As software development stocks’ Q4 earnings season wraps, let's dig into this quarters’ best and worst performers, including Bandwidth (NASDAQ:BAND) and its peers.

Software is eating the world, as Marc Andreessen says, and there is virtually no industry left that has been untouched by it. That in turn drives increasing demand for tools that help software developers do their jobs, whether it is monitoring critical cloud infrastructure, integrating audio and video functionality or ensuring smooth streaming of content.

The 13 software development stocks we track reported a mixed Q4; on average, revenues beat analyst consensus estimates by 5.08%, while on average next quarter revenue guidance was 1.67% above consensus. The technology sell-off has been putting pressure on stocks since November, but software development stocks held their ground better than others, with the share price up 1.88% since earnings, on average.

Weakest Q4: Bandwidth (NASDAQ:BAND)

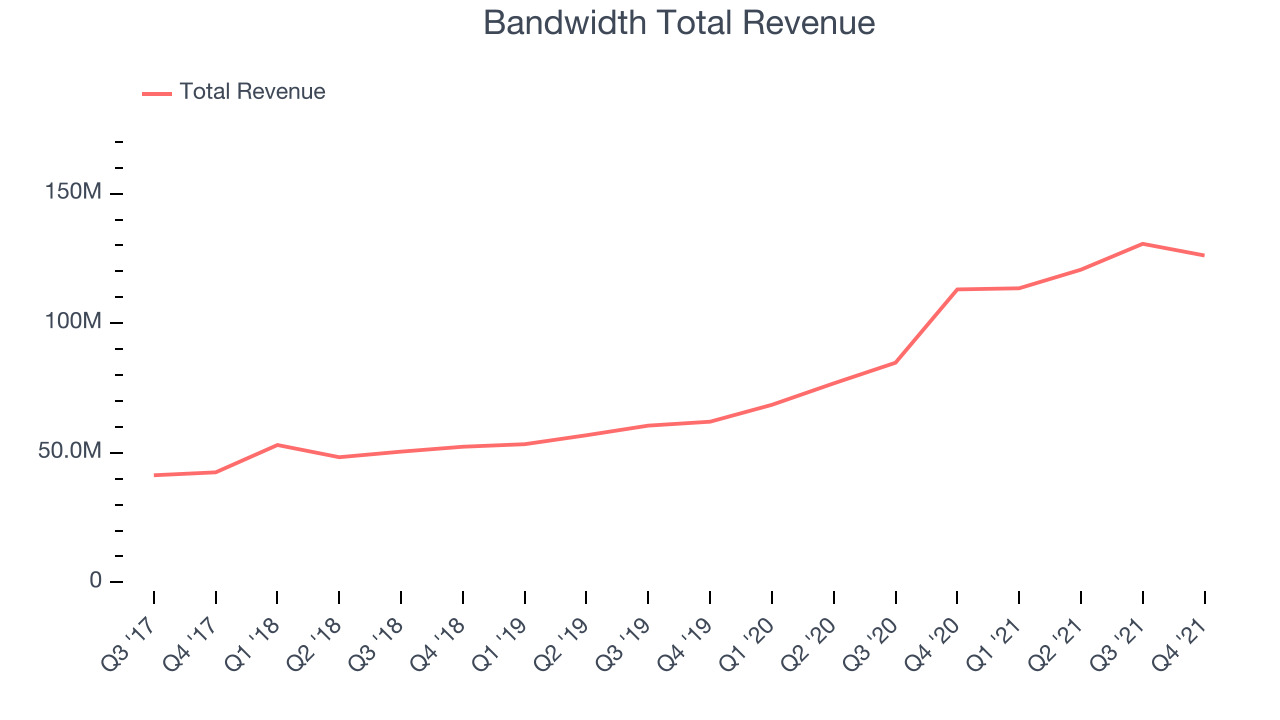

Started in 1999 by David Morken who was later joined by Henry Kaestner as co-founder in 2001, Bandwidth (NASDAQ:BAND) provides thousands of customers with a software platform that uses its own global network to provide phone numbers, voice, and text connectivity.

Bandwidth reported revenues of $126.1 million, up 11.5% year on year, beating analyst expectations by 6.72%. It was a weaker quarter for the company, with revenue guidance missing analysts' expectations for both the full year and the next quarter.

"I am very pleased with our strategic, operational and financial achievements in 2021. We helped customers unlock the potential of the cloud, deepened existing relationships and rose to the challenge of DDoS, all while delivering strong financial results," stated David Morken, Chief Executive Officer of Bandwidth.

Bandwidth delivered the weakest full year guidance update of the whole group. The company added 55 customers to a total of 3,228. The stock is down 26.8% since the results and currently trades at $33.95.

Read our full report on Bandwidth here, it's free.

Best Q4: GitLab (NASDAQ:GTLB)

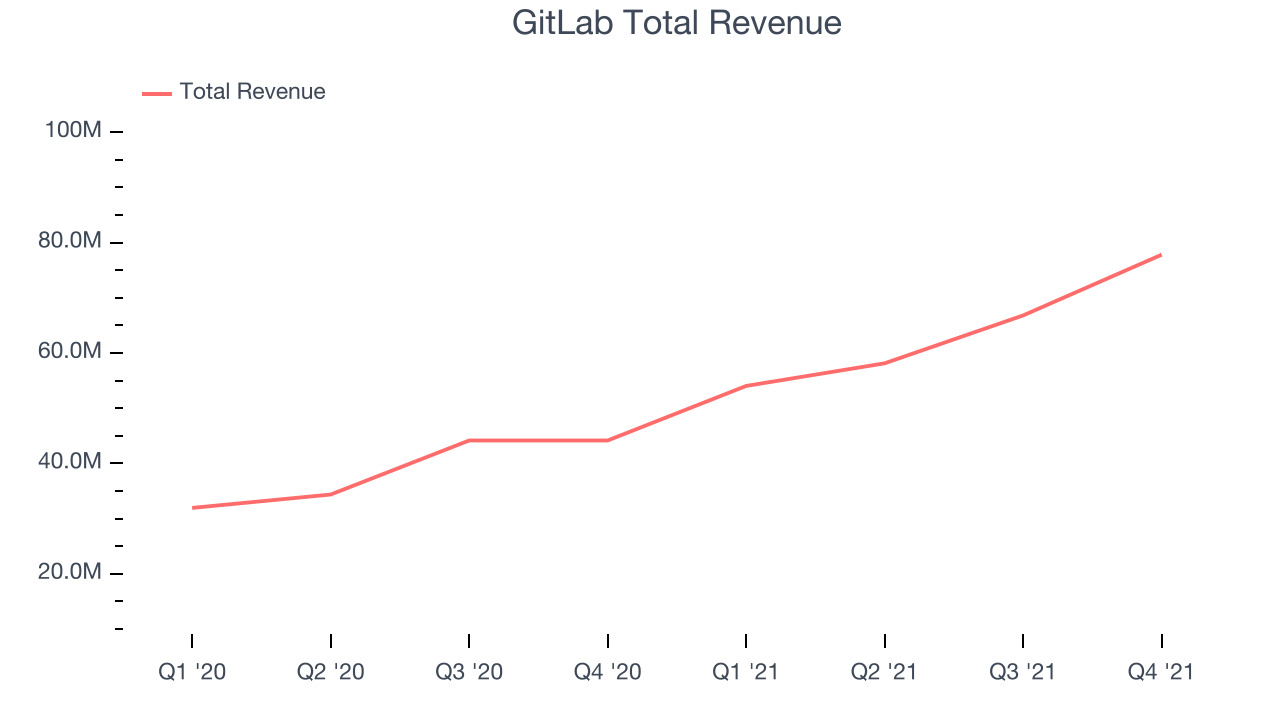

Founded as an open-source project in 2011, GitLab (NASDAQ:GTLB) is a leading software development tools platform.

GitLab reported revenues of $77.7 million, up 76.2% year on year, beating analyst expectations by 10.6%. It was a very strong quarter for the company, with an impressive beat of analyst estimates and an exceptional revenue growth.

GitLab scored the highest full year guidance raise among its peers. The stock is up 70.6% since the results and currently trades at $56.50.

Is now the time to buy GitLab? Access our full analysis of the earnings results here, it's free.

F5 Networks (NASDAQ:FFIV)

While the company initially started in the late 90s by selling hardware appliances, these days F5 (NASDAQ:FFIV) is making software that helps large enterprises ensure their web applications are always available, by distributing network traffic and protecting them from cyber attacks.

F5 Networks reported revenues of $687.1 million, up 10% year on year, beating analyst expectations by 1.31%. It was a weak quarter for the company, with an underwhelming revenue guidance for the next quarter and slow revenue growth.

The stock is down 5.48% since the results and currently trades at $209.17.

Read our full analysis of F5 Networks's results here.

Sumo Logic (NASDAQ:SUMO)

Founded in 2010 by Christian Beegden who went from driving a cab in Germany to landing an internship at Amazon, Sumo Logic (NASDAQ:SUMO) is software as a service data analytics platform that helps companies get insight into what is happening in their servers and applications.

Sumo Logic reported revenues of $67 million, up 23.8% year on year, beating analyst expectations by 4.23%. It was a mixed quarter for the company, with a very strong guidance for the next year but an underwhelming revenue guidance for the next quarter.

The stock is up 11.5% since the results and currently trades at $11.98.

Read our full, actionable report on Sumo Logic here, it's free.

PagerDuty (NYSE:PD)

Started by three former Amazon engineers, PagerDuty (NYSE:PD) is a software as a service platform that helps companies respond to IT incidents fast and make sure that any downtime is minimized.

PagerDuty reported revenues of $78.5 million, up 32.4% year on year, beating analyst expectations by 3.19%. It was a solid quarter for the company, with full-year guidance beating analysts' expectations.

The company added 379 customers to a total of 14,865. The stock is up 27.2% since the results and currently trades at $34.22.

Read our full, actionable report on PagerDuty here, it's free.

The author has no position in any of the stocks mentioned