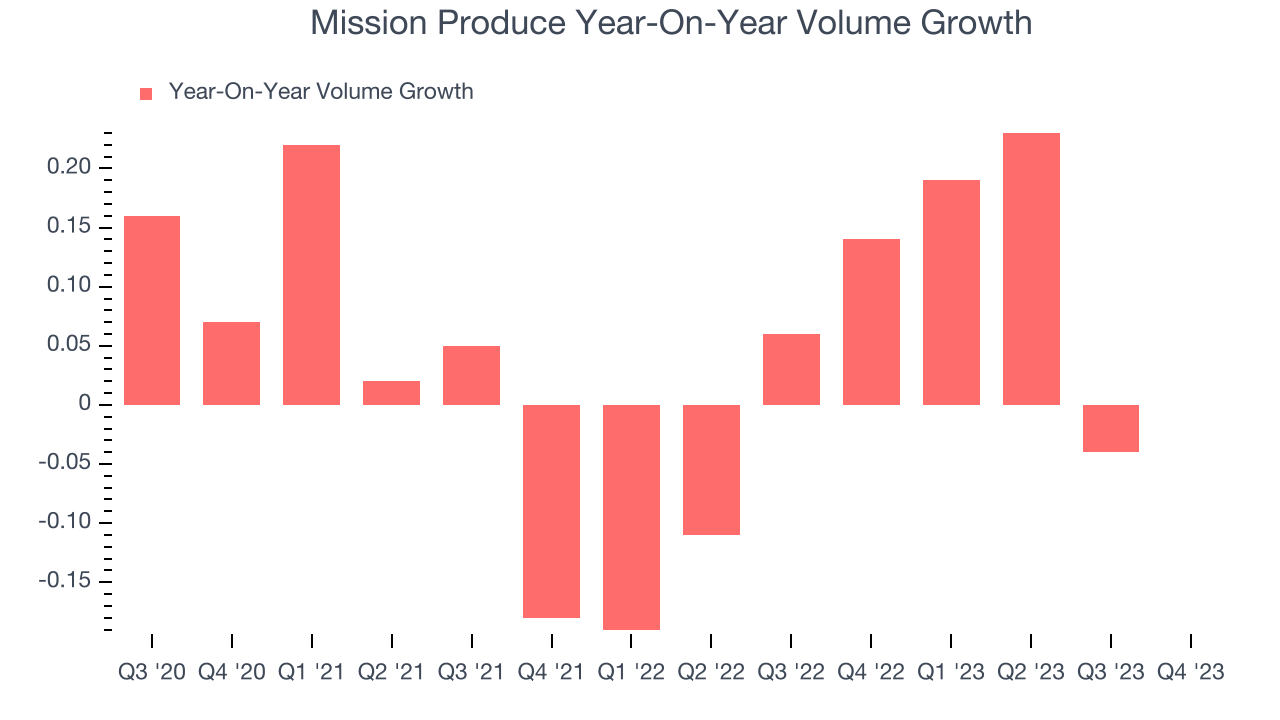

Mission Produce's average quarterly volume growth was a healthy 3.5% over the last two years. This is pleasing because it shows consumers are purchasing more of its products.

In Mission Produce's Q1 2024, year on year sales volumes were flat. By the company's standards, this result was a meaningful deceleration from the 14% year-on-year increase it posted 12 months ago. We'll be watching Mission Produce closely to see if it can reaccelerate demand for its products.

Gross Margin & Pricing Power

We prefer higher gross margins because they make it easier to generate more operating profits.

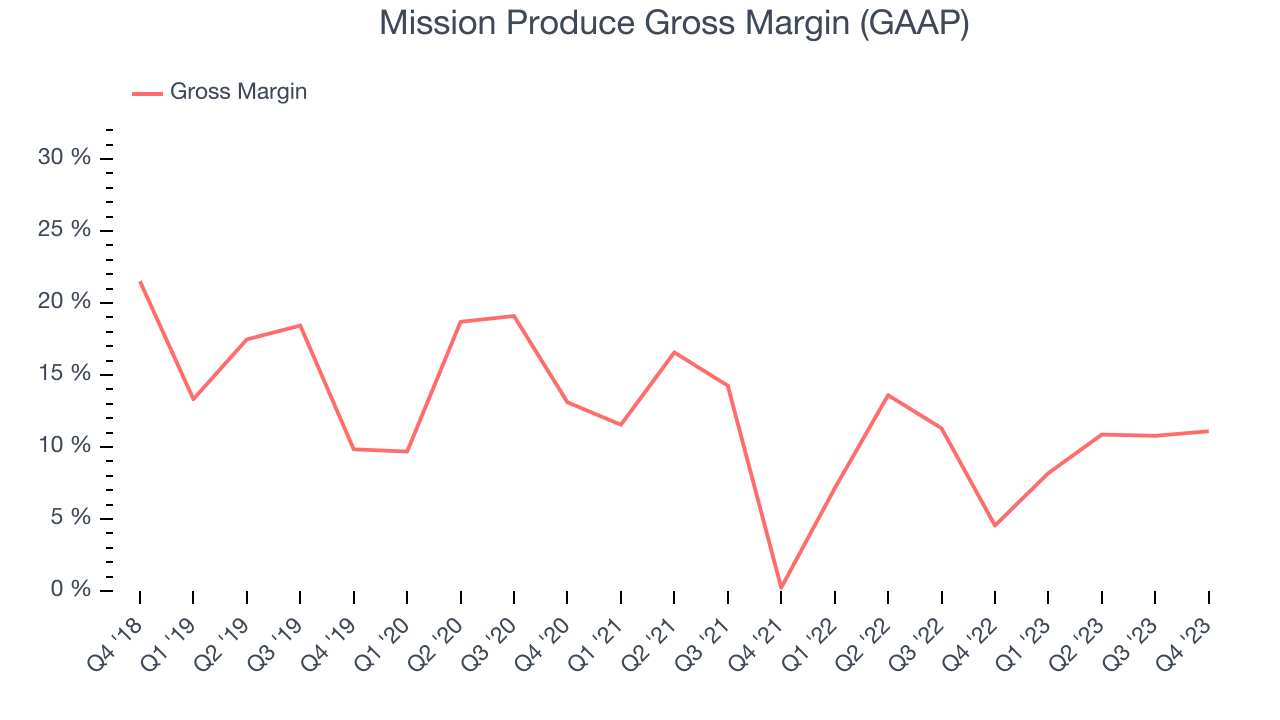

Mission Produce's gross profit margin came in at 11.1% this quarter, up 6.6 percentage points year on year. That means for every $1 in revenue, a chunky $0.89 went towards paying for raw materials, production of goods, and distribution expenses.

Mission Produce has poor unit economics for a consumer staples company, leaving it with little room for error if things go awry. As you can see above, it's averaged a paltry 9.9% gross margin over the last two years. Its margin, however, has been trending up over the last 12 months, averaging 33.6% year-on-year increases each quarter. If this trend continues, it could suggest a less competitive environment.

Operating Margin

Operating margin is a key profitability metric for companies because it accounts for all expenses enabling a business to operate smoothly, including marketing and advertising, IT systems, wages, and other administrative costs.

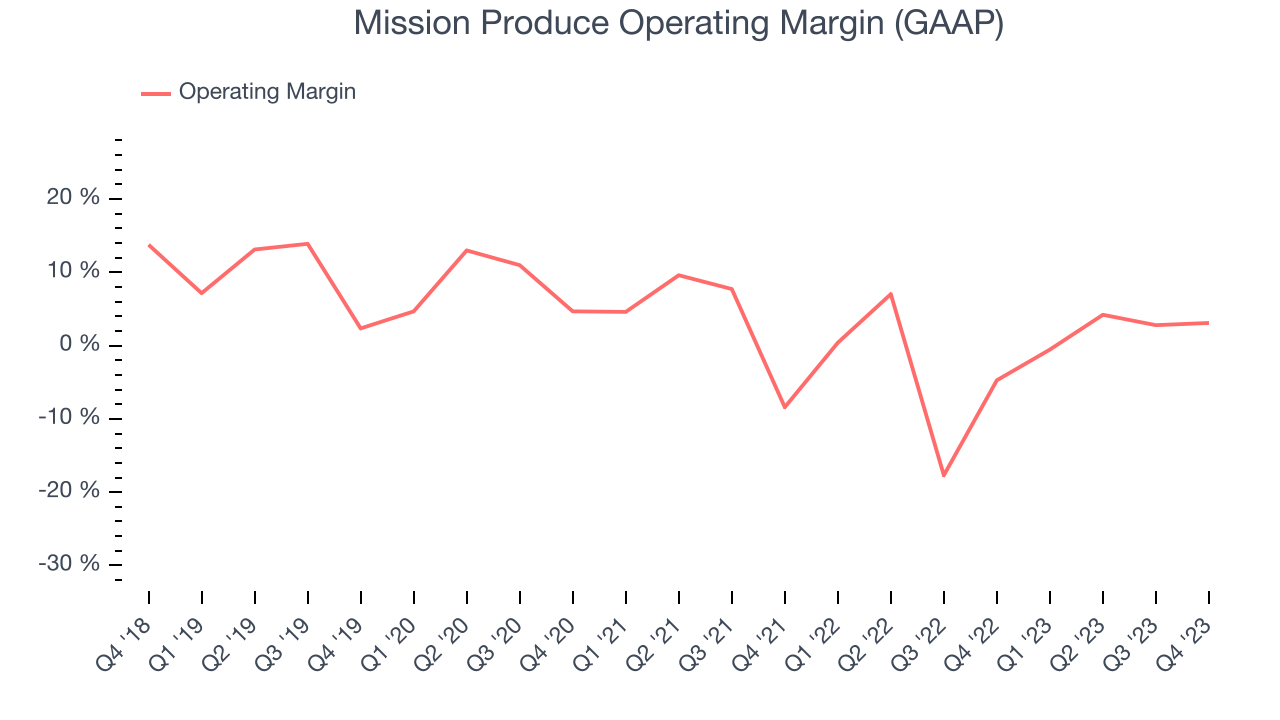

In Q1, Mission Produce generated an operating profit margin of 3.1%, up 7.8 percentage points year on year. This increase was encouraging, and we can infer Mission Produce was more efficient with its expenses because its operating margin expanded more than its gross margin.

Zooming out, Mission Produce was roughly breakeven when averaging the last two years of quarterly operating profits, weak for a consumer staples business. However, its margin has improved by 5.3 percentage points on average over the last year, an encouraging sign for shareholders. The tide could be turning.

Zooming out, Mission Produce was roughly breakeven when averaging the last two years of quarterly operating profits, weak for a consumer staples business. However, its margin has improved by 5.3 percentage points on average over the last year, an encouraging sign for shareholders. The tide could be turning.EPS

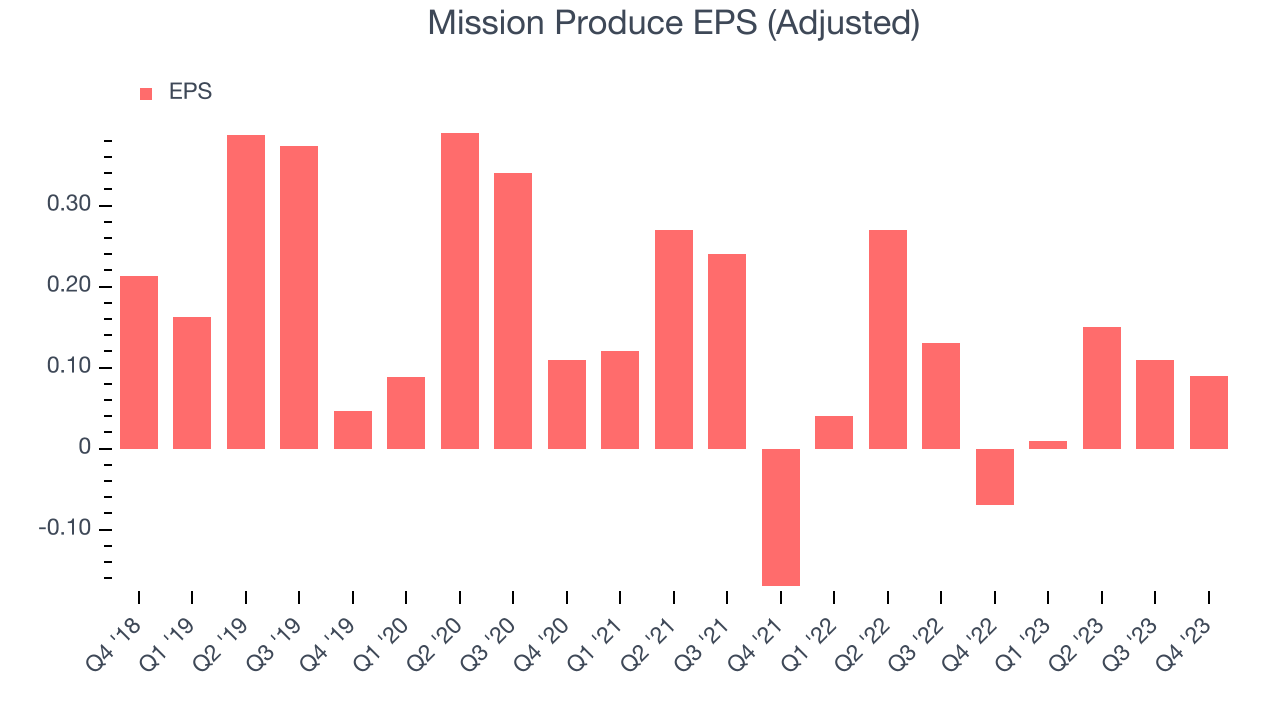

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

In Q1, Mission Produce reported EPS at $0.09, up from negative $0.07 in the same quarter a year ago. This print easily cleared Wall Street's estimates, and shareholders should be content with the results.

Between FY2021 and FY2024, Mission Produce's EPS dropped 61.2%, translating into 27.1% annualized declines. We tend to steer our readers away from companies with falling EPS, especially in the consumer staples sector, where shrinking earnings could imply changing secular trends or consumer preferences. If there's no earnings growth, it's difficult to build confidence in a business's underlying fundamentals, leaving a low margin of safety around the company's valuation (making the stock susceptible to large downward swings).

Wall Street expects Mission Produce to continue performing poorly over the next 12 months, with analysts projecting an average 30.6% year-on-year decline in EPS.

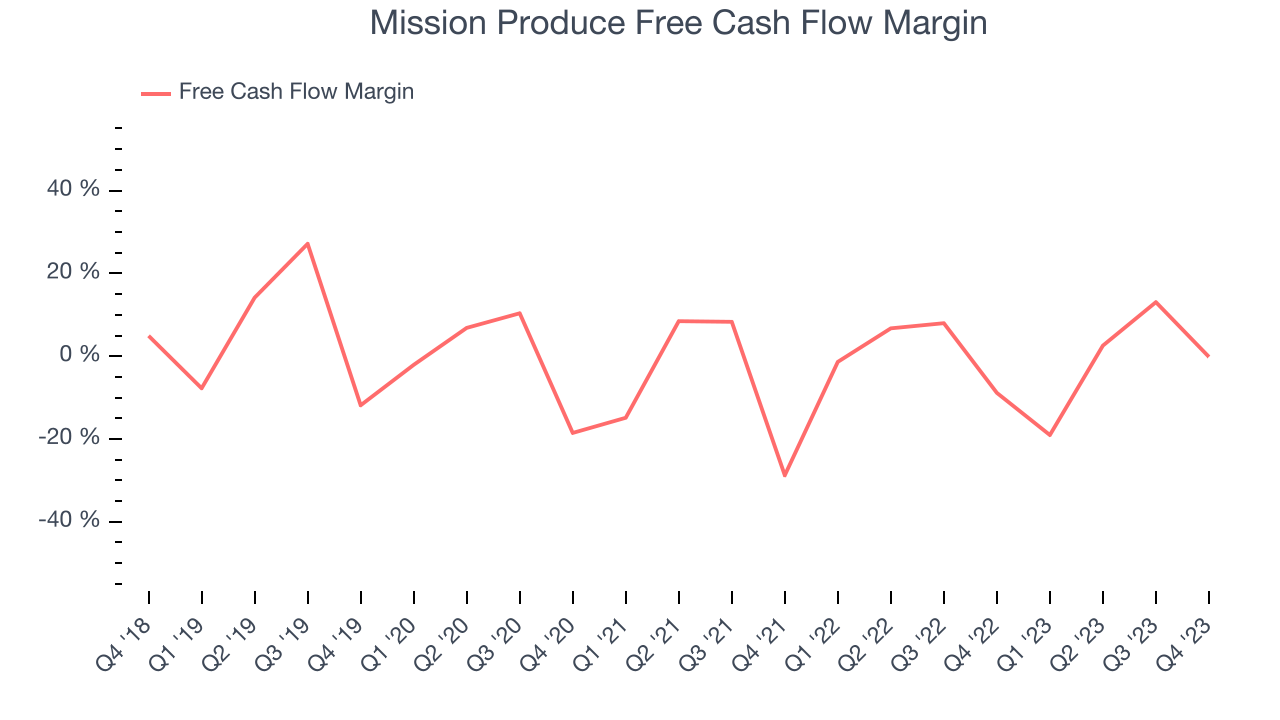

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Mission Produce broke even from a free cash flow perspective in Q1. This quarter's result was great for the business as its margin was 8.7 percentage points higher than in the same period last year.

Over the last eight quarters, Mission Produce has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 0.7%, subpar for a consumer staples business. Furthermore, its margin has averaged year-on-year declines of 1.9 percentage points over the last 12 months.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Mission Produce's five-year average ROIC was 3.2%, somewhat low compared to the best consumer staples companies that consistently pump out 20%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Mission Produce's ROIC over the last two years averaged 8.8 percentage point decreases each year. In conjunction with its already low returns, these declines suggest the company's profitable business opportunities are few and far between.

Key Takeaways from Mission Produce's Q1 Results

We were impressed by how significantly Mission Produce blew past analysts' revenue and EPS expectations this quarter. We were also excited its gross margin outperformed Wall Street's estimates. Management is pleased with recent performance, specifically margins, adding that "The team’s focus resulted in significantly improved per-unit margins, which translated to nearly 700 basis points of gross margin expansion and resulted in a significant improvement in adjusted EBITDA performance year-over-year." Zooming out, we think this was an impressive quarter that should delight shareholders. The stock is up 5.9% after reporting and currently trades at $11.33 per share.

Is Now The Time?

Mission Produce may have had a good quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Mission Produce, we'll be cheering from the sidelines. Its revenue growth has been mediocre over the last three years, and analysts expect growth to deteriorate from here. And while its volume growth has outpaced the broader consumer staples sector, the downside is its declining EPS over the last three years makes it hard to trust. On top of that, its projected EPS for the next year is lacking.

Mission Produce's price-to-earnings ratio based on the next 12 months is 42.8x. While we've no doubt one can find things to like about Mission Produce, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $12.25 per share right before these results (compared to the current share price of $11.33).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.