Database-as-a-service company Couchbase (NASDAQ: BASE) announced better-than-expected results in Q4 FY2024, with revenue up 20.3% year on year to $50.09 million. On top of that, next quarter's revenue guidance ($48.5 million at the midpoint) was surprisingly good and 3.3% above what analysts were expecting. It made a non-GAAP loss of $0.06 per share, improving from its loss of $0.18 per share in the same quarter last year.

Couchbase (BASE) Q4 FY2024 Highlights:

- Revenue: $50.09 million vs analyst estimates of $46.55 million (7.6% beat)

- EPS (non-GAAP): -$0.06 vs analyst estimates of -$0.14

- Revenue Guidance for Q1 2025 is $48.5 million at the midpoint, above analyst estimates of $46.94 million

- Management's revenue guidance for the upcoming financial year 2025 is $205 million at the midpoint, in line with analyst expectations and implying 13.9% growth (vs 16.3% in FY2024)

- Free Cash Flow was -$7.74 million compared to -$13.61 million in the previous quarter

- Gross Margin (GAAP): 89.7%, up from 85.7% in the same quarter last year

- Market Capitalization: $1.34 billion

Formed in 2011 with the merger of Membase and CouchOne, Couchbase (NASDAQ:BASE) is a database-as-a-service platform that allows enterprises to store large volumes of semi-structured data.

Databases have been in use for over 40 years to access and manipulate data to generate an outcome as simple as triggering an alarm to powering stock trading. SQL databases function like Excel on steroids, they keep information in columns and rows which can be queried and cross referenced using structured query language (SQL). This works well if you need to store a lot of data that has a similar structure, but it can create potential inefficiencies if the structure of the data you are storing varies a lot. The majority of databases today are still relational databases (SQL) that were designed for structured data and tens of thousands of users.

Today’s enterprises are going through digital transformations to deliver customer experiences through applications that respond in microseconds, requiring a modern database architecture that combines disparate data sources instantaneously and can be accessed by millions of users simultaneously.

Couchbase provides a “NoSQL" database as a service, which instead of Excel-like tables stores data in records called documents, which, similarly to a patient’s documents in a doctor’s office, have all the data for one entity in one folder, even though what is in the folder can vary a lot between entities. Couchbase’s NoSQL database allows developers to build applications that take advantage of the elasticity, scalability and flexibility of a NoSQL database while leveraging developer familiarity with SQL. Both NoSQL and SQL databases have their place, depending on what data is being stored and how it needs to be used.

Data Storage

Data is the lifeblood of the internet and software in general, and the amount of data created is accelerating. As a result, the importance of storing the data in scalable and efficient formats continues to rise, especially as its diversity and associated use cases expand from analyzing simple, structured datasets to high-scale processing of unstructured data such as images, audio, and video.

Couchbase faces a range of competitors including legacy, relational database providers, NoSQL database providers, and proprietary offerings from the giant public cloud platforms like Amazon’s DynamoDB (NASDAQ: AMZN), Microsoft Azure’s Cosmos DB (NASDAQ: MSFT) and Google Cloud SQL (NASDAQ: GOOGL). The primary legacy relational database vendors are Microsoft, Oracle (NYSE: ORCL), and IBM (NYSE: IBM), while MongoDB (NASDAQ: MDB) is the only publicly traded NoSQL database rival.

Sales Growth

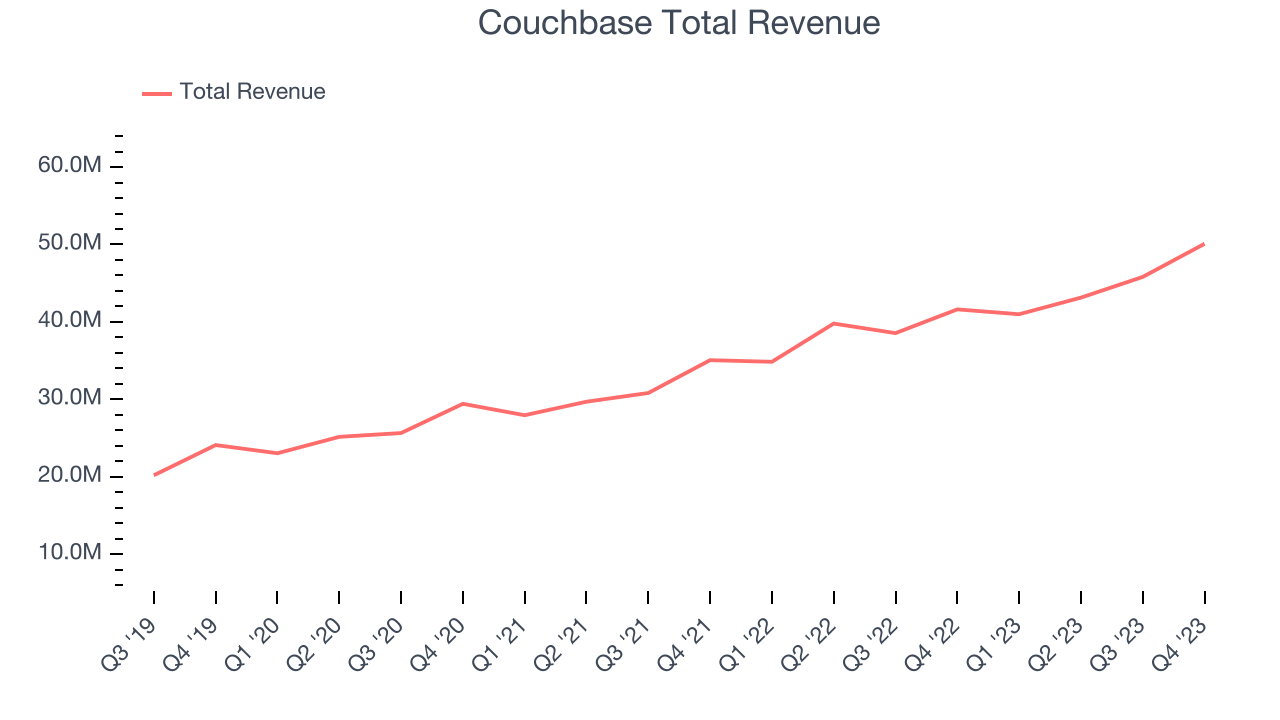

As you can see below, Couchbase's revenue growth has been strong over the last two years, growing from $35.06 million in Q4 FY2022 to $50.09 million this quarter.

This quarter, Couchbase's quarterly revenue was once again up a very solid 20.3% year on year. On top of that, its revenue increased $4.28 million quarter on quarter, a very strong improvement from the $2.67 million increase in Q3 2024. This is a sign of re-acceleration of growth and great to see.

Next quarter's guidance suggests that Couchbase is expecting revenue to grow 18.3% year on year to $48.5 million, in line with the 17.6% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $205 million at the midpoint, growing 13.9% year on year compared to the 16.3% increase in FY2024.

Profitability

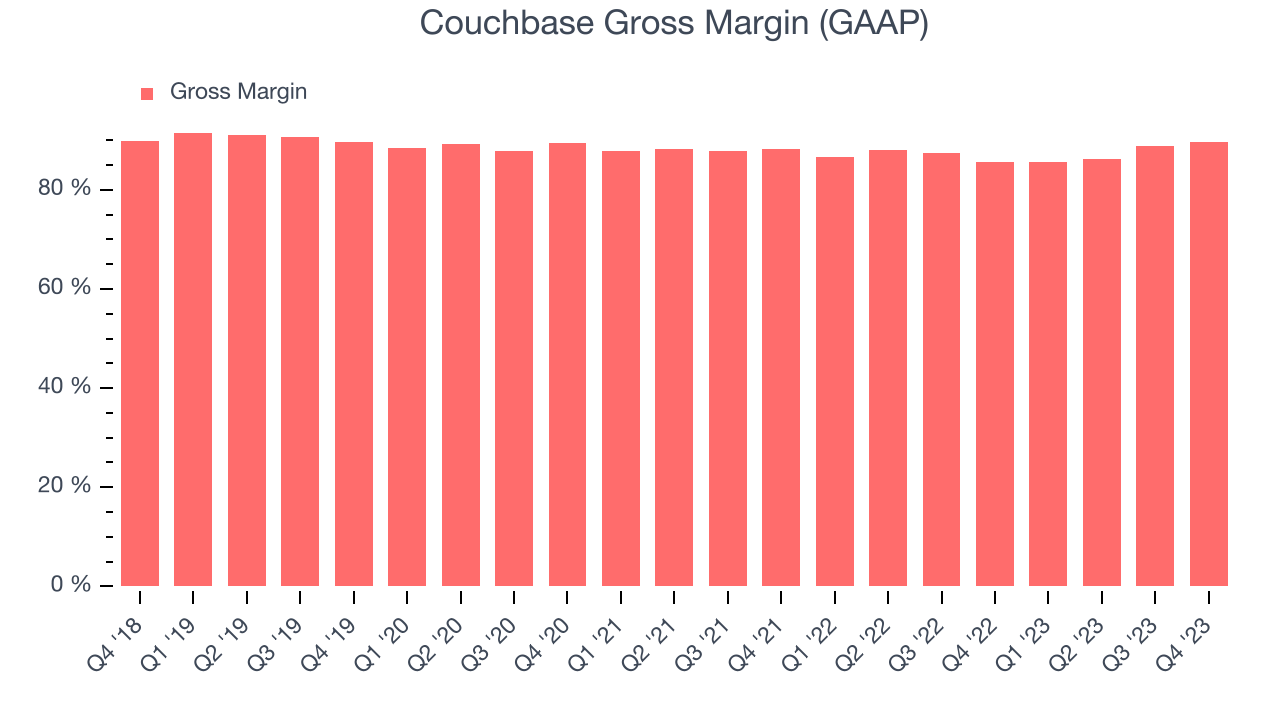

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Couchbase's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 89.7% in Q4.

That means that for every $1 in revenue the company had $0.90 left to spend on developing new products, sales and marketing, and general administrative overhead. Significantly up from the last quarter, Couchbase's excellent gross margin allows it to fund large investments in product and sales during periods of rapid growth and achieve profitability when reaching maturity.

Cash Is King

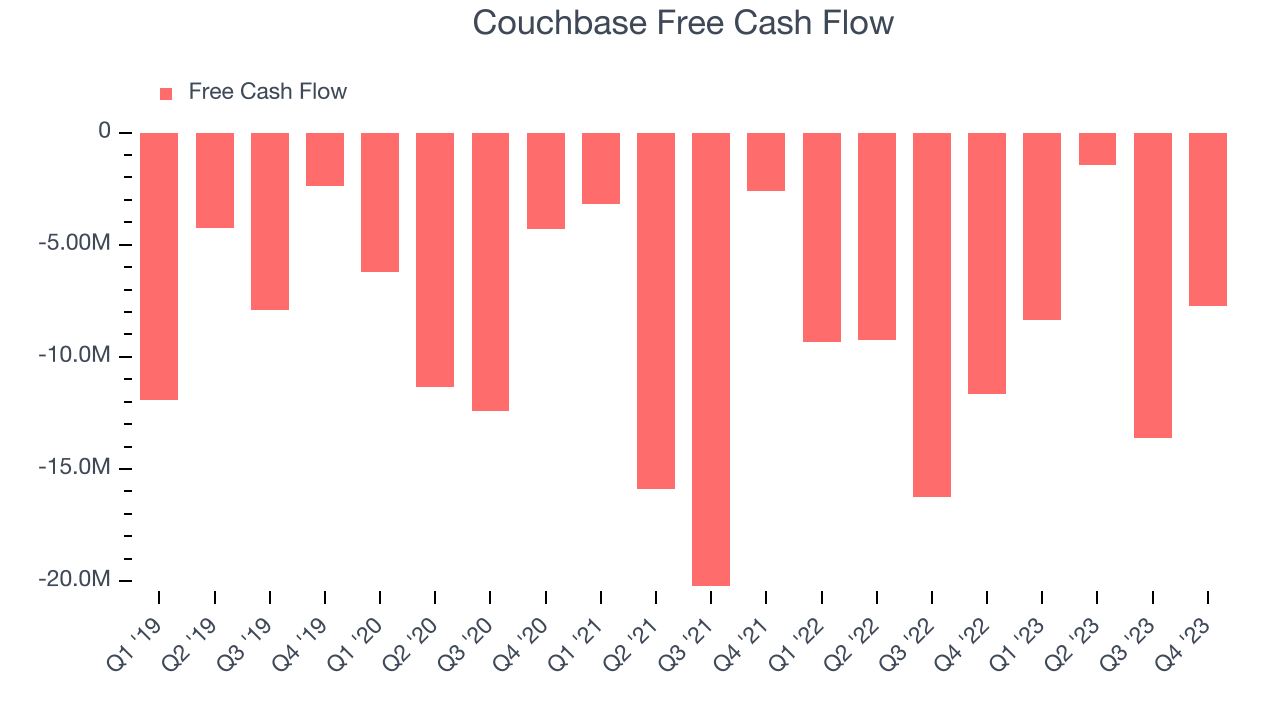

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Couchbase burned through $7.74 million of cash in Q4 , increasing its cash burn by 33.7% year on year.

Couchbase has burned through $31.15 million of cash over the last 12 months, resulting in a negative 17.3% free cash flow margin. This low FCF margin stems from Couchbase's constant need to reinvest in its business to stay competitive.

Key Takeaways from Couchbase's Q4 Results

We were impressed by how strongly Couchbase blew past analysts' total revenue, ARR (annual recurring revenue), and EPS estimates this quarter as it generated more subscription revenue than expected. We were also glad next quarter's revenue guidance was higher than Wall Street's estimates, though its full-year outlook was in line. Overall, we think this was a really good quarter that should please shareholders, especially with the broader software sector showing choppy full-year 2024 guidance. The stock is up 16% after reporting and currently trades at $31.19 per share.

Is Now The Time?

When considering an investment in Couchbase, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We think Couchbase is a solid business. We'd expect growth rates to moderate from here, but its revenue growth over the last two years has been solid. And while its customer acquisition is less efficient than many comparable companies, the good news is its impressive gross margins indicate excellent business economics.

The market is certainly expecting long-term growth from Couchbase given its price-to-sales ratio based on the next 12 months is 6.4x. There are definitely things to like about Couchbase and looking at the tech landscape right now, it seems that it doesn't trade at an unreasonable price point.

Wall Street analysts covering the company had a one-year price target of $26.55 per share right before these results (compared to the current share price of $31.19).

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.