Communications platform-as-a-service company Bandwidth (NASDAQ: BAND) reported Q4 FY2023 results exceeding Wall Street analysts' expectations, with revenue up 5.4% year on year to $165.4 million. On top of that, next quarter's revenue guidance ($165 million at the midpoint) was surprisingly good and 7% above what analysts were expecting. It made a non-GAAP profit of $0.38 per share, improving from its profit of $0.19 per share in the same quarter last year.

Bandwidth (BAND) Q4 FY2023 Highlights:

- Revenue: $165.4 million vs analyst estimates of $154.1 million (7.4% beat)

- EPS (non-GAAP): $0.38 vs analyst estimates of $0.22 ($0.16 beat)

- Revenue Guidance for Q1 2024 is $165 million at the midpoint, above analyst estimates of $154.2 million

- Management's revenue guidance for the upcoming financial year 2024 is $700 million at the midpoint, beating analyst estimates by 3.7% and implying 16.4% growth (vs 4.9% in FY2023)

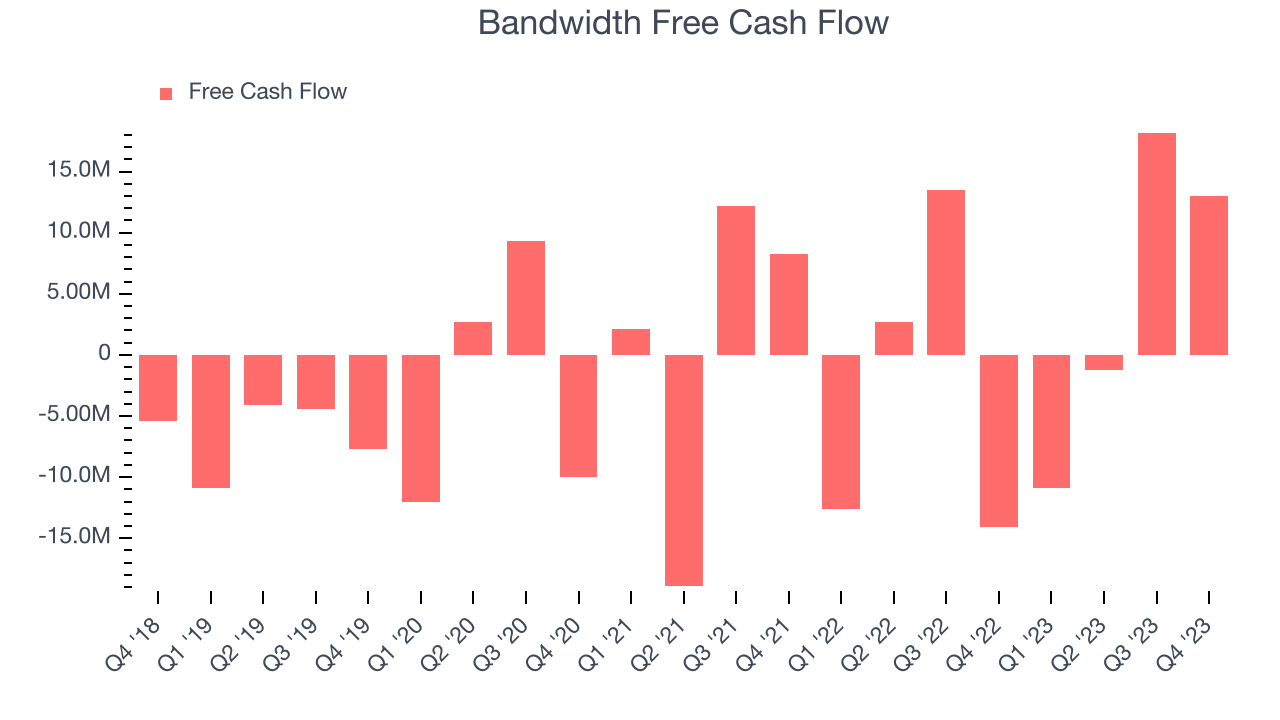

- Free Cash Flow of $13.04 million, down 28.3% from the previous quarter

- Gross Margin (GAAP): 37.5%, down from 41.1% in the same quarter last year

- Market Capitalization: $311.5 million

Started in 1999 by David Morken who was later joined by Henry Kaestner as co-founder in 2001, Bandwidth (NASDAQ:BAND) provides thousands of customers with a software platform that uses its own global network to provide phone numbers, voice, and text connectivity.

Bandwidth might not be well known with consumers, but most of us would have used their services unknowingly either using online conferencing software, or contacting customer service representatives through a company’s website. Bandwidth’s core advantage is that it provides a software platform over its own telecommunications network, and is therefore able to better control the quality of the connection, all while providing cheaper prices than a legacy voice connection.

Founder David Morken started Bandwidth while on 90 days of paid leave from the Marine Corps. He moved into his parents’ house with his three children and wife in order to bootstrap the company.

Communications Platform

The first shift towards voice communication over the internet (VOIP), rather than traditional phone networks, happened when the enterprises started replacing business phones with the cheaper VOIP technology. Today, the rise of the consumer internet has increased the need for two way audio and video functionality in applications, driving demand for software tools and platforms that enable this utility.

Even though Bandwidth competes with other well known CPaaS companies like Twilio (NYSE:TWLO), it mostly competes with legacy telecommunications companies such as Verizon (NYSE:VZ) and AT&T (NYSE:T), which lack the equivalent software layer over their own networks.

Sales Growth

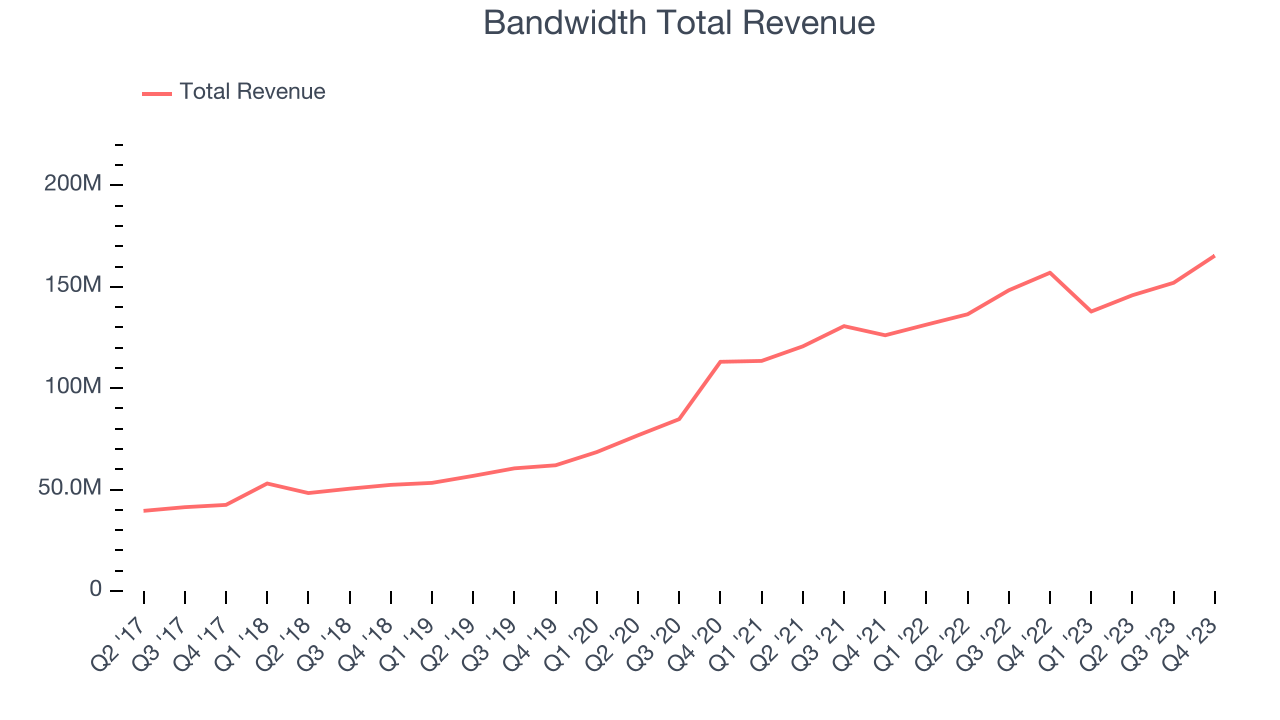

As you can see below, Bandwidth's revenue growth has been unremarkable over the last two years, growing from $126.1 million in Q4 FY2021 to $165.4 million this quarter.

Bandwidth's quarterly revenue was only up 5.4% year on year, which might disappoint some shareholders. However, we can see that the company's revenue grew by $13.37 million quarter on quarter, accelerating from $6.14 million in Q3 2023.

Next quarter's guidance suggests that Bandwidth is expecting revenue to grow 19.7% year on year to $165 million, improving on the 4.9% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $700 million at the midpoint, growing 16.4% year on year compared to the 4.9% increase in FY2023.

Profitability

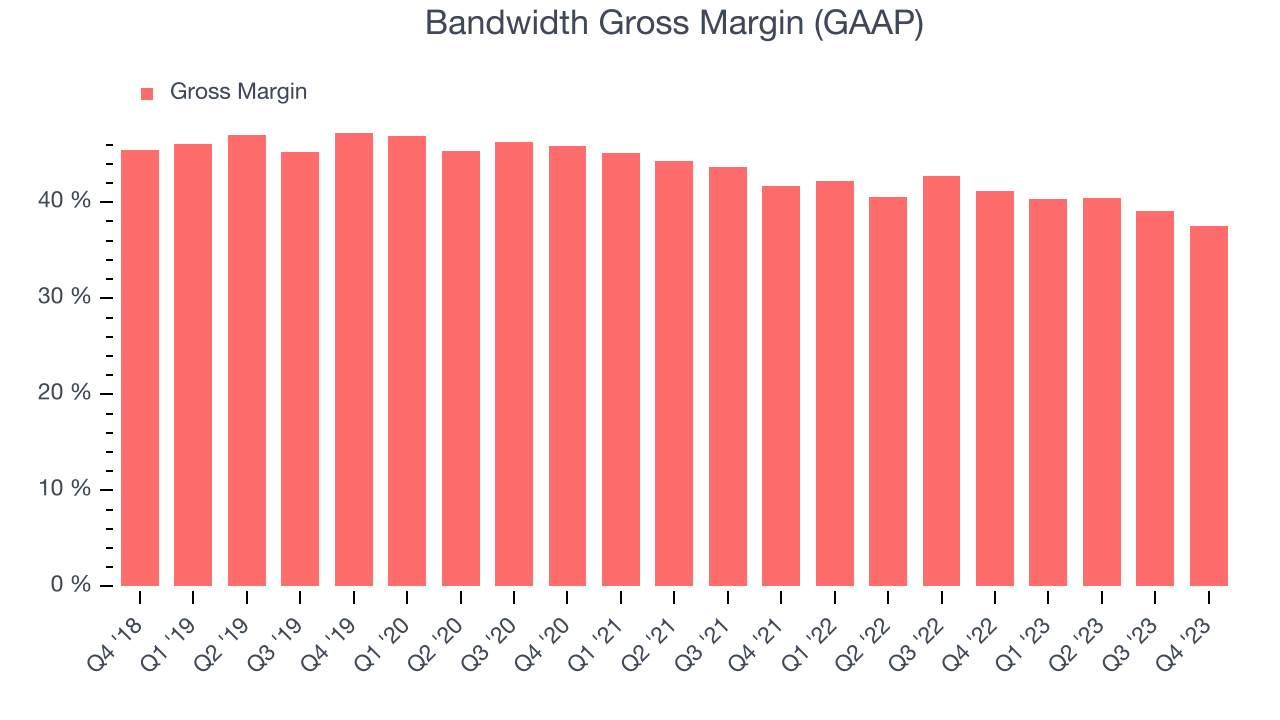

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Bandwidth's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 37.5% in Q4.

That means that for every $1 in revenue the company had $0.38 left to spend on developing new products, sales and marketing, and general administrative overhead. Bandwidth's gross margin is poor for a SaaS business and it's deteriorated even further over the last year. This is probably the opposite direction that shareholders would like to see it go.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Bandwidth's free cash flow came in at $13.04 million in Q4, turning positive over the last year.

Bandwidth has generated $19.1 million in free cash flow over the last 12 months, or 3.2% of revenue. This FCF margin enables it to reinvest in its business without depending on the capital markets.

Key Takeaways from Bandwidth's Q4 Results

We were impressed by Bandwidth's revenue guidance and rosy outlook for next quarter, which blew past analysts' expectations. We were also glad this quarter's revenue and EPS beat Wall Street's estimates. On the other hand, its gross margin declined, signaling the company's prices saw some pressure. Zooming out, we think this was an impressive quarter that should delight shareholders. The stock is up 23.3% after reporting and currently trades at $15 per share.

Is Now The Time?

Bandwidth may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We have other favorites, but we understand the arguments that Bandwidth isn't a bad business. Although its revenue growth has been mediocre over the last two years and its gross margins show its business model is much less lucrative than the best software businesses, the good news is its very efficient customer acquisition hints at the potential for strong profitability.

Wall Street analysts covering the company had a one-year price target of $20.57 per share right before these results (compared to the current share price of $15).

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.