As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q2. Today, we are looking at data storage stocks, starting with Couchbase (NASDAQ:BASE).

Data is the lifeblood of the internet and software in general, and the amount of data created is accelerating. As a result, the importance of storing the data in scalable and efficient formats continues to rise, especially as its diversity and associated use cases expand from analyzing simple, structured datasets to high-scale processing of unstructured data such as images, audio, and video.

The 5 data storage stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 2.5% while next quarter’s revenue guidance was 1.3% above.

After much suspense, the Federal Reserve cut its policy rate by 50bps (half a percent) in September 2024. This marks the central bank’s first easing of monetary policy since 2020 and the end of its most pointed inflation-busting campaign since the 1980s. Inflation had begun to run hot in 2021 post-COVID due to a confluence of factors such as supply chain disruptions, labor shortages, and stimulus spending. While CPI (inflation) readings have been supportive lately, employment measures have prompted some concern. Going forward, the markets will debate whether this rate cut (and more potential ones in 2024 and 2025) is perfect timing to support the economy or a bit too late for a macro that has already cooled too much.

Luckily, data storage stocks have performed well with share prices up 15.2% on average since the latest earnings results.

Couchbase (NASDAQ:BASE)

Formed in 2011 with the merger of Membase and CouchOne, Couchbase (NASDAQ:BASE) is a database-as-a-service platform that allows enterprises to store large volumes of semi-structured data.

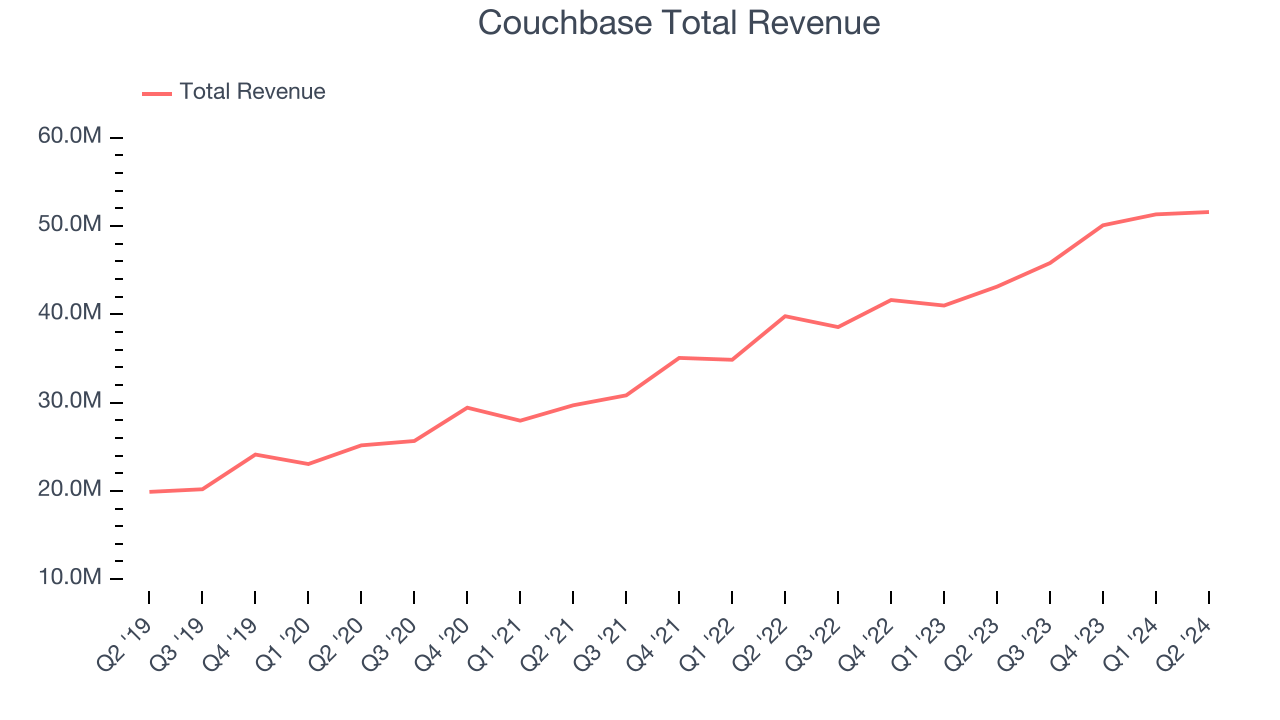

Couchbase reported revenues of $51.59 million, up 19.6% year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company with full-year revenue guidance exceeding analysts’ expectations but a miss of analysts’ billings estimates.

"I'm pleased with our hard work and execution in the quarter," said Matt Cain, Chair, President and CEO of Couchbase.

Couchbase delivered the weakest performance against analyst estimates and weakest full-year guidance update of the whole group. Unsurprisingly, the stock is down 14.4% since reporting and currently trades at $16.24.

Is now the time to buy Couchbase? Access our full analysis of the earnings results here, it’s free.

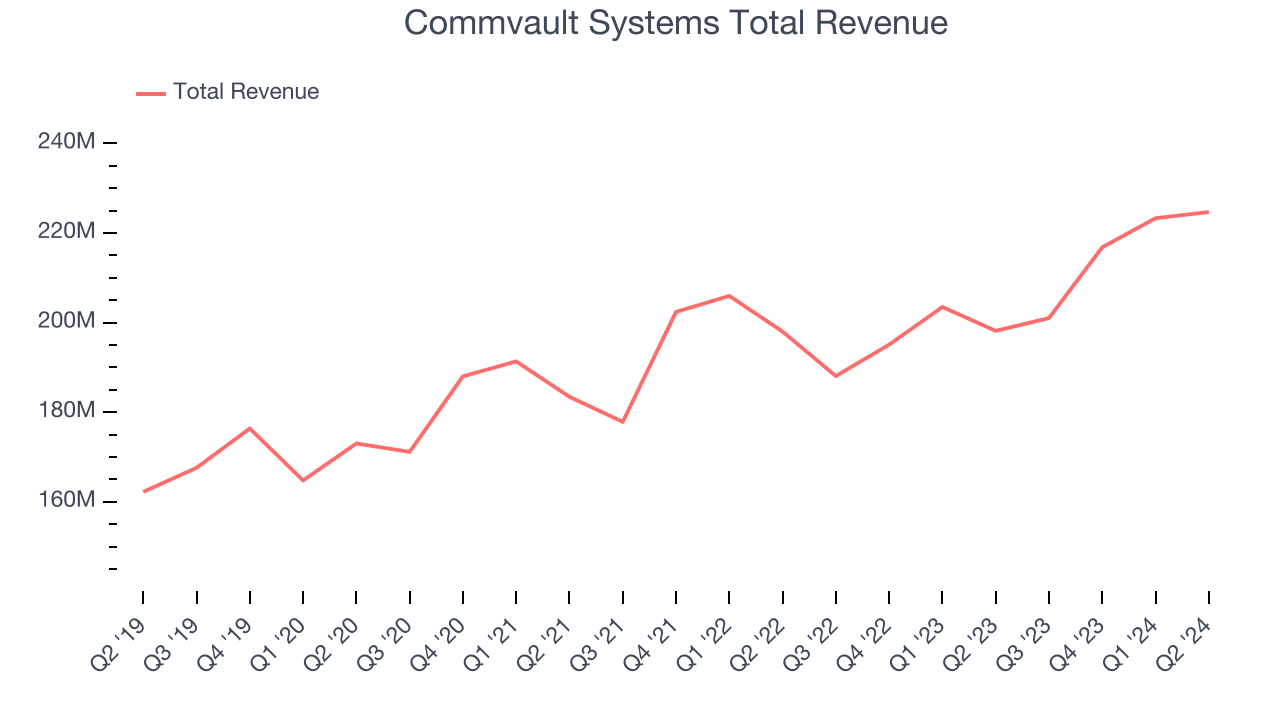

Best Q2: Commvault Systems (NASDAQ:CVLT)

Originally formed in 1988 as part of Bell Labs, Commvault (NASDAQ: CVLT) provides enterprise software used for data backup and recovery, cloud and infrastructure management, retention, and compliance.

Commvault Systems reported revenues of $224.7 million, up 13.4% year on year, outperforming analysts’ expectations by 4.2%. The business had an exceptional quarter with an impressive beat of analysts’ billings estimates and full-year revenue guidance exceeding analysts’ expectations.

Commvault Systems scored the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 30.7% since reporting. It currently trades at $161.12.

Is now the time to buy Commvault Systems? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Snowflake (NYSE:SNOW)

Founded in 2013 by three French engineers who spent decades working for Oracle, Snowflake (NYSE:SNOW) provides a data warehouse-as-a-service in the cloud that allows companies to store large amounts of data and analyze it in real time.

Snowflake reported revenues of $868.8 million, up 28.9% year on year, exceeding analysts’ expectations by 2.1%. Still, it was a slower quarter as it posted a miss of analysts’ billings estimates.

As expected, the stock is down 8% since the results and currently trades at $124.19.

Read our full analysis of Snowflake’s results here.

DigitalOcean (NYSE:DOCN)

Started by brothers Ben and Moisey Uretsky, DigitalOcean (NYSE: DOCN) provides a simple, low-cost platform that allows developers and small and medium-sized businesses to host applications and data in the cloud.

DigitalOcean reported revenues of $192.5 million, up 13.3% year on year. This number surpassed analysts’ expectations by 2%. Overall, it was a very strong quarter as it also recorded full-year revenue guidance exceeding analysts’ expectations and a solid beat of analysts’ ARR (annual recurring revenue) estimates.

DigitalOcean scored the highest full-year guidance raise among its peers. The stock is up 48.7% since reporting and currently trades at $43.28.

Read our full, actionable report on DigitalOcean here, it’s free.

MongoDB (NASDAQ:MDB)

Started in 2007 by the team behind Google’s ad platform, DoubleClick, MongoDB offers database-as-a-service that helps companies store large volumes of semi-structured data.

MongoDB reported revenues of $478.1 million, up 12.8% year on year. This print surpassed analysts’ expectations by 3%. Overall, it was a very strong quarter as it also recorded an impressive beat of analysts’ billings estimates and full-year revenue guidance exceeding analysts’ expectations.

MongoDB had the slowest revenue growth among its peers. The company added 52 enterprise customers paying more than $100,000 annually to reach a total of 2,189. The stock is up 19.2% since reporting and currently trades at $293.01.

Read our full, actionable report on MongoDB here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.