Earnings results often give us a good indication of what direction the company will take in the months ahead. Heading into the new earnings season, let’s have a look at CouchBase (NASDAQ:BASE) and its peers.

Data is the lifeblood of the internet and software in general, and the amount of data created is growing at an accelerating pace. Likewise, the importance of storing the data in scalable and efficient formats continues to rise, especially as the diversity of the data and associated use cases expand from analyzing simple, structured data to high-scale processing of unstructured data, images, audio and video.

The 5 data storage stocks we track reported a decent Q3; on average, revenues beat analyst consensus estimates by 4.64%, while on average next quarter revenue guidance was 2.13% above consensus. Technology stocks have been hit hard on fears of higher interest rates and while some of the data storage stocks have fared somewhat better, they have not been spared, with share price declining 19.7% since earnings, on average.

CouchBase (NASDAQ:BASE)

Formed in 2011 with the merger of Membase and CouchOne, Couchbase (NASDAQ:BASE) is a database as a service platform that allows enterprises to store large volumes of semi-structured data.

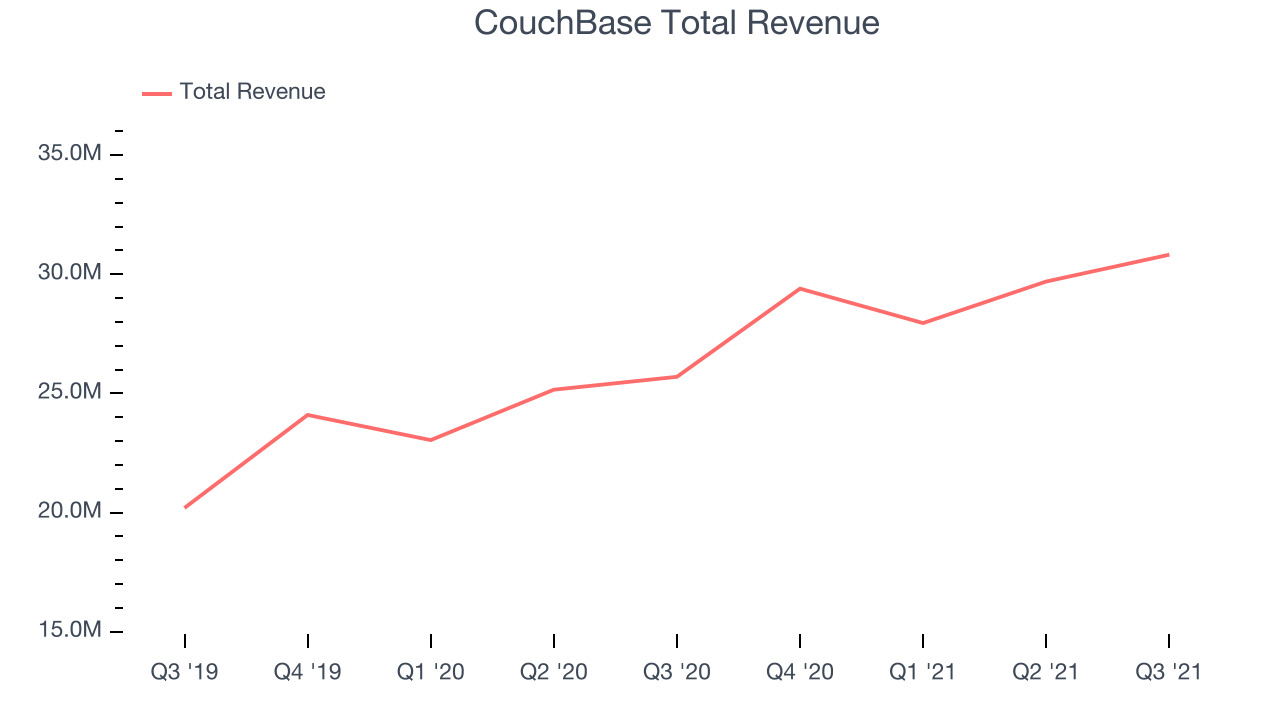

CouchBase reported revenues of $30.8 million, up 19.9% year on year, beating analyst expectations by 4.76%. It was a decent quarter for the company, with slow revenue growth and guidance for the next quarter roughly in line with what analysts were expecting.

"Our strong third quarter performance was driven by ongoing large deal momentum, including some significant expansions, as well as acceleration of our cloud business. We also delivered solid top line growth with ARR up 21% and revenue up 20% year over year," said Matt Cain, President and CEO of Couchbase.

The stock is down 25% since the results and currently trades at $22.10.

Is now the time to buy CouchBase? Access our full analysis of the earnings results here, it's free.

Best Q3: Snowflake (NYSE:SNOW)

Founded in 2013 by three French engineers who spent decades working for Oracle, Snowflake (NYSE:SNOW) provides a data warehouse-as-a-service in the cloud that allows companies to store large amounts of data and analyze it in real time.

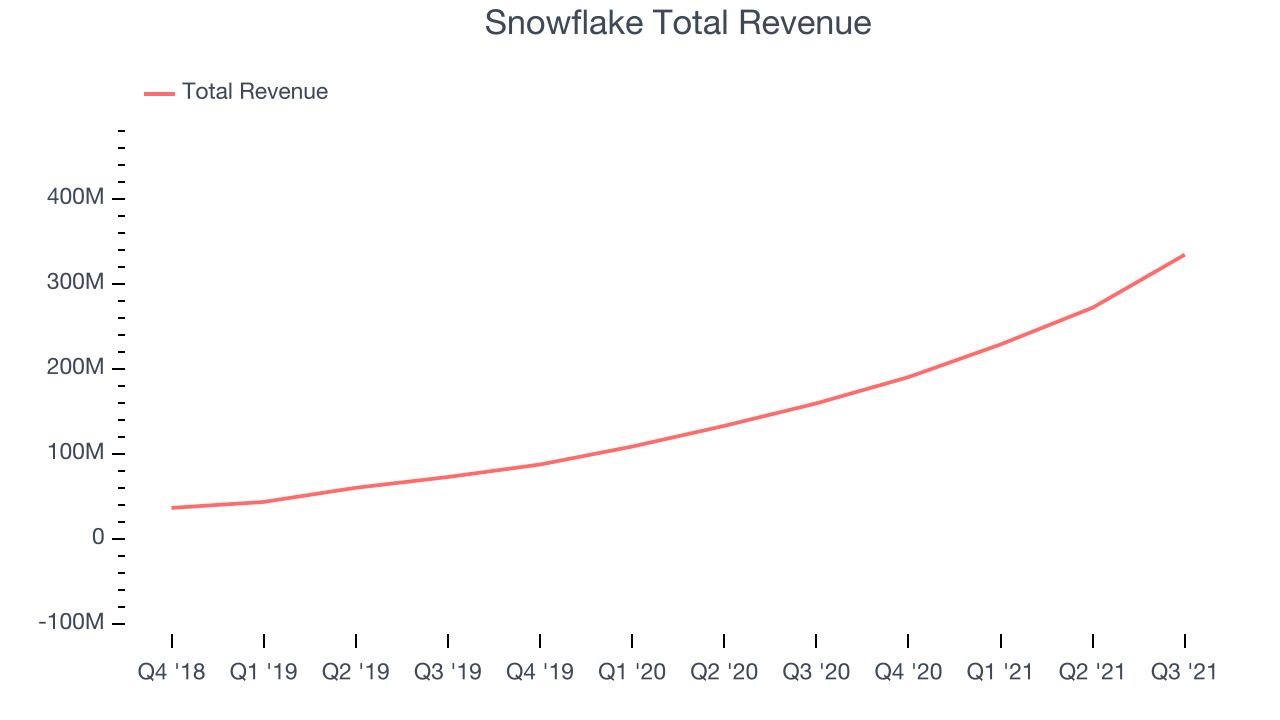

Snowflake reported revenues of $334.4 million, up 109% year on year, beating analyst expectations by 9.24%. It was a standout quarter for the company, with an exceptional revenue growth and an impressive beat of analyst estimates.

Snowflake achieved the fastest revenue growth among its peers. The company added 32 enterprise customers paying more than $1m annually to a total of 148. The stock is down 10.4% since the results and currently trades at $278.

Is now the time to buy Snowflake? Access our full analysis of the earnings results here, it's free.

Weakest Q3: Commvault (NASDAQ:CVLT)

Originally formed in 1988 as part of Bell Labs, Commvault (NASDAQ: CVLT) provides enterprise software used for data backup and recovery, cloud and infrastructure management, retention and compliance.

Commvault reported revenues of $177.8 million, up 3.91% year on year, missing analyst expectations by 3.75%. It was a weak quarter for the company, with a miss of the top line analyst estimates and a slow revenue growth.

Commvault had the weakest performance against analyst estimates and slowest revenue growth in the group. The company lost 22 enterprise customers paying more than $100,000 annually and ended up with a total of 163. The stock is down 10.7% since the results and currently trades at $67.59.

Read our full analysis of Commvault's results here.

MongoDB (NASDAQ:MDB)

Started in 2007 by the team behind Google’s ad platform DoubleClick, MongoDB offers database-as-a-service that helps companies store large volumes of semi-structured data.

MongoDB reported revenues of $226.8 million, up 50.4% year on year, beating analyst expectations by 10.5%. It was a very strong quarter for the company, with an impressive beat of analyst estimates.

MongoDB pulled off the strongest analyst estimates beat and highest full year guidance raise among the peers. The company added 75 enterprise customers paying more than $100,000 annually to a total of 1,201. The stock is down 10.7% since the results and currently trades at $382.12.

Read our full, actionable report on MongoDB here, it's free.

DigitalOcean (NYSE:DOCN)

Started by brothers Ben and Moisey Uretsky, DigitalOcean (NYSE: DOCN) provides a simple, low-cost platform that allows developers and small and medium sized businesses to host applications and data in the cloud.

DigitalOcean reported revenues of $111.4 million, up 37.2% year on year, beating analyst expectations by 2.38%. It was an OK quarter for the company, with a significant improvement in gross margin but decelerating customer growth.

DigitalOcean had the weakest full year guidance update among the peers. The company lost 4000 customers and ended up with a total of 598,000. The stock is down 41.4% since the results and currently trades at $55.40.

Read our full, actionable report on DigitalOcean here, it's free.

The author has no position in any of the stocks mentioned